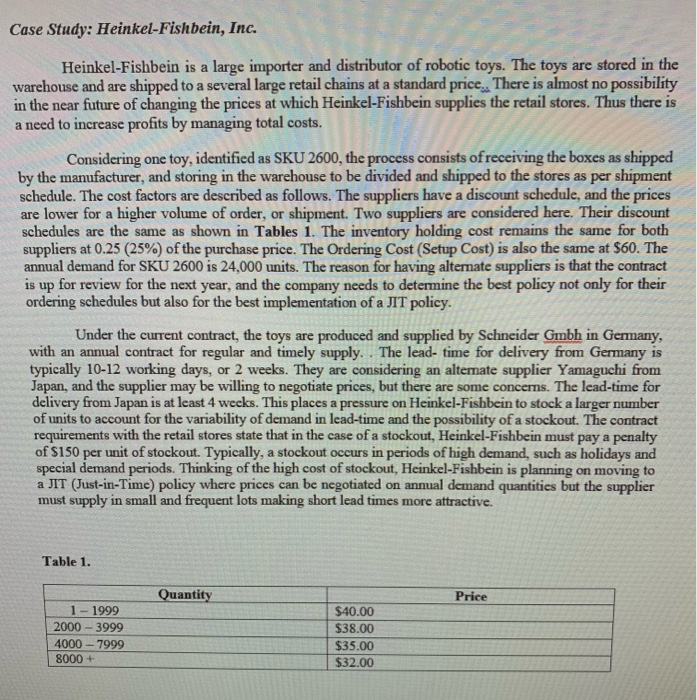

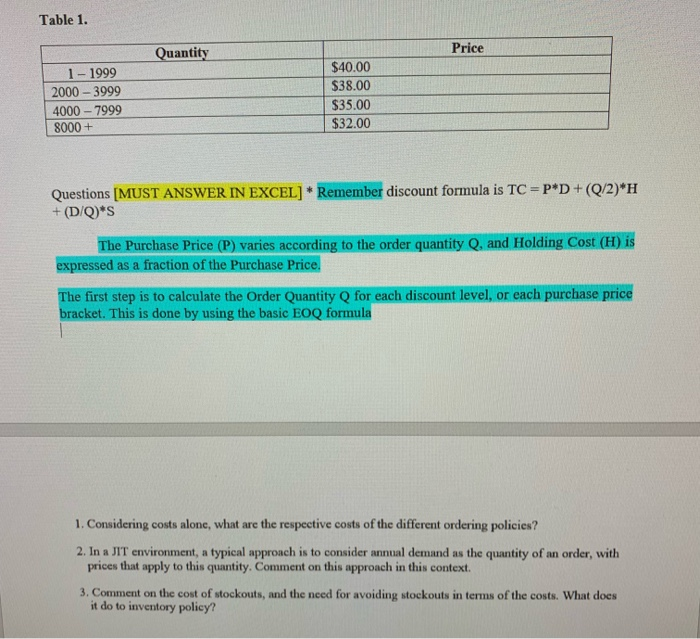

Case Study: Heinkel-Fishbein, Inc. Heinkel-Fishbein is a large importer and distributor of robotic toys. The toys are stored in the warehouse and are shipped to a several large retail chains at a standard price There is almost no possibility in the near future of changing the prices at which Heinkel-Fishbein supplies the retail stores. Thus there is a need to increase profits by managing total costs. Considering one toy, identified as SKU 2600, the process consists ofreceiving the boxes as shipped by the manufacturer, and storing in the warehouse to be divided and shipped to the stores as per shipment schedule. The cost factors are described as follows. The suppliers have a discount schedule, and the prices are lower for a higher volume of order, or shipment. Two suppliers are considered here. Their discount schedules are the same as shown in Tables 1. The inventory holding cost remains the same for both suppliers at 0.25 (25%) of the purchase price. The Ordering Cost (Setup Cost) is also the same at $60. The annual demand for SKU 2600 is 24,000 units. The reason for having alternate suppliers is that the contract is up for review for the next year, and the company needs to determine the best policy not only for their ordering schedules but also for the best implementation of a JIT policy Under the current contract, the toys are produced and supplied by Schneider Gmbh in Germany, with an annual contract for regular and timely supply. . The lead- time for delivery from Germany is typically 10-12 working days, or 2 weeks. They are considering an altemate supplier Yamaguchi from Japan, and the supplier may be willing to negotiate prices, but there are some concerns. The lead-time for delivery from Japan is at least 4 weeks. This places a pressure on Heinkel-Fishbein to stock a larger number of units to account for the variability of demand in lead-time and the possibility of a stockout. The contract requirements with the retail stores state that in the case of a stockout, Heinkel-Fishbein must pay a penalty of S150 per unit of stockout. Typically, a stockout occurs in periods of high demand, such as holidays and special demand periods. Thinking of the high cost of stockout, Heinkel-Fishbein is planning on moving to a JIT (Just-in-Time) policy where prices can be negotiated on annual demand quantities but the supplier must supply in small and frequent lots making short lead times more attractive. Table 1. Quantity Price 1-1999 $40.00 $38.00 2000-3999 -7999 $35.00 8000 + $32.00 Case Study: Heinkel-Fishbein, Inc. Heinkel-Fishbein is a large importer and distributor of robotic toys. The toys are stored in the warehouse and are shipped to a several large retail chains at a standard price There is almost no possibility in the near future of changing the prices at which Heinkel-Fishbein supplies the retail stores. Thus there is a need to increase profits by managing total costs. Considering one toy, identified as SKU 2600, the process consists ofreceiving the boxes as shipped by the manufacturer, and storing in the warehouse to be divided and shipped to the stores as per shipment schedule. The cost factors are described as follows. The suppliers have a discount schedule, and the prices are lower for a higher volume of order, or shipment. Two suppliers are considered here. Their discount schedules are the same as shown in Tables 1. The inventory holding cost remains the same for both suppliers at 0.25 (25%) of the purchase price. The Ordering Cost (Setup Cost) is also the same at $60. The annual demand for SKU 2600 is 24,000 units. The reason for having alternate suppliers is that the contract is up for review for the next year, and the company needs to determine the best policy not only for their ordering schedules but also for the best implementation of a JIT policy Under the current contract, the toys are produced and supplied by Schneider Gmbh in Germany, with an annual contract for regular and timely supply. . The lead- time for delivery from Germany is typically 10-12 working days, or 2 weeks. They are considering an altemate supplier Yamaguchi from Japan, and the supplier may be willing to negotiate prices, but there are some concerns. The lead-time for delivery from Japan is at least 4 weeks. This places a pressure on Heinkel-Fishbein to stock a larger number of units to account for the variability of demand in lead-time and the possibility of a stockout. The contract requirements with the retail stores state that in the case of a stockout, Heinkel-Fishbein must pay a penalty of S150 per unit of stockout. Typically, a stockout occurs in periods of high demand, such as holidays and special demand periods. Thinking of the high cost of stockout, Heinkel-Fishbein is planning on moving to a JIT (Just-in-Time) policy where prices can be negotiated on annual demand quantities but the supplier must supply in small and frequent lots making short lead times more attractive. Table 1. Quantity Price 1-1999 $40.00 $38.00 2000-3999 -7999 $35.00 8000 + $32.00