Question

CASE STUDY Hookey Inc., is a small company that manufactures and sells Hockey accessories in Texas. Malinda Shank, the founder of the company, is in

CASE STUDY

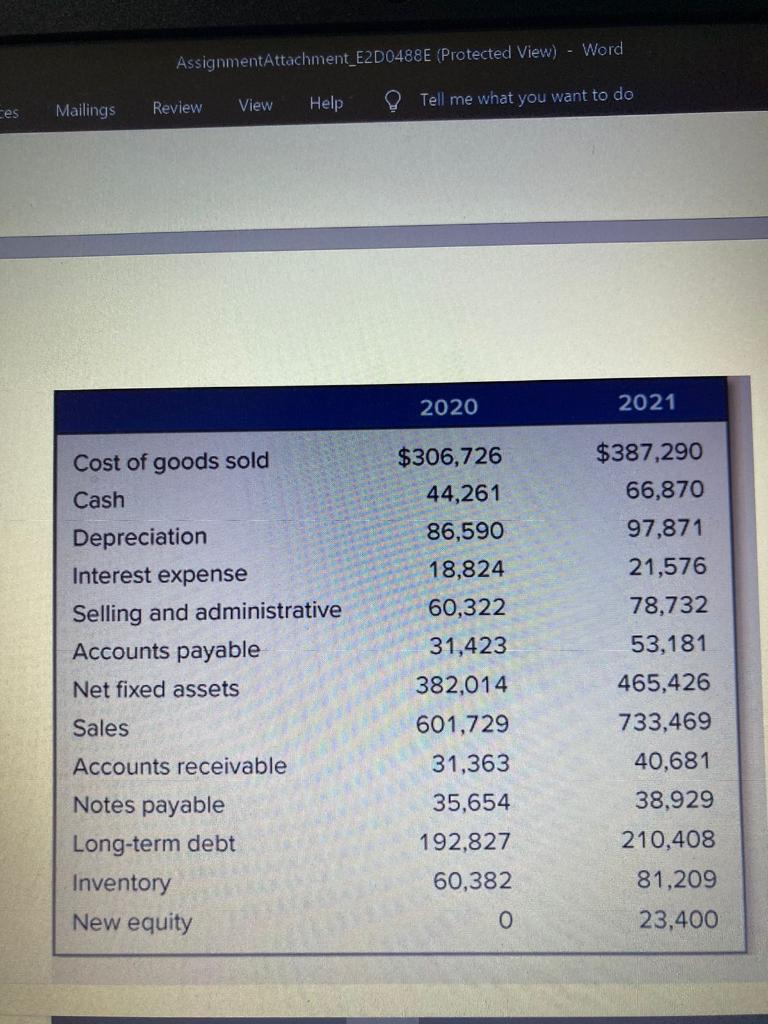

Hookey Inc., is a small company that manufactures and sells Hockey accessories in Texas. Malinda Shank, the founder of the company, is in charge of the design and sale of the Hockey accessories, but her background is in hockey as sport, not business. As a result, the companys financial records are not well maintained. The initial investment in Hookey Inc. was provided by Malinda and her friends and family. Because the initial investment was relatively small, and the company has made Hockey accessories only for its own store, the investors havent required detailed financial statements from Malinda. But thanks to word of mouth among professional hockey players, sales have picked up recently, and Malinda is considering a major expansion. Her plans include opening another Hockey accessories store in Oklahoma, as well as supplying his sticks to other sellers. Malindas expansion plans require a significant investment, which she plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Malinda has previously prepared. At the urging of her investors, she has hired financial analyst Michael Wang to evaluate the performance of the company over the past year. After rooting through old bank statements, sales receipts, tax returns, and other records, Wang has assembled the following information: Hookey Inc. currently pays out 40 percent of net income as dividends to Malinda and the other original investors, and it has a 21 percent tax rate. You are Wangs assistant, and he has asked you to prepare the following: 1. An income statement for 2020 and 2021. 2. A balance sheet for 2020 and 2021. 3. Operating cash flow for each year. 4. Cash flow from assets for 2021. 5. Cash flow to creditors for 2021. 6. Cash flow to stockholders for 2021.

Question1: How would you describe Hookey Inc.s cash flows for 2021? Write a brief discussion

Question2: In light of your discussion in the previous question, what do you think about Malindas expansion plans?

AssignmentAttachment_E2D0488E (Protected View) - Word ces Mailings Review View Help Tell me what you want to do 2020 2021 $387,290 66,870 $306,726 44,261 86,590 18,824 60,322 Cost of goods sold Cash Depreciation Interest expense Selling and administrative Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 97,871 21,576 78,732 53,181 465,426 31,423 733,469 382,014 601,729 31,363 35,654 40,681 38,929 192,827 210,408 60,382 81,209 o 23,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started