Question: Case Study: Amazon.com, Inc: Driving Disruptive Change in US grocery market. Answer all question based on mark given; 1) State the case? ( 20 marks)

Case Study: Amazon.com, Inc: Driving Disruptive Change in US grocery market. Answer all question based on mark given;

1) State the case? ( 20 marks)

2) Identify the problem and its symptoms based on case study? The answer must focus specifically on its financial performance. (20 marks)

3) Identify strategic solutions from the problem happen from answer question (2) based on case study? (20 marks)

4) Does this strategic from answer question (3) able to solve the problem? (20 marks)

5) Provide justifications from answer question (4)? (20 marks)

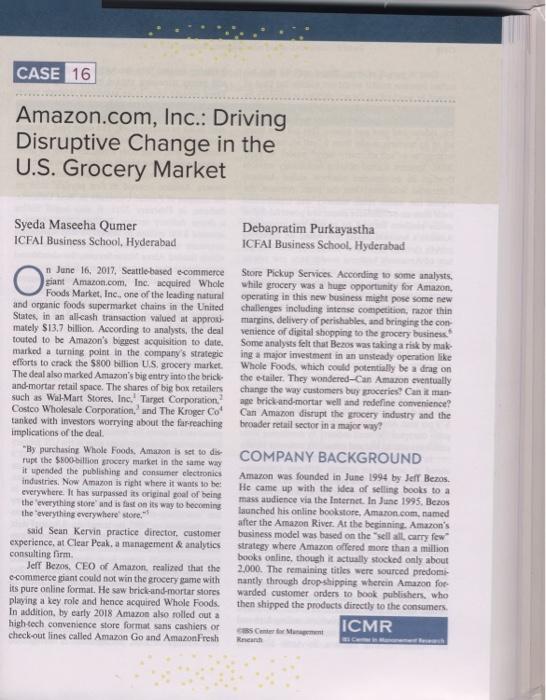

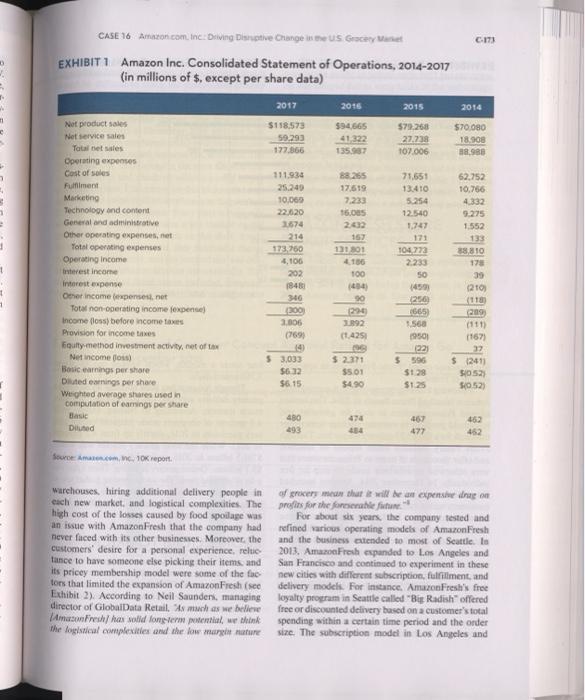

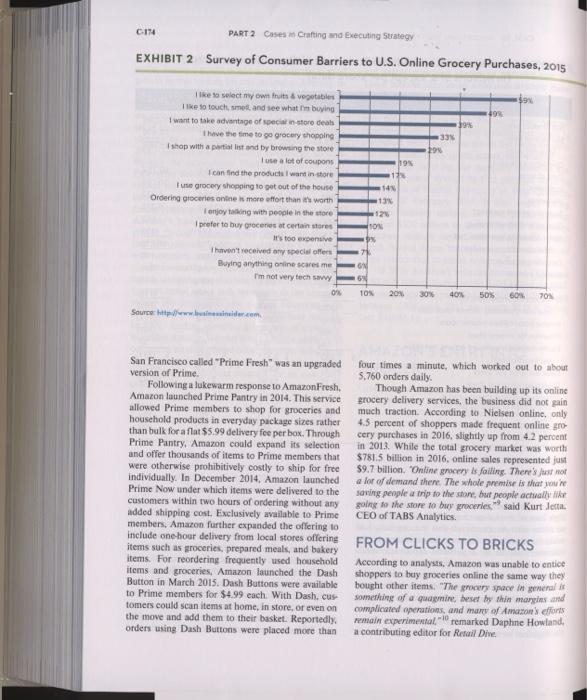

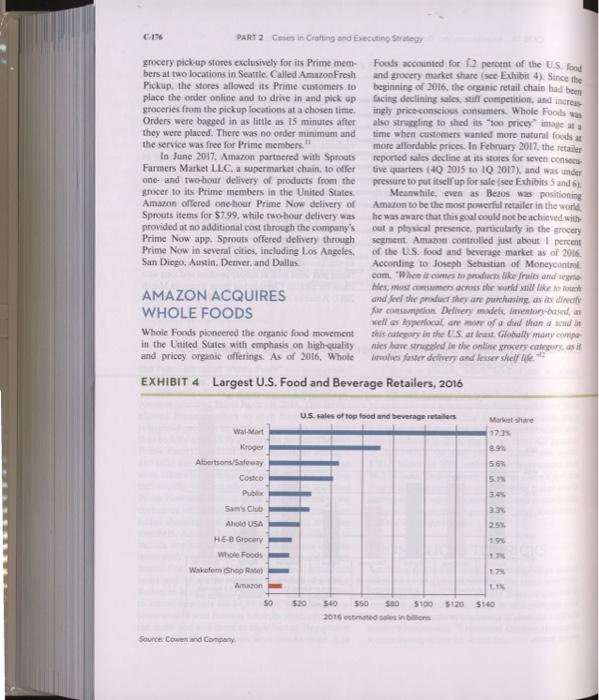

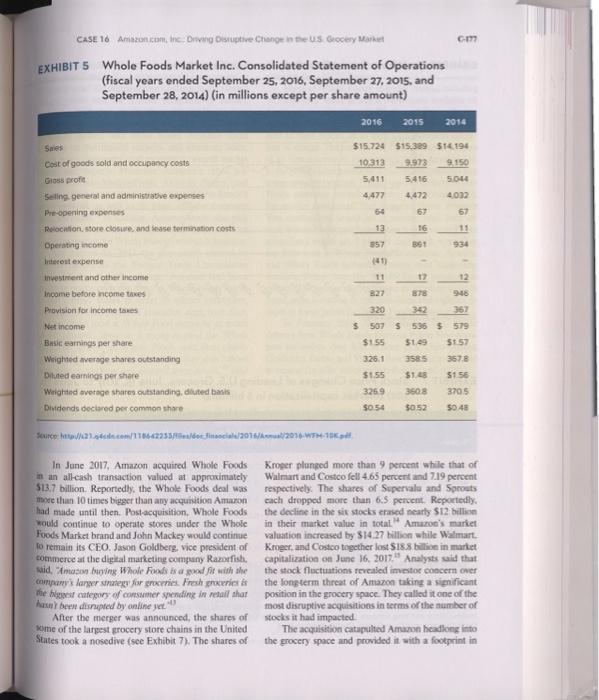

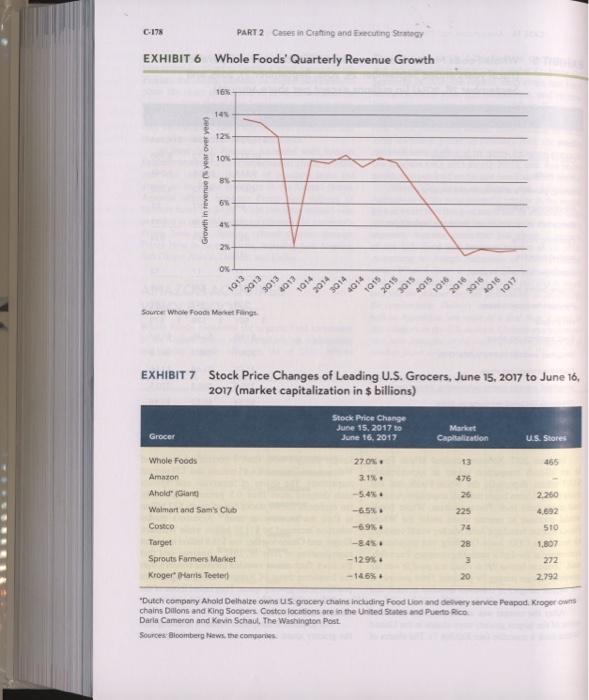

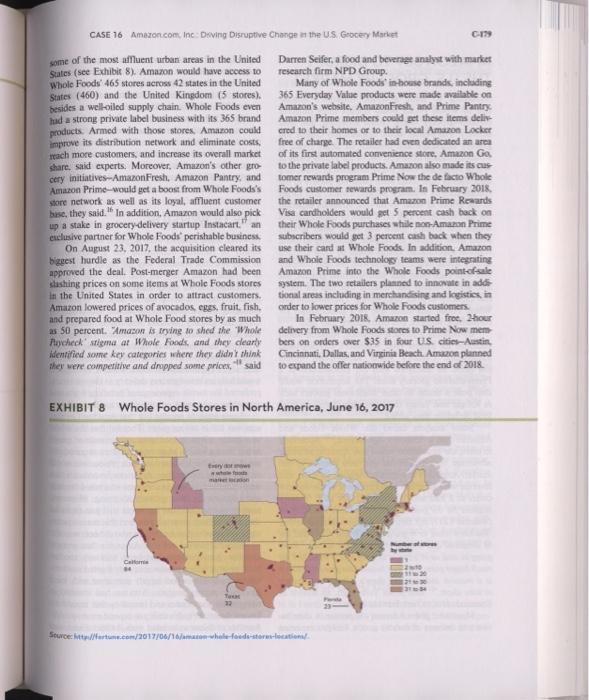

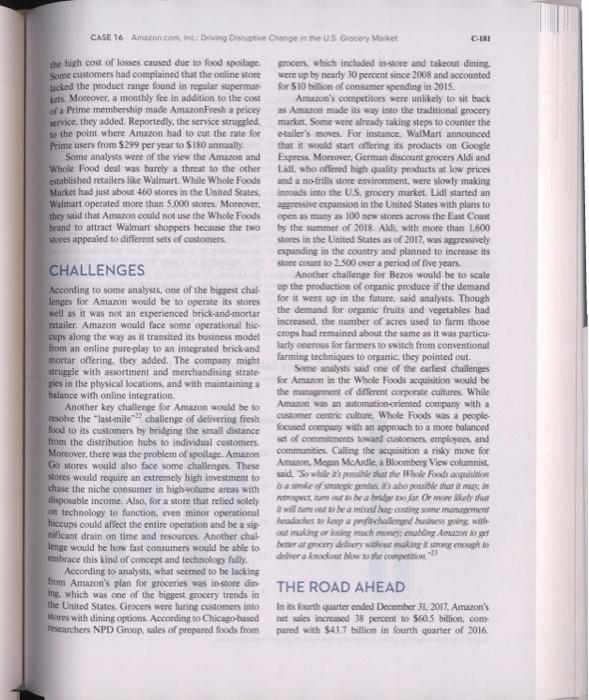

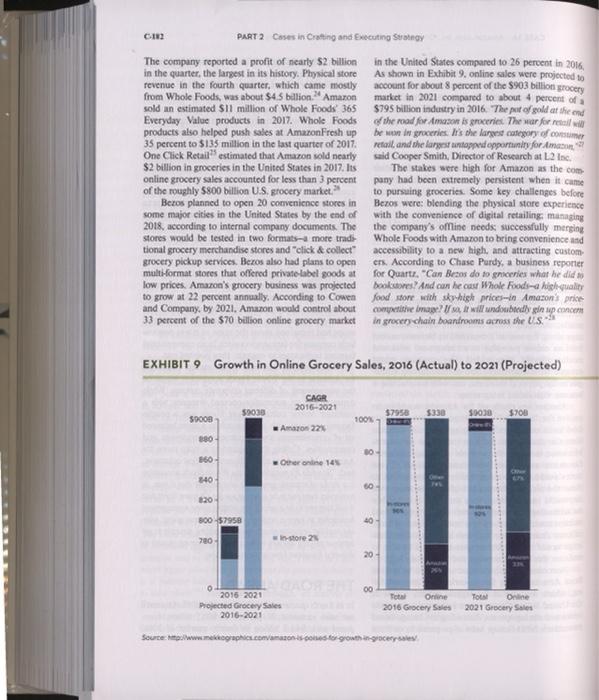

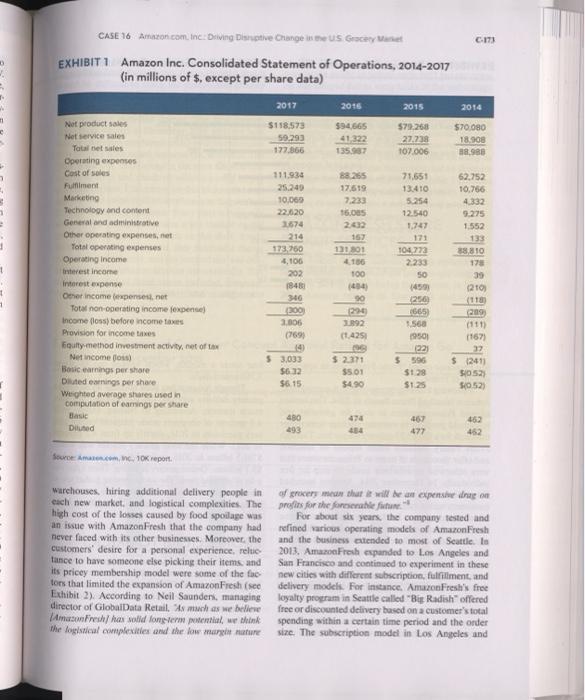

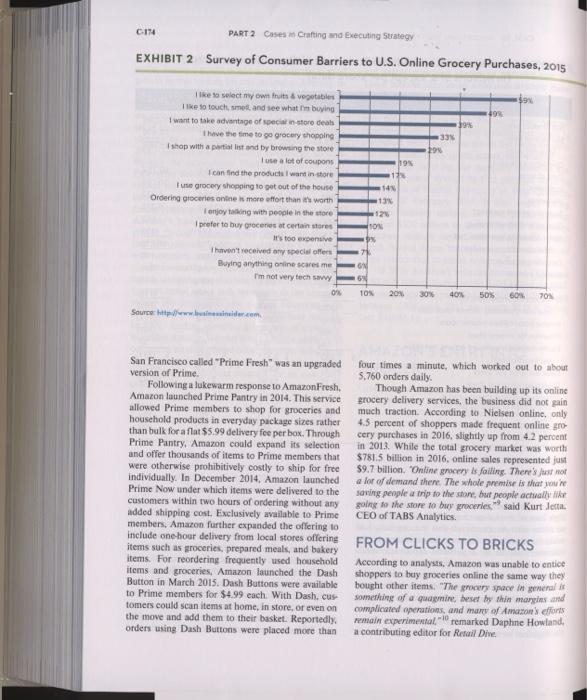

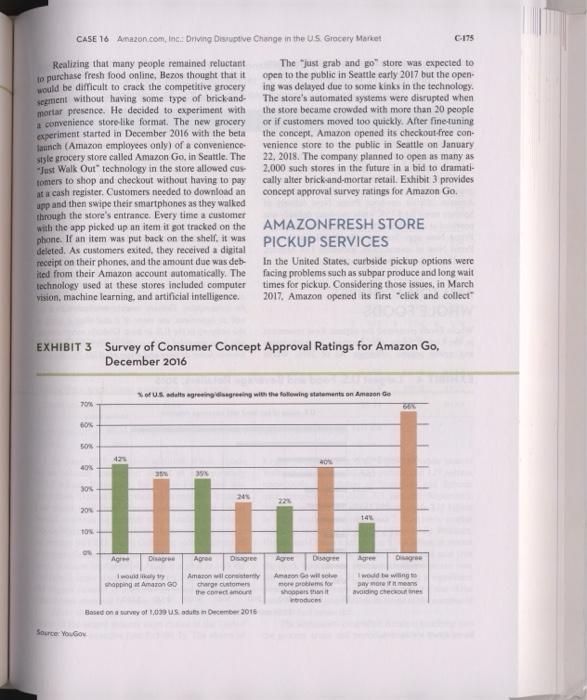

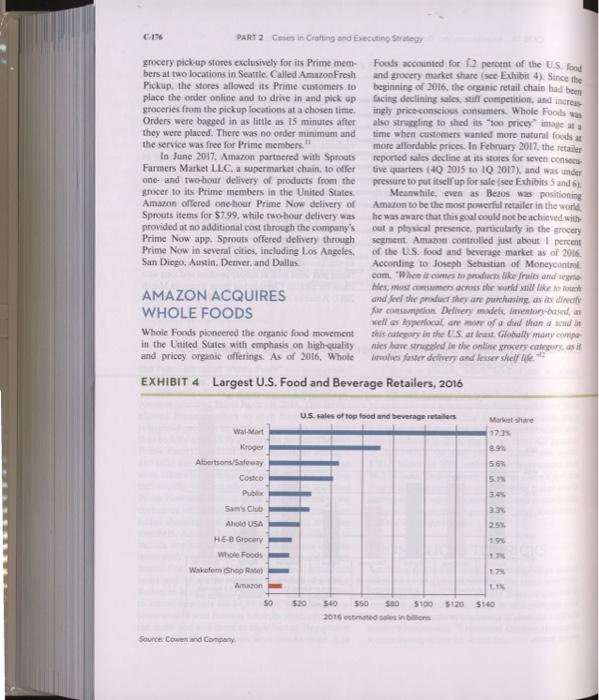

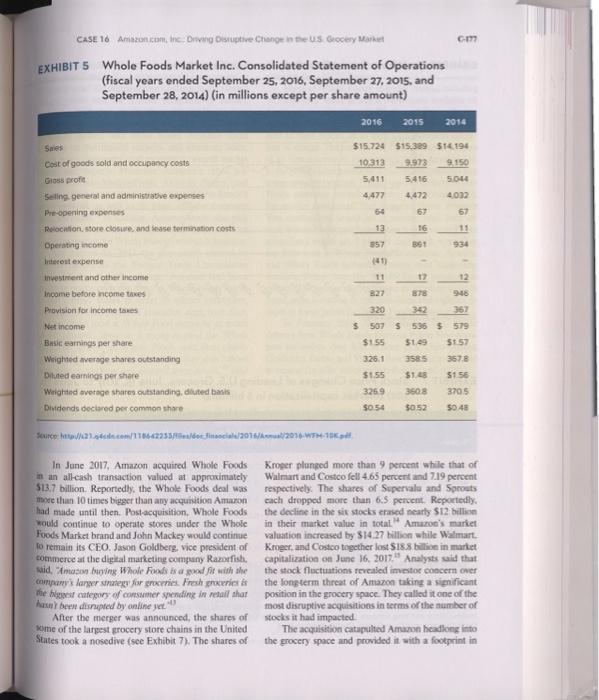

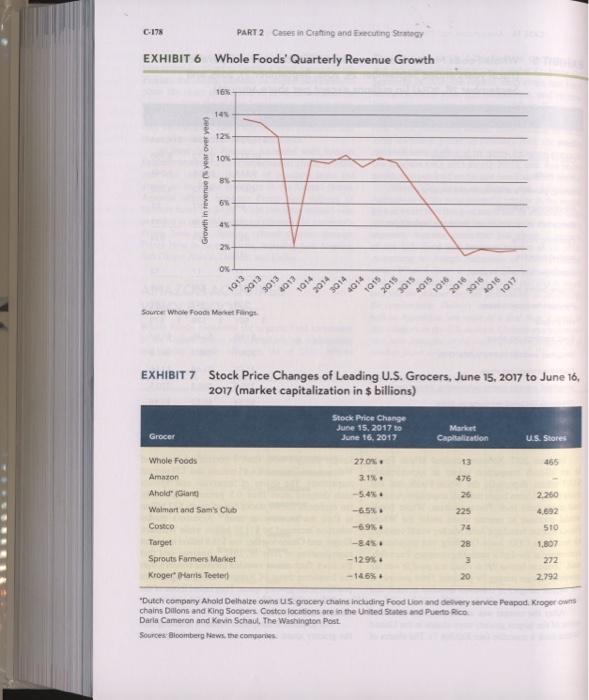

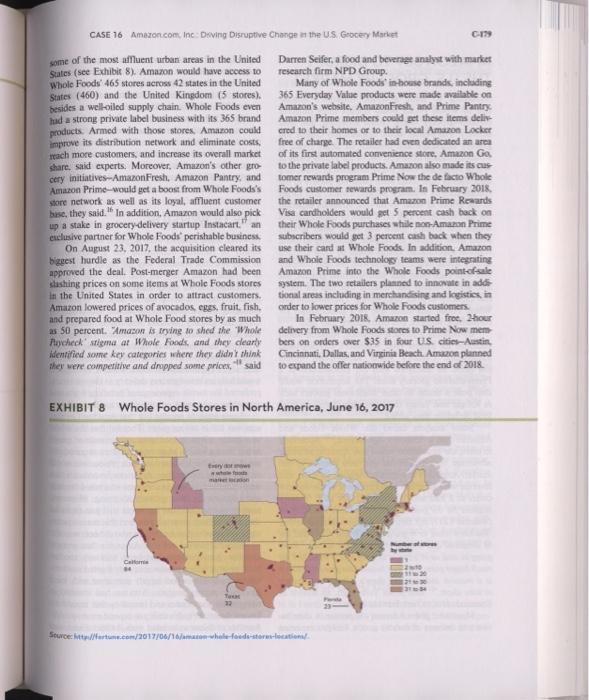

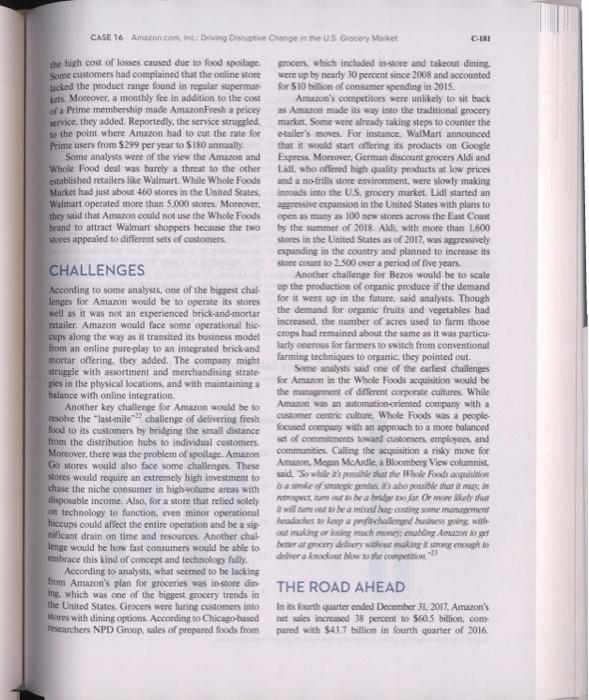

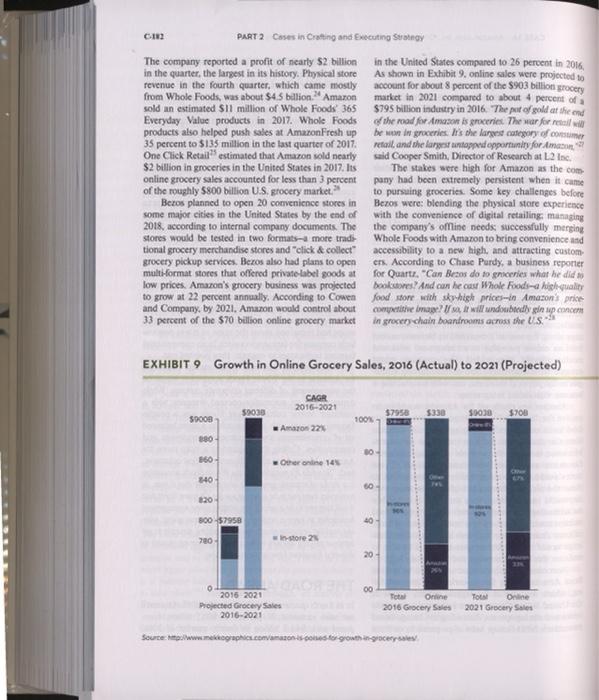

CASE 16 Amazon.com, Inc.: Driving Disruptive Change in the U.S. Grocery Market Syeda Maseeha Qumer ICFAI Business School, Hyderabad 1 June 16, 2017 Seattle based commerce giant Amazon.com, Inc. acquired Whole Debapratim Purkayastha ICFAI Business School, Hyderabad Store Pickup Services. According to some analysts. while grocery was a huge opportunity for Amazon, operating in this new business might pose some new challenges including intense competition, razor thin margins, delivery of perishables, and bringing the con venience of digital shopping to the grocery business Some analysts felt that Bezos was taking a risk by make ing a major investment in an unsteady operation like Whole Foods, which could potentially be a dragon the e-tailer. They wondered-Can Amazon eventually change the way customers buy groceries Can it man e brick and mortar well and redefine convenience? Can Amazon disrupt the grocery industry and the broader retail sector in a major way? and organic foods supermarket chains in the United States, in an all cash transaction valued at appro mately $13.7 billion. According to analysts, the deal touted to be Amazon's biggest acquisition to date. marked a turning point in the company's strategie efforts to crack the 5800 billion US, grocery market The deal also marked Amazon's big entry into the brick and-mortar retail space. The shares of big box retailers such as Wal-Mart Stores, Inc. Target Corporation Costco Wholesale Corporation, and The Kroger Cor tanked with investors worrying about the far-reaching implications of the deal "By purchasing Whole Foods, Amazon is set to dis rupt the $800-billion grocery market in the same way it upended the publishing and consumer electronics industries. Now Amazon is right where it wants to be: everywhere. It has surpassed its original goal of being the everything store and is fast on its way to becoming the everything everywhere store." said Sean Kervin practice director, customer experience, at Clear Peak, a management & analytics consulting firm Jeff Bezos, CEO of Amazon realized that the ccommerce int could not win the grocery game with its pure online format. He saw brick-and-mortar stores playing a key role and hence acquired Whole Foods In addition, by early 2018 Amazon also rolled out a high-tech convenience store format sans cashiers or check-out lines called Amazon Go and AmazonFresh COMPANY BACKGROUND Amazon was founded in June 1994 by Jeff Bezos He came up with the idea of selling books to a mass audience via the Internet. In June 1995. Bezos launched his online bookstore, Amazon.com, named after the Amazon Rivet. At the beginning. Amazon's business model was based on the "sell all carry few strategy where Amazon offered more than a million books online, though it actually stocked only about 2.000. The remaining titles were sourced predomi- nantly through dropshipping wherein Amazon for warded customer orders to book publishers, who then shipped the products directly to the consumers. ICMR Rach C-172 PART 2 Chies in Catting and Encuting Strategy company entered into the highly competitive Vide and games streaming market by releasing Fire Three months later, in an ambitious strategie now Amazon debuted in the crowded smartphone ma ket with the launch of the Fire Phone, which, how ever, failed to make a mark. The same year. Ama launched Echo, a handsfree speaker that could controlled with voice from across the room for info mation, music, news, sports scores, and weather In order to bring the company closer to cu tomers, Amazon opened its first physical store o the campus of Purdue University in West Lafayette Indiana, in February 2015. It also began testi a drone delivery service. In June 2015, Amazo invested $100 million to launch its first standalon corporate venture capital unit called Alexa Fung which funded Alexa Voice Service, the cloud-base voice service that powered Amazon Echo In 2016, Amazon's net sales increased 27 percen to $136,0 billion, compared to $107 billion in 2015 The company's sales increased an additional 25 perce between 2016 and 2017 to reach $118.6 billio (sec Exhibit) Over a period of time, Bezos realized that his earlier business model would not sustain the kind of growth he was looking for and decided to diversity. In 1998. Amazon expanded beyond books to include all sorts of shippable consumer goods such as electron ies, videos, and toys and games. This led to a rever sal of its business model from a "sell all carry few strategy to a "sell all carry more model. In early 2000, Amazon started offering technology services through its ecommerce platform called Amazon Enterprise Solutions. Over the years. Amazon dis rupted the online retail industry and transformed itself from an ecommeree player to a powerful digital media platform focused on growth and innovation Amazon's business model was based on capturing growth through innovative disruption. The four pil lars of Amazon's business model were low prices wide selection, convenience, and customer service Bezos was the key architect in building a customer centric company, transforming Amazon from a modest Internet brand into a tech behemoth as the company moved into completely new product categories such as creaders and enterprise cloud computing services. In 2002. Amazon identified a new area of growth by launching Amazon Web Services (AWS), a platform of computing services offered online for other websites or client side applications by Amazon. In 2005, Amazon launched a free shipping program for its customers called Amazon Prime, wherein customers received free two-day shipping on their purchases for a fee of $79 per year. According to industry observers, the pro gram disrupted the retail industry by enveloping more customers into its fold and enhancing customer loyalty. In 2006, Amazon developed a new business model aimed at serving an entirely different customer- the third party seller. The company offered fulfillment services to sellers through the Fallment by Amazon (FBA) program under which merchants sent cartons of their products to Amazon's warehouses while Amazon took the orders online, shipped the prod- ucts, answered queries, and processed returns. In lato 2007. Amazon set up its research division Lab 26 and launched the Kindle ebook reader. The book reader was a business model not only alien to Amazon but also potentially disruptive to the publishing industry In July 2009. Amazon acquired US based online shoe retailer Zappos. In 2012, it forayed into the world of designer fashion, selling high-end clothing, shoes, handbags, and accessories through its website Amazon Fashion. In April 2014, the AMAZON'S ENTRY INTO GROCERY Groceries, though the second largest category retail sales after general merchandise in the Unite States, represented one of the largest and most under penctrated markets for Amazon. According to a 2010 Euromonitor study, aggregate sales in the US, grocer market were $781.5 billion. However, grocery was heavily capita intensive business with intense com petition and tight margins. Despite the challenges Bezos wanted Amazon to establish its presence the grocery sector as he sought to make his compar the everything store." Amazon forayed into the gro cery business in 2007 by launching AmazonFresh an online grocery delivery service that allowed cus tomers to order fresh produce and groceries online Customers could order from more than 500,000 items for samoday and early morning delivery. The AmazonFresh service was available exclusively Prime members in select cities in the US for an addi tional monthly membership fee of $14.99 However, AmazonFresh faced problems inher ent in the home delivery service including exces sive wastage of food management of refrigeratec CASE 16 Amazon.com, Inc Diving Dictive Change in the US Grocery and C-173 EXHIBIT 1 Amazon Inc. Consolidated Statement of Operations, 2014-2017 (in millions of $, except per share data) 2017 2016 2015 2014 $118.573 59.293 177.866 $94665 41.322 135.937 579.260 27.238 107.006 $70,080 18.30 88.98 88.265 17.619 7.233 16.085 202 62.752 10.756 4332 9.275 1.552 Net product sales Net service sales Total net sales Operating expenses Cost of soles Fulfilment Marketing Technology and content General and administrative Other operating expenses.net Total operating expenses Operating income Interest income interest expense Other income expenses.net Total non operating income expense Income fossy before income taxes Provision for income taxe Equity method investment activity, net of tax Net income foss) Basic earnings per share Diluted earnings per share Weighted average shares used in computation of earnings Der Share Basic Diluted 111.934 25.249 10.06 22,620 1674 214 173,750 4,106 202 1848 340 200 3.006 (7691 11301 4156 100 404 71,651 13.410 5.254 12.540 1.747 171 104.772 2.233 50 1450 250 1665 1560 1950 122) $ 595 $128 $125 290 1 21892 (1.425 38810 175 39 (210) (110 (209 (111) 1167 32 $2411 $10523 50523 5 3.033 5612 $6.15 $ 2.31 $5.01 54.99 480 434 467 477 462 452 Source: A 10K report warehouses hiring additional delivery people in each new market, and logistical complexities. The high cost of the losses caused by food spodlage was an issue with AmazonFresh that the company had never faced with its other businesses. Moreover, the customers' desire for a personal experience, rele tance to have someone else picking their items and its pricey membership model were some of the fac tors that limited the expansion of AmazonFresh (see Exhibit 2). According to Neil Saunders, managing director of GlobalData Retail much as we believe Amusantes has solid long term potential, we think the logistical complexities and the low margt nature of grocery that will be ex dugo profits for the forente For about six years, the company tested and refined various operating models of AmazonFresh and the business extended to most of Seattle. In 2013. AmazonFresh expanded to Los Angeles and San Francisco and continued to experiment in these new cities with different subscription, fulfillment, and delivery models. For instance. AmazonFresh's free loyalty program in Seattle called "By Radish" offered free or discounted delivery based on a customer's total spending within a certain time period and the order size. The subscription model in Los Angeles and C174 PART 2 Cases Crafting and executing Strategy EXHIBIT 2 Survey of Consumer Barriers to U.S. Online Grocery Purchases, 2015 $9 499 133 198 19% ke to select my own fruits & Vegetables TIe to touch me and see what buying want to take advantage of special store deals The the time to go grocery shoping Ishop with a partial list and by browsing the store Tuse a lot of coupons I can find the products I want in store use grocery shopping to get out of the house Ordering groceries online is more effort that worth enjoy talking with people in the store prefer to buy groceries at certain stores It's too expensive Thaven't received any special offers Buying anything online scaresme I'm not very tech swy 145 13% 120 TON . 7 ON 16 10% 20% OM 30% 40% 50% 50% 708 Sourcewww.simile San Francisco called "Prime Fresh" was an upgraded four times a minute, which worked out to about version of Prime. 5.760 orders daily Following a lukewarm response to AmazonFresh Though Amazon has been building up its online Amazon launched Prime Pantry in 2014. This service grocery delivery services, the business did not gain allowed Prime members to shop for groceries and much traction. According to Nielsen online, only household products in everyday package Sizes rather 4.5 percent of shoppers made frequent online gro than bulk for a flat $5.99 delivery fee per box. Through cery purchases in 2016, slightly up from 4.2 percent Prime Pantry Amazon could expand its selection in 2013. While the total grocery market was worth and offer thousands of items to Prime members that $781.5 billion in 2016. online sales represented just were otherwise prohibitively costly to ship for free $9.7 billion. Online grocery is failing. There's just mor individually. In December 2014. Amazon launched a lor of demand there. The whole premise is that you Prime Now under which items were delivered to the saving people a trip to the store, but people actually customers within two hours of ordering without any going to the store to buy groceries said Kurt Jerta added shipping cost. Exclusively available to Prime CEO of TABS Analytics. members, Amazon further expanded the offering to include one hour delivery from local stores offering FROM CLICKS TO BRICKS items such as groceries, prepared meals, and bakery items. For reordering frequently used household According to analysts, Amazon was unable to entice items and groceries, Amazon launched the Dush shoppers to buy groceries online the same way they Button in March 2015. Dash Buttons were available bought other items. "The grocery space in general to Prime members for $4.99 each With Dash, cus something of a quagmire beset by thin margins and tomers could scan items at home, in store, or even on complicated operations, and many of Amazon efforts the move and add them to their basket. Reportedly pemain experimental remarked Daphne Howland, orders using Dash Buttons were placed more than a contributing editor for Retail Dive. CASE 16 Amazon.com, Inc.: Driving Disrupte Change in the US Grocery Market C-175 Realizing that many people remained reluctant to purchase fresh food online, Bezos thought that it would be difficult to crack the competitive grocery segment without having some type of brickand- mortar presence. He decided to experiment with convenience store like format. The new grocery experiment started in December 2016 with the beta launch (Amazon employees only) of a convenience style grocery store called Amazon Go, in Seattle. The Just Walk Out" technology in the store allowed cos tomers to shop and checkout without having to pay at cash register. Customers needed to download an upp and then swipe their smartphones as they walked through the store's entrance. Every time a customer with the app picked up an item it got tracked on the phone. If an item was put back on the shelf, it was deleted. As customers exited, they received a digital receipt on their phones, and the amount due was deb ited from their Amazon account automatically. The technology used at these stores included computer vision machine learning, and artificial intelligence. The just grab and go store was expected to open to the public in Seattle carly 2017 but the open- ing was delayed due to some kinks in the technology The store's automated systems were disrupted when the store became crowded with more than 20 people or if customers moved too quickly. After fine-tuning the concept, Amazon opened its checkout free con- venience store to the public in Seattle on January 22. 2018. The company planned to open as many as 2,000 such stores in the future in a bid to dramati- cally alter brick-and-mortar retail. Exhibit 3 provides concept approval survey ratings for Amazon Go. AMAZONFRESH STORE PICKUP SERVICES In the United States, curbside pickup options were facing problems such as subpar produce and long wait times for pickup. Considering those issues, in March 2017. Amazon opened its first click and collect EXHIBIT 3 Survey of Consumer Concept Approval Ratings for Amazon Go, December 2016 of US adults agreeing with the following statements on Amazon Go 70 420 40 40% 3 SO 25 2014 il Agr Disagree Agree Disagree Agree Dag Agree would likely try shopping at Amazon GO Amazon wil.com charge comes the correction Amarone with bore protesto Shopes that I wodwilling Day more means checo Based on a survey of 1,039 Sum December 2015 Source YouGo C16 PART 2 Cin Cifting and executing Site grocery pick-up stores exclusively for its Prime mem- Foods accounted for 2 percent of the US fond bers at two locations in Seattle Called AmazonFresh and grocery market share (see Exhibit 4). Since the Pickup the stores allowed its Prime customers to beginning of 2016, the organic retail chain had been place the order online and to drive in and pick up facing declining sales stiff competition, and increas groceries from the pickup locations at a chosen time. ingly priceconscious consumers. Whole Foods Orders were based in as little as 15 minutes after also straling to shed its "priceyime they were placed. There was no order minimum and time when customers wanted more natural foods at the service was free for Prime members." more affordable prices. In February 2017, the retailer In June 2017. Amazon partnered with Sprouts reported sales decline at its store for seven conson Farmers Market LLC, a supermarket chain, to offer tive quarters (40 2015 to 10 2017), and was under one and two-hour delivery of products from the pressure to put itself up for sale (see Exhibits Sand grocer to its Prime members in the United States Meanwhile, even as Bezos was positioning Amazon offered one hour Prime Now delivery of Amazon to be the most powerful retailer in the world Sprouts items for $7.99, while two hour delivery was he was aware that this goal could not be achieved with provided at no additional cost through the company's out a physical presence, particularly in the grocery Prime Now app. Sprouts offered delivery through segment. Amazon controlled just about percent Prime Now in several cities, including Los Angeles of the US, food and beverage market as of 2016 San Diego, Austin. Dervet, and Dallas According to Joseph Sebastian of Moneycontrol com. "Where it comes to product like fruits and we Mies must consumers across the world will die moet AMAZON ACQUIRES and feel the product they are purchasing as it direct WHOLE FOODS for conspin Delivery medel entor-based an well as dyperfocal are more of a dud than and Whole Foods pioneered the organic food movement shis category in the US ar lost. Globally many in the United States with emphasis on high-quality nies have strobe the online grocers are as it and pricey organic offerings. As of 2016, Whole - les faster delivery and lesser shelf life: EXHIBIT 4 Largest U.S. Food and Beverage Retailers, 2016 U.S. sales of top food and beverage retailers Marshane 173 Wal-Mart 89 553 Kroger Alberto Say Costco Pube Soms Club Ahold USA HEB Grocery Whole Foods 19 1 17 Woo Shoot Amazon 50 520 540 560 500 $10051205140 2016 ottens Source Comen and Company G-17 CASE 10 Amazon.com, bic: Driving Disuptive change in the us Grocery Market EXHIBIT 5 Whole Foods Market Inc. Consolidated Statement of Operations (fiscal years ended September 25, 2016, September 27, 2015. and September 28, 2014) (in millions except per share amount) 2016 2015 2014 Sales Cost of goods sold and occupancy costs Gloss profile Seling general and administrative expenses Pre-opening expenses Relocation, store closure and fease termination costs Operating income Interest expense investment and other income Income before income taxes Provision for income taxes $15.724 $15.389 $14.194 10313 9.973 9.150 5.411 5.416 5044 4.477 4032 64 67 13 16 11 557 361 934 TI 827 .* Net income Basic earnings per share Weighted average shares outstanding Diluted earnings per share Weighted average shares outstanding, diluted basis Dividends declared per common share 320 $ 507 $155 326.1 $1.55 12 B78 946 342 367 5 536 $ 579 $1.49 $157 3585 3673 $1.45 5156 3508 3705 $0.52 50.41 3269 $0 54 Source.com/11062233/loficial/2016/6/2976. WTH:10 In June 2017, Amazon acquired Whole Foods in an all-cash transaction valued at approximately 13.7 billion. Reportedly, the Whole Foods deal was more than 10 times bigger than any acquisition Amaron had made until then. Post acquisition. Whole Foods would continue to operate stores under the whole Foods Market brand and John Mackey would continue To remain its CEO. Jason Goldberg, vice president of commerce at the digital marketing company Razorfish, wid. Amazon buying Whole Foods is a good for with the company's larger strategy for grocerie Fresh proxenesis Fueges category of consumer spending in retail shar has been disrupted by online yet After the merger was announced, the shares of some of the largest grocery store chains in the United States took a nosedive isce Exhibit 7). The shares of Kroper plunged more than 9 percent while that of Walmart and Costco fell 4.65 percent and 7.19 percent respectively. The shares of Supervalu and Sprouts cach dropped more than 6.5 percent Reportedly, the decline in the sit stocks crased nearly $12 billion in their market value in total Amazon's market valuation increased by $14.27 billion while Walmart. Kroger and Costco together lost $18.8 billion in market capitalization on June 16, 2017. Analysts said that the stock fluctuations revealed imesto concern over the long term threat of Amazon taking a significant position in the grocery space. They called it one of the most disruptive acquisitions in terms of the number of stocks it had impacted The acquisition catapulted Amazon headlong into the grocery space and provided it with a footprint in C-178 PART 2 Cuen in Crafting and Decuting Star Whole Foods' Quarterly Revenue Growth EXHIBIT 6 14 12% 10 Growth in revenue 15 year over year B 6% 45 24 OX 1014 401 2016 1015 2015 3015 2015 1015 4014 DIO SLOE 3014 1013 2013 3013 2016 1017 Source Whole Foods Marketing EXHIBIT 7 Stock Price Changes of Leading U.S. Grocers. June 15, 2017 to June 16, 2017 (market capitalization in $ billions) Stock Price Change June 15, 2017 to June 16, 2017 Grocer Market Capitalization US. Stores Whole Foods 270 13 455 Amazon 476 21% -5.4%. -65% 26 2.250 225 4.692 -6.9% 74 510 Ahold Clan Walmart and Sam's Club Costco Target Sprouts Farmers Market Kroger Harris Teeter 28 -12.9% -45% 3 20 1.807 272 2.792 Dutch company Ahold Delhaize owns us grocery chains including Food Lion and delivery service Papod. Kroger chains Dillons and King Soopers Costco locations are in the United States and Puerto Rico Daria Cameron and Kevin Schaut, The Washington Post Sources Bloomberg News. The companies CASE 16 Amazon.com, Inc: Dving Disruptive Change at the US Grocery Market C-179 some of the most affluent urban areas in the United Darren Seifer, a food and beverage analyst with market States (see Exhibit 8), Amazon would have access to research firm NPD Group. Whole Foods' 465 stores across 42 states in the United Many of Whole Foods in house brands, including States (460) and the United Kingdom (5 stores), 365 Everyday Value products were made available on besides a well-oiled supply chain. Whole Foods even Amazon's website. AmazonFresh and Prime Pantry had a strong private label business with its 365 brand Amazon Prime members could get these items del products. Armed with those stores Amazon could cred to their homes or to their local Amazon Locker improve its distribution network and eliminate costs free of charge. The retailer had con dedicated an area reach more customers, and increase its overall market of its first automated convenience store, Amazon Go share, said experts. Moreover, Amazon's other gro to the private label products. Amazon also made its cus cery initiatives AmazonFresh, Amazon Pantry, and tomer rewards program Prime Now the de facto Whole Amazon Prime would get a boost from Whole Foods's Foods customer rewards program. Is February 2018 store network as well as its loyal, affluent customer the retailer announced that Amazon Prime Rewards besc, they said." In addition, Amazon would also pick Visa cardholders would get 5 percent cash back on up a stake in grocery delivery startup Instacart, an their Whole Foods purchases while on Amazon Prime exclusive partner for Whole Foods' perishable business subscribers would get 3 percent cash back when they On August 23, 2017, the acquisition cleared its use their cand at Whole Foods. In addition Amazon biggest hurdle as the Federal Trade Commission and Whole Foods technology teams were integrating approved the deal. Post-merger Amazon had been Amazon Prime into the Whole Foods point-of-sale slasting prices on some items at Whole Foods stores system. The two retailers planned to innovate in ados in the United States in order to attract customers. tional areas including in merchandising and logisties, in Amazon lowered prices of avocados, eges, fruit, fish, order to lower prices for Whole Foods customers. and prepared food at Whole Food stores by as much In February 2018, Amazon started free hour as 50 percent. "Amason is trying to shed the whole delivery from Whole Foods stores to Prime Now me Pocheck stigma at Whole Foods, and they clearly bers on orders over $35 in four US cities-Austin identified some key categories where they didn't think Cincinnati. Dallas, and Virginia Beach Amazon planned they were competitive and dropped some prices , said to expand the offer nationwide before the end of 2018 EXHIBIT 8 Whole Foods Stores in North America, June 16, 2017 who ma C 30 22 Source: http://fortune.com/2017/06/16/man-while-feed-to-locational C-180 PART 2 Cases in Cating and Executing Stegy the online behemoth to expand its footprint in food delivery and become a disruptor of the food service distribution models, particularly the independently owned restaurant sector, which was a market wort about $256 billion in the United States Some industry observers even felt that Aman's automation model, if widely adopted, had the potes tial to pose a huge threat to the retail workforce the United States. They said the model wool likely disrupt the labor force in the United States, which employed $67,920 grocery cashiers in 2016. accord ing to the Bureau of Labor Statistics AMAZON SET TO DISRUPT THE U.S. GROCERY MARKET According to some analysts. Amazon's acquist- tion of Whole Foods would disrupt three different markets-grocery stores, online shopping and food delivery. The ettiler would dramatically change the grocery landscape and threaten its larger rivals. It would eventually drive cost out of the supply chain at Whole Foods and lower prices to undercut rivals, they said: This in turn could force other big players in the market such as Walmart, Kroger, Costco, and Target to cut prices in order to survive. Analysts expected the partnership to kick off a wave of consolidations within the grocery space and leave other grocers under more pressure to compete. According to them, regional supermarket chains would be most affected as they would have to contend with not only competi- tion with each other and nontraditional grocers, but also with a retailer like Amazon that had the finan- cial capacity to price aggressively. The Amazon and Whole Foods deal could also be a gamechanger for consumers, vendors, and distributors, they said. By building a physical presence, Amazon would undercut its biggest rival Walmart's on the ground advantages. Costco's yearly subscription model too could be disrupted with the introduction of a Prime enabled grocery store. The acquisition would also pose a threat to other traditional grocers such as Kroger and Target that were already reeling from food deflation, they added." Some analysts called the Whole Foods and Amazon deal a "Grocery Apocalypse" According to them, the acquisition would give Amazon an unfair advantage over traditional and new players in the market. Amazon's strengths in logistics, its scale, and leverage with suppliers could enable it to disrupt gro- ceries as it had with bookselling they said. Her negative for the grocery business because I dont think (Amazon CEO) Jeff Bezos is going into this just saying You know what we de going to buy Whole Foods and just he a natural and organie grocer' think he spex Were pobeg ir, and we're going in in a big think he's go much biggrans than that because the groury Industry is a massive industry and there a lot of opportunity to take share, said Brian Yarbrough, an analyst at financial services firm Edward Jones. Moreover, given Amazon's expertise in distribu tion and delivery of durable goods, analysts expected THE DOWNSIDE However, some analysts were skeptical about the pos sibility of Amazon dominating the grocery sector as they felt that Amazon was still in an early stage of physical retail. They felt that traditional retailers would still have an upper hand over Amazon in the physical retail market given its lack of experience managing brick-and-mortar locations. According to them, the grocery business was highly competitive with survival driven by repeat business. The margin were thin, the product was highly perishable, and the supply chain expensive and complex. Morcover, there were some apprehensions about whether consumen would fully embrace grocery delivery as they generally preferred the tactile experience of handling fruits and vegetables and to pick out the groceries themselves Some analysts pointed out that Amaron Go.com cept was still in testing mode. They felt that the mode was better suited to nonperishable consumer goods rather than grocery. Moreover, the store required the use of a credit or debit card and this prerequisite would exclude about nine million American households that were unbanked, as well as shoppers who relied on cash and coupons for their grocery shopping Morcov analysts pointed out that the stores trial had excluded shoppers without smartphones and this meant sota ing about one third of Americans who did not own on Experts pointed out that Amazon's first grocery initiative AmazonFresh had been relatively modest in its growth with a presence in only limited markets Where competitors had largely partnered with local grocers to supply produce, Amazon had invested in refrigerated warehouses and inventory that reported limited AmazonFresh's ability to expand more quickly Another problem associated with AmazonFresh was CASE 16 Amazon.com, int Diving Disruptive Change the US Grocery Market CINI the high cost of losses caused due to food spoilage Some customers had complained that the online store Licked the product range found in regular supermar- kets. Moreover, a monthly fee in addition to the cost of a Prime membership made AmazonFresh a pricey service, they added. Reportedly, the service struggled. to the point where Amazon had to cut the rate for Prime users from $299 per year to S180 annually Some analysts were of the view the Amazon and Whole Food deal was barely a threat to the other established retailers like Walmart. While Whole Foods Market had just about 460 stores in the United States Walmart operated more than 5,000 stores. Moreover, they said that Amazon could not use the Whole Foods brand to attract Walmart shoppers because the two cores appealed to different sets of customers CHALLENGES According to some analysts, one of the biggest chal lenges for Amazon would be to operate its stores well as it was not an experienced brick-and-mortar Tetailer. Amazon would face some operational hio cops along the way as it transited its business model from an online pure play to an integrated brick and mortar offering, they added. The company might struggle with assortment and merchandising strate gles in the physical locations, and with maintaining balance with online integration Another key challenge for Amazon would be to resolve the last-mile challenge of delivering fresh food to its customers by bridging the small distance from the distribution hubs to individual customers Moreover, there was the problem of spoilage. Amaron Go stores would also face some challenges. These Mores would require an extremely high investment to chase the niche consumer in high-volume areas with disposable income. Also, for a store that relied solely on technology to function, even minor operational hiccups could affect the entire operation and be a sig nificant drain on time and resources. Another chal lenge would be how fast consumers would be able to embrace this kind of concept and technology fully According to analysts, what seemed to be lacking from Amazon's plan for groceries was in-store din ing, which was one of the biggest grocery trends in the United States. Grocers were luring customers into Mores with dining options. According to Chicago-based researchers NPD Group, sales of prepared foods from grocers, which included in-store and takeout dining, were up by nearly 30 percent since 2008 and accounted for $10 billion of consumer spending in 2015. Amazon's competitors were unlikely to sit back as Amazon made its way into the traditional grocery market. Some were already taking steps to counter the tailer's soves. For instance. Wal Mart announced that it would start offering its products on Google Express. Moreover, German discount grocers Aldi and who offered high quality products at low prices and a no frills store environment, were slowly making inroads into the U.S. grocery market. Lidl started an agressive expansion in the United States with plans to open as many as 100 new stores across the East Coast by the summer of 2018. Aldi, with more than 1.600 stores in the United States as of 2017, was aggressively expanding in the country and planned to increase its store count to 2.500 over a period of five years. Another challenge for Bezos would be to scale up the production of organic produce if the demand for it went up in the future, said analysts. Though the demand for organic fruits and vegetables had increased the number of acres used to farm those crops had remained about the same as it was particu Jarly onerous for farmers to switch from conventional farming techniques to organic, they pointed out. Some analysts and one of the earliest challenges for Amanda in the Whole Foods acquisition would be the management of different corporate cultures. While Aman was an automation-oriented company with a customer centric culture, Whole Foods was a people focused company with an approach to a more balanced set of commitments toward customers, employees, and communities. Calling the acquisition a risky move for Amazon, Megan McArdle, a Bloomberg View columnist. said. So while it's possible at the Whole Foods acquisition B a stroke ofte gehes, it's cabo possible that may ham bebrier Ormonike that it will be buscam moment headaches keep a challenged business going with out making or using much mones, enabling Amazon doger besteracer deler without making it string enough deler a knockeur blow to the competition THE ROAD AHEAD Inies Surth quarter ended December 31, 2017. Amazon's net sales increased 38 percent to $60.5 billion, com pared with $41.7 billion in fourth quarter of 2016 CIN PART 2 Cases in Crating and executing Strategy The company reported a profit of nearly $2 billion in the United States compared to 26 percent in 2016, in the quarter, the largest in its history. Physical store As shown in Exhibit 9. online sales were projected to revenue in the fourth quarter, which came mostly account for about 8 percent of the $903 billion grocery from Whole Foods, was about $4.5 bilion. Amazon market in 2021 compared to about 4 percent of sold an estimated Sil million of Whole Foods 365 $795 billion industry in 2016. The progold at the end Everyday Value products in 2017. Whole Foods of the road for Amazon is groceries. The murforretail products also helped push sales at AmazonFresh up ben in groceries. It's the largest category of com 35 percent to $135 million in the last quarter of 2017. retail and the largest stoppad opportunity for Amazon One Click Retail estimated that Amazon sold nearly said Cooper Smith, Director of Research at L2 Inc $2 billion in groceries in the United States in 2017. Its The stakes were high for Amazon as the com online grocery sales accounted for less than 3 percent pany had been extremely persistent when it came of the roughly 5800 billion U.S.grocery market. to pursuing groceries. Some key challenges before Beros planned to open 20 convenience stores in Bezos were: blending the physical store experience some major cities in the United States by the end of with the convenience of digital retailing managing 2018, according to internal company documents. The the company's offline needs successfully merging stores would be tested in two formats more trade Whole Foods with Amazon to bring convenience and tional grocery merchandise stores and click & collect accessibility to a new high, and attracting custom grocery pickup services. Bezos also had plans to open ers. According to Chase Purdy, a business reporter multi-format stores that offered private label goods at for Quartz. "Can Bezos do to groceries what he did low prices. Amazon's grocery business was projected books. And can be cau Whole Foods quality to grow at 22 percent annually. According to Cowen food store with skyhigh prices Amazon price and Company, by 2021. Amazon would control about competitive image! I will undoubtedly glo up com.com 33 percent of the $70 bilion online grocery market in grocery chain boantrooms across the US EXHIBIT 9 Growth in Online Grocery Sales, 2016 (Actual) to 2021 (Projected) CAGR 2016-2021 59030 37950 5330 50030 $700 59008 100% Amazon 22 080 30 360 Other online 145 ....... 840 320 800-$7958 8 200 store 2 20- 2 00 o 2016 2021 Projected Grocery Sales 2016-2021 Online Online 2016 Grocery Sales 2021 Grocery Sales Source: www.methiconeonis como growth in goce CASE 16 Amazon.com, Inc.: Driving Disruptive Change in the U.S. Grocery Market Syeda Maseeha Qumer ICFAI Business School, Hyderabad 1 June 16, 2017 Seattle based commerce giant Amazon.com, Inc. acquired Whole Debapratim Purkayastha ICFAI Business School, Hyderabad Store Pickup Services. According to some analysts. while grocery was a huge opportunity for Amazon, operating in this new business might pose some new challenges including intense competition, razor thin margins, delivery of perishables, and bringing the con venience of digital shopping to the grocery business Some analysts felt that Bezos was taking a risk by make ing a major investment in an unsteady operation like Whole Foods, which could potentially be a dragon the e-tailer. They wondered-Can Amazon eventually change the way customers buy groceries Can it man e brick and mortar well and redefine convenience? Can Amazon disrupt the grocery industry and the broader retail sector in a major way? and organic foods supermarket chains in the United States, in an all cash transaction valued at appro mately $13.7 billion. According to analysts, the deal touted to be Amazon's biggest acquisition to date. marked a turning point in the company's strategie efforts to crack the 5800 billion US, grocery market The deal also marked Amazon's big entry into the brick and-mortar retail space. The shares of big box retailers such as Wal-Mart Stores, Inc. Target Corporation Costco Wholesale Corporation, and The Kroger Cor tanked with investors worrying about the far-reaching implications of the deal "By purchasing Whole Foods, Amazon is set to dis rupt the $800-billion grocery market in the same way it upended the publishing and consumer electronics industries. Now Amazon is right where it wants to be: everywhere. It has surpassed its original goal of being the everything store and is fast on its way to becoming the everything everywhere store." said Sean Kervin practice director, customer experience, at Clear Peak, a management & analytics consulting firm Jeff Bezos, CEO of Amazon realized that the ccommerce int could not win the grocery game with its pure online format. He saw brick-and-mortar stores playing a key role and hence acquired Whole Foods In addition, by early 2018 Amazon also rolled out a high-tech convenience store format sans cashiers or check-out lines called Amazon Go and AmazonFresh COMPANY BACKGROUND Amazon was founded in June 1994 by Jeff Bezos He came up with the idea of selling books to a mass audience via the Internet. In June 1995. Bezos launched his online bookstore, Amazon.com, named after the Amazon Rivet. At the beginning. Amazon's business model was based on the "sell all carry few strategy where Amazon offered more than a million books online, though it actually stocked only about 2.000. The remaining titles were sourced predomi- nantly through dropshipping wherein Amazon for warded customer orders to book publishers, who then shipped the products directly to the consumers. ICMR Rach C-172 PART 2 Chies in Catting and Encuting Strategy company entered into the highly competitive Vide and games streaming market by releasing Fire Three months later, in an ambitious strategie now Amazon debuted in the crowded smartphone ma ket with the launch of the Fire Phone, which, how ever, failed to make a mark. The same year. Ama launched Echo, a handsfree speaker that could controlled with voice from across the room for info mation, music, news, sports scores, and weather In order to bring the company closer to cu tomers, Amazon opened its first physical store o the campus of Purdue University in West Lafayette Indiana, in February 2015. It also began testi a drone delivery service. In June 2015, Amazo invested $100 million to launch its first standalon corporate venture capital unit called Alexa Fung which funded Alexa Voice Service, the cloud-base voice service that powered Amazon Echo In 2016, Amazon's net sales increased 27 percen to $136,0 billion, compared to $107 billion in 2015 The company's sales increased an additional 25 perce between 2016 and 2017 to reach $118.6 billio (sec Exhibit) Over a period of time, Bezos realized that his earlier business model would not sustain the kind of growth he was looking for and decided to diversity. In 1998. Amazon expanded beyond books to include all sorts of shippable consumer goods such as electron ies, videos, and toys and games. This led to a rever sal of its business model from a "sell all carry few strategy to a "sell all carry more model. In early 2000, Amazon started offering technology services through its ecommerce platform called Amazon Enterprise Solutions. Over the years. Amazon dis rupted the online retail industry and transformed itself from an ecommeree player to a powerful digital media platform focused on growth and innovation Amazon's business model was based on capturing growth through innovative disruption. The four pil lars of Amazon's business model were low prices wide selection, convenience, and customer service Bezos was the key architect in building a customer centric company, transforming Amazon from a modest Internet brand into a tech behemoth as the company moved into completely new product categories such as creaders and enterprise cloud computing services. In 2002. Amazon identified a new area of growth by launching Amazon Web Services (AWS), a platform of computing services offered online for other websites or client side applications by Amazon. In 2005, Amazon launched a free shipping program for its customers called Amazon Prime, wherein customers received free two-day shipping on their purchases for a fee of $79 per year. According to industry observers, the pro gram disrupted the retail industry by enveloping more customers into its fold and enhancing customer loyalty. In 2006, Amazon developed a new business model aimed at serving an entirely different customer- the third party seller. The company offered fulfillment services to sellers through the Fallment by Amazon (FBA) program under which merchants sent cartons of their products to Amazon's warehouses while Amazon took the orders online, shipped the prod- ucts, answered queries, and processed returns. In lato 2007. Amazon set up its research division Lab 26 and launched the Kindle ebook reader. The book reader was a business model not only alien to Amazon but also potentially disruptive to the publishing industry In July 2009. Amazon acquired US based online shoe retailer Zappos. In 2012, it forayed into the world of designer fashion, selling high-end clothing, shoes, handbags, and accessories through its website Amazon Fashion. In April 2014, the AMAZON'S ENTRY INTO GROCERY Groceries, though the second largest category retail sales after general merchandise in the Unite States, represented one of the largest and most under penctrated markets for Amazon. According to a 2010 Euromonitor study, aggregate sales in the US, grocer market were $781.5 billion. However, grocery was heavily capita intensive business with intense com petition and tight margins. Despite the challenges Bezos wanted Amazon to establish its presence the grocery sector as he sought to make his compar the everything store." Amazon forayed into the gro cery business in 2007 by launching AmazonFresh an online grocery delivery service that allowed cus tomers to order fresh produce and groceries online Customers could order from more than 500,000 items for samoday and early morning delivery. The AmazonFresh service was available exclusively Prime members in select cities in the US for an addi tional monthly membership fee of $14.99 However, AmazonFresh faced problems inher ent in the home delivery service including exces sive wastage of food management of refrigeratec CASE 16 Amazon.com, Inc Diving Dictive Change in the US Grocery and C-173 EXHIBIT 1 Amazon Inc. Consolidated Statement of Operations, 2014-2017 (in millions of $, except per share data) 2017 2016 2015 2014 $118.573 59.293 177.866 $94665 41.322 135.937 579.260 27.238 107.006 $70,080 18.30 88.98 88.265 17.619 7.233 16.085 202 62.752 10.756 4332 9.275 1.552 Net product sales Net service sales Total net sales Operating expenses Cost of soles Fulfilment Marketing Technology and content General and administrative Other operating expenses.net Total operating expenses Operating income Interest income interest expense Other income expenses.net Total non operating income expense Income fossy before income taxes Provision for income taxe Equity method investment activity, net of tax Net income foss) Basic earnings per share Diluted earnings per share Weighted average shares used in computation of earnings Der Share Basic Diluted 111.934 25.249 10.06 22,620 1674 214 173,750 4,106 202 1848 340 200 3.006 (7691 11301 4156 100 404 71,651 13.410 5.254 12.540 1.747 171 104.772 2.233 50 1450 250 1665 1560 1950 122) $ 595 $128 $125 290 1 21892 (1.425 38810 175 39 (210) (110 (209 (111) 1167 32 $2411 $10523 50523 5 3.033 5612 $6.15 $ 2.31 $5.01 54.99 480 434 467 477 462 452 Source: A 10K report warehouses hiring additional delivery people in each new market, and logistical complexities. The high cost of the losses caused by food spodlage was an issue with AmazonFresh that the company had never faced with its other businesses. Moreover, the customers' desire for a personal experience, rele tance to have someone else picking their items and its pricey membership model were some of the fac tors that limited the expansion of AmazonFresh (see Exhibit 2). According to Neil Saunders, managing director of GlobalData Retail much as we believe Amusantes has solid long term potential, we think the logistical complexities and the low margt nature of grocery that will be ex dugo profits for the forente For about six years, the company tested and refined various operating models of AmazonFresh and the business extended to most of Seattle. In 2013. AmazonFresh expanded to Los Angeles and San Francisco and continued to experiment in these new cities with different subscription, fulfillment, and delivery models. For instance. AmazonFresh's free loyalty program in Seattle called "By Radish" offered free or discounted delivery based on a customer's total spending within a certain time period and the order size. The subscription model in Los Angeles and C174 PART 2 Cases Crafting and executing Strategy EXHIBIT 2 Survey of Consumer Barriers to U.S. Online Grocery Purchases, 2015 $9 499 133 198 19% ke to select my own fruits & Vegetables TIe to touch me and see what buying want to take advantage of special store deals The the time to go grocery shoping Ishop with a partial list and by browsing the store Tuse a lot of coupons I can find the products I want in store use grocery shopping to get out of the house Ordering groceries online is more effort that worth enjoy talking with people in the store prefer to buy groceries at certain stores It's too expensive Thaven't received any special offers Buying anything online scaresme I'm not very tech swy 145 13% 120 TON . 7 ON 16 10% 20% OM 30% 40% 50% 50% 708 Sourcewww.simile San Francisco called "Prime Fresh" was an upgraded four times a minute, which worked out to about version of Prime. 5.760 orders daily Following a lukewarm response to AmazonFresh Though Amazon has been building up its online Amazon launched Prime Pantry in 2014. This service grocery delivery services, the business did not gain allowed Prime members to shop for groceries and much traction. According to Nielsen online, only household products in everyday package Sizes rather 4.5 percent of shoppers made frequent online gro than bulk for a flat $5.99 delivery fee per box. Through cery purchases in 2016, slightly up from 4.2 percent Prime Pantry Amazon could expand its selection in 2013. While the total grocery market was worth and offer thousands of items to Prime members that $781.5 billion in 2016. online sales represented just were otherwise prohibitively costly to ship for free $9.7 billion. Online grocery is failing. There's just mor individually. In December 2014. Amazon launched a lor of demand there. The whole premise is that you Prime Now under which items were delivered to the saving people a trip to the store, but people actually customers within two hours of ordering without any going to the store to buy groceries said Kurt Jerta added shipping cost. Exclusively available to Prime CEO of TABS Analytics. members, Amazon further expanded the offering to include one hour delivery from local stores offering FROM CLICKS TO BRICKS items such as groceries, prepared meals, and bakery items. For reordering frequently used household According to analysts, Amazon was unable to entice items and groceries, Amazon launched the Dush shoppers to buy groceries online the same way they Button in March 2015. Dash Buttons were available bought other items. "The grocery space in general to Prime members for $4.99 each With Dash, cus something of a quagmire beset by thin margins and tomers could scan items at home, in store, or even on complicated operations, and many of Amazon efforts the move and add them to their basket. Reportedly pemain experimental remarked Daphne Howland, orders using Dash Buttons were placed more than a contributing editor for Retail Dive. CASE 16 Amazon.com, Inc.: Driving Disrupte Change in the US Grocery Market C-175 Realizing that many people remained reluctant to purchase fresh food online, Bezos thought that it would be difficult to crack the competitive grocery segment without having some type of brickand- mortar presence. He decided to experiment with convenience store like format. The new grocery experiment started in December 2016 with the beta launch (Amazon employees only) of a convenience style grocery store called Amazon Go, in Seattle. The Just Walk Out" technology in the store allowed cos tomers to shop and checkout without having to pay at cash register. Customers needed to download an upp and then swipe their smartphones as they walked through the store's entrance. Every time a customer with the app picked up an item it got tracked on the phone. If an item was put back on the shelf, it was deleted. As customers exited, they received a digital receipt on their phones, and the amount due was deb ited from their Amazon account automatically. The technology used at these stores included computer vision machine learning, and artificial intelligence. The just grab and go store was expected to open to the public in Seattle carly 2017 but the open- ing was delayed due to some kinks in the technology The store's automated systems were disrupted when the store became crowded with more than 20 people or if customers moved too quickly. After fine-tuning the concept, Amazon opened its checkout free con- venience store to the public in Seattle on January 22. 2018. The company planned to open as many as 2,000 such stores in the future in a bid to dramati- cally alter brick-and-mortar retail. Exhibit 3 provides concept approval survey ratings for Amazon Go. AMAZONFRESH STORE PICKUP SERVICES In the United States, curbside pickup options were facing problems such as subpar produce and long wait times for pickup. Considering those issues, in March 2017. Amazon opened its first click and collect EXHIBIT 3 Survey of Consumer Concept Approval Ratings for Amazon Go, December 2016 of US adults agreeing with the following statements on Amazon Go 70 420 40 40% 3 SO 25 2014 il Agr Disagree Agree Disagree Agree Dag Agree would likely try shopping at Amazon GO Amazon wil.com charge comes the correction Amarone with bore protesto Shopes that I wodwilling Day more means checo Based on a survey of 1,039 Sum December 2015 Source YouGo C16 PART 2 Cin Cifting and executing Site grocery pick-up stores exclusively for its Prime mem- Foods accounted for 2 percent of the US fond bers at two locations in Seattle Called AmazonFresh and grocery market share (see Exhibit 4). Since the Pickup the stores allowed its Prime customers to beginning of 2016, the organic retail chain had been place the order online and to drive in and pick up facing declining sales stiff competition, and increas groceries from the pickup locations at a chosen time. ingly priceconscious consumers. Whole Foods Orders were based in as little as 15 minutes after also straling to shed its "priceyime they were placed. There was no order minimum and time when customers wanted more natural foods at the service was free for Prime members." more affordable prices. In February 2017, the retailer In June 2017. Amazon partnered with Sprouts reported sales decline at its store for seven conson Farmers Market LLC, a supermarket chain, to offer tive quarters (40 2015 to 10 2017), and was under one and two-hour delivery of products from the pressure to put itself up for sale (see Exhibits Sand grocer to its Prime members in the United States Meanwhile, even as Bezos was positioning Amazon offered one hour Prime Now delivery of Amazon to be the most powerful retailer in the world Sprouts items for $7.99, while two hour delivery was he was aware that this goal could not be achieved with provided at no additional cost through the company's out a physical presence, particularly in the grocery Prime Now app. Sprouts offered delivery through segment. Amazon controlled just about percent Prime Now in several cities, including Los Angeles of the US, food and beverage market as of 2016 San Diego, Austin. Dervet, and Dallas According to Joseph Sebastian of Moneycontrol com. "Where it comes to product like fruits and we Mies must consumers across the world will die moet AMAZON ACQUIRES and feel the product they are purchasing as it direct WHOLE FOODS for conspin Delivery medel entor-based an well as dyperfocal are more of a dud than and Whole Foods pioneered the organic food movement shis category in the US ar lost. Globally many in the United States with emphasis on high-quality nies have strobe the online grocers are as it and pricey organic offerings. As of 2016, Whole - les faster delivery and lesser shelf life: EXHIBIT 4 Largest U.S. Food and Beverage Retailers, 2016 U.S. sales of top food and beverage retailers Marshane 173 Wal-Mart 89 553 Kroger Alberto Say Costco Pube Soms Club Ahold USA HEB Grocery Whole Foods 19 1 17 Woo Shoot Amazon 50 520 540 560 500 $10051205140 2016 ottens Source Comen and Company G-17 CASE 10 Amazon.com, bic: Driving Disuptive change in the us Grocery Market EXHIBIT 5 Whole Foods Market Inc. Consolidated Statement of Operations (fiscal years ended September 25, 2016, September 27, 2015. and September 28, 2014) (in millions except per share amount) 2016 2015 2014 Sales Cost of goods sold and occupancy costs Gloss profile Seling general and administrative expenses Pre-opening expenses Relocation, store closure and fease termination costs Operating income Interest expense investment and other income Income before income taxes Provision for income taxes $15.724 $15.389 $14.194 10313 9.973 9.150 5.411 5.416 5044 4.477 4032 64 67 13 16 11 557 361 934 TI 827 .* Net income Basic earnings per share Weighted average shares outstanding Diluted earnings per share Weighted average shares outstanding, diluted basis Dividends declared per common share 320 $ 507 $155 326.1 $1.55 12 B78 946 342 367 5 536 $ 579 $1.49 $157 3585 3673 $1.45 5156 3508 3705 $0.52 50.41 3269 $0 54 Source.com/11062233/loficial/2016/6/2976. WTH:10 In June 2017, Amazon acquired Whole Foods in an all-cash transaction valued at approximately 13.7 billion. Reportedly, the Whole Foods deal was more than 10 times bigger than any acquisition Amaron had made until then. Post acquisition. Whole Foods would continue to operate stores under the whole Foods Market brand and John Mackey would continue To remain its CEO. Jason Goldberg, vice president of commerce at the digital marketing company Razorfish, wid. Amazon buying Whole Foods is a good for with the company's larger strategy for grocerie Fresh proxenesis Fueges category of consumer spending in retail shar has been disrupted by online yet After the merger was announced, the shares of some of the largest grocery store chains in the United States took a nosedive isce Exhibit 7). The shares of Kroper plunged more than 9 percent while that of Walmart and Costco fell 4.65 percent and 7.19 percent respectively. The shares of Supervalu and Sprouts cach dropped more than 6.5 percent Reportedly, the decline in the sit stocks crased nearly $12 billion in their market value in total Amazon's market valuation increased by $14.27 billion while Walmart. Kroger and Costco together lost $18.8 billion in market capitalization on June 16, 2017. Analysts said that the stock fluctuations revealed imesto concern over the long term threat of Amazon taking a significant position in the grocery space. They called it one of the most disruptive acquisitions in terms of the number of stocks it had impacted The acquisition catapulted Amazon headlong into the grocery space and provided it with a footprint in C-178 PART 2 Cuen in Crafting and Decuting Star Whole Foods' Quarterly Revenue Growth EXHIBIT 6 14 12% 10 Growth in revenue 15 year over year B 6% 45 24 OX 1014 401 2016 1015 2015 3015 2015 1015 4014 DIO SLOE 3014 1013 2013 3013 2016 1017 Source Whole Foods Marketing EXHIBIT 7 Stock Price Changes of Leading U.S. Grocers. June 15, 2017 to June 16, 2017 (market capitalization in $ billions) Stock Price Change June 15, 2017 to June 16, 2017 Grocer Market Capitalization US. Stores Whole Foods 270 13 455 Amazon 476 21% -5.4%. -65% 26 2.250 225 4.692 -6.9% 74 510 Ahold Clan Walmart and Sam's Club Costco Target Sprouts Farmers Market Kroger Harris Teeter 28 -12.9% -45% 3 20 1.807 272 2.792 Dutch company Ahold Delhaize owns us grocery chains including Food Lion and delivery service Papod. Kroger chains Dillons and King Soopers Costco locations are in the United States and Puerto Rico Daria Cameron and Kevin Schaut, The Washington Post Sources Bloomberg News. The companies CASE 16 Amazon.com, Inc: Dving Disruptive Change at the US Grocery Market C-179 some of the most affluent urban areas in the United Darren Seifer, a food and beverage analyst with market States (see Exhibit 8), Amazon would have access to research firm NPD Group. Whole Foods' 465 stores across 42 states in the United Many of Whole Foods in house brands, including States (460) and the United Kingdom (5 stores), 365 Everyday Value products were made available on besides a well-oiled supply chain. Whole Foods even Amazon's website. AmazonFresh and Prime Pantry had a strong private label business with its 365 brand Amazon Prime members could get these items del products. Armed with those stores Amazon could cred to their homes or to their local Amazon Locker improve its distribution network and eliminate costs free of charge. The retailer had con dedicated an area reach more customers, and increase its overall market of its first automated convenience store, Amazon Go share, said experts. Moreover, Amazon's other gro to the private label products. Amazon also made its cus cery initiatives AmazonFresh, Amazon Pantry, and tomer rewards program Prime Now the de facto Whole Amazon Prime would get a boost from Whole Foods's Foods customer rewards program. Is February 2018 store network as well as its loyal, affluent customer the retailer announced that Amazon Prime Rewards besc, they said." In addition, Amazon would also pick Visa cardholders would get 5 percent cash back on up a stake in grocery delivery startup Instacart, an their Whole Foods purchases while on Amazon Prime exclusive partner for Whole Foods' perishable business subscribers would get 3 percent cash back when they On August 23, 2017, the acquisition cleared its use their cand at Whole Foods. In addition Amazon biggest hurdle as the Federal Trade Commission and Whole Foods technology teams were integrating approved the deal. Post-merger Amazon had been Amazon Prime into the Whole Foods point-of-sale slasting prices on some items at Whole Foods stores system. The two retailers planned to innovate in ados in the United States in order to attract customers. tional areas including in merchandising and logisties, in Amazon lowered prices of avocados, eges, fruit, fish, order to lower prices for Whole Foods customers. and prepared food at Whole Food stores by as much In February 2018, Amazon started free hour as 50 percent. "Amason is trying to shed the whole delivery from Whole Foods stores to Prime Now me Pocheck stigma at Whole Foods, and they clearly bers on orders over $35 in four US cities-Austin identified some key categories where they didn't think Cincinnati. Dallas, and Virginia Beach Amazon planned they were competitive and dropped some prices , said to expand the offer nationwid