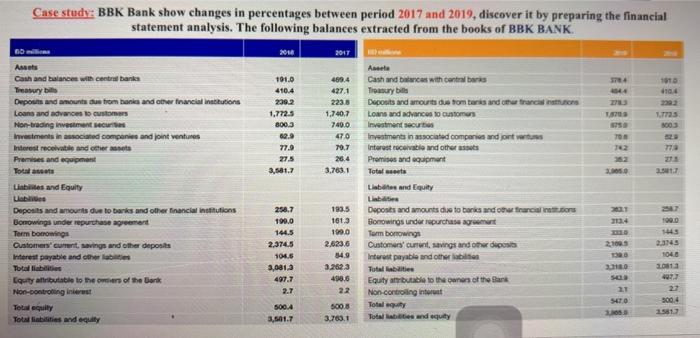

Case study: BBK Bank show changes in percentages between period 2017 and 2019, discover it by preparing the financial statement analysis. The following balances extracted from the books of BBK BANK 2017 118 ST 44 1104 Assets Cash and balances with central banks Treasury bite Deposits and amount tombanks and other financial institutions Loons and advance to customers Non-trading Investment secure Investments inced companies and joint ventures Interest receive and other Premises and equipment Total 191.0 410.4 2392 1,772.5 400.4 427.1 223.8 1.740.7 740.0 . 8003 1725 NO 40 TO 62.9 77.0 27.5 3.581.7 79.7 26.4 3.763.1 Lisbies and Equity Cash and balance with centras Treasury bits Depools and amourts due tomtenis and other trarca retice Loans and advance to customers Investment sec Investments in associated companies and join us Interest racesti ad others Promises and equipment Totalt Lisbetes and Equity Lab Deposts and amounts o to bars and oth fracalinations Bonowings underrepurchase agreement Tarm bonowing Customers current savings and other diposis Interest payable and others Total labai Equity arbutable to the owners of the Bank Non-controlling intet Total Totalt and equity Deposits and amours due to banks and other financial institutions Borowings underrepurchase agreement Term borrons Customers current saving and other deposits Interest payable and other las Tota la Equity attributable to themes of the Bank Non-controling interest Total equity Total liabilities and equity 258.7 190.0 144.5 2,374.5 100.6 3,081,2 497.7 2.7 193.5 1613 199.0 2.623.6 14.9 3.2623 4906 22 5008 3.763.1 1900 1445 2015 1040 2013 2130 547 0 500.4 3,501.7 300.4 1.5613 Case study: BBK Bank show changes in percentages between period 2017 and 2019, discover it by preparing the financial statement analysis. The following balances extracted from the books of BBK BANK 2017 118 ST 44 1104 Assets Cash and balances with central banks Treasury bite Deposits and amount tombanks and other financial institutions Loons and advance to customers Non-trading Investment secure Investments inced companies and joint ventures Interest receive and other Premises and equipment Total 191.0 410.4 2392 1,772.5 400.4 427.1 223.8 1.740.7 740.0 . 8003 1725 NO 40 TO 62.9 77.0 27.5 3.581.7 79.7 26.4 3.763.1 Lisbies and Equity Cash and balance with centras Treasury bits Depools and amourts due tomtenis and other trarca retice Loans and advance to customers Investment sec Investments in associated companies and join us Interest racesti ad others Promises and equipment Totalt Lisbetes and Equity Lab Deposts and amounts o to bars and oth fracalinations Bonowings underrepurchase agreement Tarm bonowing Customers current savings and other diposis Interest payable and others Total labai Equity arbutable to the owners of the Bank Non-controlling intet Total Totalt and equity Deposits and amours due to banks and other financial institutions Borowings underrepurchase agreement Term borrons Customers current saving and other deposits Interest payable and other las Tota la Equity attributable to themes of the Bank Non-controling interest Total equity Total liabilities and equity 258.7 190.0 144.5 2,374.5 100.6 3,081,2 497.7 2.7 193.5 1613 199.0 2.623.6 14.9 3.2623 4906 22 5008 3.763.1 1900 1445 2015 1040 2013 2130 547 0 500.4 3,501.7 300.4 1.5613