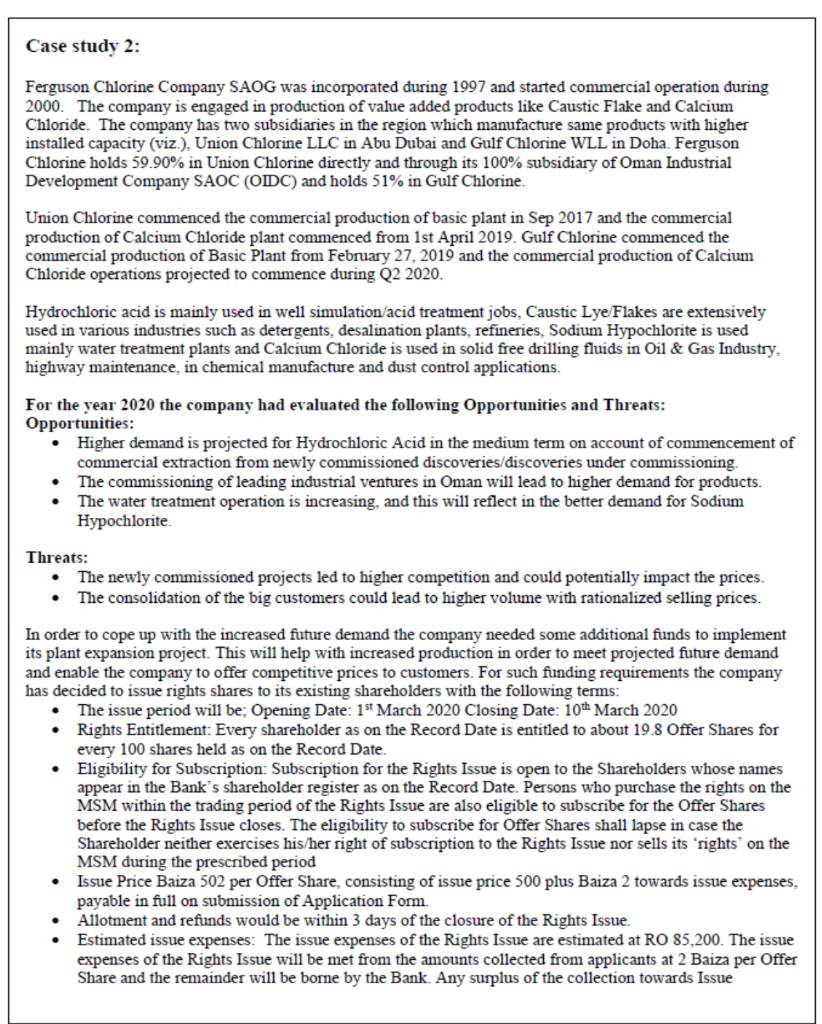

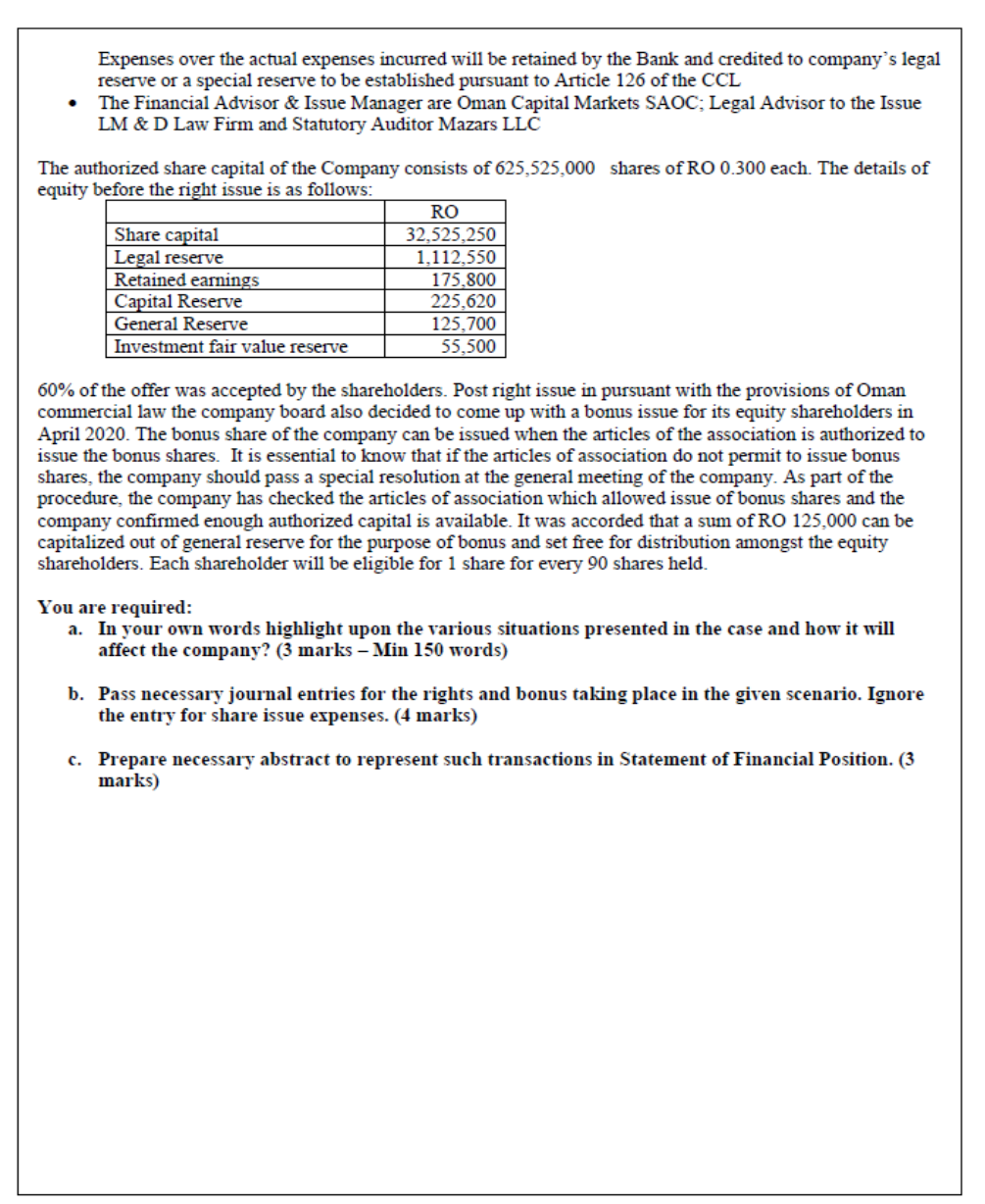

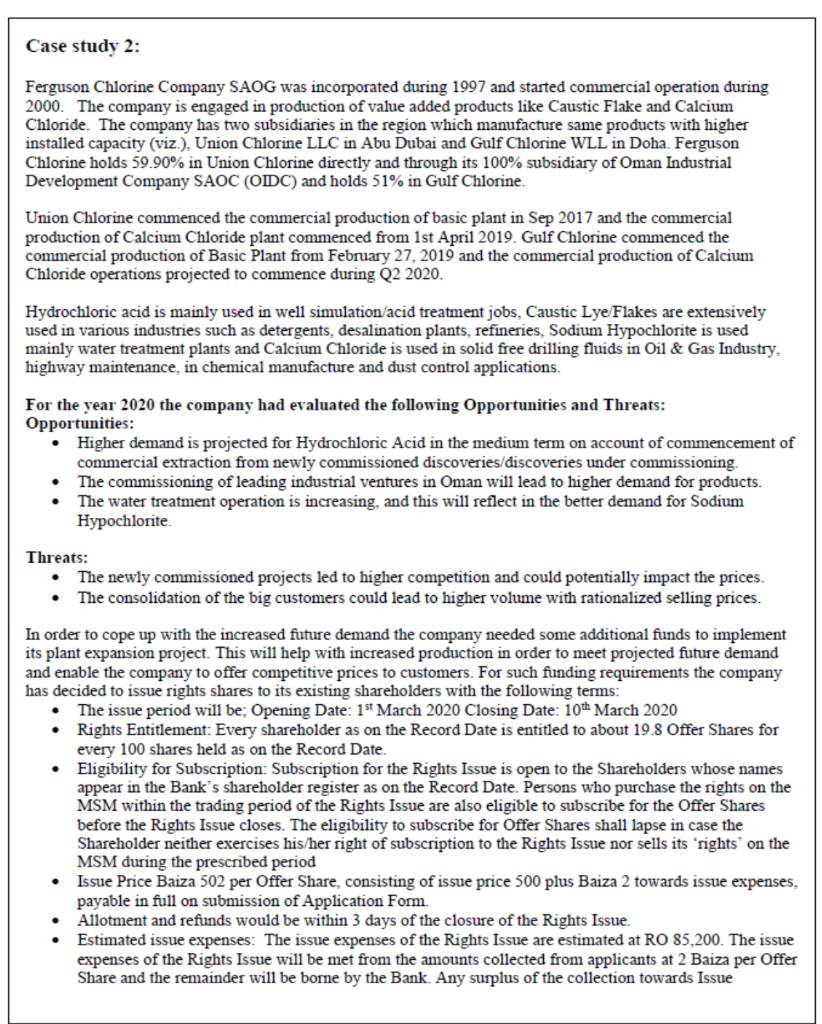

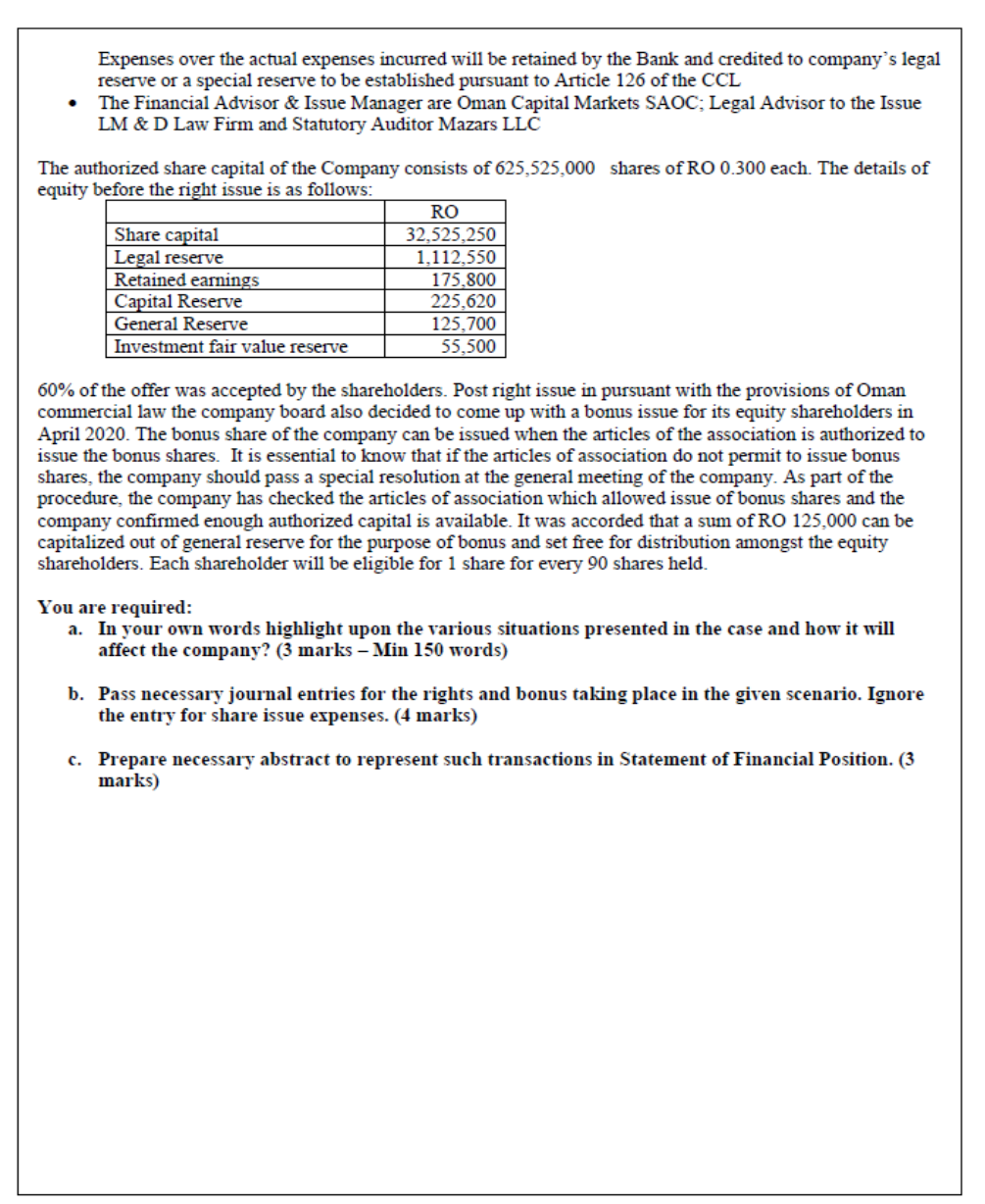

Case study 2: Ferguson Chlorine Company SAOG was incorporated during 1997 and started commercial operation during 2000. The company is engaged in production of value added products like Caustic Flake and Calcium Chloride. The company has two subsidiaries in the region which manufacture same products with higher installed capacity (viz.), Union Chlorine LLC in Abu Dubai and Gulf Chlorine WLL in Doha. Ferguson Chlorine holds 59.90% in Union Chlorine directly and through its 100% subsidiary of Oman Industrial Development Company SAOC (ODC) and holds 51% in Gulf Chlorine. Union Chlorine commenced the commercial production of basic plant in Sep 2017 and the commercial production of Calcium Chloride plant commenced from 1st April 2019. Gulf Chlorine commenced the commercial production of Basic Plant from February 27, 2019 and the commercial production of Calcium Chloride operations projected to commence during Q2 2020. Hydrochloric acid is mainly used in well simulation/acid treatment jobs, Caustic Lye Flakes are extensively used in various industries such as detergents, desalination plants, refineries, Sodium Hypochlorite is used mainly water treatment plants and Calcium Chloride is used in solid free drilling fluids in Oil & Gas Industry, highway maintenance, in chemical manufacture and dust control applications. For the year 2020 the company had evaluated the following Opportunities and Threats: Opportunities: Higher demand is projected for Hydrochloric Acid in the medium term on account of commencement of commercial extraction from newly commissioned coveries/discoveries under commissioning The commissioning of leading industrial ventures in Oman will lead to higher demand for products. The water treatment operation is increasing, and this will reflect in the better demand for Sodium Hypochlorite. Threats: The newly commissioned projects led to higher competition and could potentially impact the prices. The consolidation of the big customers could lead to higher volume with rationalized selling prices. In order to cope up with the increased future demand the company needed some additional funds to implement its plant expansion project. This will help with increased production in order to meet projected future demand and enable the company to offer competitive prices to customers. For such funding requirements the company has decided to issue rights shares to its existing shareholders with the following terms: The issue period will be; Opening Date: 1st March 2020 Closing Date: 10th March 2020 Rights Entitlement: Every shareholder as on the Record Date is entitled to about 19.8 Offer Shares for every 100 shares held as on the Record Date. Eligibility for Subscription: Subscription for the Rights Issue is open to the Shareholders whose names appear in the Bank's shareholder register as on the Record Date. Persons who purchase the rights on the MSM within the trading period of the Rights Issue are also eligible to subscribe for the Offer Shares before the Rights Issue closes. The eligibility to subscribe for Offer Shares shall lapse in case the Shareholder neither exercises his/her right of subscription to the Rights Issue nor sells its rights on the MSM during the prescribed period Issue Price Baiza 502 per Offer Share, consisting of issue price 500 plus Baiza 2 towards issue expenses, payable in full on submission of Application Form. Allotment and refunds would be within 3 days of the closure of the Rights Issue. Estimated issue expenses: The issue expenses of the Rights Issue are estimated at RO 85,200. The issue expenses of the Rights Issue will be met from the amounts collected from applicants at 2 Baiza per Offer Share and the remainder will be borne by the Bank. Any surplus of the collection towards Issue Expenses over the actual expenses incurred will be retained by the Bank and credited to company's legal reserve or a special reserve to be established pursuant to Article 126 of the CCL The Financial Advisor & Issue Manager are Oman Capital Markets SAOC; Legal Advisor to the Issue LM & D Law Firm and Statutory Auditor Mazars LLC The authorized share capital of the Company consists of 625,525,000 shares of RO 0.300 each. The details of equity before the right issue is as follows: RO Share capital 32,525,250 Legal reserve 1.112.550 Retained earnings 175.800 Capital Reserve 225,620 General Reserve 125,700 Investment fair value reserve 55,500 60% of the offer was accepted by the shareholders. Post right issue in pursuant with the provisions of Oman commercial law the company board also decided to come up with a bonus issue for its equity shareholders in April 2020. The bonus share of the company can be issued when the articles of the association is authorized to issue the bonus shares. It is essential to know that if the articles of association do not permit to issue bonus shares, the company should pass a special resolution at the general meeting of the company. As part of the procedure, the company has checked the articles of association which allowed issue of bonus shares and the company confirmed enough authorized capital is available. It was accorded that a sum of RO 125,000 can be capitalized out of general reserve for the purpose of bonus and set free for distribution amongst the equity shareholders. Each shareholder will be eligible for 1 share for every 90 shares held. You are required: a. In your own words highlight upon the various situations presented in the case and how it will affect the company? (3 marks - Min 150 words) b. Pass necessary journal entries for the rights and bonus taking place in the given scenario. Ignore the entry for share issue expenses. (4 marks) c. Prepare necessary abstract to represent such transactions in Statement of Financial Position. (3 marks) Case study 2: Ferguson Chlorine Company SAOG was incorporated during 1997 and started commercial operation during 2000. The company is engaged in production of value added products like Caustic Flake and Calcium Chloride. The company has two subsidiaries in the region which manufacture same products with higher installed capacity (viz.), Union Chlorine LLC in Abu Dubai and Gulf Chlorine WLL in Doha. Ferguson Chlorine holds 59.90% in Union Chlorine directly and through its 100% subsidiary of Oman Industrial Development Company SAOC (ODC) and holds 51% in Gulf Chlorine. Union Chlorine commenced the commercial production of basic plant in Sep 2017 and the commercial production of Calcium Chloride plant commenced from 1st April 2019. Gulf Chlorine commenced the commercial production of Basic Plant from February 27, 2019 and the commercial production of Calcium Chloride operations projected to commence during Q2 2020. Hydrochloric acid is mainly used in well simulation/acid treatment jobs, Caustic Lye Flakes are extensively used in various industries such as detergents, desalination plants, refineries, Sodium Hypochlorite is used mainly water treatment plants and Calcium Chloride is used in solid free drilling fluids in Oil & Gas Industry, highway maintenance, in chemical manufacture and dust control applications. For the year 2020 the company had evaluated the following Opportunities and Threats: Opportunities: Higher demand is projected for Hydrochloric Acid in the medium term on account of commencement of commercial extraction from newly commissioned coveries/discoveries under commissioning The commissioning of leading industrial ventures in Oman will lead to higher demand for products. The water treatment operation is increasing, and this will reflect in the better demand for Sodium Hypochlorite. Threats: The newly commissioned projects led to higher competition and could potentially impact the prices. The consolidation of the big customers could lead to higher volume with rationalized selling prices. In order to cope up with the increased future demand the company needed some additional funds to implement its plant expansion project. This will help with increased production in order to meet projected future demand and enable the company to offer competitive prices to customers. For such funding requirements the company has decided to issue rights shares to its existing shareholders with the following terms: The issue period will be; Opening Date: 1st March 2020 Closing Date: 10th March 2020 Rights Entitlement: Every shareholder as on the Record Date is entitled to about 19.8 Offer Shares for every 100 shares held as on the Record Date. Eligibility for Subscription: Subscription for the Rights Issue is open to the Shareholders whose names appear in the Bank's shareholder register as on the Record Date. Persons who purchase the rights on the MSM within the trading period of the Rights Issue are also eligible to subscribe for the Offer Shares before the Rights Issue closes. The eligibility to subscribe for Offer Shares shall lapse in case the Shareholder neither exercises his/her right of subscription to the Rights Issue nor sells its rights on the MSM during the prescribed period Issue Price Baiza 502 per Offer Share, consisting of issue price 500 plus Baiza 2 towards issue expenses, payable in full on submission of Application Form. Allotment and refunds would be within 3 days of the closure of the Rights Issue. Estimated issue expenses: The issue expenses of the Rights Issue are estimated at RO 85,200. The issue expenses of the Rights Issue will be met from the amounts collected from applicants at 2 Baiza per Offer Share and the remainder will be borne by the Bank. Any surplus of the collection towards Issue Expenses over the actual expenses incurred will be retained by the Bank and credited to company's legal reserve or a special reserve to be established pursuant to Article 126 of the CCL The Financial Advisor & Issue Manager are Oman Capital Markets SAOC; Legal Advisor to the Issue LM & D Law Firm and Statutory Auditor Mazars LLC The authorized share capital of the Company consists of 625,525,000 shares of RO 0.300 each. The details of equity before the right issue is as follows: RO Share capital 32,525,250 Legal reserve 1.112.550 Retained earnings 175.800 Capital Reserve 225,620 General Reserve 125,700 Investment fair value reserve 55,500 60% of the offer was accepted by the shareholders. Post right issue in pursuant with the provisions of Oman commercial law the company board also decided to come up with a bonus issue for its equity shareholders in April 2020. The bonus share of the company can be issued when the articles of the association is authorized to issue the bonus shares. It is essential to know that if the articles of association do not permit to issue bonus shares, the company should pass a special resolution at the general meeting of the company. As part of the procedure, the company has checked the articles of association which allowed issue of bonus shares and the company confirmed enough authorized capital is available. It was accorded that a sum of RO 125,000 can be capitalized out of general reserve for the purpose of bonus and set free for distribution amongst the equity shareholders. Each shareholder will be eligible for 1 share for every 90 shares held. You are required: a. In your own words highlight upon the various situations presented in the case and how it will affect the company? (3 marks - Min 150 words) b. Pass necessary journal entries for the rights and bonus taking place in the given scenario. Ignore the entry for share issue expenses. (4 marks) c. Prepare necessary abstract to represent such transactions in Statement of Financial Position