Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study Cultural PART II Although Gray's model relates cultural values to the accounting value of conservatism as it is embodied in a country's financial

Case Study

Cultural

PART II

Although Gray's model relates cultural values to the accounting value of conservatism as it is embodied in a country's financial reporting rules, it can be argued that the model is equally applicable to the way a country's accountants apply those rules:

Accountant's

Application of Financial

Reporting Rules

Required:

Discuss the implications this argument has for the comparability of financial statements across countries, even in an environment of substantial international accounting convergence. Identify areas in which differences in cultural dimensions across countries could lead to differences in the application of financial reporting rules.

PART III

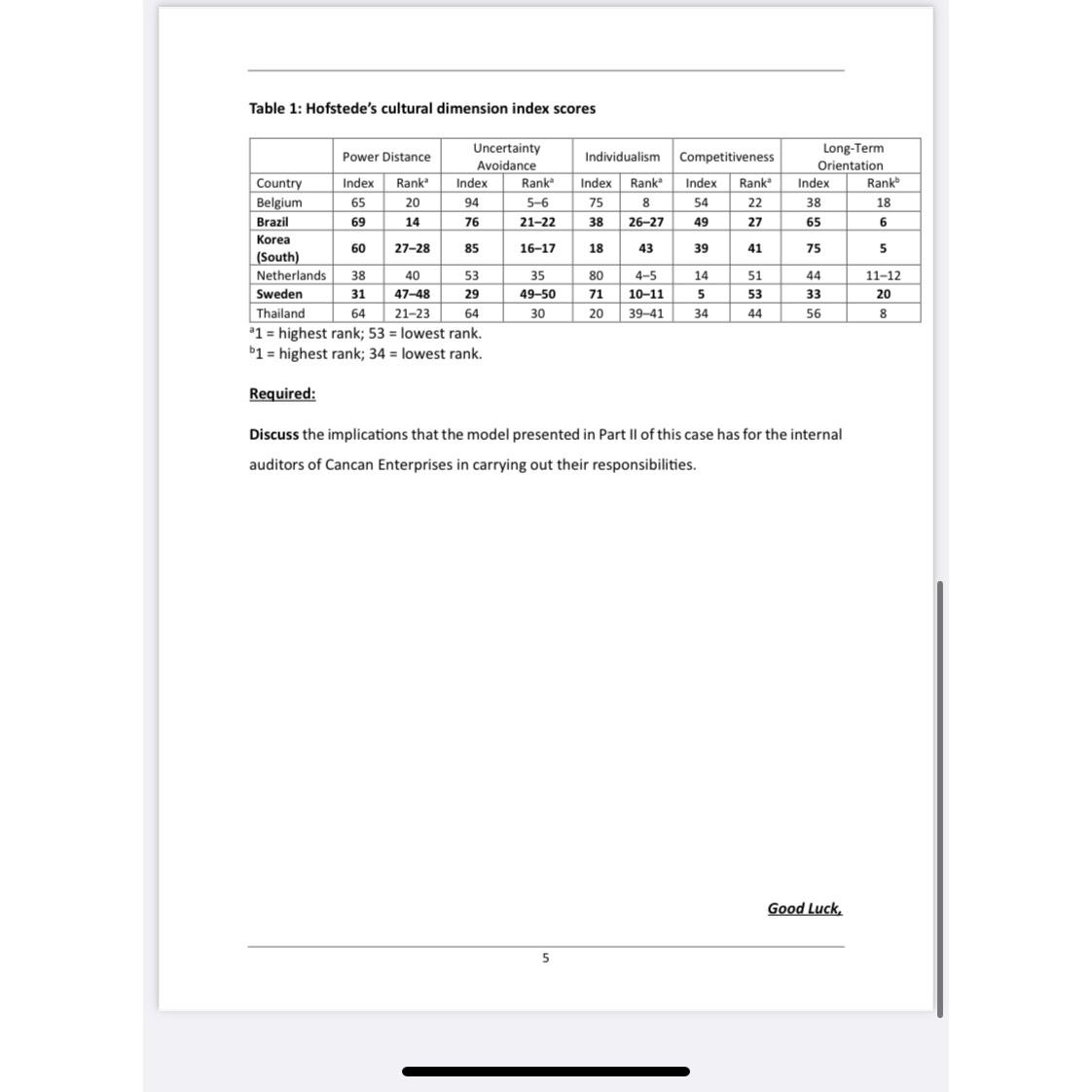

Cancan Enterprises Inc. is a Canadianbased company with subsidiaries located in Brazil, Korea, and Sweden. Hofstedes cultural dimension index scores for these countries are presented in Table Cancan Enterprises must apply IFRS worldwide in preparing consolidated financial statements. Cancan has developed a corporate accounting manual that prescribes the accounting policies based on IFRS that are to be applied by all the company's operations. Each year, Cancan's internal auditors have the responsibility of ensuring that the company's accounting policies have been applied consistently companywide.

Table : Hofstede's cultural dimension index scores

tableCountryPower Distance,tableUncertaintyAvoidanceIndividualism,Competitiveness,tableLongTermOrientationIndexRank,Index,Rank Index,Rank Index,Rank Index,Rank

International Accounting

The Impact of Culture Diversity on Conservatism

PART I

The framework created by Sidney Gray in to explain the development of a country's accounting system is presented in Exhibit presented as follows:

Exhibit :

Source: Adapted from S J Gny "Towands a Theory of Culneral Influence on the Development of Accounting Systens

Internationally, "Abacse, Morch I PeR,

Gray theorized that culture has an impact on a country's accounting system through its influence on accounting values. Focusing on that part of a country's accounting system comprised of financial reporting rules and practices, the model can be visualized as follows:

In short, cultural values shared by members of a society influence the accounting values shared by members of the accounting subculture. The shared values of the accounting subculture in turn affect the financial reporting rules and practices found within a country.

With respect to the accounting value of conservatism, Gray hypothesized that the higher a country ranks on the cultural dimensions of uncertainty avoidance and longterm orientation, and the lower it ranks in terms of individualism and competitiveness, then the more likely it is to rank highly in terms of conservatism. Conservatism is a preference for a cautious approach to measurement.

Conservatism is manifested in a country's accounting system through a tendency to defer recognition of assets and items that increase net income and a tendency to accelerate the recognition of liabilities and items that decrease net income. One example of conservatism in practice would be a rule that requires an unrealized contingent liability to be recognized when it is probable that an outflow of future resources will arise but that does not allow the recognition of an unrealized contingent asset under any circumstances.

Required:

Discuss the implications for the global convergence of financial reporting standards raised by Gray's model.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started