Question

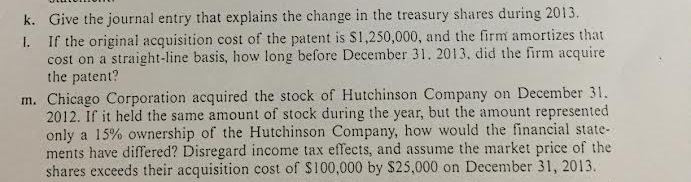

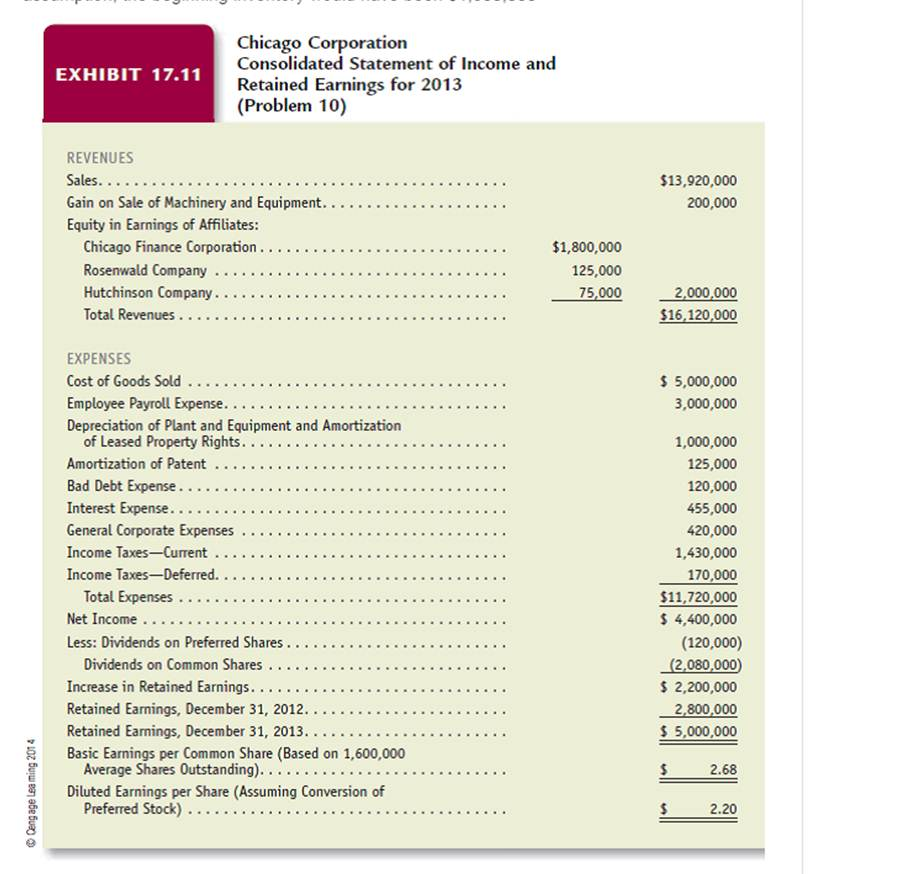

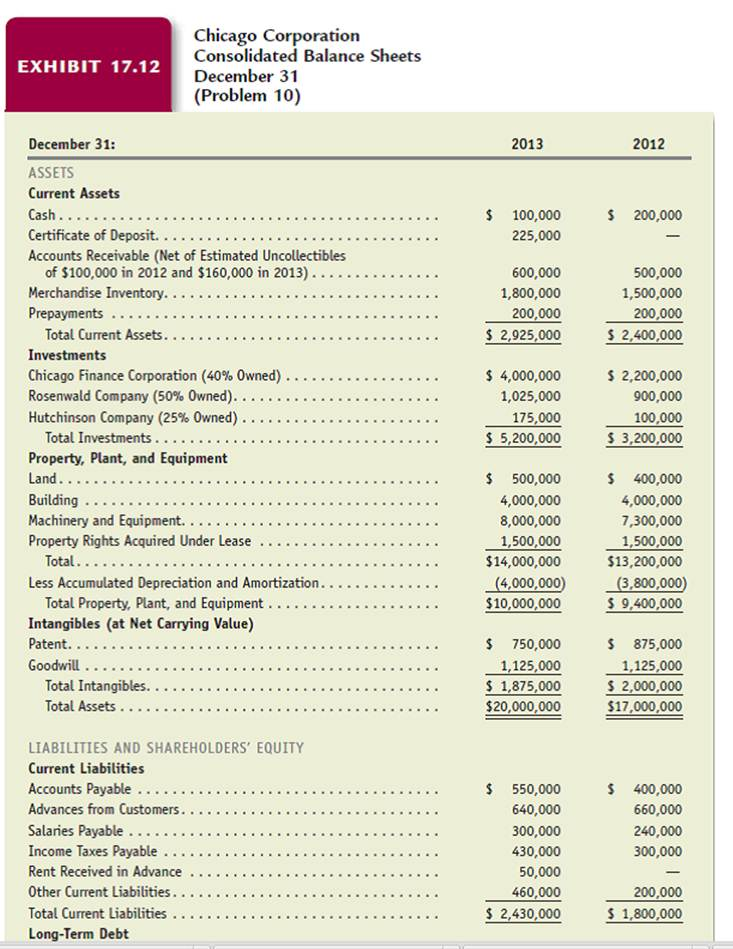

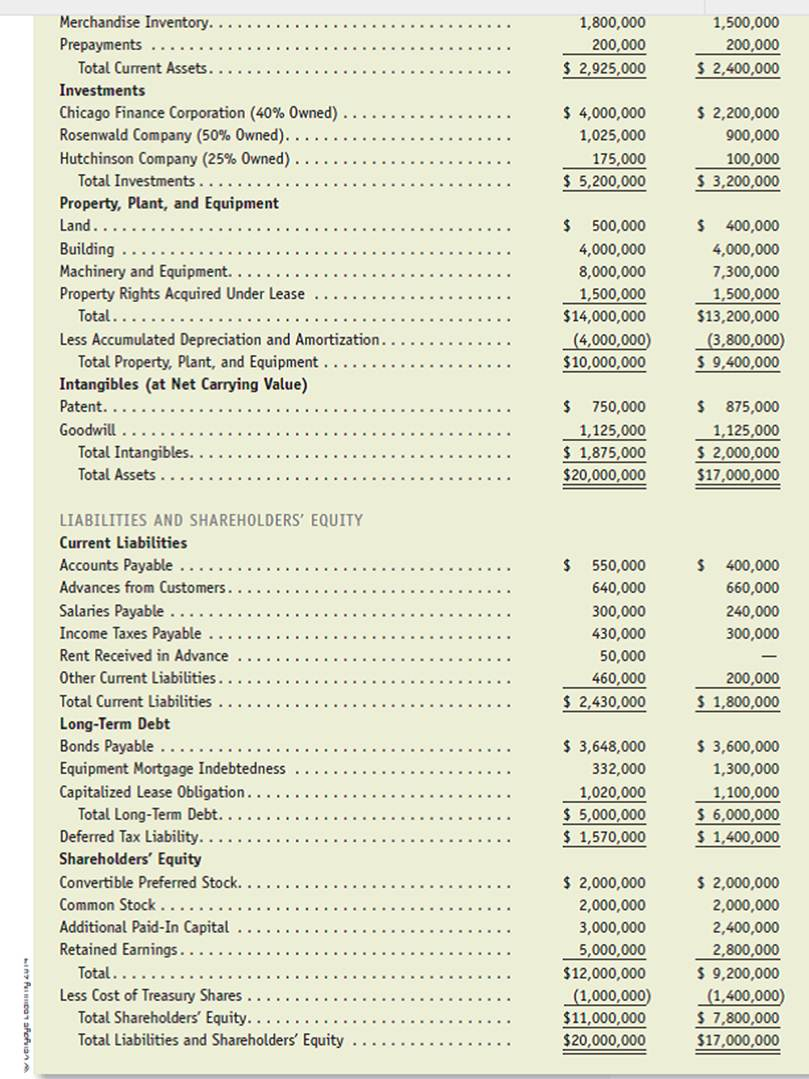

Case study (Accounting questions) solution required for questions K, L and M regarding Chicago Corpration Case at chapter 17, the case no is 10p in

Case study (Accounting questions) solution required for questions K, L and M regarding Chicago Corpration Case at chapter 17, the case no is 10p in (Financial Accounting Book (14th Edition). i was able to find the case but there is no answers! I have attached the financials as PDF also here is the link to the case, it includes all financial statements you need, your help is highly appreciated.

here is the link to the case in Chegg websit:

http://www.chegg.com/homework-help/comprehensive-review-problem-exhibits-1711-1712-present-part-chapter-17-problem-10p-solution-9781111823450-exc

the case from this book (Financial Accounting Book (14th Edition)

here is the link to the book the case from:

http://www.chegg.com/textbooks/financial-accounting-14th-edition-9781111823450-1111823456?trackid=51e6b63a&strackid=29013c2d&ii=1

all financial statements are available below along with the questions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started