Question

Case Study: Bond Valuation and Risks This will be graded. It is due by the end of Week 4 class. No credit for late assignments.

Case Study: Bond Valuation and Risks

This will be graded. It is due by the end of Week 4 class. No credit for late assignments.

On January 15, 2017, Huskies Inc., a company founded by a USM graduate, donated $10 million to USM to fund scholarships for students in the business school. USM has hired your investment firm to manage an endowment funded by the gift. You work in the bond research department. The head portfolio manager has asked you to evaluate several bonds for potential purchase.

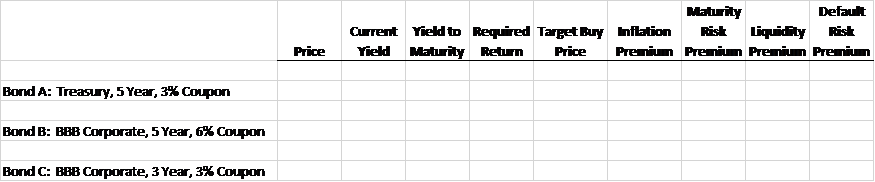

All bonds were issued yesterday. Bond A is a 5 year $1,000 par value 3% annual coupon U.S. Treasury bond. Bond B is a 5 year $1,000 par value 6% annual coupon BBB rated corporate bond. Bond C is a 3 year $1,000 par value 3% annual coupon BBB rated corporate bond. All three bonds are trading at $900 per bond.

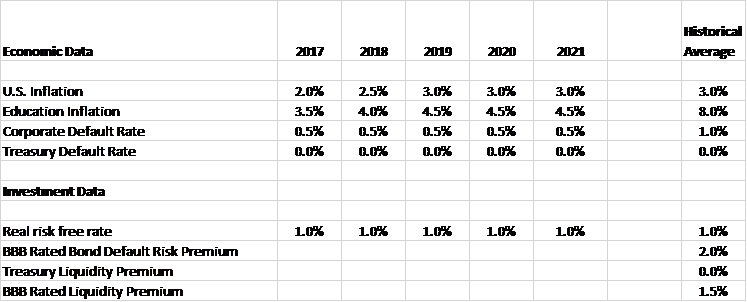

The firms economics team has updated its economic forecasts for the next five years and shared the assumptions with your department. The fixed income departments valuation model estimates the maturity risk premium for all bonds using the following formula: 0.1% (t-1), t=years to maturity. The firm uses an annual average of expected U.S. inflation to determine the inflation premium over the remaining years to maturity and 1% as the real risk free rate. U.S. treasury bonds are assumed to have no default risk.

The firm uses the required return formula taught in the USM Financial Management 320 class and will purchase a bond when it reaches a price at or below the price calculated using the required return from the formula below as the discount rate.

Required return = real risk free rate + IP (inflation premium) + DRP (default risk premium) + LP (liquidity premium) + MRP (maturity risk premium)

economic data:

US inflation 3.0

edcation inflation4.5

corporate defualt rate0.5

treasuary default rate0.0%

investment data :

real risk rate 1.0%

BBBrate bond default risk primuim 2.0%

treasury liquidity premium0.0%

BBB rate

Name:

This is an open book exercise. You may use notes and class materials. To help analyze the bonds, the head portfolio manager wants you to complete the following table. Target buy price is your intrinsic value estimate based on your required return assumption.

Are any of the bonds a buy? Why?

The head portfolio manager is worried that the economy may enter a recession in 2021. Which bond would have the least risk in this scenario? Which bond would have the most risk? Why?

The head portfolio has asked you to identify any bonds that offer a return that would exceed the historical average for education inflation. Do any bonds meet this criterion? Explain.

Histprical Econonic Daja 2n7 2019 2I220 I21 Aerage U.S. Inflation Education Inflation Corporate Default Rate Treasury Default Rate 2.0% 3.5% 0.5% 0.0% 2.5% 4.0% 0.5% 0.0% 3.0% 45% 0.5% 0.0% 3.0% 45% 0.5% 0.0% 3.0% 45% 0.5% 0.0% 3.0% 8.0% 0% 0.0% eshnent Data Real risk free rate BBB Rated Bond Default Risk Premium Treasury Liquidity Premium BBB Rated Liquidrty Premiunm 0% 0% 0% 0% 0% 0% 2.0% 0.0% 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started