Answered step by step

Verified Expert Solution

Question

1 Approved Answer

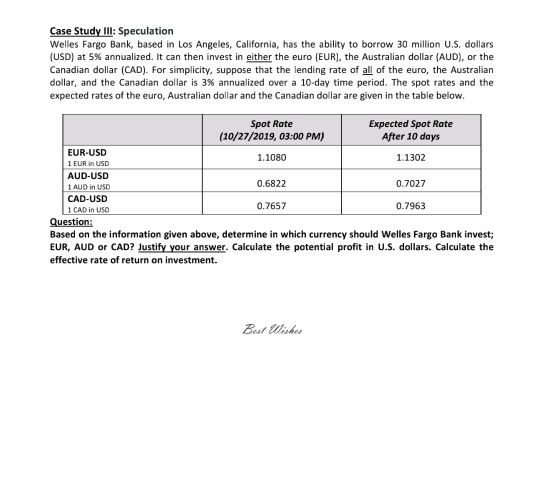

Case Study III: Speculation Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U.S. dollars (USD) at 5% annualized.

Case Study III: Speculation Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U.S. dollars (USD) at 5% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD), or the Canadian dollar (CAD). For simplicity, suppose that the lending rate of all of the euro, the Australian dollar, and the Canadian dollar is 3% annualized over a 10-day time period. The spot rates and the expected rates of the euro, Australian dollar and the Canadian dollar are given in the table below. Spot Rate Expected Spot Rate (10/27/2019, 03:00 PM) After 10 days EUR-USD 1.1080 1 EUR in USD 1.1302 AUD-USD 1 AUD in USD 0.6822 0.7027 CAD-USD 1 CAD in USO 0.7657 0.7963 Question: Based on the information given above, determine in which currency should Welles Fargo Bank invest; EUR, AUD Or CAD? Justify your answer. Calculate the potential profit in U.S. dollars. Calculate the effective rate of return on investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started