Case Study

Island View Tech Solutions and Quarter & Associates

Background

This case involves you, as a salesperson representing the institutional sales division of Island View Tech Solutions, a leading reseller of technology hardware and software, and Dalton Genge, Director of Technology for Quarter & Associates, a prominent St. Johns-based law firm specializing in corporate litigation. Quarter & Associates is preparing to move to larger facilities and wants to update its computer technology in the new facilities. Corner Brook-based Island View Tech Solutions has established itself as a major competitor in the technology marketplace specializing in value-added systems solutions for business institutions and government entities nationwide. This past year, Island View Tech Solutions has added sales and distribution centres in Burlington, Ontario; Halifax, Nova Scotia; and St. Johns, Newfoundland and Labrador.

Current Situation

As an integral part of their move to new and larger facilities, Quarter & Associates want to replace their computers and information technology systems including laptop/desktop combinations for each of their 21 attorneys, desktop systems for their 10 staff members, along with archive and e-mail servers. Island View Tech Solutions specializes in this type of systems selling and uses their network of hardware and software providers in combination with their own in-house engineering, programming, and systems group to consistently provide higher value solutions than the competition.

In preparation for an initial meeting with Dalton Genge, the Island View Tech Solutions sales representative is outlining their information needs and developing a draft set of needs discovery questions. These needs discovery questions will be the focus of the meeting with Dalton Genge, and enable Island View Tech Solutions to better identify and confirm the actual needs, desires, and expectations of Quarter & Associates in relation to new and expanded computer and information technology capabilities.

Questions

1. What information does the Island View Tech Solutionssalesperson need to fully understand the technology needs of Quarter & Associates?

2. Following the ADAPT methodology for needs discovery questioning, develop a series of salesperson questions and anticipated buyer responses that might apply to this selling situation.

Role Play

Situation: Review the above Island View Tech SolutionsQuarter & Associates case and the ADAPT questions you developed in response to the questions associated with this case.

Characters: Yourself, salesperson for Island View Tech Solutions; Dalton Genge, Director of Technology for Quarter & Associates.

Scene:

LocationDalton Genges office at Quarter & Associates.

ActionAs a salesperson for Island View Tech Solutions, you are making an initial sales call to Dalton Genge for the purpose of identifying and detailing the specific needs and expectations Quarter & Associates has for new and expanded computers and information technology. Role play this needs discovery sales call and demonstrate how you might use SPIN or ADAPT questioning sequences to identify the technology needs.

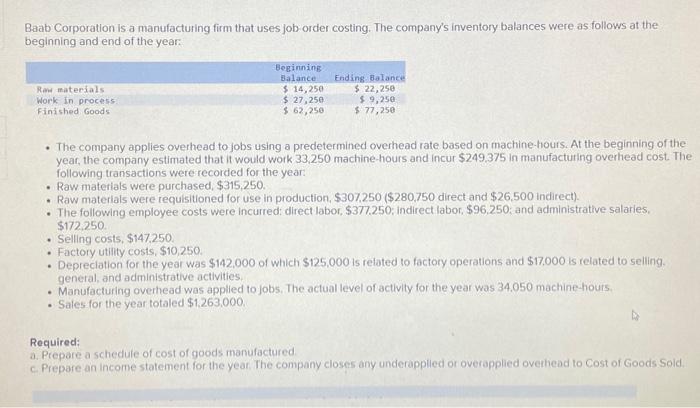

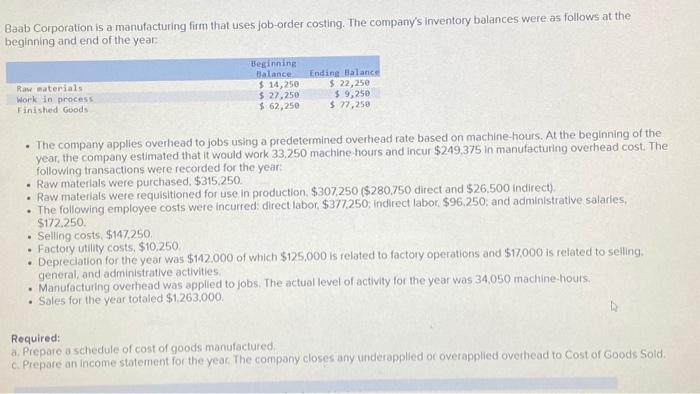

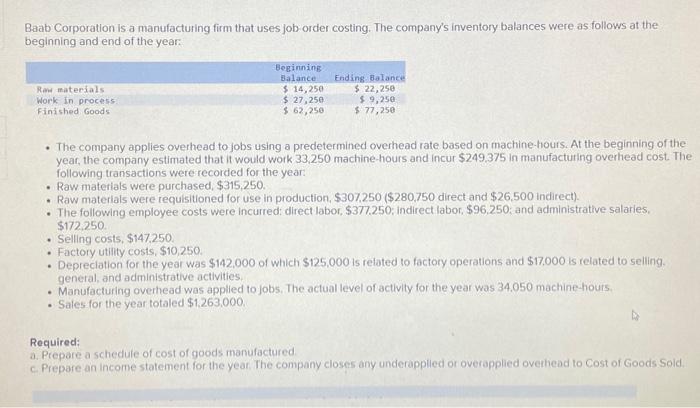

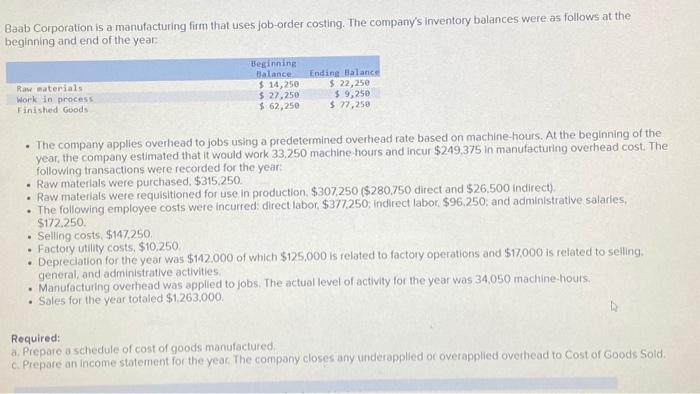

Baab Corporation is a manufacturing firm that uses job order costing. The company's inventory balances were as follows at the beginning and end of the year: - The company applies overhead to jobs using a predetermined overhead rate based on machine-hours, At the beginning of the year, the company estimated that it would work 33,250 machine-hours and incur $249,375 in manufacturing overhead cost. The following transactions were recorded for the year: - Raw materials were purchased, $315,250. - Raw materials were requisitioned for use in production, $307,250 ( $280,750 direct and $26,500 indirect). - The following employee costs were incurredi direct labor, $377.250; indirect labor, $96.250; and administrative salaries, $172,250 - Selling costs, $147,250. - Factory utility costs, $10,250. - Depreciation for the year was $142,000 of which $125,000 is related to factory operations and $17,000 is related to selling. general, and administrative activities. - Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34.050 machine hours. - Sales for the year totaled $1,263,000 Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year: - The company applles overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,250 machine hours and incur $249,375 in manufacturing overhead cost. The following transactions were recorded for the year: - Raw materials were purchased, $315,250. - Raw materials were requisitioned for use in production, $307,250 ( $280,750 direct and $26,500 indirect) - The following employee costs were incurred: direct labor, $377,250; indirect labor, $96,250; and administrative salaries, $172.250. - Selling costs, $147,250 - Factory utility costs, $10,250 - Depreciation for the year was $142,000 of which $125,000 is related to factory operations and $17,000 is related to selling. general, and administrative activities. - Manufacturing overhead was appiled to jobs. The actual level of activity for the year was 34,050 machine-hours. - Sales for the year totaled \$1,263,000. Required: a. Prepare a schedule of cost of goods manufoctured. Pienare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold. Baab Corporation is a manufacturing firm that uses job order costing. The company's inventory balances were as follows at the beginning and end of the year: - The company applies overhead to jobs using a predetermined overhead rate based on machine-hours, At the beginning of the year, the company estimated that it would work 33,250 machine-hours and incur $249,375 in manufacturing overhead cost. The following transactions were recorded for the year: - Raw materials were purchased, $315,250. - Raw materials were requisitioned for use in production, $307,250 ( $280,750 direct and $26,500 indirect). - The following employee costs were incurredi direct labor, $377.250; indirect labor, $96.250; and administrative salaries, $172,250 - Selling costs, $147,250. - Factory utility costs, $10,250. - Depreciation for the year was $142,000 of which $125,000 is related to factory operations and $17,000 is related to selling. general, and administrative activities. - Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34.050 machine hours. - Sales for the year totaled $1,263,000 Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year: - The company applles overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,250 machine hours and incur $249,375 in manufacturing overhead cost. The following transactions were recorded for the year: - Raw materials were purchased, $315,250. - Raw materials were requisitioned for use in production, $307,250 ( $280,750 direct and $26,500 indirect) - The following employee costs were incurred: direct labor, $377,250; indirect labor, $96,250; and administrative salaries, $172.250. - Selling costs, $147,250 - Factory utility costs, $10,250 - Depreciation for the year was $142,000 of which $125,000 is related to factory operations and $17,000 is related to selling. general, and administrative activities. - Manufacturing overhead was appiled to jobs. The actual level of activity for the year was 34,050 machine-hours. - Sales for the year totaled \$1,263,000. Required: a. Prepare a schedule of cost of goods manufoctured. Pienare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold