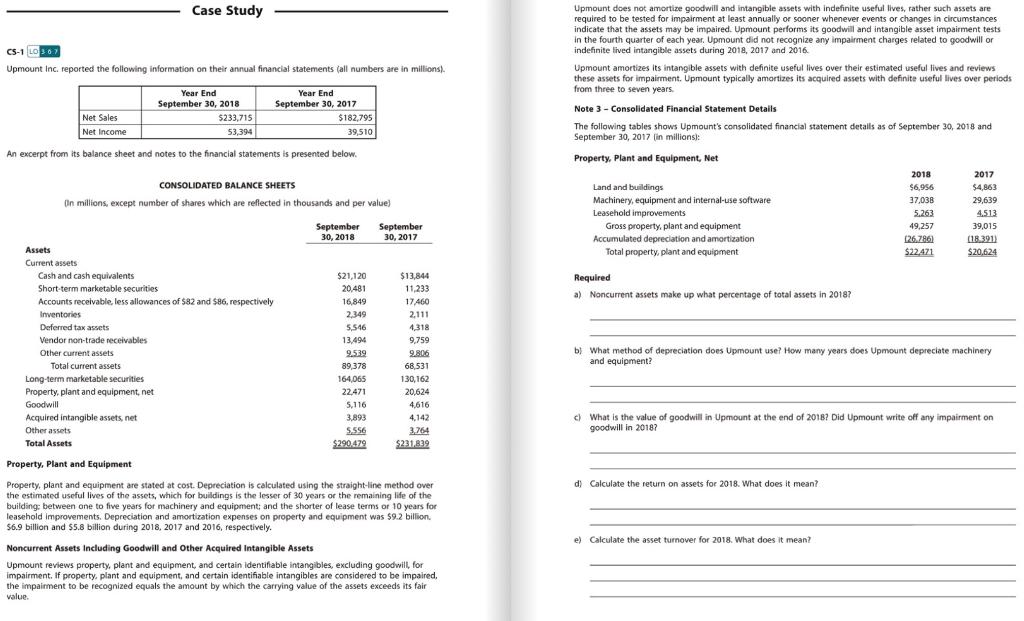

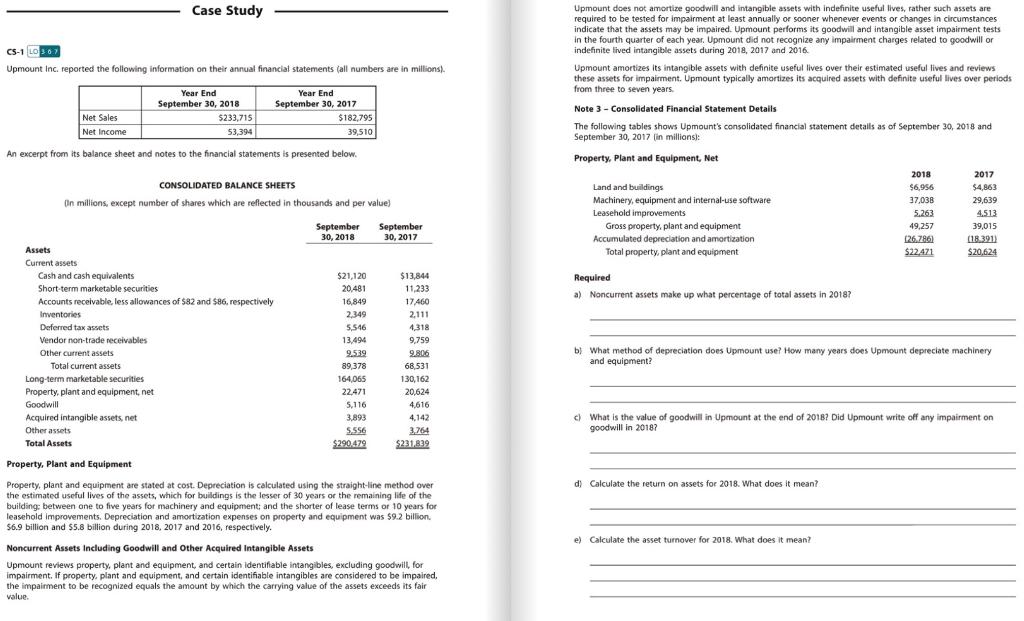

Case Study CS-110 307 Upmount Inc. reported the following information on their annual financial statements (all numbers are in millions). . Net Sales Net Income Year End September 30, 2018 5233,715 53.394 Year End September 30, 2017 $182,795 39,510 Upmount does not amortize goodwill and intangible assets with indefinite useful lives, rather such assets are required to be tested for impairment at least annually or sooner whenever events or changes in circumstances indicate that the assets may be impaired. Upmount performs its goodwill and intangible asset impairment tests In the fourth quarter of each year. Upmount did not recognize any impairment charges related to goodwill or indefinite lived intangible assets during 2018, 2017 and 2016 Upmount amortizes its intangible assets with definite useful lives over their estimated useful lives and reviews these assets for impairment. Upmount typically amortizes its acquired assets with definite useful lives over periods from three to seven years. Note 3 - Consolidated Financial Statement Details The following tables shows Upmount's consolidated financial statement details as of September 30, 2018 and September 30, 2017 fin millions): Property, plant and Equipment, Net 2018 2017 Land and buildings $6,956 $4,863 Machinery, equipment and internal-use software 37,038 29,639 Leasehold improvements 5.263 4.513 Gross property, plant and equipment 49.257 39,015 Accumulated depreciation and amortization 126,786) (18.3911 Total property, plant and equipment $22.421 $20.624 An excerpt from its balance sheet and notes to the financial statements is presented below. CONSOLIDATED BALANCE SHEETS On millions, except number of shares which are reflected in thousands and per value) September 30, 2018 September 30, 2017 Required a) Noncurrent assets make up what percentage of total assets in 2018? Assets Current assets Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $82 and $86, respectively Inventories Deferred tax assets Vendor non-trade receivables Other current assets Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other assets Total Assets $21,120 20,481 16,849 2349 5,516 13,4944 9.539 89,378 164,065 22,471 5,116 3,893 5.556 $290.478 $13,844 11.233 17460 2.111 4,318 9,759 9.806 68,531 130,162 20,624 4,616 4.142 3.764 $231.832 b) What method of depreciation does Upmount use? How many years does Upmount depreciate machinery and equipment? c) What is the value of goodwill in Upmount at the end of 2018? Did Upmount write off any impairment on goodwill In 2018? Property, Plant and Equipment d) Calculate the return on assets for 2018. What does it mean? Property, plant and equipment are stated at cost. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets, which for buildings is the lesser of 30 years or the remaining life of the building: between one to five years for machinery and equipment and the shorter of lease terms or 10 years for leasehold improvements. Depreciation and amortization expenses on property and equipment was $9.2 billion. 56.9 billion and 55.8 billion during 2018, 2017 and 2016, respectively. e) Calculate the asset turnover for 2018. What does it mean? Noncurrent Assets Including Goodwill and Other Acquired Intangible Assets Upmount reviews property, plant and equipment, and certain identifiable intangibles, excluding goodwill, for impairment. If property, plant and equipment, and certain identifiable intangibles are considered to be impaired. the impairment to be recognized equals the amount by which the carrying value of the assets exceeds its fair value