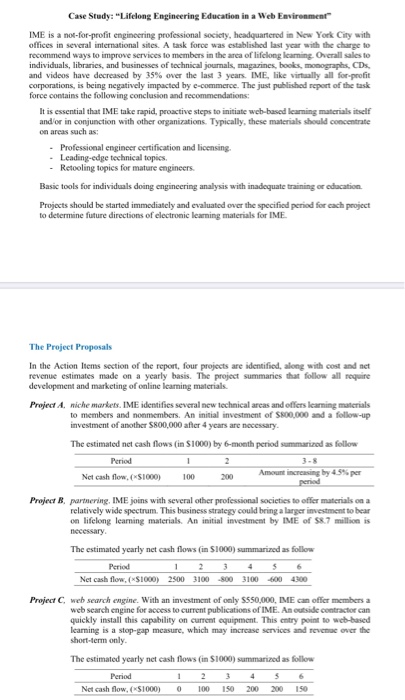

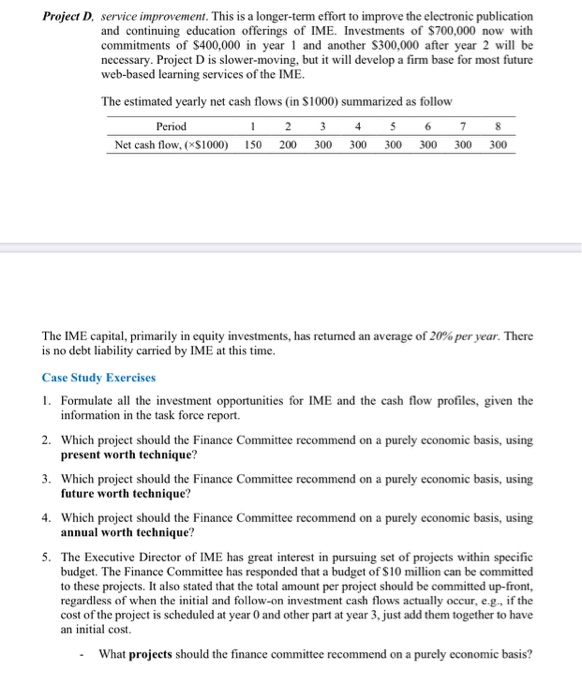

Case Study: "Lifelong Engineering Education in a Web Environment IME is a not-for-profit engineering professional society, headquartered in New York City with offices in several international sites. A task force was established last year with the charge to recommend ways to improve services to members in the area of lifelong leaming. Overall sales to individuals, libraries, and businesses of technical journals, magazines, books, monographs, CDs, and videos have decreased by 35% over the last 3 years. IME, like virtually all for profit corporations, is being negatively impacted by e-commerce. The just published report of the task force contains the following conclusion and recommendations: It is essential that IME take rapid, proactive steps to initiate web-based learning materials itself and or in conjunction with other organizations. Typically, these materials should concentrate on areas such as: - Professional engineer certification and licensing. Leading-edge technical topics - Retooling topics for mature engineers Basic tools for individuals doing engineering analysis with inadequate training or education Projects should be started immediately and evaluated over the specified period for each project to determine future directions of electronic learning materials for IME The Project Proposals In the Action Items section of the report, four projects are identified, along with cost and net revenue estimates made on a yearly basis. The project summaries that follow all require development and marketing of online learning materials Project 4. niche markets. IME identifies several new technical areas and offers learning materials to members and nonmembers. An initial investment of $800,000 and a follow-up investment of another S800.000 after 4 years are necessary. The estimated net cash flows (in S1000) by 6-month period summarized as follow Period Net cash flow. (XS1000) 100 Amount increasing by 45% per Project B partnering. IME joins with several other professional societies to offer materials on a relatively wide spectrum. This business strategy could bring a larger investment to bear on lifelong learning materials. An initial investment by IME of $87 million is necessary The estimated yearly net cash flows (in $1000) summarized as follow Period 1 2 3 4 5 6 Net cash flow. (S1000) 2500 3100 300 3100 -600 4300 Project Cweb search engine. With an investment of only 5550,000, IME can offer members a web search engine for access to current publications of IME. An outside contractor can quickly install this capability on current equipment. This entry point to web-based learning is a stop-gap measure, which may increase services and revenue over the short-term only The estimated yearly net cash flows (in S1000) summarized as follow Period 1 2 3 4 5 6 Net cash flow. (51000) 0 100 150 200 200 150 Project D, service improvement. This is a longer-term effort to improve the electronic publication and continuing education offerings of IME. Investments of $700,000 now with commitments of $400,000 in year 1 and another $300,000 after year 2 will be necessary. Project D is slower-moving, but it will develop a firm base for most future web-based learning services of the IME. The estimated yearly net cash flows (in $1000) summarized as follow Period 1 2 3 4 5 6 7 Net cash flow, ($1000) 150 200 300 300 300 300 300 8 300 The IME capital, primarily in equity investments, has returned an average of 20% per year. There is no debt liability carried by IME at this time. Case Study Exercises 1. Formulate all the investment opportunities for IME and the cash flow profiles, given the information in the task force report. 2. Which project should the Finance Committee recommend on a purely economic basis, using present worth technique? 3. Which project should the Finance Committee recommend on a purely economic basis, using future worth technique? 4. Which project should the Finance Committee recommend on a purely economic basis, using annual worth technique? The Executive Director of IME has great interest in pursuing set of projects within specific budget. The Finance Committee has responded that a budget of $10 milli to these projects. It also stated that the total amount per project should be committed up-front, regardless of when the initial and follow-on investment cash flows actually occur, c.g., if the cost of the project is scheduled at year 0 and other part at year 3, just add them together to have an initial cost. What projects should the finance committee recommend on a purely economic basis