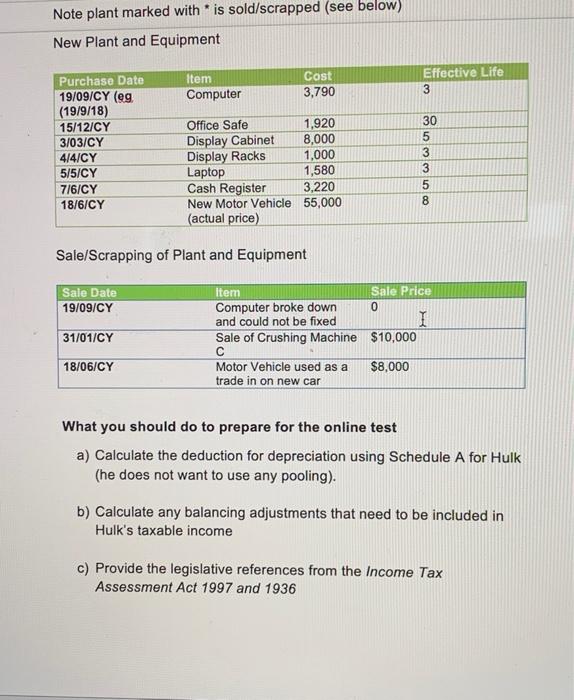

Case Study 3 Uniform Capital Allowance Hulk ran a successful scrapyard business knowns as the "Green Junk Yard" and during the year purchased some additional plant and equipment for the business. He traded-in or scrapped several of the older pieces of equipment. The details of his existing plant and equipment and transactions during the year are as follows: Existing plant and Equipment (use this information to create the 2021 schedule eg Office Furniture OAV for 2021 is $1500) Item Cost OAV Rate using DV method Office Furniture 4,200 1,500 40% Crushing 15,000 7,400 20% Machine A Crushing 6,000 3,000 20% Machine B Motor Vehicle 18,000 16,575 25.0% Crushing 7,000 5,000 10.0% Machine C Crushing 12,500 12,082 20% Machine D Carpets 5,700 5,319 40% Computer 2,500 1,865 40% will Note plant marked with is sold/scrapped (see below) New Plant and Equipment Item Computer Cost 3,790 Effective Life 3 Purchase Date 19/09/CY (eg (19/9/18) 15/12/CY 3/03/CY 4/4/CY 5/5/CY 7/6/CY 18/6/CY Office Safe 1,920 Display Cabinet 8,000 Display Racks 1,000 Laptop 1,580 Cash Register 3,220 New Motor Vehicle 55,000 (actual price) 30 5 3 3 5 8 Sale/Scrapping of Plant and Equipment Sale Date 19/09/CY I 31/01/CY Item Sale Price Computer broke down 0 and could not be fixed I Sale of Crushing Machine $10,000 Motor Vehicle used as a $8,000 trade in on new car 18/06/CY What you should do to prepare for the online test a) Calculate the deduction for depreciation using Schedule A for Hulk (he does not want to use any pooling). b) Calculate any balancing adjustments that need to be included in Hulk's taxable income c) Provide the legislative references from the Income Tax Assessment Act 1997 and 1936 Case Study 3 Uniform Capital Allowance Hulk ran a successful scrapyard business knowns as the "Green Junk Yard" and during the year purchased some additional plant and equipment for the business. He traded-in or scrapped several of the older pieces of equipment. The details of his existing plant and equipment and transactions during the year are as follows: Existing plant and Equipment (use this information to create the 2021 schedule eg Office Furniture OAV for 2021 is $1500) Item Cost OAV Rate using DV method Office Furniture 4,200 1,500 40% Crushing 15,000 7,400 20% Machine A Crushing 6,000 3,000 20% Machine B Motor Vehicle 18,000 16,575 25.0% Crushing 7,000 5,000 10.0% Machine C Crushing 12,500 12,082 20% Machine D Carpets 5,700 5,319 40% Computer 2,500 1,865 40% will Note plant marked with is sold/scrapped (see below) New Plant and Equipment Item Computer Cost 3,790 Effective Life 3 Purchase Date 19/09/CY (eg (19/9/18) 15/12/CY 3/03/CY 4/4/CY 5/5/CY 7/6/CY 18/6/CY Office Safe 1,920 Display Cabinet 8,000 Display Racks 1,000 Laptop 1,580 Cash Register 3,220 New Motor Vehicle 55,000 (actual price) 30 5 3 3 5 8 Sale/Scrapping of Plant and Equipment Sale Date 19/09/CY I 31/01/CY Item Sale Price Computer broke down 0 and could not be fixed I Sale of Crushing Machine $10,000 Motor Vehicle used as a $8,000 trade in on new car 18/06/CY What you should do to prepare for the online test a) Calculate the deduction for depreciation using Schedule A for Hulk (he does not want to use any pooling). b) Calculate any balancing adjustments that need to be included in Hulk's taxable income c) Provide the legislative references from the Income Tax Assessment Act 1997 and 1936