Question

Case Study - AppTown Inc. Apptown Inc. (Apptown) develops software applications for consumer use. Apptown started in 2013 and is a provincially incorporated company. Apptowns

Case Study - AppTown Inc.

Apptown Inc. (Apptown) develops software applications for consumer use.

Apptown started in 2013 and is a provincially incorporated company. Apptowns focus has been the creation of apps applications that can be sold in volume to consumers through iTunes and other distribution channels. Apptowns successful apps share one main characteristic they are able to present useful knowledge to consumers in an engaging and easy-to-use way.

Apptown presently has two main apps:

-BuyHome, an app that walks a prospective buyer through the purchase of a home in Canada, step by step using a board game type of approach. This app is free to the consumer and was funded by the CMHC, an agency of the federal government. BuyHome has been downloaded 3 million times. Apptown created the app for a fee paid by CMHC and made a small profit on the project

-Celebercise, an app that provides consumers with access to a constantly changing set of exercise workouts that celebrities follow. The app sells mainly through the iTunes and Android App Stores for $3.99. The celebrities involved receive 10% of gross revenue from sales, Apple/Android receives 20% and AppTown receives 70%. Celebercise has received several awards for the engaging and innovative approach to exercise that it provides. Celebercise has been downloaded more than 1 million times over the past three years, giving AppTown a small profit after paying the development costs involved in creating the app. Celebercise sales have steadily increased, however Celebercise faces increasing competition from VR (virtual reality) and AR (augmented reality) enabled apps in the fitness field that increasingly are given to consumers for no charge by companies such as UnderArmour or Nike. Apptown was founded by three Lower Mainland residents who have advanced education and skills in software development (age as of 2017 in brackets) - Richard Hendricks 25, Dinesh Chugtai 27 and Bertram Gilfoyle 28.

The company presently has 100,000 common voting shares, divided equally between the three founders.

Capitalization Table, Apptown Inc. As of March 2017

|

| Percentage of Common Voting Shares Owned | Common Voting Shares Owned |

| Richard Hendricks | 33% | 33,333 |

| Dinesh Chugtai | 33% | 33,333 |

| Bertram Gilfoyle | 33% | 33,333 |

The Apptown Board of Directors has one member - Richard Hendricks. Apptown has seven employees as of March 2017, including the three founders. Apptown is located in a small office space in the Gastown area of Vancouver, on a month-to-month lease.

The Future VR App and TV App

Apptown now faces the challenge of coming up with a new app or apps that will continue the three year run of steadily rising sales, but also allow the company to finally turn a significant profit. Apptown plans to focus on two areas for future app development. Both involve shifting the business model from consumer revenue to revenue from business customers. Two core apps would be developed and then customized for specific clients VR App 1 and TV App 1

VR App 1 - the first direction for future development is to create apps that allow companies to make their online presence more engaging by providing a virtual reality (VR) experience for visitors to their website. The first app is codenamed VR App 1. For example, Amazon could contract Apptown to produce a customized version of VR App 1 that would allow Amazon customers to browse through Amazon products in VR, viewing product features and customer testimonials. Apptown is targeting major online retailers and government agencies such as US Marine Corps recruitment for VR App 1. Apptown anticipates receiving a flat fee combined with a pay-per-click royalty (i.e. Apptown would receive a payment from the client each time the app is used by visitors to the website)

TV App 1 - the second direction for future development is to create apps that allow video content providers to present their content in a more engaging manner that employs new 4K, VR and AVR technology. The first app, codenamed TV App 1, would allow users to set preferences, organize content, schedule viewing, share with social media, export content to mobile devices, watch VR clips of content and other features. Unlike present solutions on the market, TV App 1 would provide a comprehensive, engaging, easy-to-use user app. For example, press coverage has recently highlighted Apples failure to create such an app for its Apple TV product and related iTunes video service. TV App 1 could be marketed to Apple as the gateway to an engaging video experience for Apple TV users. TV App 1 could be marketed to an ever-widening range of clients, including Facebook, Youtube/Google, HBO, Netflix and smart car manufacturers. Apptown anticipates receiving a flat fee combined with a pay-per-click royalty (i.e. Apptown would receive a payment from the client each time the app is used by visitors to the website) Both VR App 1 and TV App 1 allow clients to move forward into new technologies and forms of user engagement. Both apps build on Apptowns demonstrated ability to present useful knowledge to consumers in an engaging and easy-to-use way. The long term plan is to combine VR App 1 and TV App 1 to create a super app that would act as the standard user interface for online video streaming, much in the way Amazon has established its user interface as the standard for online retail (the profit in the Amazon business model is in the Amazon Web Services division, which provides the foundation for much of online retail). The founders feel that such a super app could generate annual pay per click revenue of over $100 million for Apptown , while making the company an attractive acquisition target for companies such as Amazon, Microsoft, Google, Facebook or Apple.

The company estimates it will need at least $4 million in financing to implement its 2018-2021 plan:

-$2.5 million to develop the TV-1 and VR-1 apps, mainly to hire new developers with advanced video, VR and animation skills, either as employees or sub-contractors

-$400,000 to hire sale representatives to approach and close top level prospects such as Amazon and Netflix

-$400,000 for costs associated with a new office space. This will entail entering into a new lease in 2017 for a larger rental space.

-$400,000 in new equipment (mostly highly specialized video and animation equipment)

-$400,000 in working capital, to be used mostly in 2017 and 2018.

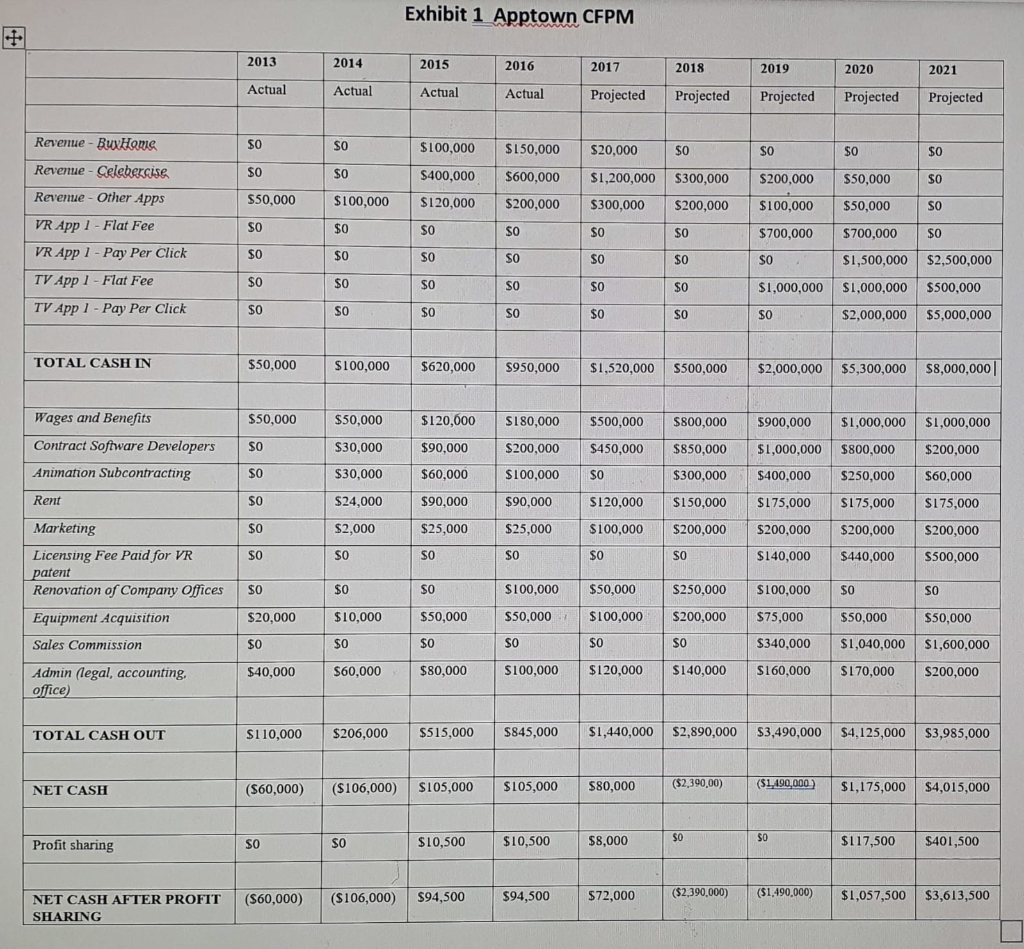

Apptown has prepared a Cash Flow Model as Exhibit 1. 2013-2016 show how the company actually performed; 2017-2021 are projections based on the companys best estimates.

Enter the Investors..

The growth of Apptown has attracted attention from four potential investors (age as of 2017 in brackets) Juliana Martinez (55) grew up in Burnaby and was a child prodigy and elite athlete, eventually graduating from Stanford with a PhD in Electrical Engineering at 20 years of age. She is also one of Canada's wealthiest women. The Martinez Trust, established by Juliana Martinez to hold patent interests for inventions she had developed during her work for Microsoft, Apple and Blackberry is estimated to yield an annual royalty stream in excess of $120 million. Dr. Martinez serves as a member of the Board of Directors of Apple, LinkedIn, Time Warner and Ford Motor Company. Dr. Martinez has made 25 early stage technology companies throughout British Columbia over the past 15 years. Six of these companies were acquired by larger companies. Four other investments are now publicly traded and have become established companies in their respective industries. Ankush Dadhwal (65) is an angel investor with a background in the production of movies and television shows. He was a successful executive with both Fox and Showtime broadcast networks. He retired from his career in broadcasting in 2015 and is now an angel investor who has invested in three early stage companies that are developing apps for video content providers such as Netflix. He has extensive contacts and an established reputation inside the American and international entertainment industries. Shaakir Ali (26) is an angel investor who has a background as a successful app developer in Vancouver. The company he founded, AppFarm, created a gaming app that set a record for annual downloads on the iTunes and Android stores. Ali sold his shares in Appfarm to Activision in 2016 for $20 million and is now seeking to invest and play a leadership role in early stage technology companies. Battlestar Capital is a venture capital firm based in Vancouver that opened for business in 2014. The company manages $180 million on behalf of several large pension plans that are seeking to diversify their investment portfolios by investing in early stage technology companies with significant growth prospects. Battlestar has made six investments in early stage technology companies since 2014. Battlestar is managed by five partners who have past experience in venture capital, banking and international trade.

Exhibit 1 Apptown CFPM

Case Study Question 1 (50 marks)

For both parts of this question, assume that Apptown must choose to obtain the $4 million in future financing from either one or two of the four prospective investors described above. i.e. you cannot choose three or four investors you must choose one or two

For both parts of this question, assume you are an advisor to Apptown hired to help identify and close the required financing.

Question 1A. Which investor or combination of investors should Apptown choose? Identify the investor or combination of investors. Explain why this investor or combination of investors is the best selection for Apptown. (20 marks)

Question 1B. The Investment Proposal presented in class has four sections: The Opportunity, The Business of the Company, Cash Flow Projection, Proposed Financing. Describe and explain the main points of The Opportunity and Proposed Financing sections you would present to the investor or combination of investors you have selected in the answer to Question 1A. (30 marks)

Exhibit 1 Apptown CFPM 2014 2015 2018 2013 Actual 2019 2016 Actual 2017 Projected Actual 2020 Projected 2021 Projected Actual Projected Projected SO SO $100,000 $150,000 SO SO $0 $400,000 $120,000 $600,000 $200,000 $20,000 $1,200,000 $300,000 $0 $300,000 $200,000 $100,000 $50,000 $50,000 Revenue - Buxoris. Revenue - Celebercise Revenue - Other Apps VR App 1 - Flat Fee VR App 1 - Pay Per Click TV App 1 - Flat Fee TV App 1 - Pay Per Click $200,000 $100,000 $700,000 so $50,000 SO SO SO $700,000 $0 $0 SO SO $1,000,000 $1,500,000 $1,000,000 $2,000,000 $2,500,000 $500,000 $5,000,000 SO SO SO SO SO TOTAL CASH IN $50,000 $100,000 $620,000 $950,000 $1,520,000 $500,000 $2,000,000 $5,300,000 $8,000,000 Wages and Benefits $120,000 S180,000 $800,000 $50,000 SO $50,000 $30,000 $30,000 $1,000,000 $800,000 Contract Software Developers Animation Subcontracting $1,000,000 $200,000 $200,000 $850,000 $90,000 $60,000 $100,000 $500,000 $450,000 $0 $120,000 $100,000 $300,000 $250,000 $60,000 5900,000 $1,000,000 $400,000 $175,000 $200,000 $140,000 Rent $24,000 $90,000 $175,000 $90,000 $25,000 SO $150,000 $200,000 $2,000 $25,000 $175,000 $200,000 $440,000 $200,000 $500,000 SO SO 50 $0 SO Marketing Licensing Fee Paid for VR patent Renovation of Company Offices Equipment Acquisition mon Sales Commission SO SO SO $50,000 $100,000 $250,000 $200,000 so $20,000 SO $40,000 $10,000 SO $60,000 $50,000 50 $80,000 $100,000 $50,000 SO $100,000 $100,000 $75,000 $340,000 $160,000 SO $50,000 $1,040,000 $170,000 SO SO $50,000 $1,600,000 $200,000 $120,000 Admin (legal, accounting, office) $140,000 TOTAL CASH OUT $110,000 $206,000 $515,000 5845,000 $1,440,000 $2,890,000 $3,490,000 $4,125,000 $3,985,000 NET CASH ($60,000) ($106,000) $105,000 $105,000 $80,000 ($2,390,00) (51,490,000 $1,175,000 $4,015,000 Profit sharing $10,500 $10,500 $8,000 $117,500 $401,500 (560,000) ($106,000) $94,500 $94,500 $72,000 ($2,390,000) (51,490,000) $1,057,500 $3,613,500 NET CASH AFTER PROFIT SHARING Exhibit 1 Apptown CFPM 2014 2015 2018 2013 Actual 2019 2016 Actual 2017 Projected Actual 2020 Projected 2021 Projected Actual Projected Projected SO SO $100,000 $150,000 SO SO $0 $400,000 $120,000 $600,000 $200,000 $20,000 $1,200,000 $300,000 $0 $300,000 $200,000 $100,000 $50,000 $50,000 Revenue - Buxoris. Revenue - Celebercise Revenue - Other Apps VR App 1 - Flat Fee VR App 1 - Pay Per Click TV App 1 - Flat Fee TV App 1 - Pay Per Click $200,000 $100,000 $700,000 so $50,000 SO SO SO $700,000 $0 $0 SO SO $1,000,000 $1,500,000 $1,000,000 $2,000,000 $2,500,000 $500,000 $5,000,000 SO SO SO SO SO TOTAL CASH IN $50,000 $100,000 $620,000 $950,000 $1,520,000 $500,000 $2,000,000 $5,300,000 $8,000,000 Wages and Benefits $120,000 S180,000 $800,000 $50,000 SO $50,000 $30,000 $30,000 $1,000,000 $800,000 Contract Software Developers Animation Subcontracting $1,000,000 $200,000 $200,000 $850,000 $90,000 $60,000 $100,000 $500,000 $450,000 $0 $120,000 $100,000 $300,000 $250,000 $60,000 5900,000 $1,000,000 $400,000 $175,000 $200,000 $140,000 Rent $24,000 $90,000 $175,000 $90,000 $25,000 SO $150,000 $200,000 $2,000 $25,000 $175,000 $200,000 $440,000 $200,000 $500,000 SO SO 50 $0 SO Marketing Licensing Fee Paid for VR patent Renovation of Company Offices Equipment Acquisition mon Sales Commission SO SO SO $50,000 $100,000 $250,000 $200,000 so $20,000 SO $40,000 $10,000 SO $60,000 $50,000 50 $80,000 $100,000 $50,000 SO $100,000 $100,000 $75,000 $340,000 $160,000 SO $50,000 $1,040,000 $170,000 SO SO $50,000 $1,600,000 $200,000 $120,000 Admin (legal, accounting, office) $140,000 TOTAL CASH OUT $110,000 $206,000 $515,000 5845,000 $1,440,000 $2,890,000 $3,490,000 $4,125,000 $3,985,000 NET CASH ($60,000) ($106,000) $105,000 $105,000 $80,000 ($2,390,00) (51,490,000 $1,175,000 $4,015,000 Profit sharing $10,500 $10,500 $8,000 $117,500 $401,500 (560,000) ($106,000) $94,500 $94,500 $72,000 ($2,390,000) (51,490,000) $1,057,500 $3,613,500 NET CASH AFTER PROFIT SHARINGStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started