Question

Case Study : Foreign Exchange Goodluck Corporation, a US company, manufacturing and markets office operating systems. Based on predictions of rapid economic growth in South

Case Study : Foreign Exchange

Goodluck Corporation, a US company, manufacturing and markets office operating systems. Based on predictions of rapid economic growth in South America during the next decade, Goodluck plans to establish a wholly owned subsidiary in Colombia as of January 1, year 8, to manufacture and market office operating systems in that country. It will import from Goodluck a portion of the electronic software needed for the systems. Assembly will take place in Colombia.

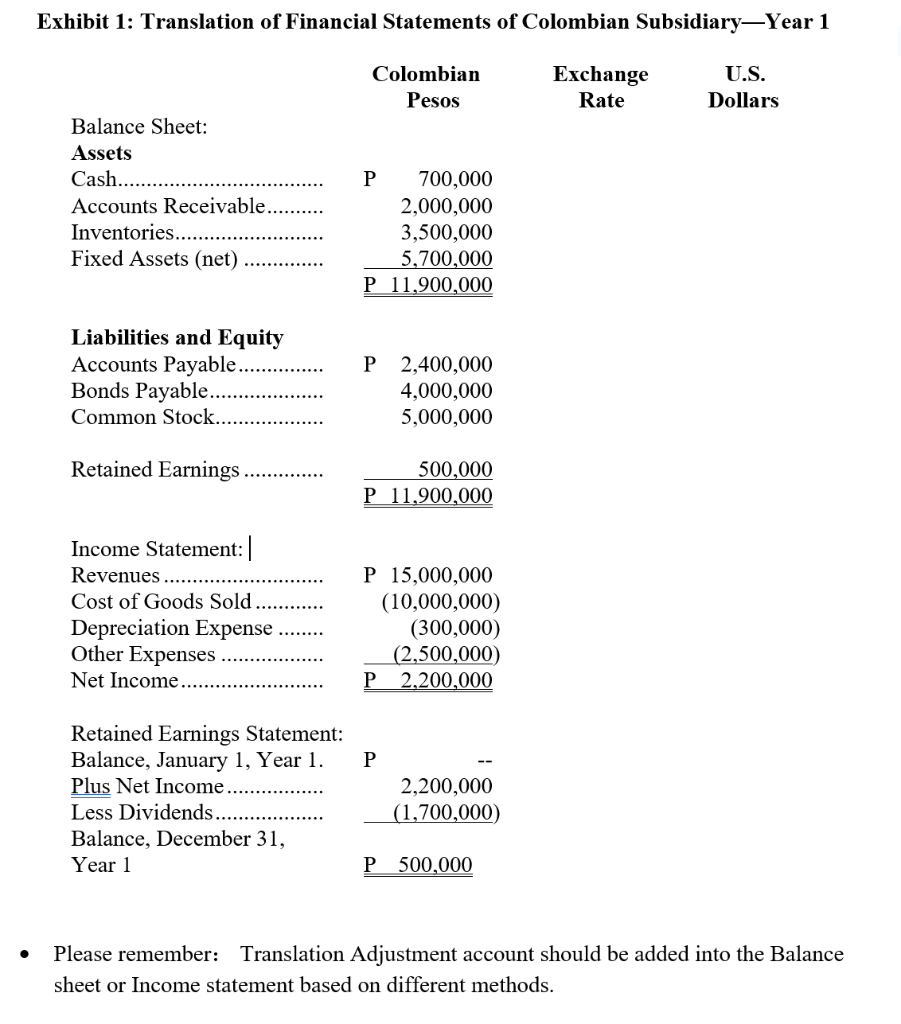

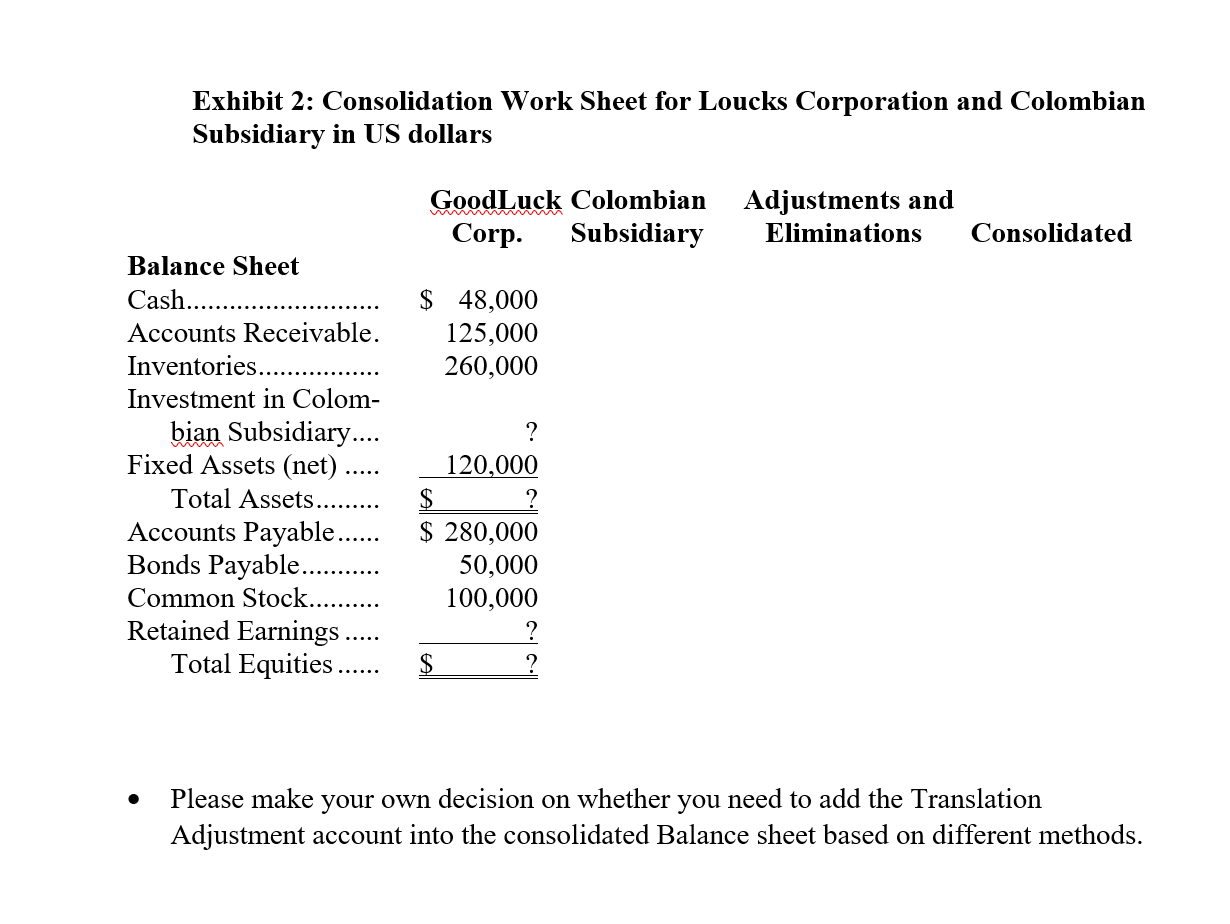

Goodluck plans to contribute $100,000 to establish the subsidiary on January 1, Year 8. The exchange rate between the Colombian and the U.S dollar is expected to be $0.02:P1 on this date. Exhibit 1 presents pro forma financial statements for Year 8 for the Colombian subsidiary during its first year of operation. Exhibit 2 presents a partial pro forma consolidation balance sheet worksheet for Goodluck and its Colombian subsidiary for Year 8. The Colombian subsidiary expects to sell all office operating system by the end of Year 8 in Colombian pesos.

REQUIRED:

a: Discuss whether Goodluck should use the U.S. dollar or the Colombian Peso as the functional currency for its Colombian subsidiary, and why? (3 Marks)

b: Goodluck expects the exchange rate between the U.S. dollar and the Colombian peso to change as follow during Year 8:

| Jan 1, Year8 | $0.02: P1 |

| Average, Year 8 | $0.018: P1 |

| December 31, Year 8 | $0.015: P1 |

Complete Exhibit 1, showing the translation of the subsidiarys accounts into U.S. dollars based on the current method, and assuming that the Colombian peso is the functional currency. Using the translated amounts, complete the consolidation worksheet in Exhibit 2.

(5 Marks)

c: Repeat Part b, based on the temporal method this time. (5 Marks)

d: Compute the net income to revenues ratio based on (1) amounts originally measured in Colombian pesos; (2) amounts measured in U.S. dollars from part b; (3) amounts measured in U.S. dollars from part c. why is the net income to revenues percentage the same under (1) and (2), but different under (3)? (3 Marks)

e: Outline the potential foreign exchange rate risk management strategy for Goodluck.

(4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started