Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: ABC Manufacturing Inc. - Accounting for Complex Revenue Recognition Background: ABC Manufacturing Inc. is a global company that specializes in manufacturing high-

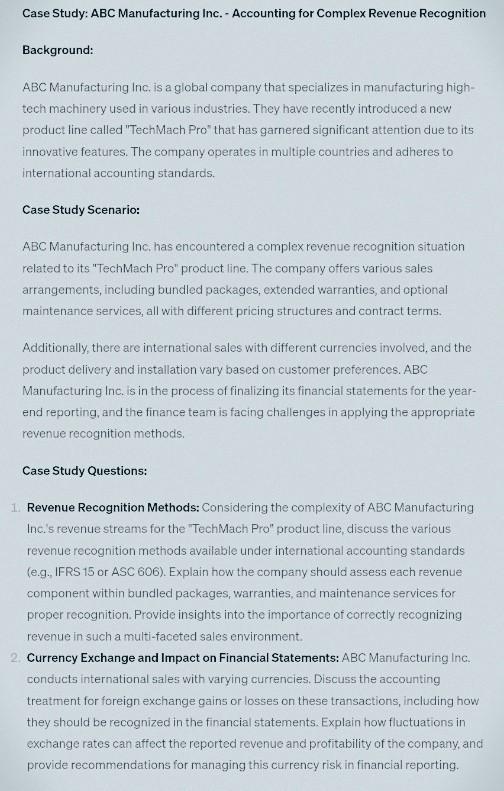

Case Study: ABC Manufacturing Inc. - Accounting for Complex Revenue Recognition Background: ABC Manufacturing Inc. is a global company that specializes in manufacturing high- tech machinery used in various industries. They have recently introduced a new product line called "TechMach Pro" that has garnered significant attention due to its innovative features. The company operates in multiple countries and adheres to international accounting standards. Case Study Scenario: ABC Manufacturing Inc. has encountered a complex revenue recognition situation related to its "TechMach Pro" product line. The company offers various sales arrangements, including bundled packages, extended warranties, and optional maintenance services, all with different pricing structures and contract terms. Additionally, there are international sales with different currencies involved, and the product delivery and installation vary based on customer preferences. ABC Manufacturing Inc. is in the process of finalizing its financial statements for the year- end reporting, and the finance team is facing challenges in applying the appropriate revenue recognition methods. Case Study Questions: 1. Revenue Recognition Methods: Considering the complexity of ABC Manufacturing Inc.'s revenue streams for the "TechMach Pro" product line, discuss the various revenue recognition methods available under international accounting standards (e.g., IFRS 15 or ASC 606). Explain how the company should assess each reven component within bundled packages, warranties, and maintenance services for proper recognition. Provide insights into the importance of correctly recognizing revenue in such a multi-faceted sales environment. venue 2. Currency Exchange and Impact on Financial Statements: ABC Manufacturing Inc. conducts international sales with varying currencies. Discuss the accounting treatment for foreign exchange gains or losses on these transactions, including how they should be recognized in the financial statements. Explain how fluctuations in exchange rates can affect the reported revenue and profitability of the company, and provide recommendations for managing this currency risk in financial reporting.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The image contains a case study about ABC Manufacturing Inc Accounting for Complex Revenue Recognition with a background section and two ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started