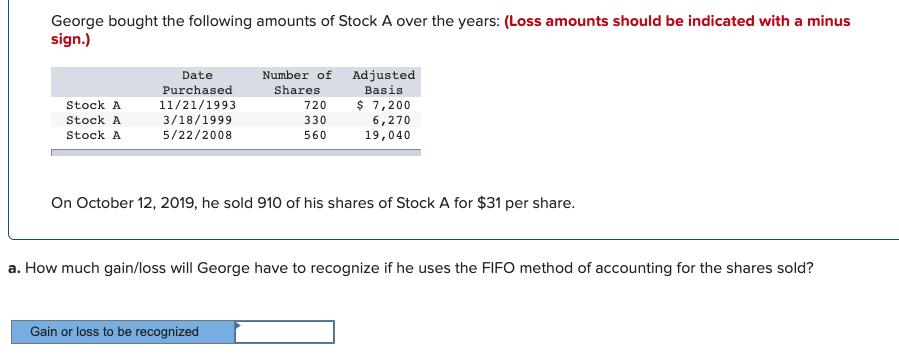

George bought the following amounts of Stock A over the years: (Loss amounts should be indicated with a minus sign.) Number of Adjusted Basis

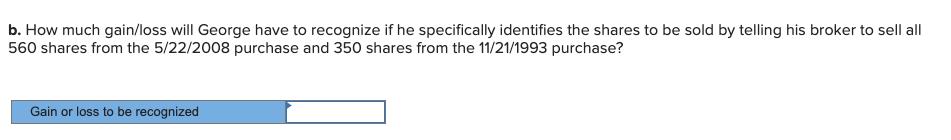

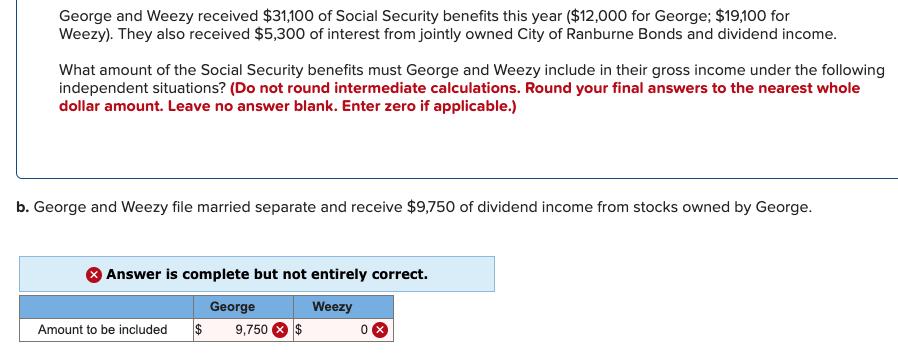

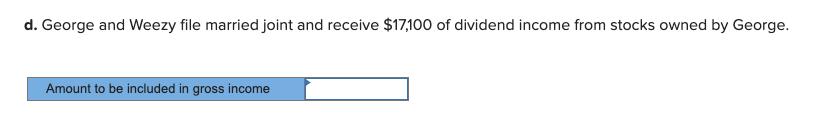

George bought the following amounts of Stock A over the years: (Loss amounts should be indicated with a minus sign.) Number of Adjusted Basis $ 7,200 6,270 Date Purchased Shares Stock A 11/21/1993 3/18/1999 720 Stock A 330 Stock A 5/22/2008 560 19,040 On October 12, 2019, he sold 910 of his shares of Stock A for $31 per share. a. How much gain/loss will George have to recognize if he uses the FIFO method of accounting for the shares sold? Gain or loss to be recognized b. How much gain/loss will George have to recognize if he specifically identifies the shares to be sold by telling his broker to sell all 560 shares from the 5/22/2008 purchase and 350 shares from the 11/21/1993 purchase? Gain or loss to be recognized George and Weezy received $31,100 of Social Security benefits this year ($12,000 for George; $19,100 for Weezy). They also received $5,300 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Weezy include in their gross income under the following independent situations? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) b. George and Weezy file married separate and receive $9,750 of dividend income from stocks owned by George. Answer is complete but not entirely correct. George Weezy Amount to be included $ 9,750 d. George and Weezy file married joint and receive $17,100 of dividend income from stocks owned by George. Amount to be included in gross income

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Answer a Sale value of sold shares 910 shares 31 28210 Using FIFO method the cost of ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards