Question

Case Study: Hedging Soymeal Price Risk for Feed Mills in Vietnam Industry Background Vietnam has a population of over 90 million people and consumes over

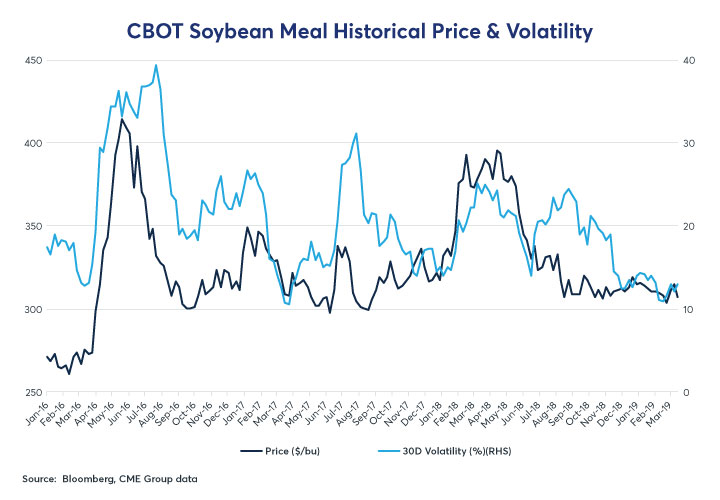

Case Study: Hedging Soymeal Price Risk for Feed Mills in Vietnam Industry Background Vietnam has a population of over 90 million people and consumes over 6 million metric tons (MT) of soymeal, mostly as animal feed for hogs, the most popular meat consumed in the country. Vietnam is one of the world's largest importers of soymeal, importing over 4.3 million MT2 in 2017, 85% of which was from Argentina and the rest mainly from the U.S. and Brazil. Soymeal production within Vietnam is small, and domestic demand is mostly met by imports. Numerous small- to medium-sized feed mills buy and import most of the soymeal. Risks Associated with Soymeal Imports Vietnam is the world's second biggest soymeal importer (after the EU-27 bloc); the three largest soymeal exporters are Argentina, Brazil and the U.S. The Sino-U.S. trade tariff disagreements that started in April 2018 have had an impact on the global soybean and soymeal trade resulting in the possibility for additional price volatility. Firms involved in importing soymeal into Vietnam may want to consider an active hedge program to guard against unforeseen price volatility

450 400 350 300 250 Jan-16 Feb-16 Mar-16 Apr-16 CBOT Soybean Meal Historical Price & Volatility May-16 Jun-16 Jul-16 Aug-16 Sep-16 Source: Bloomberg, CME Group data Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Price ($/bu) Jun-17 Jul-17 n Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 -30D Volatility (%)(RHS) Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 40 30 20 10

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

As a risk management consultant I would recommend that feed mills in Vietnam consider hedging their soymeal price risk to mitigate the impact of price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started