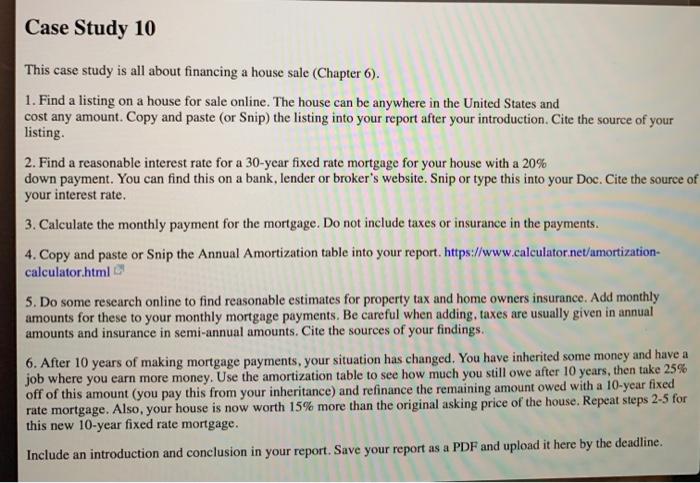

Case Study 10 This case study is all about financing a house sale (Chapter 6). 1. Find a listing on a house for sale online. The house can be anywhere in the United States and cost any amount. Copy and paste (or Snip) the listing into your report after your introduction. Cite the source of your listing 2. Find a reasonable interest rate for a 30-year fixed rate mortgage for your house with a 20% down payment. You can find this on a bank, lender or broker's website. Snip or type this into your Doc. Cite the source of your interest rate 3. Calculate the monthly payment for the mortgage. Do not include taxes or insurance in the payments. 4. Copy and paste or Snip the Annual Amortization table into your report. https://www.calculator.net/amortization- calculator.html 5. Do some research online to find reasonable estimates for property tax and home owners insurance. Add monthly amounts for these to your monthly mortgage payments. Be careful when adding, taxes are usually given in annual amounts and insurance in semi-annual amounts. Cite the sources of your findings. 6. After 10 years of making mortgage payments, your situation has changed. You have inherited some money and have a job where you earn more money. Use the amortization table to see how much you still owe after 10 years, then take 25% off of this amount (you pay this from your inheritance) and refinance the remaining amount owed with a 10-year fixed rate mortgage. Also, your house is now worth 15% more than the original asking price of the house. Repeat steps 2-5 for this new 10-year fixed rate mortgage. Include an introduction and conclusion in your report. Save your report as a PDF and upload it here by the deadline. Case Study 10 This case study is all about financing a house sale (Chapter 6). 1. Find a listing on a house for sale online. The house can be anywhere in the United States and cost any amount. Copy and paste (or Snip) the listing into your report after your introduction. Cite the source of your listing 2. Find a reasonable interest rate for a 30-year fixed rate mortgage for your house with a 20% down payment. You can find this on a bank, lender or broker's website. Snip or type this into your Doc. Cite the source of your interest rate 3. Calculate the monthly payment for the mortgage. Do not include taxes or insurance in the payments. 4. Copy and paste or Snip the Annual Amortization table into your report. https://www.calculator.net/amortization- calculator.html 5. Do some research online to find reasonable estimates for property tax and home owners insurance. Add monthly amounts for these to your monthly mortgage payments. Be careful when adding, taxes are usually given in annual amounts and insurance in semi-annual amounts. Cite the sources of your findings. 6. After 10 years of making mortgage payments, your situation has changed. You have inherited some money and have a job where you earn more money. Use the amortization table to see how much you still owe after 10 years, then take 25% off of this amount (you pay this from your inheritance) and refinance the remaining amount owed with a 10-year fixed rate mortgage. Also, your house is now worth 15% more than the original asking price of the house. Repeat steps 2-5 for this new 10-year fixed rate mortgage. Include an introduction and conclusion in your report. Save your report as a PDF and upload it here by the deadline