Answered step by step

Verified Expert Solution

Question

1 Approved Answer

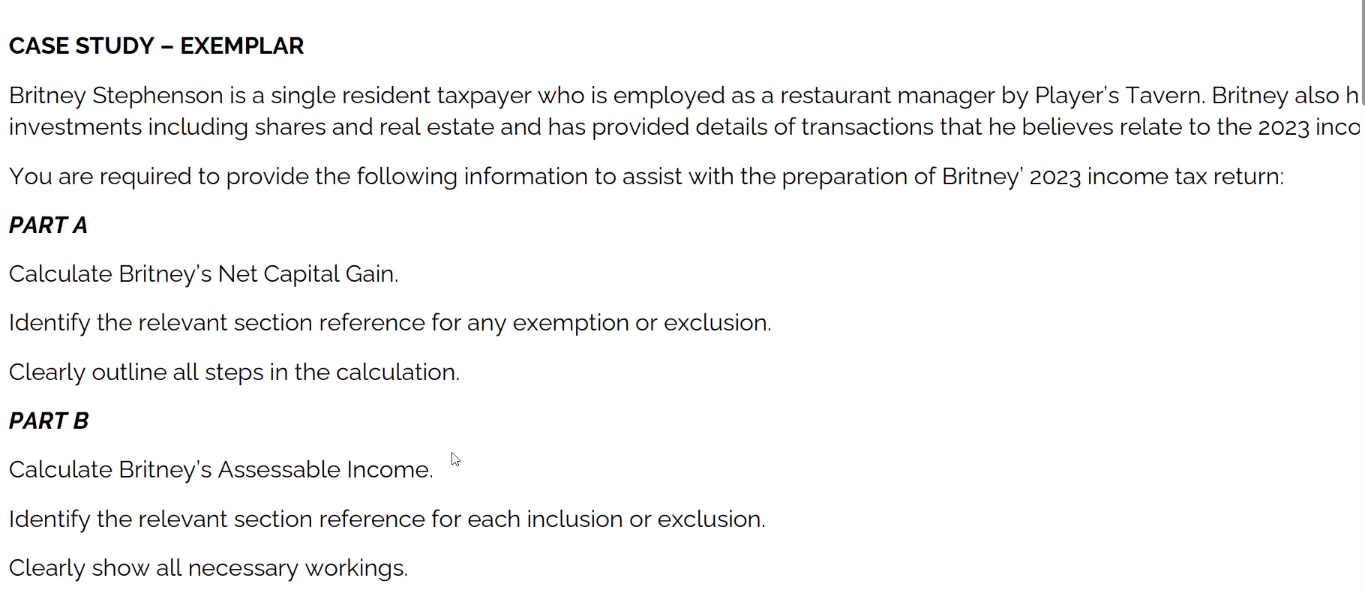

CASE STUDY - EXEMPLAR Britney Stephenson is a single resident taxpayer who is employed as a restaurant manager by Player's Tavern. Britney also h

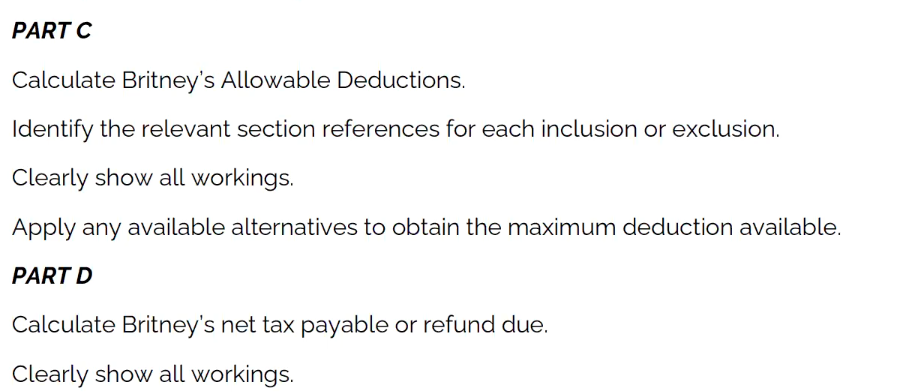

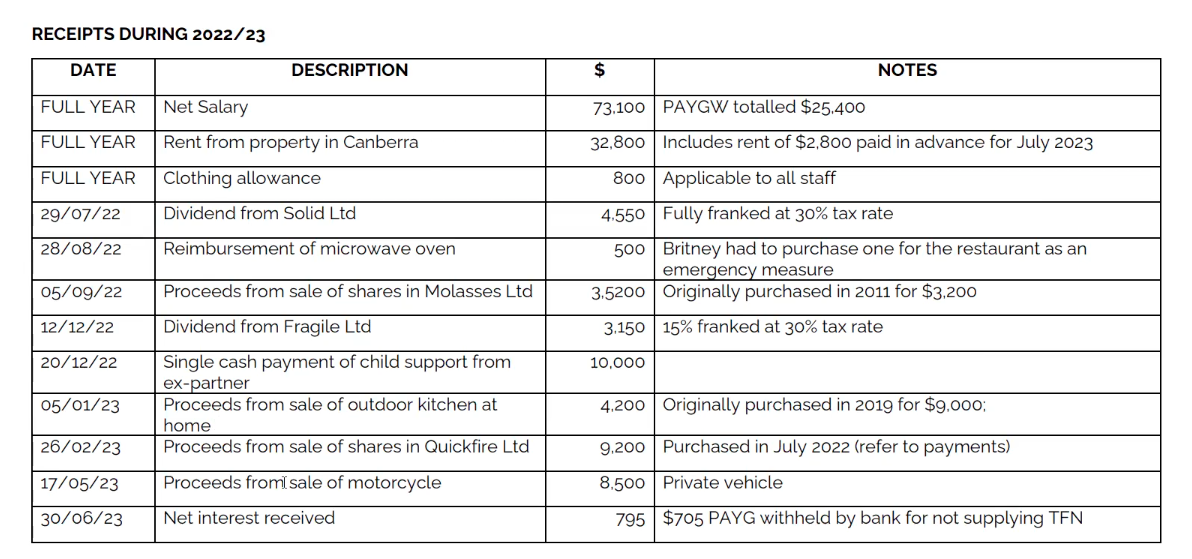

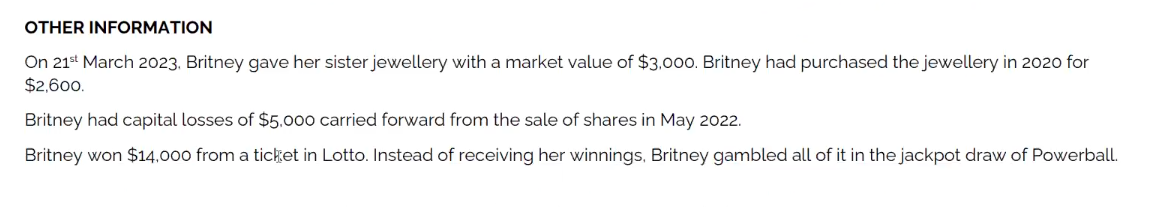

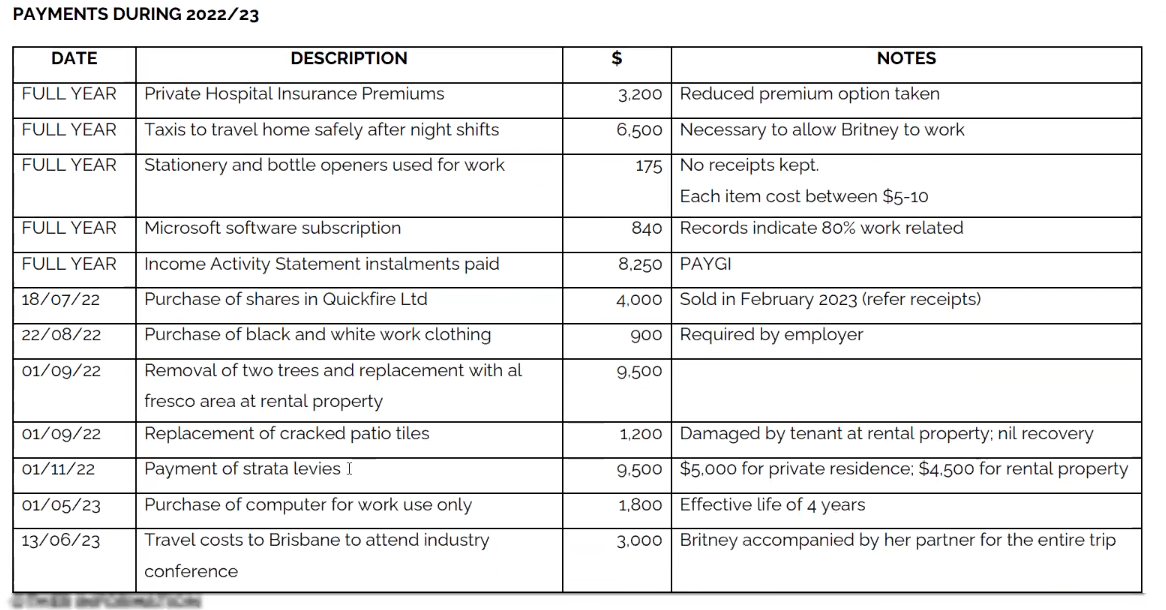

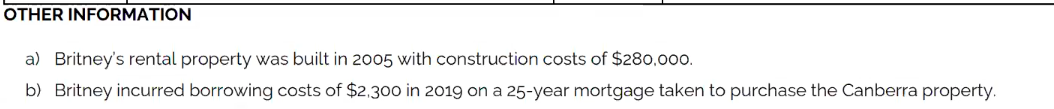

CASE STUDY - EXEMPLAR Britney Stephenson is a single resident taxpayer who is employed as a restaurant manager by Player's Tavern. Britney also h investments including shares and real estate and has provided details of transactions that he believes relate to the 2023 inco You are required to provide the following information to assist with the preparation of Britney' 2023 income tax return: PART A Calculate Britney's Net Capital Gain. Identify the relevant section reference for any exemption or exclusion. Clearly outline all steps in the calculation. PART B Calculate Britney's Assessable Income. W Identify the relevant section reference for each inclusion or exclusion. Clearly show all necessary workings. PART C Calculate Britney's Allowable Deductions. Identify the relevant section references for each inclusion or exclusion. Clearly show all workings. Apply any available alternatives to obtain the maximum deduction available. PART D Calculate Britney's net tax payable or refund due. Clearly show all workings. RECEIPTS DURING 2022/23 Rent from property in Canberra DATE DESCRIPTION FULL YEAR Net Salary FULL YEAR FULL YEAR Clothing allowance 29/07/22 28/08/22 Dividend from Solid Ltd Reimbursement of microwave oven 05/09/22 12/12/22 Proceeds from sale of shares in Molasses Ltd Dividend from Fragile Ltd 20/12/22 05/01/23 26/02/23 17/05/23 30/06/23 Single cash payment of child support from ex-partner Proceeds from sale of outdoor kitchen at home Proceeds from sale of shares in Quickfire Ltd Proceeds from sale of motorcycle Net interest received $ 73.100 PAYGW totalled $25.400 NOTES 32,800 Includes rent of $2,800 paid in advance for July 2023 800 Applicable to all staff 4.550 Fully franked at 30% tax rate 500 Britney had to purchase one for the restaurant as an emergency measure 3.5200 Originally purchased in 2011 for $3,200 3.150 15% franked at 30% tax rate 10,000 4.200 Originally purchased in 2019 for $9,000; 9.200 Purchased in July 2022 (refer to payments) 8.500 Private vehicle 795 $705 PAYG withheld by bank for not supplying TFN OTHER INFORMATION On 21st March 2023. Britney gave her sister jewellery with a market value of $3,000. Britney had purchased the jewellery in 2020 for $2,600. Britney had capital losses of $5,000 carried forward from the sale of shares in May 2022. Britney won $14,000 from a ticket in Lotto. Instead of receiving her winnings, Britney gambled all of it in the jackpot draw of Powerball. PAYMENTS DURING 2022/23 DATE DESCRIPTION $ NOTES FULL YEAR Private Hospital Insurance Premiums Taxis to travel home safely after night shifts Stationery and bottle openers used for work FULL YEAR FULL YEAR FULL YEAR FULL YEAR 18/07/22 22/08/22 01/09/22 01/09/22 01/11/22 01/05/23 13/06/23 Microsoft software subscription Income Activity Statement instalments paid Purchase of shares in Quickfire Ltd Purchase of black and white work clothing Removal of two trees and replacement with al fresco area at rental property Replacement of cracked patio tiles Payment of strata levies I Purchase of computer for work use only Travel costs to Brisbane to attend industry conference 3.200 Reduced premium option taken 6.500 Necessary to allow Britney to work 175 No receipts kept. Each item cost between $5-10 840 Records indicate 80% work related 8,250 PAYGI 4,000 Sold in February 2023 (refer receipts) goo Required by employer 9.500 1,200 Damaged by tenant at rental property; nil recovery 9.500 $5,000 for private residence; $4.500 for rental property 1,800 Effective life of 4 years 3.000 Britney accompanied by her partner for the entire trip OTHER INFORMATION a) Britney's rental property was built in 2005 with construction costs of $280,000. b) Britney incurred borrowing costs of $2,300 in 2019 on a 25-year mortgage taken to purchase the Canberra property.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started