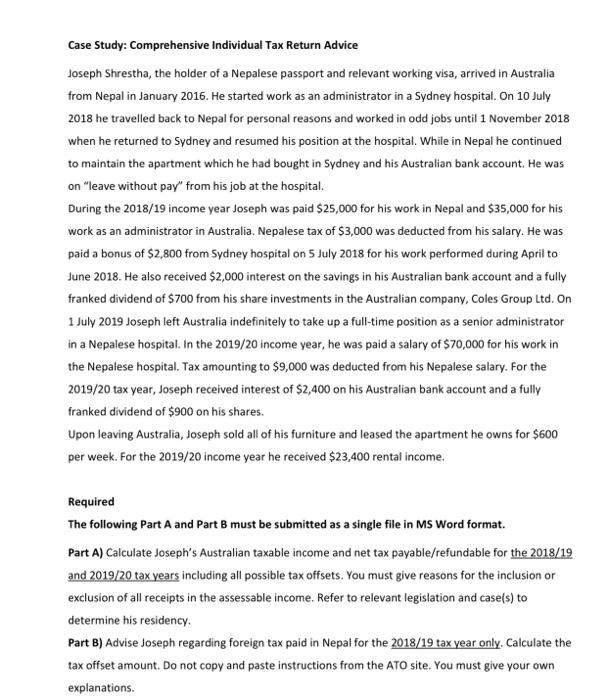

Case Study: Comprehensive individual Tax Return Advice Joseph Shrestha, the holder of a Nepalese passport and relevant working visa, arrived in Australia from Nepal in January 2016. He started work as an administrator in a Sydney hospital. On 10 July 2018 he travelled back to Nepal for personal reasons and worked in odd jobs until 1 November 2018 when he returned to Sydney and resumed his position at the hospital. While in Nepal he continued to maintain the apartment which he had bought in Sydney and his Australian bank account. He was on "leave without pay" from his job at the hospital. During the 2018/19 income year Joseph was paid $25,000 for his work in Nepal and $35,000 for his work as an administrator in Australia. Nepalese tax of $3,000 was deducted from his salary. He was paid a bonus of $2,800 from Sydney hospital on 5 July 2018 for his work performed during April to June 2018. He also received $2,000 interest on the savings in his Australian bank account and a fully franked dividend of $700 from his share investments in the Australian company, Coles Group Ltd. On 1 July 2019 Joseph left Australia indefinitely to take up a full-time position as a senior administrator in a Nepalese hospital. In the 2019/20 income year, he was paid a salary of $70,000 for his work in the Nepalese hospital. Tax amounting to $9,000 was deducted from his Nepalese salary. For the 2019/20 tax year, Joseph received interest of $2,400 on his Australian bank account and a fully franked dividend of $900 on his shares. Upon leaving Australia, Joseph sold all of his furniture and leased the apartment he owns for $600 per week. For the 2019/20 income year he received $23,400 rental income. Required The following Part A and Part B must be submitted as a single file in MS Word format. Part A) Calculate Joseph's Australian taxable income and net tax payable/refundable for the 2018/19 and 2019/20 tax years including all possible tax offsets. You must give reasons for the inclusion or exclusion of all receipts in the assessable income. Refer to relevant legislation and case(s) to determine his residency Part B) Advise Joseph regarding foreign tax paid in Nepal for the 2018/19 tax year only. Calculate the tax offset amount. Do not copy and paste instructions from the ATO site. You must give your own explanations