Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study #4 Excel Submission - Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for

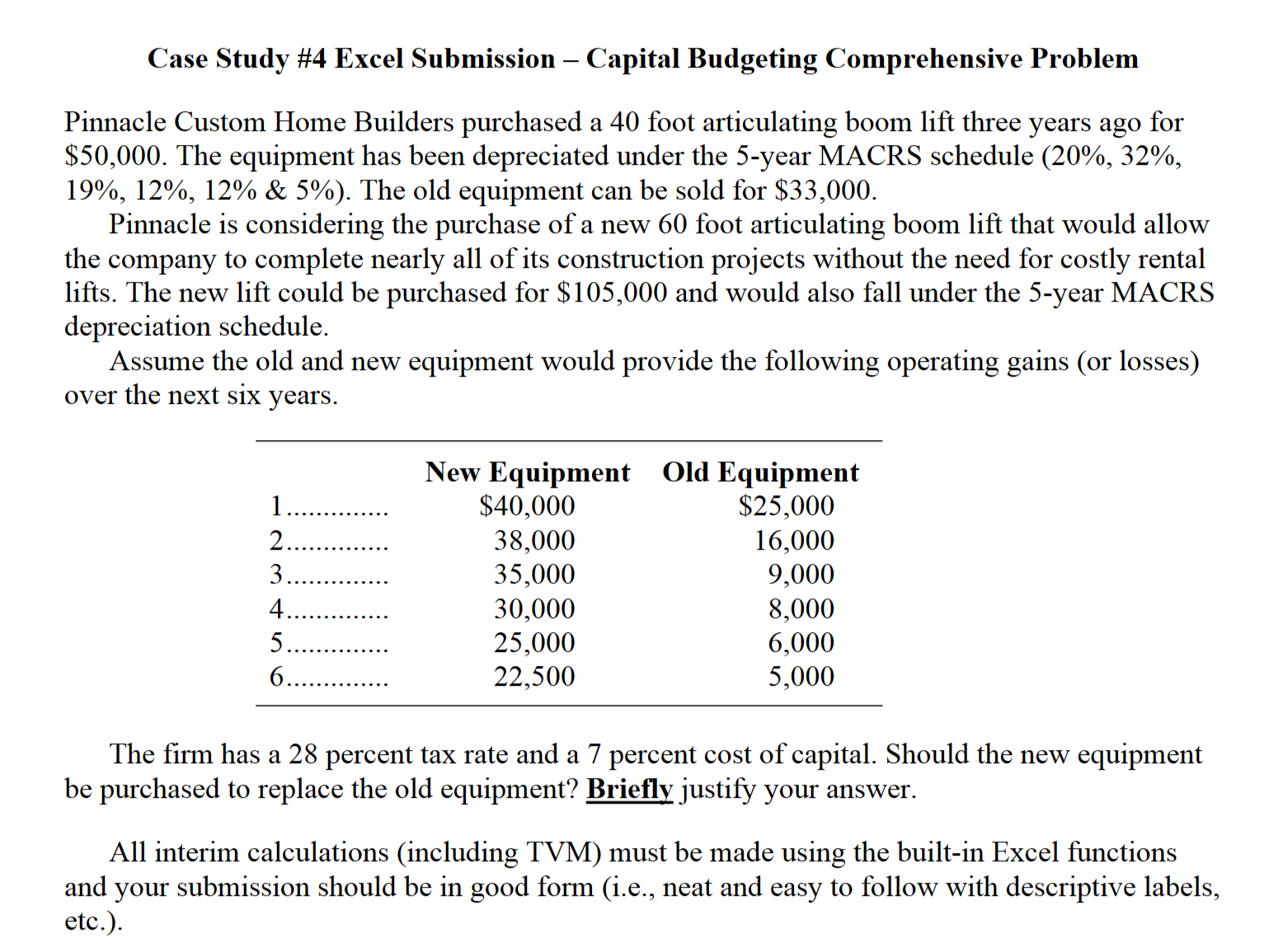

Case Study \#4 Excel Submission - Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%,32%, 19%,12%,12%&5% ). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the company to complete nearly all of its construction projects without the need for costly rental lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. All interim calculations (including TVM) must be made using the built-in Excel functions and your submission should be in good form (i.e., neat and easy to follow with descriptive labels, etc.). Case Study \#4 Excel Submission - Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%,32%, 19%,12%,12%&5% ). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the company to complete nearly all of its construction projects without the need for costly rental lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. All interim calculations (including TVM) must be made using the built-in Excel functions and your submission should be in good form (i.e., neat and easy to follow with descriptive labels, etc.)

Case Study \#4 Excel Submission - Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%,32%, 19%,12%,12%&5% ). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the company to complete nearly all of its construction projects without the need for costly rental lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. All interim calculations (including TVM) must be made using the built-in Excel functions and your submission should be in good form (i.e., neat and easy to follow with descriptive labels, etc.). Case Study \#4 Excel Submission - Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%,32%, 19%,12%,12%&5% ). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the company to complete nearly all of its construction projects without the need for costly rental lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. All interim calculations (including TVM) must be made using the built-in Excel functions and your submission should be in good form (i.e., neat and easy to follow with descriptive labels, etc.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started