Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Chase Sapphire: Creating a Millennial Cult Brand. Please make the following assumptions: The costs for JP Morgan Chase to acquire a Chase Sapphire

Case Study: Chase Sapphire: Creating a Millennial Cult Brand.

Please make the following assumptions:

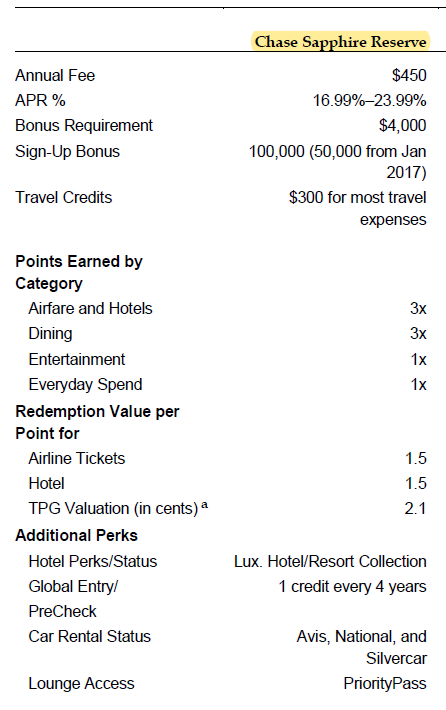

- The costs for JP Morgan Chase to acquire a Chase Sapphire Reserve customer is 375 dollars plus the cost of providing 100,000 points sign-up bonus.

- Transactor and Revolver segment customers spent an average of 16,000 dollars in the first year, but the Dormant segment customer spent just enough to earn the sign-up bonus.

- Transactor and Dormant segment customers paid off their balance each month, but the Revolver segment customer carried an average balance of 8,000 dollars across the year.

- The interest rate charged to customers is 20.5% per annum by Chase Sapphire and the interchange fee it earns on transactions is 1.5%.

- The annual fee of 450 dollars is only charged to customers after the first year.)

- The travel credits cost Chase about half of the value given to the customers (Travel credits value to customers was $300)

- On average, customers redeem I point per $ spent on credit card (while they earn between 1 to 3 points depending on the category, there are some points that go unredeemed so 1 point as an average redemption)

Question: How profitable are the three segments (Transactors, Revolvers, and Dormants) relative to each other in the first year? Do all calculations at the level of the individual customer and do not forget to conclude with what you learnt from your analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started