Consder the following scenaria You sel heavy-duty ekctrik punps, used by a variety of manufacturing companies in a varety of plnts. Your price is

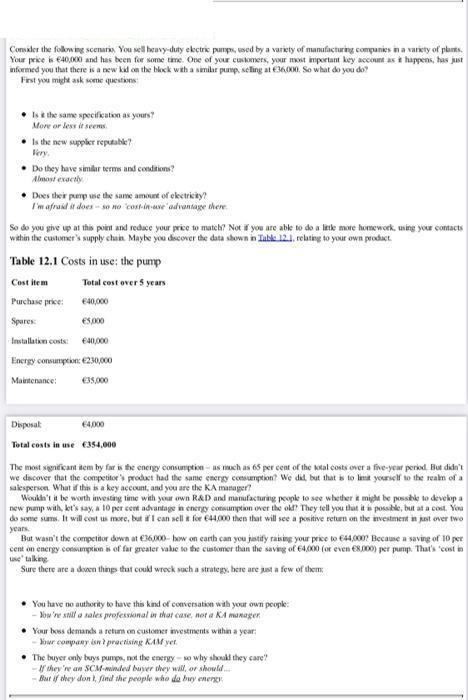

Consder the following scenaria You sel heavy-duty ekctrik punps, used by a variety of manufacturing companies in a varety of plnts. Your price is 40,000 and has been for some time. One of your cuskomers, your most important key account as i happens, has just informed you that there is a new kid on the block with a similar pump, seling at 36.000. So what do you do? First you might ask some questions Is the same specification as yours? More or less it seems. Is the new sappler reputable? Fery. Do they have similar terms and conditions? Almost exactly Does their punp vse the same amount of eketricity? I'm afraid it does - so no cost-in-ave advantage there. So do you give up at this poit and reduce your price to match Not if you are abke to do a letke more homework, uming your cotacts within the customer's supply chain. Maybe you dscover the data shown in Tuble 121, relating to your own prodact. Table 12.1 Costs in use; the punp Cost item Total cost over 5 years Purchase price: C40,000 Spures: Esp00 Installatkn costs: ean,000 Energy consumpeion: 230,000 Maintenance: E35,000 Disposat 4000 Total costs in use 354,000 The most significant item by far is the energy consumption - as much as 65 per cent of the kital costs over a five-year period. But didn't we dscover that the competitor's product had the same encrgy consumption? We did, but that is to linit yourself to the realm of a salesperson. What if thi is a key account, and you are the KA manager? Woukh't it be worth investing time with your own R&D and manufacturing people to see whether i might be possble to devekop a new pump with, ket's say, a 10 per cent advantage in energy consumption over the okf? They tell you that it s possble, but at a cost. You do some sums. It will cost us more, but ifI can sell a for 44,000 then that will see a positive return on the investment in just over two years. But wasn't the competitor down at 36000- how on earth can you jastify raising your price to 44,000 Because a saving of 10 per cent on energy consunprion is of far greater vale to the customer than the saving of 64,000 (or even 8000) per punmp. That's "cost in use" talking Sure there are a doen things that coukd wreck such a strategy, bere are just a few of them You have no authority to have this kind of conversation with your owni peopk: - Now're still a sales professional in that case, not a KA manager Your boss demands a retum on customer ivestments within a year: - ur conpany isn? practising KAM yet. The buyer only buys pumps, not the energy - so why shoukd they care? f they 're an SCM-minded buyer they will, or should But if they don t, find the people who da bey energy on the due date. Case Study - Cost in use, not cost to buy 1. Review the case study on pages 137 - 138 of our textbook. If your energy consumption savings over 5 years equals a 10 percent saving, how much do you save in a euro amount? 2. Explain the difference between "cost in use" and "cost to buy". How could this help you develop a value proposition? 3. Based on this saving, what other strategies could you employ to keep this customer happy other than the ones supplied in this case study. List three other strategies.

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Period 5years Energy consumption saving rate 10 Amount of savings I 0 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started