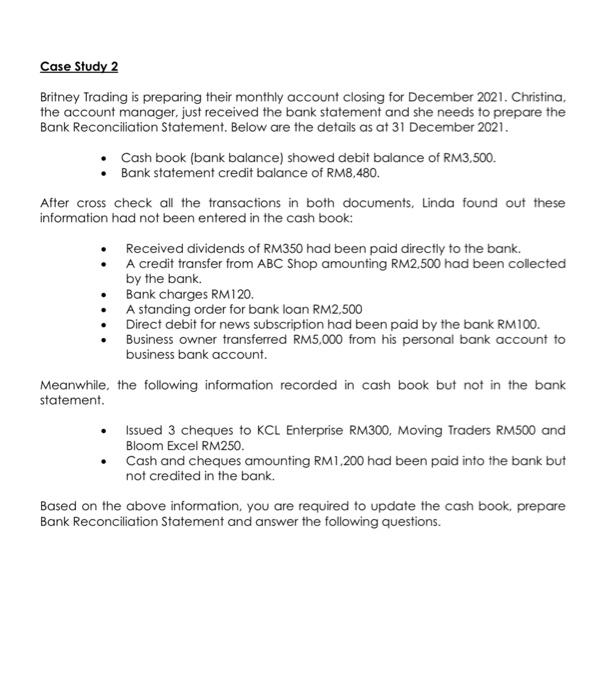

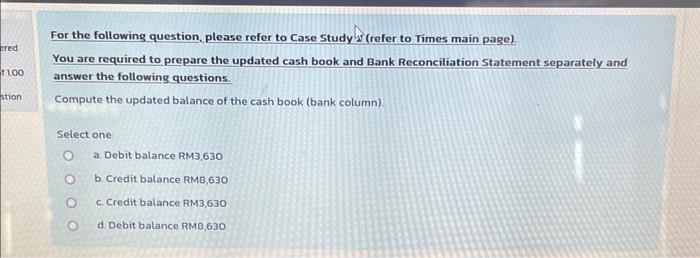

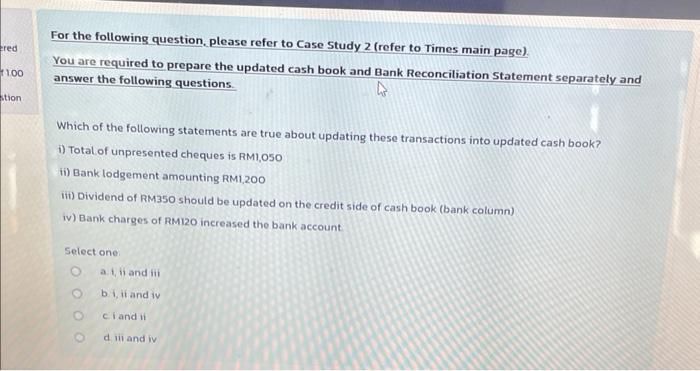

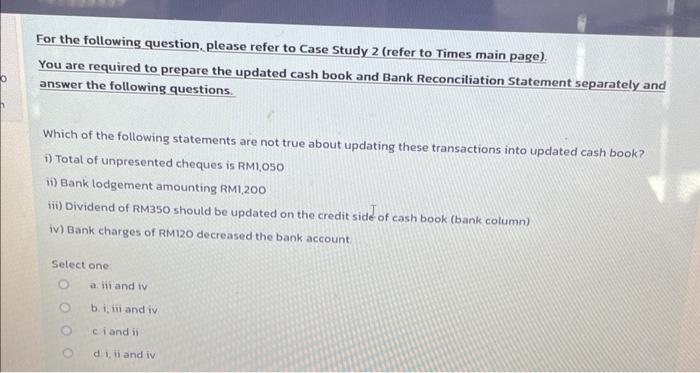

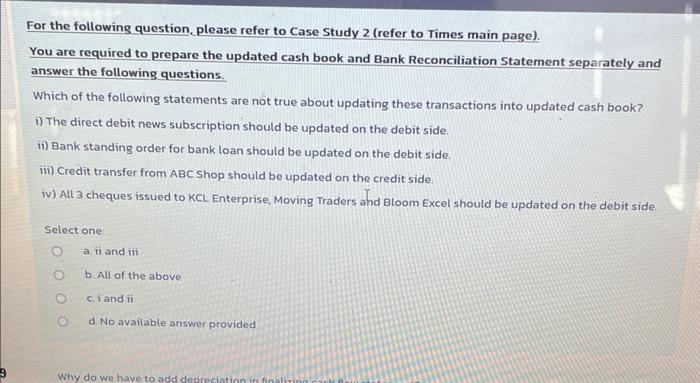

Case Study 2 Britney Trading is preparing their monthly account closing for December 2021. Christina, the account manager, just received the bank statement and she needs to prepare the Bank Reconciliation Statement. Below are the details as at 31 December 2021. - Cash book (bank balance) showed debit balance of RM3.500. - Bank statement credit balance of RM8,480. After cross check all the transactions in both documents, Linda found out these information had not been entered in the cash book: - Received dividends of RM350 had been paid directly to the bank. - A credit transfer from ABC Shop amounting RM2,500 had been collected by the bank. - Bank charges RM120. - A standing order for bank loan RM2,500 - Direct debit for news subscription had been paid by the bank RM100. - Business owner transferred RM5,000 from his personal bank account to business bank account. Meanwhile, the following information recorded in cash book but not in the bank statement. - Issued 3 cheques to KCL Enterprise RM300, Moving Traders RM500 and Bloom Excel RM250. - Cash and cheques amounting RM1,200 had been paid into the bank but not credited in the bank. Based on the above information, you are required to update the cash book, prepare Bank Reconciliation Statement and answer the following questions. For the following question. please refer to Case study (refer to Times main page). You are required to prepare the updated cash book and Bank Reconciliation Statement separately and answer the following questions. Compute the updated balance of the cash book (bank column). Select one: a. Debit balance RM3,630 b. Credit balance RMB,630 c. Credit balance RM3,630 d. Debit balance RMB,630 answer the following questions. Which of the following statements are true about updating these transactions into updated cash book? i) Total of unpresented cheques is RM1,050 ii) Bank lodgement amounting RM1,200 iii) Dividend of RM350 should be updated on the credit side of cash book (bank column) iv) Bank charges of RM12O increased the bank account. Select one a. 1,11 and iii b i, if and iv ciand if d 3 and iv You are required to prepare the updated cash book and Bank Reconciliation Statement separately and answer the following questions. Which of the following statements are not true about updating these transactions into updated cash book? i) Total of unpresented cheques is RM1,050 ii) Bank lodgement amounting RM1,200 iii) Dividend of RM350 should be updated on the credit side of cash book (bank column) iv) Bank charges of RMI2O decreased the bank account. Select one: a. 11 and iv b. i, iii and iv c.i and ii d 1,1i and iv For the following question, please refer to Case Study 2 (refer to Times main page). You are required to prepare the updated cash book and Bank Reconciliation Statement separately and answer the following questions. Which of the following statements are not true about updating these transactions into updated cash book? i) The direct debit news subscription should be updated on the debit side. ii) Bank standing order for bank loan should be updated on the debit side. iii) Credit transfer from ABC Shop should be updated on the credit side. iv) All 3 cheques issued to KCL Enterprise, Moving Traders and Bloom Excel should be updated on the debit side. Select one: a. ii and iii b. All of the above c. 1 and ii d. No available answer provided