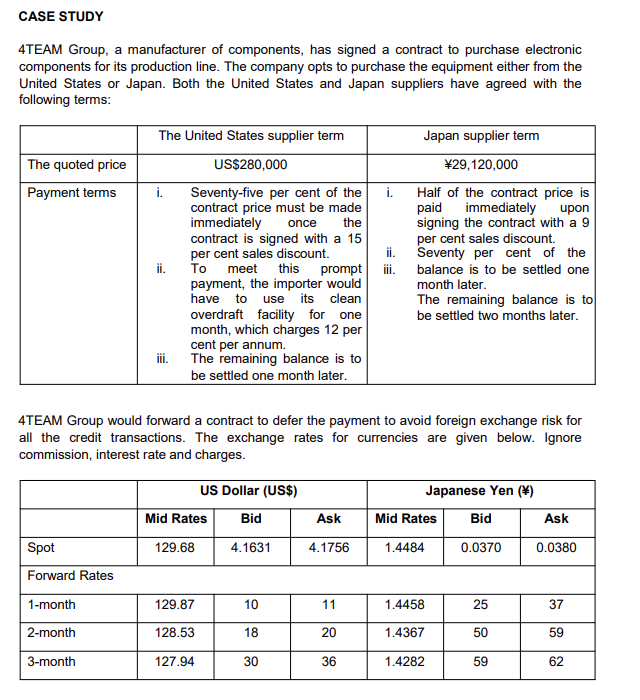

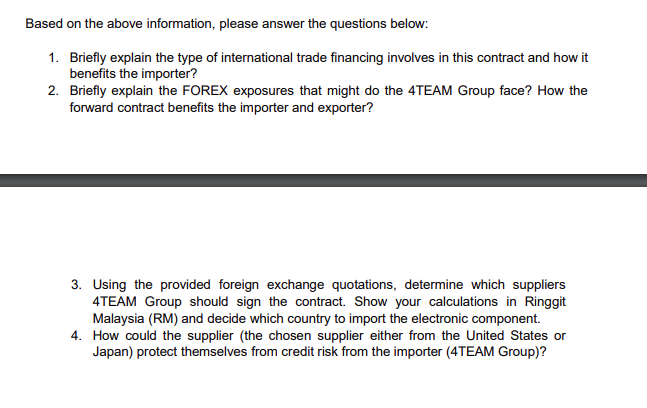

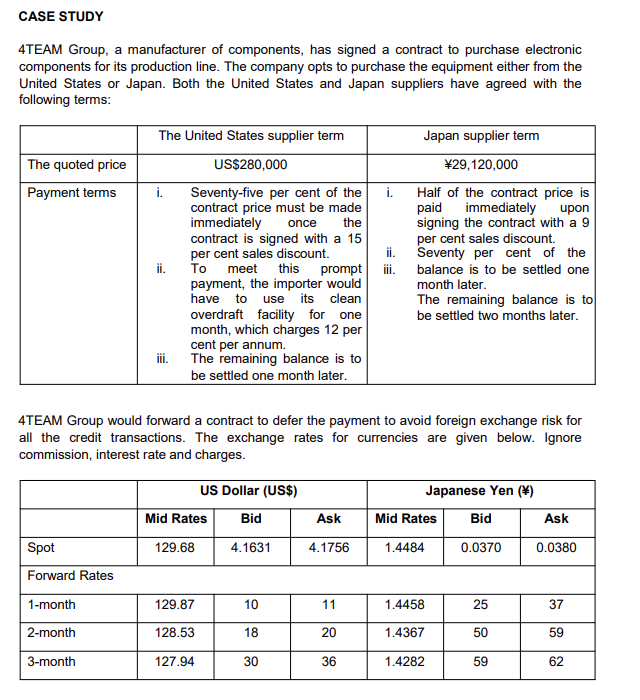

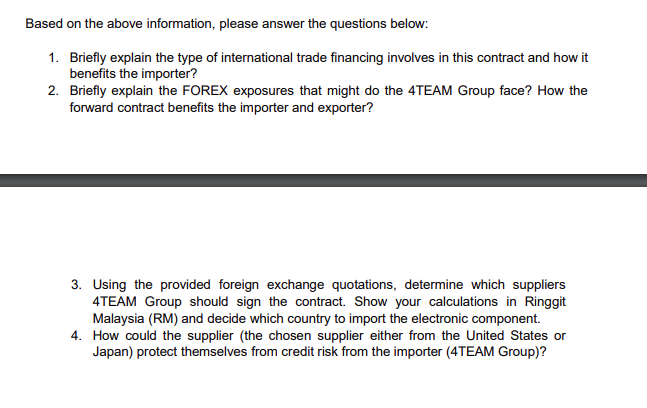

CASE STUDY 4TEAM Group, a manufacturer of components, has signed a contract to purchase electronic components for its production line. The company opts to purchase the equipment either from the United States or Japan. Both the United States and Japan suppliers have agreed with the following terms: The quoted price Payment terms The United States supplier term US$280,000 Spot Forward Rates 1-month 2-month 3-month i. Seventy-five per cent of the contract price must be made immediately once the To contract is signed with a 15 per cent sales discount. meet this prompt payment, the importer would have to use its clean overdraft facility for one month, which charges 12 per cent per annum. The remaining balance is to be settled one month later. ii. iii. 4TEAM Group would forward a contract to defer the payment to avoid foreign exchange risk for all the credit transactions. The exchange rates for currencies are given below. Ignore commission, interest rate and charges. Mid Rates 129.68 US Dollar (US$) Bid 4.1631 129.87 128.53 127.94 10 30 Ask 4.1756 i. 11 20 36 ii. iii. Japan supplier term 29,120,000 Half of the contract price is paid immediately upon signing the contract with a 9 per cent sales discount. Seventy per cent of the balance is to be settled one month later. The remaining balance is to be settled two months later. Mid Rates 1.4484 Japanese Yen (*) 1.4458 1.4367 1.4282 Bid 0.0370 25 50 59 Ask 0.0380 37 59 62 Based on the above information, please answer the questions below: 1. Briefly explain the type of international trade financing involves in this contract and how it benefits the importer? 2. Briefly explain the FOREX exposures that might do the 4TEAM Group face? How the forward contract benefits the importer and exporter? 3. Using the provided foreign exchange quotations, determine which suppliers 4TEAM Group should sign the contract. Show your calculations in Ringgit Malaysia (RM) and decide which country to import the electronic component. 4. How could the supplier (the chosen supplier either from the United States or Japan) protect themselves from credit risk from the importer (4TEAM Group)? CASE STUDY 4TEAM Group, a manufacturer of components, has signed a contract to purchase electronic components for its production line. The company opts to purchase the equipment either from the United States or Japan. Both the United States and Japan suppliers have agreed with the following terms: The quoted price Payment terms The United States supplier term US$280,000 Spot Forward Rates 1-month 2-month 3-month i. Seventy-five per cent of the contract price must be made immediately once the To contract is signed with a 15 per cent sales discount. meet this prompt payment, the importer would have to use its clean overdraft facility for one month, which charges 12 per cent per annum. The remaining balance is to be settled one month later. ii. iii. 4TEAM Group would forward a contract to defer the payment to avoid foreign exchange risk for all the credit transactions. The exchange rates for currencies are given below. Ignore commission, interest rate and charges. Mid Rates 129.68 US Dollar (US$) Bid 4.1631 129.87 128.53 127.94 10 30 Ask 4.1756 i. 11 20 36 ii. iii. Japan supplier term 29,120,000 Half of the contract price is paid immediately upon signing the contract with a 9 per cent sales discount. Seventy per cent of the balance is to be settled one month later. The remaining balance is to be settled two months later. Mid Rates 1.4484 Japanese Yen (*) 1.4458 1.4367 1.4282 Bid 0.0370 25 50 59 Ask 0.0380 37 59 62 Based on the above information, please answer the questions below: 1. Briefly explain the type of international trade financing involves in this contract and how it benefits the importer? 2. Briefly explain the FOREX exposures that might do the 4TEAM Group face? How the forward contract benefits the importer and exporter? 3. Using the provided foreign exchange quotations, determine which suppliers 4TEAM Group should sign the contract. Show your calculations in Ringgit Malaysia (RM) and decide which country to import the electronic component. 4. How could the supplier (the chosen supplier either from the United States or Japan) protect themselves from credit risk from the importer (4TEAM Group)