Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Audit Procedures for Revenue Sharing Agreements In today's dynamic business environment, revenue sharing agreements have become increasingly prevalent as organizations seek collaborative opportunities

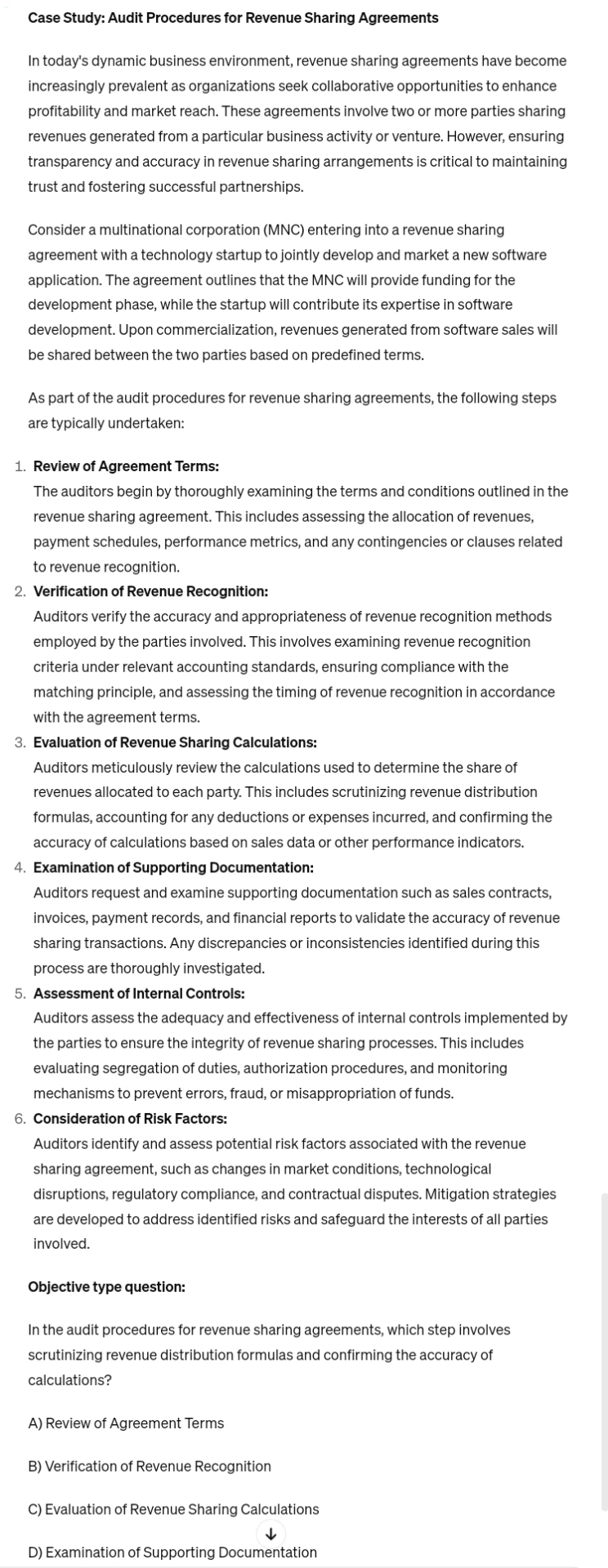

Case Study: Audit Procedures for Revenue Sharing Agreements

In today's dynamic business environment, revenue sharing agreements have become increasingly prevalent as organizations seek collaborative opportunities to enhance profitability and market reach. These agreements involve two or more parties sharing revenues generated from a particular business activity or venture. However, ensuring transparency and accuracy in revenue sharing arrangements is critical to maintaining trust and fostering successful partnerships.

Consider a multinational corporation MNC entering into a revenue sharing agreement with a technology startup to jointly develop and market a new software application. The agreement outlines that the MNC will provide funding for the development phase, while the startup will contribute its expertise in software development. Upon commercialization, revenues generated from software sales will be shared between the two parties based on predefined terms.

As part of the audit procedures for revenue sharing agreements, the following steps are typically undertaken:

Review of Agreement Terms:

The auditors begin by thoroughly examining the terms and conditions outlined in the revenue sharing agreement. This includes assessing the allocation of revenues, payment schedules, performance metrics, and any contingencies or clauses related to revenue recognition.

Verification of Revenue Recognition:

Auditors verify the accuracy and appropriateness of revenue recognition methods employed by the parties involved. This involves examining revenue recognition criteria under relevant accounting standards, ensuring compliance with the matching principle, and assessing the timing of revenue recognition in accordance with the agreement terms.

Evaluation of Revenue Sharing Calculations:

Auditors meticulously review the calculations used to determine the share of revenues allocated to each party. This includes scrutinizing revenue distribution formulas, accounting for any deductions or expenses incurred, and confirming the accuracy of calculations based on sales data or other performance indicators.

Examination of Supporting Documentation:

Auditors request and examine supporting documentation such as sales contracts, invoices, payment records, and financial reports to validate the accuracy of revenue sharing transactions. Any discrepancies or inconsistencies identified during this process are thoroughly investigated.

Assessment of Internal Controls:

Auditors assess the adequacy and effectiveness of internal controls implemented by the parties to ensure the integrity of revenue sharing processes. This includes evaluating segregation of duties, authorization procedures, and monitoring mechanisms to prevent errors, fraud, or misappropriation of funds.

Consideration of Risk Factors:

Auditors identify and assess potential risk factors associated with the revenue sharing agreement, such as changes in market conditions, technological disruptions, regulatory compliance, and contractual disputes. Mitigation strategies are developed to address identified risks and safeguard the interests of all parties involved.

Objective type question:

In the audit procedures for revenue sharing agreements, which step involves scrutinizing revenue distribution formulas and confirming the accuracy of calculations?

A Review of Agreement Terms

B Verification of Revenue Recognition

C Evaluation of Revenue Sharing Calculations

D Examination of Supporting Documentation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started