Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case study 14 - Chestnut Food 1. Why is Van Muur soliciting control of Chestnut? 2. Do you agree with Meyers dinner conversation assertions? Estimate

Case study 14 - Chestnut Food

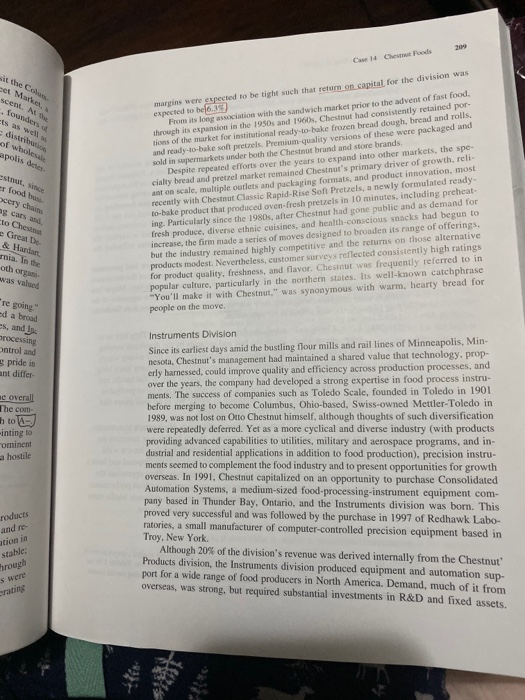

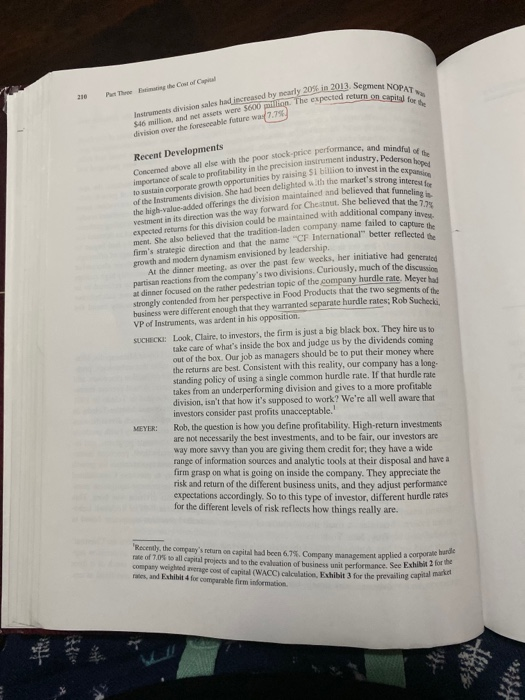

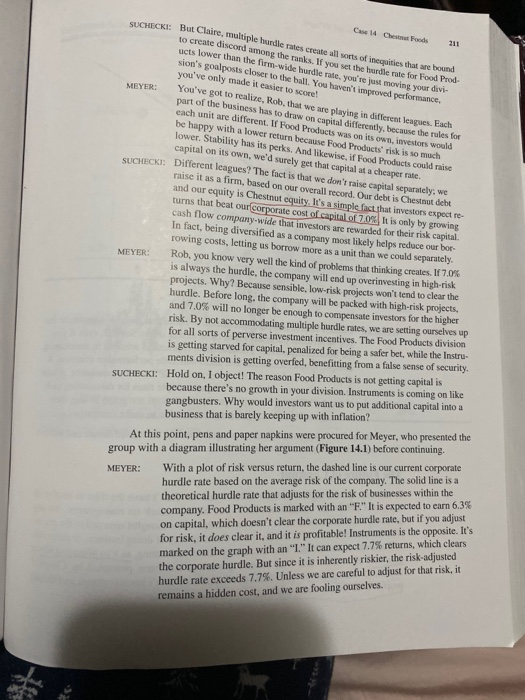

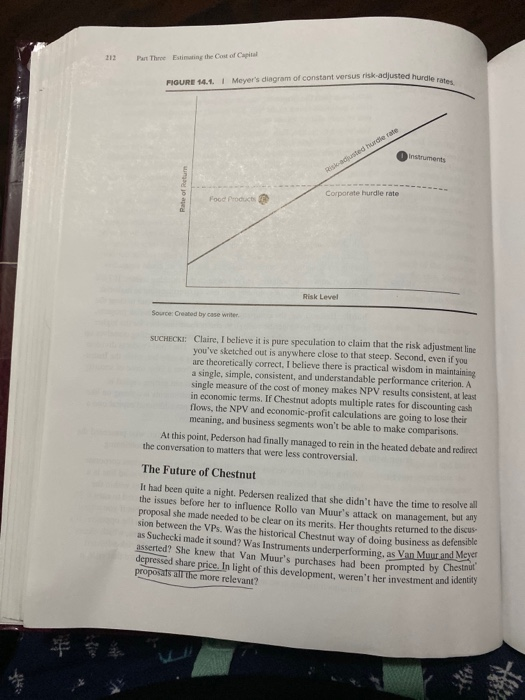

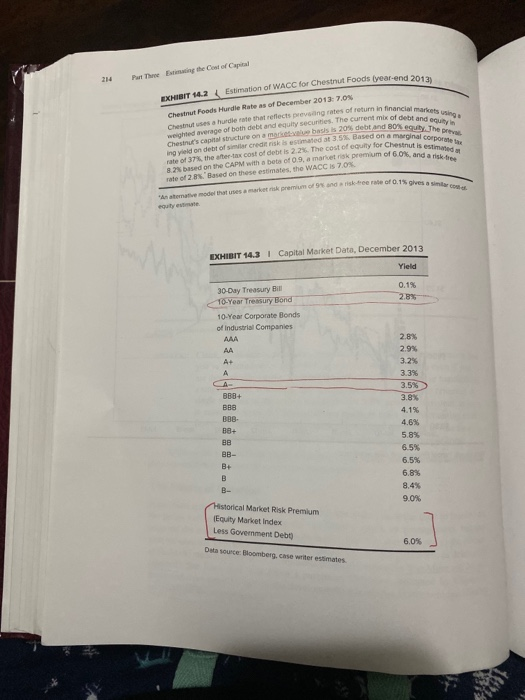

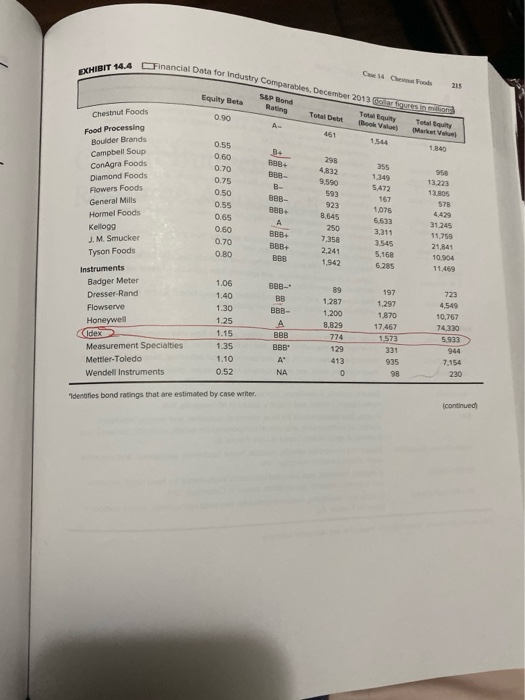

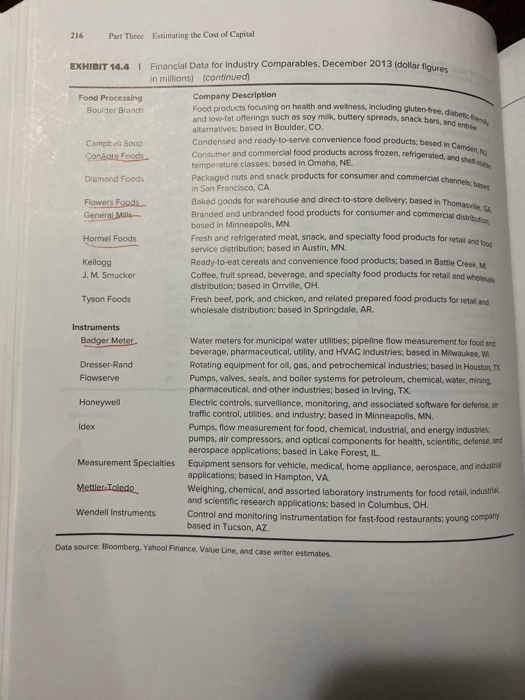

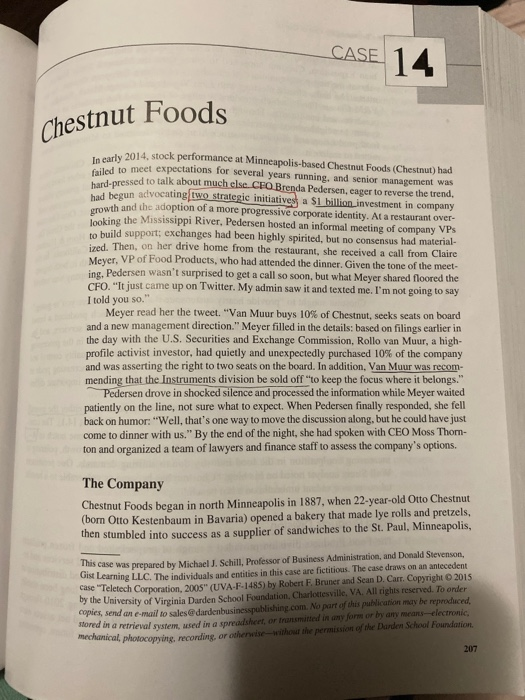

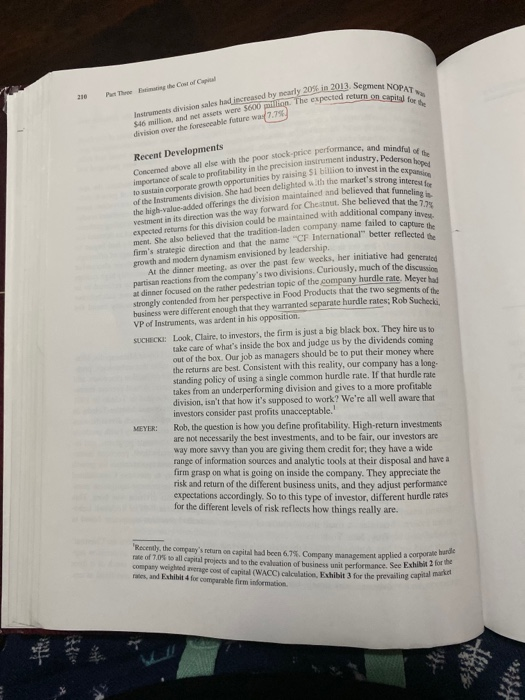

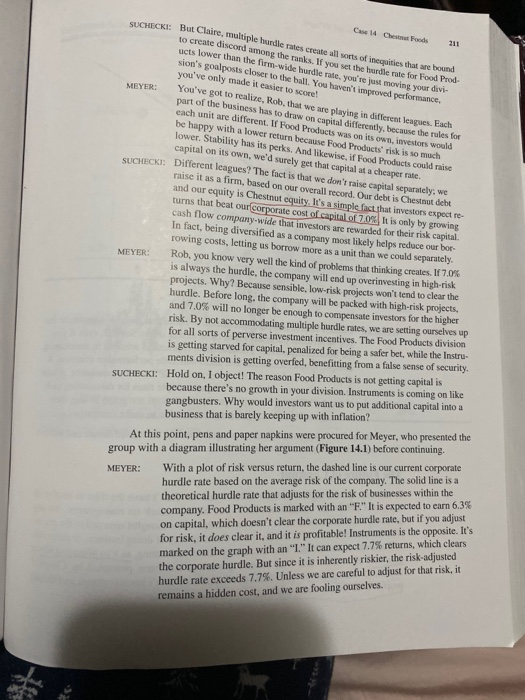

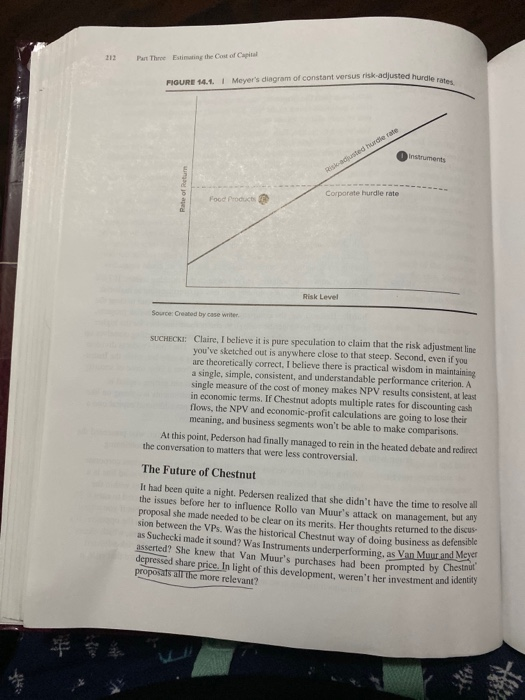

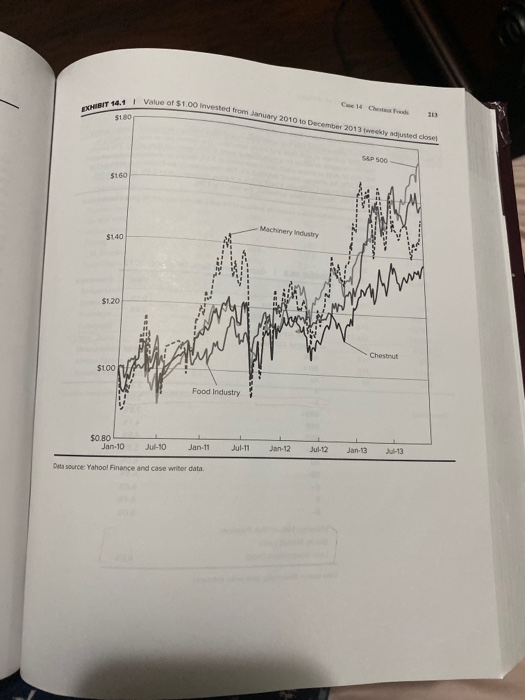

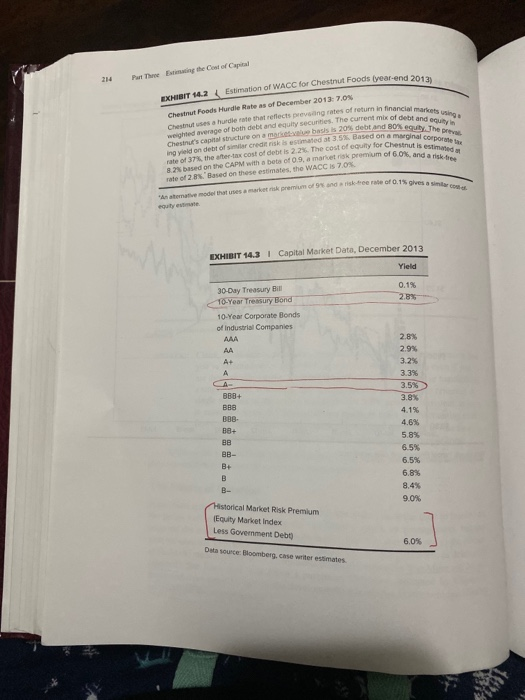

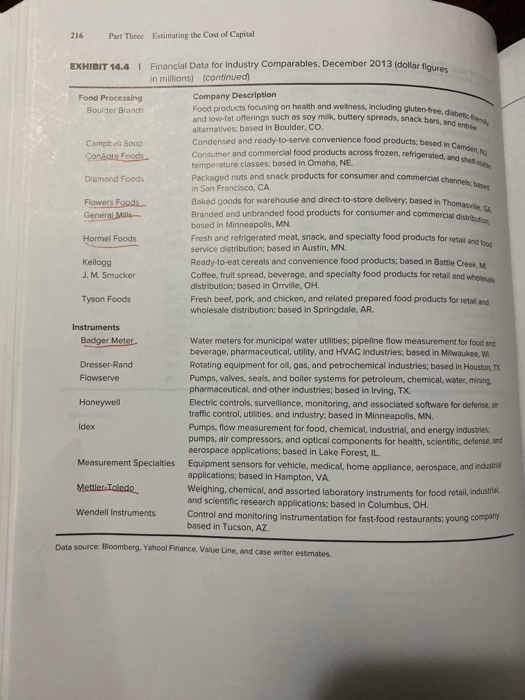

CASE 14 Chestnut Foods dy 2014. stock performance at Minneapolis-based Chestnut Foods (Chestnut) had iled to meet expectations for several years running, and senior management was dressed to talk about much else CEO Brenda Pedersen, cager to reverse the trend, dhegun advocating two strategic initiatives a $1 billion investment in company wth and the adoption of a more progressive corporate identity. At a restaurant over- Looking the Mississippi River, Pedersen hosted an informal meeting of company VPS o build support: exchanges had been highly spirited, but no consensus had material- ined. Then, on her drive home from the restaurant, she received a call from Claire Mever, VP of Food Products, who had attended the dinner. Given the tone of the meet- ing, Pedersen wasn't surprised to get a call so soon, but what Meyer shared floored the CFO, "It just came up on Twitter. My admin saw it and texted me. I'm not going to say I told you so." Meyer read her the tweet. "Van Muur buys 10% of Chestnut, seeks seats on board and a new management direction." Meyer filled in the details: based on filings earlier in the day with the U.S. Securities and Exchange Commission, Rollo van Muur, a high- profile activist investor, had quietly and unexpectedly purchased 10% of the company and was asserting the right to two seats on the board. In addition, Van Muur was recom mending that the Instruments division be sold off to keep the focus where it belongs." Pedersen drove in shocked silence and processed the information while Meyer waited patiently on the line, not sure what to expect. When Pedersen finally responded, she fell back on humor: "Well, that's one way to move the discussion along, but he could have just come to dinner with us." By the end of the night, she had spoken with CEO Moss Thom- ton and organized a team of lawyers and finance staff to assess the company's options. The Company Chestnut Foods began in north Minneapolis in 1887, when 22-year-old Otto Chestnut (bom Otto Kestenbaum in Bavaria) opened a bakery that made lye rolls and pretzels. then stumbled into success as a supplier of sandwiches to the St. Paul, Minneapolis, This case was prepared by Michael J. Schill, Professor of Business Administration, and Donald Stevenson, List Learning LLC. The individuals and entities in this case are fictitious. The case draws on an antecedent Case "Teletech Corporation, 2005" (UVA-R-485) by Robert E. Bruner and Sean D. Carr. Copyright 2015 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To onder copies, send an email to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, or in a retrieval system med in a spreadsher, or transmitted in any form or by any meansclectronic umical, photocopyine mondine, or others whow the permission e Dardent School Foundation to visit the Colu Street Market, descent. At the Maszk, founders of boc distribution vision of wholesale to Minneapolis deter- ck the regional grocery chains way. Six years later, on a trip to Chicago, Illinois, to visit the Mian Exp Chestnut happened to come upon the Maxwell Street vibrant melting por community of merchants of castern European desce a m o re Maske shancementing with Lem VAM Classe Fonds, which provided a range of meat and fish products presenes and condiments. Through the witnessed a nascent ad hoe dielli system to nechborhood groceries in the padly growing city. A vision of wh food production and distribution struck him and he returned to Minneapoli m ed to realize it. By 1920 as regional grocery chains had begun to materialize, Chestnut joined by his sons Thomas and Andrew, had purchased V&M among other food nesses. Their plan was for the expanded Chestnut to stock the regional grocerych across the upper Midwest, while also continuing to supply and dining Cars beginning in 1921. a Chestnut chain of automati c ago and Detroit. Otto Cher died in 1927 atae 62. but the company was well positioned to weather the Great pression in 1935. the Chestnut brothers sold the automat division to Horn & Hande then used the proceeds to purchase farmland in Florida and central California postwar period, as the supermarket model emerged, Chestnut grew with it, both organi cally and through acquisition, going public in 1979. By 2013, the company was valued at Sl 8 billion, with annual profits of more than $130 million Chestnut sought to provide hearty sustenance that gets you where you're going The firm had two main business segments: Food Products, which produced a broad range of fresh, prepackaged, and processed foods for retail and food services, and In- struments, which delivered systems and specialized equipment used in the processing and packaging of food products. Instruments provided a variety of quality control and automation services used within the company. The company took increasing pride in the high quality of its manufacturing process and believed it to be an important differ entiator among both investors and consumers. In recent years, Chestnut's shares had failed to keep pace with either the overall stock market or industry Indexes for foods or machinery (see Exhibit 14.1). The com- pany's credit rating with Standard & Poor's had recently declined one notch to - Securities analysts had remarked on the firm's lackluster earnings growth, pointing to increasing competition in the food industry due to shifting demands. One prominent Wall Street analyst noted on his blog, "Chestnut has become as vulnerable to a hostile takeover as a vacant umbrella on a hot beach." Food Products Division The Food Products division provided a range of prepackaged and frozen products related to the bread and sandwich market for both institutional food services and tail grocery distribution throughout North America, and some limited distribution in parts of Central and South America. Revenues for the segment had long been som the company achieved an average annual growth rate of 29 during 2010 throws 2013. In 2013, segment net operating profit after tax (NOPAT) and net assets were S88 million and 51.4 billion, respectively. Looking to the foreseeable future, oper Som NOPAT i thet of AT 210 Puth ed return on capital for Instruments division sales adressed by early 20 2013. Sem $16 million and met assets were $600 million. The expected return division over the foreseeable future was 7.756) se, and mindful of the stry, Pederson hoped invest in the expansi ket's strong interest red that funneling is he believed that the 7. hdditional company inves Recent Developments Co ed above all else with the poor sockprice performance, and mi importance of scale to profitability in the precious ment industry. Po to sustain corporate growth opportunities by raising on to invest in th of the Instruments division. She had been delighted with the market's strona the lich-value-added offerings the division maintained and believed that fun vestment in its direction was the way forward for Chestnut She believed that expected returns for this division could be maintained with additional company ment. She also believed that the tradition-laden company name failed to cap firm's strategie direction and that the name CF International better reflected growth and modern dynamism envisioned by leadership At the dinner meeting, as over the past few weeks, her initiative had generate partisan reactions from the company's two divisions. Curiously, much of the disc at dinner focused on the rather pedestrian topic of the company hurdle rate. Meyer strongly contended from her perspective in Food Products that the two segments of th business were different enough that they wanted separate hurdle rates; Rob Suchecki VP of Instruments, was ardent in his opposition. SUCHUCKI: Look, Claire, to investors, the firm is just a big black box. They hires take care of what's inside the box and judge us by the dividends coming out of the box. Our job as managers should be to put their money where the returns are best. Consistent with this reality, our company has a long standing policy of using a single common hurdle rate. If that hurdle rate takes from an underperforming division and gives to a more profitable division, isn't that how it's supposed to work? We're all well aware that investors consider past profits unacceptable.' MEYER Rob, the question is how you define profitability. High-return investments are not necessarily the best investments, and to be fair, our investors are way more savvy than you are giving them credit for they have a wide range of information sources and analytic tools at their disposal and have a firm grasp on what is going on inside the company. They appreciate the risk and return of the different business units, and they adjust performance expectations accordingly. So to this type of investor, different hurdle rates for the different levels of risk reflects how things really are. Recently, the company's return on capital had been 6. 7. Company management applied a corporis Sahibit 2 for the rate of 7.0 to all capital projects and to the evaluation of business unit performance. See Exhibit company weighted mange cost of capital (WACC) calculatie Exhibit 3 for the prevailing capela and Exhibit 4 for com e firm intomatic for the prevailing capital market MEYER: Case 14 Chest Foods 211 SHCHECKE: But Claire, multiple bundle rates create allts of ineguities that are bound to create discord among the ranks. If you set the burdle me for Food Prod- ucts lower than the firm-wide harde rate, you're just moving your divi- sion's goalposts closer to the ball. You haven't improved performance you've only made it easier to score! You've got to realize, Rob, that we are playing in different leagues. Each part of the business has to draw on capital differently, because the rules for cach unit are different. If Food Products was on its own, investors would be happy with a lower return because Food Products' risk is so much lower. Stability has its perks. And likewise, if Food Products could raise capital on its own, we'd surely get that capital at a cheaper te Different leagues? The fact is that we don't raise capital separately, we raise it as a firm, based on our overall record. Our debt is Chestnut debt and our equity is Chestnut equity. It's a simple fact that investors expect re- turns that beat our corporate cost of capital of 70. It is only by growing cash flow company-wide that investors are rewarded for their risk capital In fact, being diversified as a company most likely helps reduce our bor- rowing costs, letting us borrow more as a unit than we could separately. Rob, you know very well the kind of problems that thinking creates. If 7.0% SUCHECKI: MEYER: is always the hurdle, the company will end up overinvesting in high-risk projects. Why? Because sensible, low-risk projects won't tend to clear the hurdle. Before long, the company will be packed with high-risk projects, and 7.0% will no longer be enough to compensate investors for the higher risk. By not accommodating multiple hurdle rates, we are setting ourselves up for all sorts of perverse investment incentives. The Food Products division is getting starved for capital, penalized for being a safer bet, while the Instru- ments division is getting overfed, benefitting from a false sense of security SUCHECKI: Hold on, I object! The reason Food Products is not getting capital is because there's no growth in your division. Instruments is coming on like gangbusters. Why would investors want us to put additional capital into a business that is barely keeping up with inflation? At this point, pens and paper napkins were procured for Meyer, who presented the group with a diagram illustrating her argument (Figure 14.1) before continuing. MEYER: With a plot of risk versus return, the dashed line is our current corporate hurdle rate based on the average risk of the company. The solid line is a theoretical hurdle rate that adjusts for the risk of businesses within the company. Food Products is marked with an "E" It is expected to earn 6.3% on capital, which doesn't clear the corporate hurdle rate, but if you adjust for risk, it does clear it, and it is profitable! Instruments is the opposite. It's marked on the graph with an "I" It can expect 7.7% returns, which clears the corporate hurdle. But since it is inherently riskier, the risk-adjusted hurdle rate exceeds 7.7%. Unless we are careful to adjust for that risk, it remains a hidden cost, and we are fooling ourselves. 212 Part Three Estimating the cost of Capital FIGURE 14.1. Meyer's diagram of constant versus risk-adjusted hund Rio dusted hundert Corporate hurdle rate Risk Level Source: Created by case writer SUCHECKI: Claire, I believe it is pure speculation to claim that the risk adjustment line you've sketched out is anywhere close to that steep. Second, even if you are theoretically correct, I believe there is practical wisdom in maintaining a single, simple, consistent, and understandable performance criterion. A single measure of the cost of money makes NPV results consistent, at least in economic terms. If Chestnut adopts multiple rates for discounting cash flows, the NPV and economic profit calculations are going to lose their meaning, and business segments won't be able to make comparisons. At this point, Pederson had finally managed to rein in the heated debate and redired the conversation to matters that were less controversial. The Future of Chestnut It had been quite a night. Pedersen realized that she didn't have the time to resolve all the issues before her to influence Rollo van Muur's attack on management, but any proposal she made needed to be clear on its merits. Her thoughts returned to the discus sion between the VPS Was the historical Chestnut way of doing business as defensa as Suchecki made it sound? Was Instruments underperforming, as Van Muur and 2 asserted? She knew that Van Muur's purchases had been prompted by Chestnut depressed share price. In light of this development, weren't her investment and iden proposats all the more relevant? 14.11 Value of $100 Investad BOUBIT 14.7 Inverted from January 2010 December 2013 weekly adjusted close SO $120 Chestnut $100 ALLA Food Industry 1 $0.80 Jan-10 Jul 10 Jan 11 Jul 11 Jan 12 Jan 13 13 Data Source Yahoo Finance and case writer data 214 Put The B ig the Cost of Capital g EXHIBIT 14.2 Estimation of WACC for Chestnut Foods year-end 2012 Chestnut Foods Hurdle Rate as of December 2013: 7.0% Chat uses a hurdle rate that reflects providing rates of return in financial weighed average of both debt and equity securities. The current mix of debt an Chestnut's capital structure on a market basisi 2016 debt and 80% O don debt of similar credit risk is estimated at 3,5%. Based on a marginal e of 37% the after-tax cost of debt is 2.2%. The cost of equity for Chestnutis based on the CAPM with a bots of 0.9, amanet m of 60an rate of 2 Based on these estimates, the WACC IS 7.0% t O and a risk tree d 15 gives a similar premium and ask cewe of 0.15 vesa As some model that uses a market EXHIBIT 14.3 | Capital Market Data, December 2013 Yield 0.1% 2.8% 30 Day Treasury Bill 10-Year Treasury Bond 10-Year Corporate Bonds of Industrial Companies 33% 3.5% BBB 4.1% 4.6% 5.89 6.5% BB- 6.5% 6.8% 8.4% 9.0% B- Historical Market Risk Premium Equity Market Index Less Government Debo 6.0% Datasource Bloomberg.case writer estimates O EXHIBIT 14.4 Financial Data for Industry Companies, December 2013 Gollar figuresi SSP Bond Total Equity Total Equity Beta Total Debt took Value Mar 0.90 461 1840 0.55 0.60 0.70 B+ BBB 298 Chestnut Foods Food Processing Boulder Brands Campbell Soup ConAgra Foods Diamond Foods Flowers Foods General Mills Hormel Foods Kellogg J. M. Smucker Tyson Foods 0.75 1.349 9,590 958 13.223 12 BOS 5.472 0.50 593 923 157 B8B- B 0.55 . 1,075 0.65 8,645 0.60 250 0.70 BBB+ BBB+ BBB 7.358 2.241 1.942 0.80 31.245 11.759 21,841 10.504 11.469 3,311 3.545 5.168 6.285 1.06 1.40 BBB- BB 1.30 BBB- Instruments Badger Meter Dresser-Rand Flowserve Honeywell idex Measurement Specialties Mettler-Toledo Wendell Instruments 1.287 1.200 8.829 1.25 1.15 1.297 1,870 17,467 1.573 723 4,549 10,767 74,330 5913 774 BAB BBB 129 331 944 1.35 1.10 0.52 413 935 7,154 0 230 Identifies bond ratings that are estimated by case writer, continued 216 Part Three Estimating the Cost of Capital entree, ditore based in Camden. al channels, beses EXHIBIT 14.4 Financial Data for Industry Comparables, December 2013 (dollar fle dollar figures in millions) (continued) Food Processing Company Description Boulder Brands Bendroducts focusing on health and wellness, including gluten-free and low-fat offerings such as soy milk, buttery spreads, snack bars and on alternatives; based in Boulder, CO. Campbell Soup Condensed and ready to serve convenience food products, based in Congre Foods Consumer and commercial food products across frozen, refrigerated.de temperature classes, based in Omaha, NE. Diamond Foods Packaged nuts and snack products for consumer and commercial channel in San Francisco, CA. Flowers Foods Baked goods for warehouse and direct-to-store delivery, based in Thomas General Mills Branded and unbranded food products for consumer and commercial de cial distribution based in Minneapolis, MN Hormel Foods Fresh and refrigerated meat, snack, and specialty food products for retail and service distribution; based in Austin, MN. Kellogg Ready-to-eat cereals and convenience food products, based in Battle Creek J. M. Smucker Coffee, fruit spread, beverage, and specialty food products for retail and whole distribution, based in Orrville, OH Tyson Foods Fresh beef, pork, and chicken, and related prepared food products for retail and wholesale distribution, based in Springdale, AR. Instruments Badger Meter Water meters for municipal water utilities: pipeline flow measurement for food and beverage, pharmaceutical, utility, and HVAC industries, based in Milwaukee, WL Dresser-Rand Rotating equipment for oil, gas, and petrochemical industries, based in Houston, TX Flowserve Pumps, valves, seals, and boiler systems for petroleum, chemical, water, mining pharmaceutical, and other industries; based in Irving, TX. Honeywell Electric controls, surveillance, monitoring, and associated software for defense, al traffic control, utilities, and industry, based in Minneapolis, MN. Pumps, flow measurement for food, chemical Industrial, and energy industries pumps, air compressors, and optical components for health, scientific, defense, and aerospace applications, based in Lake Forest, IL. Measurement Specialties Equipment sensors for vehicle, medical, home appliance, aerospace, and indus applications; based in Hampton, VA MettlerToledo Weighing, chemical, and assorted laboratory Instruments for food retail, Industriel and scientific research applications based in Columbus, OH. Wendell Instruments Control and monitoring Instrumentation for fast-food restaurants; young company based in Tucson, AZ. Idex Data source Bloomberg, Yahool Finance Value Line, and case writer estimates CASE 14 Chestnut Foods dy 2014. stock performance at Minneapolis-based Chestnut Foods (Chestnut) had iled to meet expectations for several years running, and senior management was dressed to talk about much else CEO Brenda Pedersen, cager to reverse the trend, dhegun advocating two strategic initiatives a $1 billion investment in company wth and the adoption of a more progressive corporate identity. At a restaurant over- Looking the Mississippi River, Pedersen hosted an informal meeting of company VPS o build support: exchanges had been highly spirited, but no consensus had material- ined. Then, on her drive home from the restaurant, she received a call from Claire Mever, VP of Food Products, who had attended the dinner. Given the tone of the meet- ing, Pedersen wasn't surprised to get a call so soon, but what Meyer shared floored the CFO, "It just came up on Twitter. My admin saw it and texted me. I'm not going to say I told you so." Meyer read her the tweet. "Van Muur buys 10% of Chestnut, seeks seats on board and a new management direction." Meyer filled in the details: based on filings earlier in the day with the U.S. Securities and Exchange Commission, Rollo van Muur, a high- profile activist investor, had quietly and unexpectedly purchased 10% of the company and was asserting the right to two seats on the board. In addition, Van Muur was recom mending that the Instruments division be sold off to keep the focus where it belongs." Pedersen drove in shocked silence and processed the information while Meyer waited patiently on the line, not sure what to expect. When Pedersen finally responded, she fell back on humor: "Well, that's one way to move the discussion along, but he could have just come to dinner with us." By the end of the night, she had spoken with CEO Moss Thom- ton and organized a team of lawyers and finance staff to assess the company's options. The Company Chestnut Foods began in north Minneapolis in 1887, when 22-year-old Otto Chestnut (bom Otto Kestenbaum in Bavaria) opened a bakery that made lye rolls and pretzels. then stumbled into success as a supplier of sandwiches to the St. Paul, Minneapolis, This case was prepared by Michael J. Schill, Professor of Business Administration, and Donald Stevenson, List Learning LLC. The individuals and entities in this case are fictitious. The case draws on an antecedent Case "Teletech Corporation, 2005" (UVA-R-485) by Robert E. Bruner and Sean D. Carr. Copyright 2015 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To onder copies, send an email to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, or in a retrieval system med in a spreadsher, or transmitted in any form or by any meansclectronic umical, photocopyine mondine, or others whow the permission e Dardent School Foundation to visit the Colu Street Market, descent. At the Maszk, founders of boc distribution vision of wholesale to Minneapolis deter- ck the regional grocery chains way. Six years later, on a trip to Chicago, Illinois, to visit the Mian Exp Chestnut happened to come upon the Maxwell Street vibrant melting por community of merchants of castern European desce a m o re Maske shancementing with Lem VAM Classe Fonds, which provided a range of meat and fish products presenes and condiments. Through the witnessed a nascent ad hoe dielli system to nechborhood groceries in the padly growing city. A vision of wh food production and distribution struck him and he returned to Minneapoli m ed to realize it. By 1920 as regional grocery chains had begun to materialize, Chestnut joined by his sons Thomas and Andrew, had purchased V&M among other food nesses. Their plan was for the expanded Chestnut to stock the regional grocerych across the upper Midwest, while also continuing to supply and dining Cars beginning in 1921. a Chestnut chain of automati c ago and Detroit. Otto Cher died in 1927 atae 62. but the company was well positioned to weather the Great pression in 1935. the Chestnut brothers sold the automat division to Horn & Hande then used the proceeds to purchase farmland in Florida and central California postwar period, as the supermarket model emerged, Chestnut grew with it, both organi cally and through acquisition, going public in 1979. By 2013, the company was valued at Sl 8 billion, with annual profits of more than $130 million Chestnut sought to provide hearty sustenance that gets you where you're going The firm had two main business segments: Food Products, which produced a broad range of fresh, prepackaged, and processed foods for retail and food services, and In- struments, which delivered systems and specialized equipment used in the processing and packaging of food products. Instruments provided a variety of quality control and automation services used within the company. The company took increasing pride in the high quality of its manufacturing process and believed it to be an important differ entiator among both investors and consumers. In recent years, Chestnut's shares had failed to keep pace with either the overall stock market or industry Indexes for foods or machinery (see Exhibit 14.1). The com- pany's credit rating with Standard & Poor's had recently declined one notch to - Securities analysts had remarked on the firm's lackluster earnings growth, pointing to increasing competition in the food industry due to shifting demands. One prominent Wall Street analyst noted on his blog, "Chestnut has become as vulnerable to a hostile takeover as a vacant umbrella on a hot beach." Food Products Division The Food Products division provided a range of prepackaged and frozen products related to the bread and sandwich market for both institutional food services and tail grocery distribution throughout North America, and some limited distribution in parts of Central and South America. Revenues for the segment had long been som the company achieved an average annual growth rate of 29 during 2010 throws 2013. In 2013, segment net operating profit after tax (NOPAT) and net assets were S88 million and 51.4 billion, respectively. Looking to the foreseeable future, oper Som NOPAT i thet of AT 210 Puth ed return on capital for Instruments division sales adressed by early 20 2013. Sem $16 million and met assets were $600 million. The expected return division over the foreseeable future was 7.756) se, and mindful of the stry, Pederson hoped invest in the expansi ket's strong interest red that funneling is he believed that the 7. hdditional company inves Recent Developments Co ed above all else with the poor sockprice performance, and mi importance of scale to profitability in the precious ment industry. Po to sustain corporate growth opportunities by raising on to invest in th of the Instruments division. She had been delighted with the market's strona the lich-value-added offerings the division maintained and believed that fun vestment in its direction was the way forward for Chestnut She believed that expected returns for this division could be maintained with additional company ment. She also believed that the tradition-laden company name failed to cap firm's strategie direction and that the name CF International better reflected growth and modern dynamism envisioned by leadership At the dinner meeting, as over the past few weeks, her initiative had generate partisan reactions from the company's two divisions. Curiously, much of the disc at dinner focused on the rather pedestrian topic of the company hurdle rate. Meyer strongly contended from her perspective in Food Products that the two segments of th business were different enough that they wanted separate hurdle rates; Rob Suchecki VP of Instruments, was ardent in his opposition. SUCHUCKI: Look, Claire, to investors, the firm is just a big black box. They hires take care of what's inside the box and judge us by the dividends coming out of the box. Our job as managers should be to put their money where the returns are best. Consistent with this reality, our company has a long standing policy of using a single common hurdle rate. If that hurdle rate takes from an underperforming division and gives to a more profitable division, isn't that how it's supposed to work? We're all well aware that investors consider past profits unacceptable.' MEYER Rob, the question is how you define profitability. High-return investments are not necessarily the best investments, and to be fair, our investors are way more savvy than you are giving them credit for they have a wide range of information sources and analytic tools at their disposal and have a firm grasp on what is going on inside the company. They appreciate the risk and return of the different business units, and they adjust performance expectations accordingly. So to this type of investor, different hurdle rates for the different levels of risk reflects how things really are. Recently, the company's return on capital had been 6. 7. Company management applied a corporis Sahibit 2 for the rate of 7.0 to all capital projects and to the evaluation of business unit performance. See Exhibit company weighted mange cost of capital (WACC) calculatie Exhibit 3 for the prevailing capela and Exhibit 4 for com e firm intomatic for the prevailing capital market MEYER: Case 14 Chest Foods 211 SHCHECKE: But Claire, multiple bundle rates create allts of ineguities that are bound to create discord among the ranks. If you set the burdle me for Food Prod- ucts lower than the firm-wide harde rate, you're just moving your divi- sion's goalposts closer to the ball. You haven't improved performance you've only made it easier to score! You've got to realize, Rob, that we are playing in different leagues. Each part of the business has to draw on capital differently, because the rules for cach unit are different. If Food Products was on its own, investors would be happy with a lower return because Food Products' risk is so much lower. Stability has its perks. And likewise, if Food Products could raise capital on its own, we'd surely get that capital at a cheaper te Different leagues? The fact is that we don't raise capital separately, we raise it as a firm, based on our overall record. Our debt is Chestnut debt and our equity is Chestnut equity. It's a simple fact that investors expect re- turns that beat our corporate cost of capital of 70. It is only by growing cash flow company-wide that investors are rewarded for their risk capital In fact, being diversified as a company most likely helps reduce our bor- rowing costs, letting us borrow more as a unit than we could separately. Rob, you know very well the kind of problems that thinking creates. If 7.0% SUCHECKI: MEYER: is always the hurdle, the company will end up overinvesting in high-risk projects. Why? Because sensible, low-risk projects won't tend to clear the hurdle. Before long, the company will be packed with high-risk projects, and 7.0% will no longer be enough to compensate investors for the higher risk. By not accommodating multiple hurdle rates, we are setting ourselves up for all sorts of perverse investment incentives. The Food Products division is getting starved for capital, penalized for being a safer bet, while the Instru- ments division is getting overfed, benefitting from a false sense of security SUCHECKI: Hold on, I object! The reason Food Products is not getting capital is because there's no growth in your division. Instruments is coming on like gangbusters. Why would investors want us to put additional capital into a business that is barely keeping up with inflation? At this point, pens and paper napkins were procured for Meyer, who presented the group with a diagram illustrating her argument (Figure 14.1) before continuing. MEYER: With a plot of risk versus return, the dashed line is our current corporate hurdle rate based on the average risk of the company. The solid line is a theoretical hurdle rate that adjusts for the risk of businesses within the company. Food Products is marked with an "E" It is expected to earn 6.3% on capital, which doesn't clear the corporate hurdle rate, but if you adjust for risk, it does clear it, and it is profitable! Instruments is the opposite. It's marked on the graph with an "I" It can expect 7.7% returns, which clears the corporate hurdle. But since it is inherently riskier, the risk-adjusted hurdle rate exceeds 7.7%. Unless we are careful to adjust for that risk, it remains a hidden cost, and we are fooling ourselves. 212 Part Three Estimating the cost of Capital FIGURE 14.1. Meyer's diagram of constant versus risk-adjusted hund Rio dusted hundert Corporate hurdle rate Risk Level Source: Created by case writer SUCHECKI: Claire, I believe it is pure speculation to claim that the risk adjustment line you've sketched out is anywhere close to that steep. Second, even if you are theoretically correct, I believe there is practical wisdom in maintaining a single, simple, consistent, and understandable performance criterion. A single measure of the cost of money makes NPV results consistent, at least in economic terms. If Chestnut adopts multiple rates for discounting cash flows, the NPV and economic profit calculations are going to lose their meaning, and business segments won't be able to make comparisons. At this point, Pederson had finally managed to rein in the heated debate and redired the conversation to matters that were less controversial. The Future of Chestnut It had been quite a night. Pedersen realized that she didn't have the time to resolve all the issues before her to influence Rollo van Muur's attack on management, but any proposal she made needed to be clear on its merits. Her thoughts returned to the discus sion between the VPS Was the historical Chestnut way of doing business as defensa as Suchecki made it sound? Was Instruments underperforming, as Van Muur and 2 asserted? She knew that Van Muur's purchases had been prompted by Chestnut depressed share price. In light of this development, weren't her investment and iden proposats all the more relevant? 14.11 Value of $100 Investad BOUBIT 14.7 Inverted from January 2010 December 2013 weekly adjusted close SO $120 Chestnut $100 ALLA Food Industry 1 $0.80 Jan-10 Jul 10 Jan 11 Jul 11 Jan 12 Jan 13 13 Data Source Yahoo Finance and case writer data 214 Put The B ig the Cost of Capital g EXHIBIT 14.2 Estimation of WACC for Chestnut Foods year-end 2012 Chestnut Foods Hurdle Rate as of December 2013: 7.0% Chat uses a hurdle rate that reflects providing rates of return in financial weighed average of both debt and equity securities. The current mix of debt an Chestnut's capital structure on a market basisi 2016 debt and 80% O don debt of similar credit risk is estimated at 3,5%. Based on a marginal e of 37% the after-tax cost of debt is 2.2%. The cost of equity for Chestnutis based on the CAPM with a bots of 0.9, amanet m of 60an rate of 2 Based on these estimates, the WACC IS 7.0% t O and a risk tree d 15 gives a similar premium and ask cewe of 0.15 vesa As some model that uses a market EXHIBIT 14.3 | Capital Market Data, December 2013 Yield 0.1% 2.8% 30 Day Treasury Bill 10-Year Treasury Bond 10-Year Corporate Bonds of Industrial Companies 33% 3.5% BBB 4.1% 4.6% 5.89 6.5% BB- 6.5% 6.8% 8.4% 9.0% B- Historical Market Risk Premium Equity Market Index Less Government Debo 6.0% Datasource Bloomberg.case writer estimates O EXHIBIT 14.4 Financial Data for Industry Companies, December 2013 Gollar figuresi SSP Bond Total Equity Total Equity Beta Total Debt took Value Mar 0.90 461 1840 0.55 0.60 0.70 B+ BBB 298 Chestnut Foods Food Processing Boulder Brands Campbell Soup ConAgra Foods Diamond Foods Flowers Foods General Mills Hormel Foods Kellogg J. M. Smucker Tyson Foods 0.75 1.349 9,590 958 13.223 12 BOS 5.472 0.50 593 923 157 B8B- B 0.55 . 1,075 0.65 8,645 0.60 250 0.70 BBB+ BBB+ BBB 7.358 2.241 1.942 0.80 31.245 11.759 21,841 10.504 11.469 3,311 3.545 5.168 6.285 1.06 1.40 BBB- BB 1.30 BBB- Instruments Badger Meter Dresser-Rand Flowserve Honeywell idex Measurement Specialties Mettler-Toledo Wendell Instruments 1.287 1.200 8.829 1.25 1.15 1.297 1,870 17,467 1.573 723 4,549 10,767 74,330 5913 774 BAB BBB 129 331 944 1.35 1.10 0.52 413 935 7,154 0 230 Identifies bond ratings that are estimated by case writer, continued 216 Part Three Estimating the Cost of Capital entree, ditore based in Camden. al channels, beses EXHIBIT 14.4 Financial Data for Industry Comparables, December 2013 (dollar fle dollar figures in millions) (continued) Food Processing Company Description Boulder Brands Bendroducts focusing on health and wellness, including gluten-free and low-fat offerings such as soy milk, buttery spreads, snack bars and on alternatives; based in Boulder, CO. Campbell Soup Condensed and ready to serve convenience food products, based in Congre Foods Consumer and commercial food products across frozen, refrigerated.de temperature classes, based in Omaha, NE. Diamond Foods Packaged nuts and snack products for consumer and commercial channel in San Francisco, CA. Flowers Foods Baked goods for warehouse and direct-to-store delivery, based in Thomas General Mills Branded and unbranded food products for consumer and commercial de cial distribution based in Minneapolis, MN Hormel Foods Fresh and refrigerated meat, snack, and specialty food products for retail and service distribution; based in Austin, MN. Kellogg Ready-to-eat cereals and convenience food products, based in Battle Creek J. M. Smucker Coffee, fruit spread, beverage, and specialty food products for retail and whole distribution, based in Orrville, OH Tyson Foods Fresh beef, pork, and chicken, and related prepared food products for retail and wholesale distribution, based in Springdale, AR. Instruments Badger Meter Water meters for municipal water utilities: pipeline flow measurement for food and beverage, pharmaceutical, utility, and HVAC industries, based in Milwaukee, WL Dresser-Rand Rotating equipment for oil, gas, and petrochemical industries, based in Houston, TX Flowserve Pumps, valves, seals, and boiler systems for petroleum, chemical, water, mining pharmaceutical, and other industries; based in Irving, TX. Honeywell Electric controls, surveillance, monitoring, and associated software for defense, al traffic control, utilities, and industry, based in Minneapolis, MN. Pumps, flow measurement for food, chemical Industrial, and energy industries pumps, air compressors, and optical components for health, scientific, defense, and aerospace applications, based in Lake Forest, IL. Measurement Specialties Equipment sensors for vehicle, medical, home appliance, aerospace, and indus applications; based in Hampton, VA MettlerToledo Weighing, chemical, and assorted laboratory Instruments for food retail, Industriel and scientific research applications based in Columbus, OH. Wendell Instruments Control and monitoring Instrumentation for fast-food restaurants; young company based in Tucson, AZ. Idex Data source Bloomberg, Yahool Finance Value Line, and case writer estimates 1. Why is Van Muur soliciting control of Chestnut?

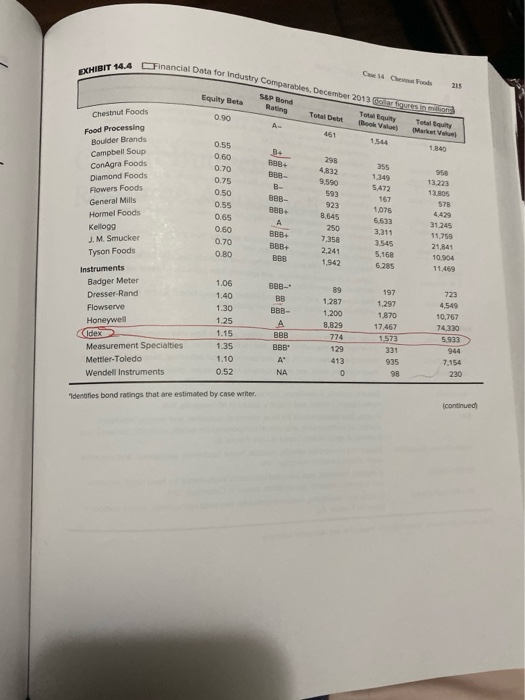

2. Do you agree with Meyers dinner conversation assertions? Estimate a risk-adjusted cost of capital for the two business units and comment on whether Meyers graph is accurate (case Figure 1). In estimating the cost of capital, please consider WACC estimates based on the comparable companies. How does the choice of a constant versus risk-adjusted hurdle rate affect your evaluation of Chestnuts two divisions?

3. Do you support Pedersons proposal? In light of the recent developments, is her investment and identity proposal more relevant? What recommendations should Pederson make to respond to Van Muur?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started