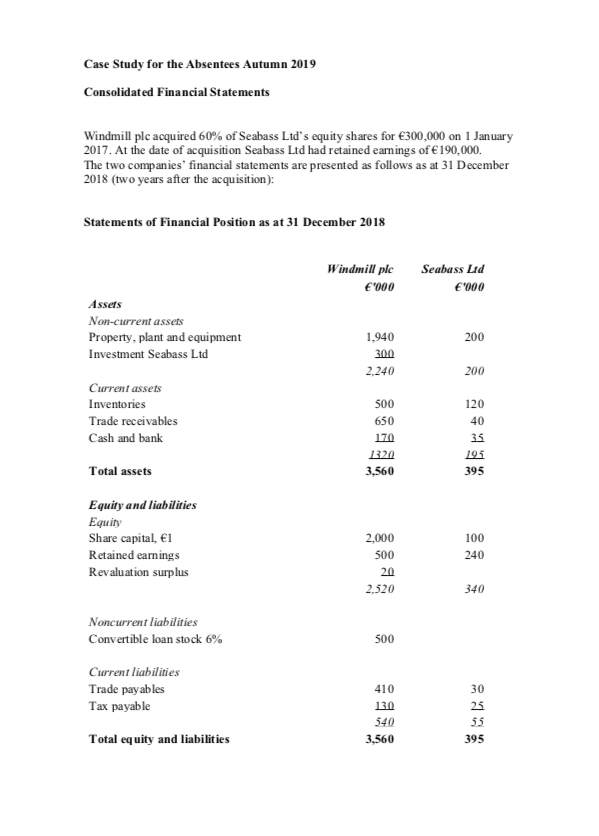

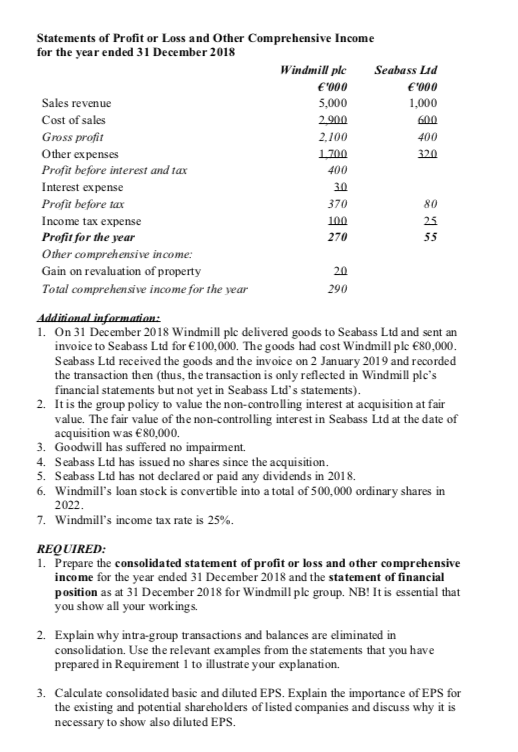

Case Study for the Absentees Autumn 2019 Consolidated Financial Statements Windmill plc acquired 60% of Seabass Ltd's equity shares for 300,000 on 1 January 2017. At the date of acquisition Seabass Ltd had retained eamings of190,000. The two companies financial statements are presented as follows as at 31 December 2018 (two years after the acquisition): Statements of Financial Position as at 31 December 2018 Windmill plc Seabass Ltd 00 e000 Assets Non-current assets Property, plant and equipment 1,940 200 Investment Seabass Ltd 300 200 2,240 Current assets Inventories 500 120 Trade receivables 650 40 Cash and bank 170 35 320 195 Total assets 3,560 395 Equity and liabilities Equity Share capital, 2,000 100 Retained earmings 500 240 Revaluation surplus 20 2,520 340 Noncurrent liabilities Convertible loan stock 6% 500 Current liabilities Trade pay ables 30 410 x ayable 130 25 540 55 Total equity and liabilities 395 3,560 Statements of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2018 Windmill ple Seabass Lid '000 E'000 Sales revenue 5,000 1,000 Cost of sales 2,900 600 Gross profit 2.100 400 Other expenses 1200 320 Profit before interest and tax 400 Interest expense 30 Profit before tax 370 80 100 Income tax expense 25 Profit for the year Other comprehensive income Gain on revaluation of property 55 270 20 Total comprehensive income for the year 290 Addinional informatian 1. On 31 December 2018 Windmill plc delivered goods to Seabass Ltd and sent an invoice to Seabass Ltd for 100,000. The goods had cost Win dmill plc 80,000. Seabass Ltd received the goods and the invoice on 2 January 2019 and recorded the transaction then (thus, the transaction is only reflected in Windmill plc's financial statements but not yet in Seabass Ltd's statements). 2. Itis the group policy to value the non-contro lling interest at acquisition at fair value. The fair value of the non-controlling interest in Seabass Ltd at the date of acquisition was 80,000. 3. Goodwill has suffered no impairment 4. Seabass Ltd has issued no shares since the acquisition 5. Seabass Ltd has not declared or paid any dividends in 201 8. 6. Windmill's loan stock is convertible into a total of 500,000 ordinary shares in 2022 7. Windmill's income tax rate is 25% REQUIRED 1. Prepare the consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2018 and the statement of financial position as at 31 Dec ember 2018 for Windmill plc group. NB! It is essential that you show all your workings 2. Explain why intra-group transactions and balances are eliminated in consolidation. Use the relevant examples from the statements that you have prepared in Requirement 1 to illustrate your explanation 3. Calculate consolidated basic and diluted EPS. Explain the importance of EPS for the existing and potential shareholders of listed companies and discuss why it is necessary to show also diluted EPS