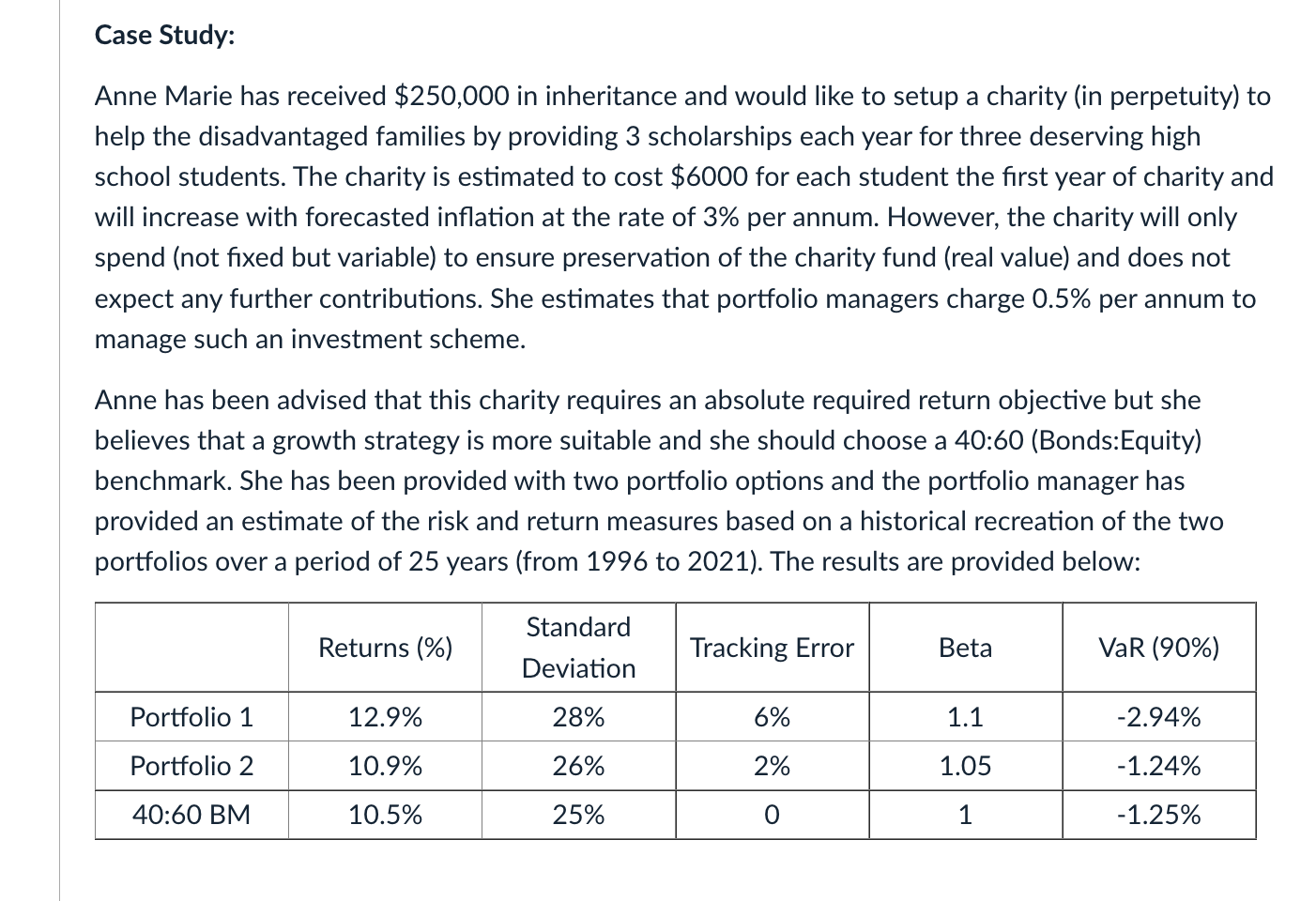

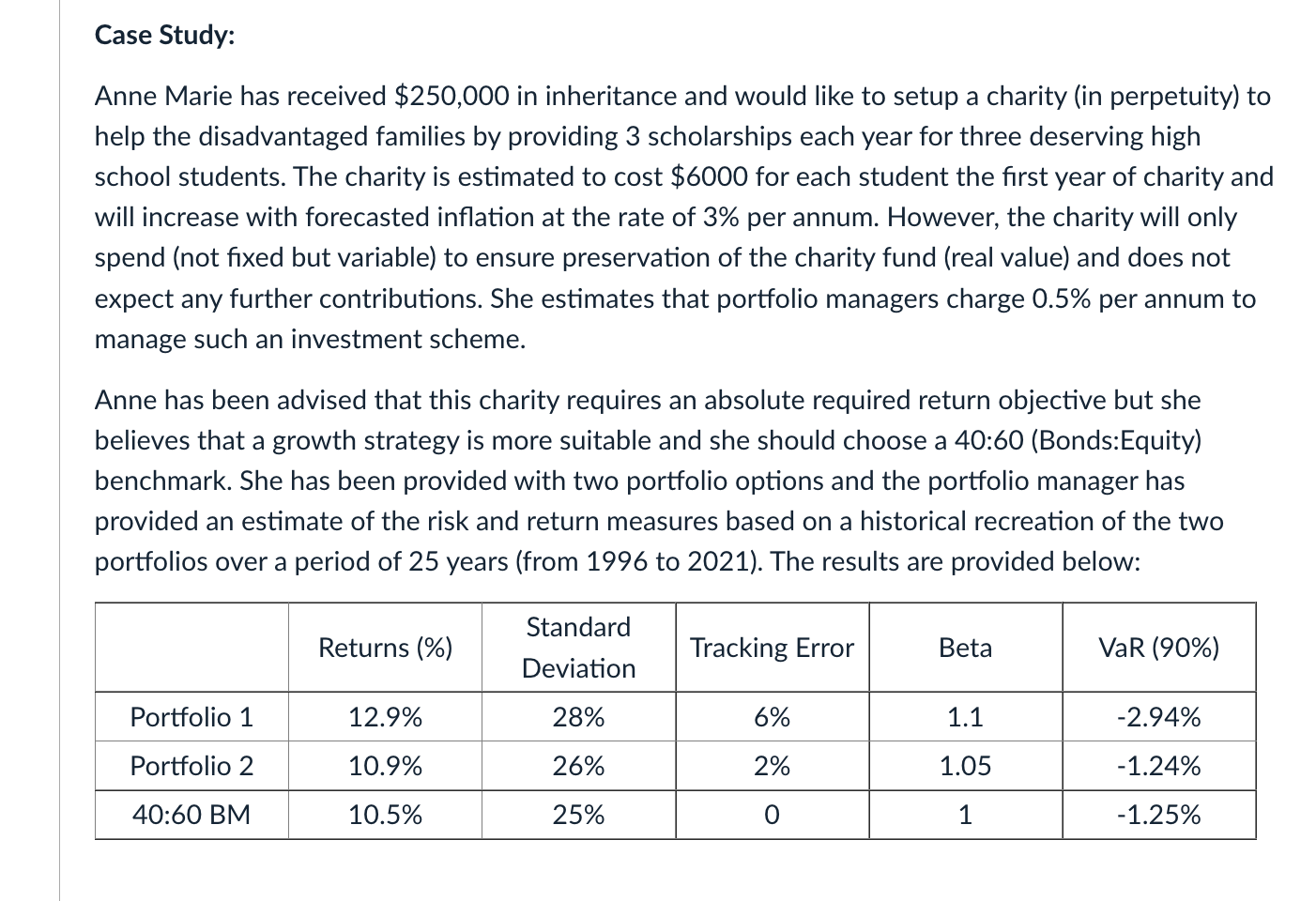

Case Study: Anne Marie has received $250,000 in inheritance and would like to setup a charity (in perpetuity) to help the disadvantaged families by providing 3 scholarships each year for three deserving high school students. The charity is estimated to cost $6000 for each student the first year of charity and will increase with forecasted inflation at the rate of 3% per annum. However, the charity will only spend (not fixed but variable) to ensure preservation of the charity fund (real value) and does not expect any further contributions. She estimates that portfolio managers charge 0.5% per annum to manage such an investment scheme. Anne has been advised that this charity requires an absolute required return objective but she believes that a growth strategy is more suitable and she should choose a 40:60 (Bonds:Equity) benchmark. She has been provided with two portfolio options and the portfolio manager has provided an estimate of the risk and return measures based on a historical recreation of the two portfolios over a period of 25 years (from 1996 to 2021). The results are provided below: Standard Returns (%) Tracking Error Beta VaR (90%) Deviation Portfolio 1 12.9% 28% 6% 1.1 -2.94% Portfolio 2 10.9% 26% 2% 1.05 -1.24% 40:60 BM 10.5% 25% 0 1 -1.25% Question 2: (i) Calculate the required return for the charity. Please also explain each variables used in the calculation and not just a number (1 mark) (ii) State and Explain two advantages if the charity fund used a benchmark based required return objective instead of a specific required return objective? (1 + 1 = 2 marks) (iii) Explain which portfolio is best able to achieve the charity fund's return objective. Please discuss only from the point of view of the returns achieved on a historical basis by the two portfolios and the benchmark (1 + 1 = 2 marks) Question 3 (i) The table presents various risk measures. Identify the most relevant risk measure and explain why it is most important for this fund's investment objective (0.5 + 1 = 1.5 marks) (ii) Based on your answer in (i) above, explain what would be an appropriate risk objective for this fund? (1 mark) (iii) Based on the required return calculated in Question 2 (i) above and the risk objective, explain if you feel that the portfolio selected in Question 2 (iii) is still suitable or do you feel the other portfolio is better suited for this charity fund? (0.5 + 1 = 1.5 marks) Case Study: Anne Marie has received $250,000 in inheritance and would like to setup a charity (in perpetuity) to help the disadvantaged families by providing 3 scholarships each year for three deserving high school students. The charity is estimated to cost $6000 for each student the first year of charity and will increase with forecasted inflation at the rate of 3% per annum. However, the charity will only spend (not fixed but variable) to ensure preservation of the charity fund (real value) and does not expect any further contributions. She estimates that portfolio managers charge 0.5% per annum to manage such an investment scheme. Anne has been advised that this charity requires an absolute required return objective but she believes that a growth strategy is more suitable and she should choose a 40:60 (Bonds:Equity) benchmark. She has been provided with two portfolio options and the portfolio manager has provided an estimate of the risk and return measures based on a historical recreation of the two portfolios over a period of 25 years (from 1996 to 2021). The results are provided below: Standard Returns (%) Tracking Error Beta VaR (90%) Deviation Portfolio 1 12.9% 28% 6% 1.1 -2.94% Portfolio 2 10.9% 26% 2% 1.05 -1.24% 40:60 BM 10.5% 25% 0 1 -1.25% Question 2: (i) Calculate the required return for the charity. Please also explain each variables used in the calculation and not just a number (1 mark) (ii) State and Explain two advantages if the charity fund used a benchmark based required return objective instead of a specific required return objective? (1 + 1 = 2 marks) (iii) Explain which portfolio is best able to achieve the charity fund's return objective. Please discuss only from the point of view of the returns achieved on a historical basis by the two portfolios and the benchmark (1 + 1 = 2 marks) Question 3 (i) The table presents various risk measures. Identify the most relevant risk measure and explain why it is most important for this fund's investment objective (0.5 + 1 = 1.5 marks) (ii) Based on your answer in (i) above, explain what would be an appropriate risk objective for this fund? (1 mark) (iii) Based on the required return calculated in Question 2 (i) above and the risk objective, explain if you feel that the portfolio selected in Question 2 (iii) is still suitable or do you feel the other portfolio is better suited for this charity fund? (0.5 + 1 = 1.5 marks)