Case Study: Adjusting the Budget (PLEASE HELP ME!!)

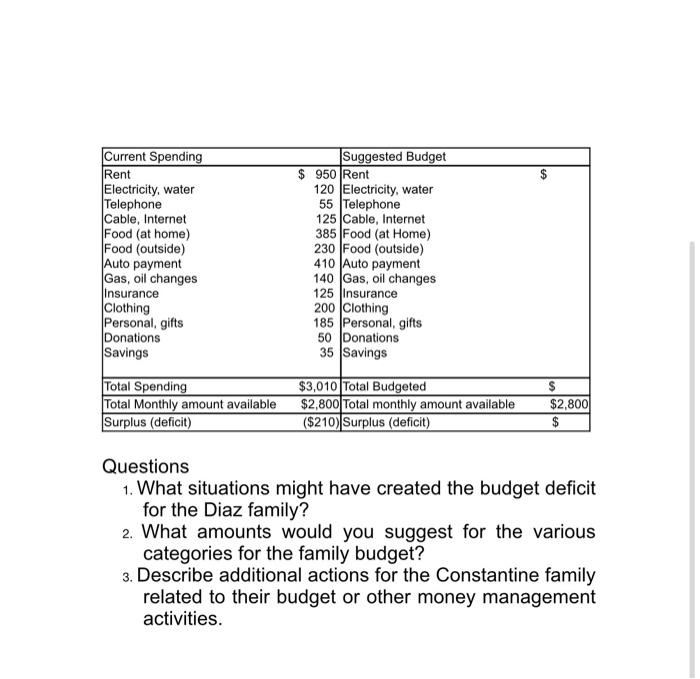

In a recent month, the Diaz family had a budget deficit, which is something they want to avoid so they do not have future financial difficulties. Jason and Karen Diaz and their children (ages 10 and 12) plan to discuss the situation after dinner this evening. While at work, Jason was talking with his friend Ken Lopez. Ken have been a regular saver since he was very young, starting with a small savings account. Those funds were then invested in various stocks and mutual funds. While in college, Ken was able to pay for this education while continuing to save between $50 and $100 a month. He closely monitored his spending. Ken realized that the few dollars here and there for snacks and other minor purchases quickly add up. Today, ken works as a customer service manager for an online division of a retailing company. He lives with his wife and their two young children. The family's spending plan allows for all their needs and also includes regularly saving and investing for the children's education and for retirement Jason asked ken, "How come you never seem to have financial stress in your household? Ken replied, "Do you know where your money is going each month?" "Not really," was Jason's response. "You'd be surprised by how much is spent on little things you might do without,". Ken responded. "I guess so. I just don't want to have to go around with a notebook writing down every amount i spend." Jason said in a troubled voice. "Well, you have to take some action if you want your financial situation to change." Ken countered. That evening, the Diaz family met to discuss their budget situation: Current Spending Rent Electricity, water Telephone Cable, Internet Food (at home) Food (outside) Auto payment Gas, oil changes Insurance Clothing Personal, gifts Donations Savings Suggested Budget $ 950 Rent 120 Electricity, water 55 Telephone 125 Cable, Internet 385 Food (at Home) 230 Food (outside) 410 Auto payment 140 Gas, oil changes 125 Insurance 200 Clothing 185 Personal, gifts 50 Donations 35 Savings Total Spending Total Monthly amount available Surplus (deficit) $3,010 Total Budgeted $2,800 Total monthly amount available ($210) Surplus (deficit) $2,8001 $ Questions 1. What situations might have created the budget deficit for the Diaz family? 2. What amounts would you suggest for the various categories for the family budget? 3. Describe additional actions for the Constantine family related to their budget or other money management activities