Question

Case Study: Market Risk Management at Chase Chase Manhattan (subsequent to the writing of this case, Chase acquired JP Morgan to form JP Morgan Chase),

Case Study: Market Risk Management at Chase

Chase Manhattan (subsequent to the writing of this case, Chase acquired JP Morgan to form JP Morgan Chase), one of America's largest banks, has a venerable history. It can trace its antecedents all the way back to a water-supply company founded in 1799, but the current institution is, by and large, the product of two mergers, each the largest in US banking history at the time. The first was the 1991 merger of Manufacturers Hanover and Chemical Bank; the second, the 1996 merger of Chase Manhattan (founded in 1877) and Chemical Bank (founded in 1823). This Chase Manhattan is a holding company operating three main lines of business:

1. The Global Bank, which offers commercial and investment banking services,

2. Global Services, which offers processing and settlement; and 3. National Consumer Services, which serves retail customers through a wide variety of financial products and services.

During the 1999 fiscal year, Chase boasted more than $400 billion in

assets, operating revenue of $23 billion (up 17 percent from $20 billion in 1998), operating earnings of $5.4 billion (up from $4.0 billion in 1998) and return on average common shareholders' equity of 24 percent. Chase attributes this performance to a number of factors. Prominent among these is a highly successful risk management system that emphasizes the creation of shareholder value and links it to employee compensation. It claims to view risk as a central aspect of its business and risk management as an area of competitive advantage. As the Chairman's letter states:

Let me begin by stating the obvious: We are in the "risk" business, and managing risk smartly and proactively with sophisticated risk management systems can create significant strategic advantages.

This may be stating the obvious, but it certainly helps to set the tone for the organization. Risk management at Chase focuses on the following principles and activities:

Formal definition of risk management governance Risk oversight independent of business units

Continual evaluation of risk appetite, communicated through risk limits Diversification

Disciplined risk assessment and measurement, including Value-at-Risk analysis and portfolio stress testing

Allocation of economic capital to business units and measuring per-formance on the basis of shareholder value-added (SVA)

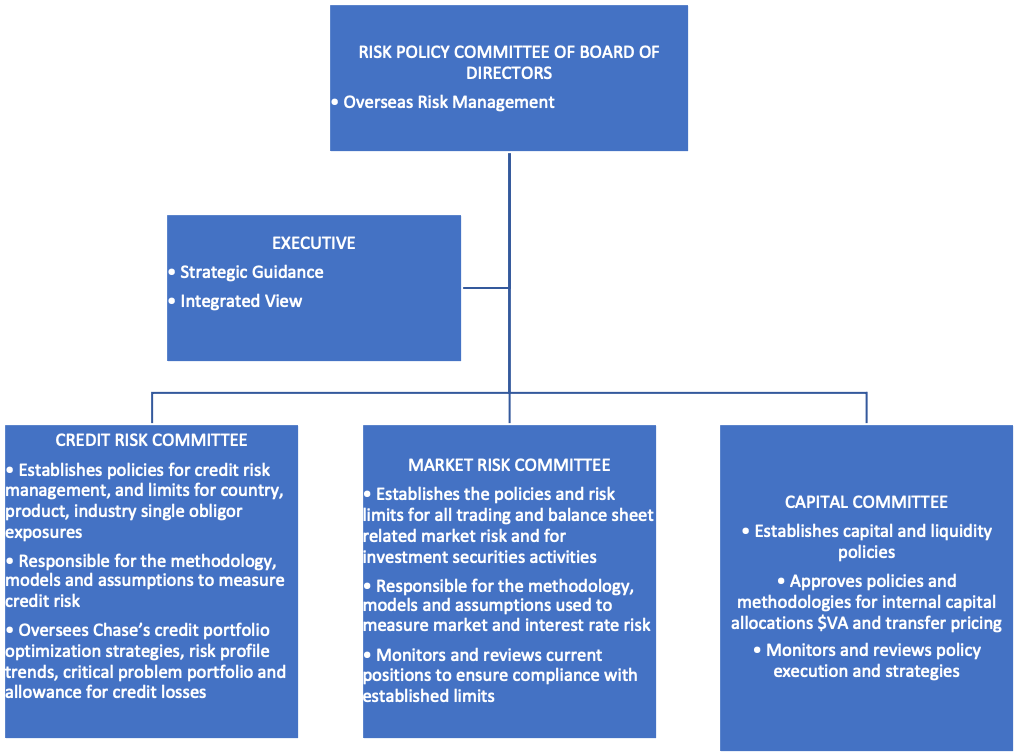

Three committees carry out the above activities: one dedicated to credit

risk, one to market risk, and one to capital. Their responsibilities are sum-marized in Figure 13.5, and each has decision-making authority within these areas. The Executive Committee, however, takes responsibility for major policy decisions, determines the company's risk appetite, and formulates the company's risks; it in turn reports to the Risk Policy Committee of the Board of Directors. Chase's Market Risk Management Group employed some 70 profes-sionals around the world prior to its merger with JP Morgan. The group's mandate is to develop appropriate risk measures, set and monitor limits, and keep the company's risk profile within the boundaries of the risk ap-petite mandated by the Board. Part of the reason behind the team's success

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started