Answered step by step

Verified Expert Solution

Question

1 Approved Answer

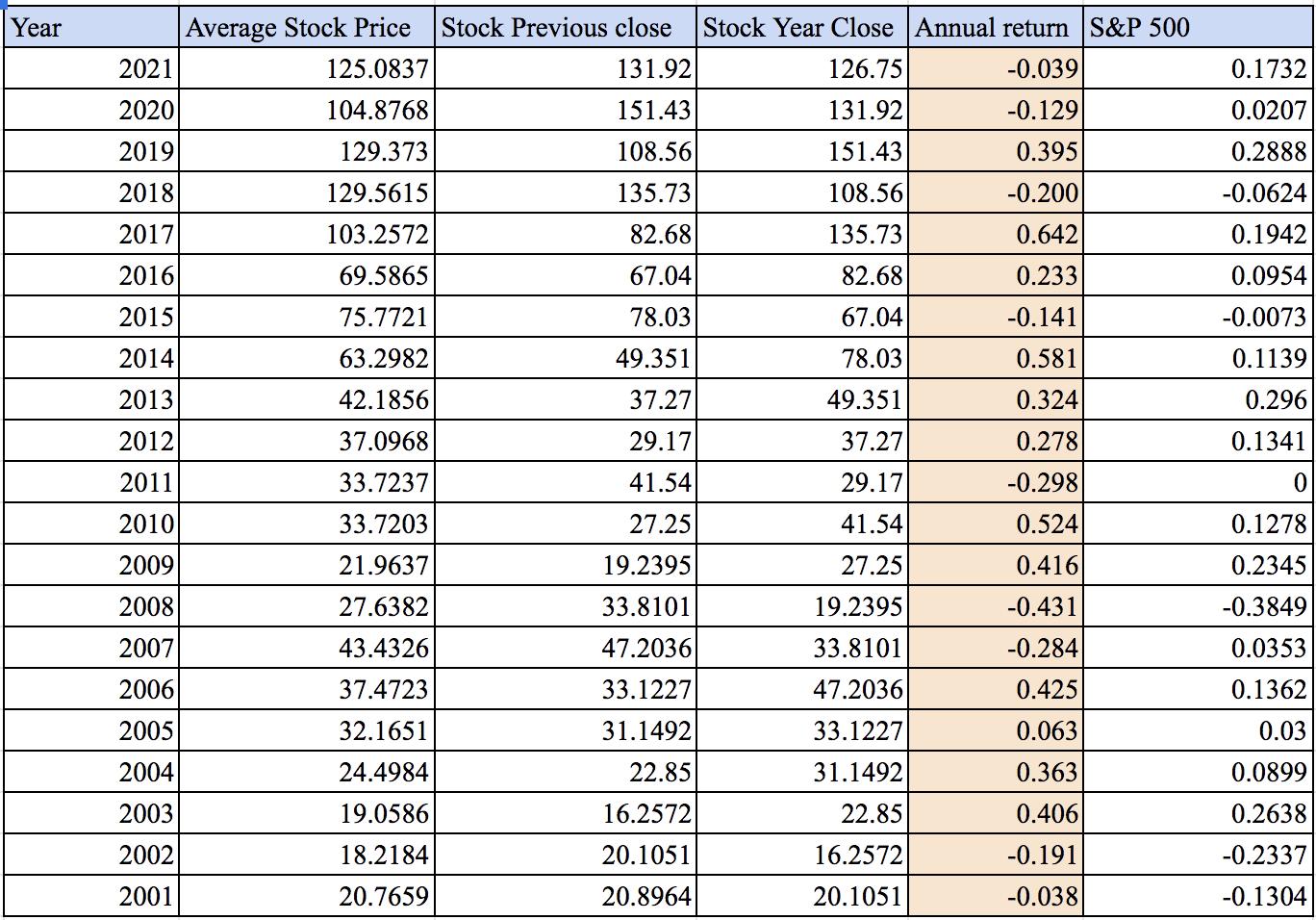

Retrieve the risk-free rate of return as the annual interest rate of US treasuries. Based on these values estimate the expected annual rate of return

Retrieve the risk-free rate of return as the annual interest rate of US treasuries. Based on these values estimate the expected annual rate of return of the corporation’s security.

Compare your estimate with the expected rate of return as evaluated based on your data.

Case study- Marriott International

Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 Average Stock Price 125.0837 104.8768 129.373 129.5615 103.2572 69.5865 75.7721 63.2982 42.1856 37.0968 33.7237 33.7203 21.9637 27.6382 43.4326 37.4723 32.1651 24.4984 19.0586 18.2184 20.7659 Stock Previous close Stock Year Close Annual return S&P 500 131.92 126.75 -0.039 151.43 131.92 -0.129 108.56 151.43 0.395 135.73 108.56 -0.200 82.68 135.73 0.642 67.04 82.68 0.233 78.03 67.04 -0.141 49.351 78.03 0.581 37.27 49.351 0.324 29.17 37.27 0.278 41.54 29.17 -0.298 27.25 41.54 0.524 19.2395 27.25 0.416 33.8101 19.2395 -0.431 47.2036 33.8101 -0.284 33.1227 47.2036 0.425 31.1492 33.1227 0.063 22.85 31.1492 0.363 16.2572 22.85 0.406 20.1051 16.2572 -0.191 20.8964 20.1051 -0.038 0.1732 0.0207 0.2888 -0.0624 0.1942 0.0954 -0.0073 0.1139 0.296 0.1341 0 0.1278 0.2345 -0.3849 0.0353 0.1362 0.03 0.0899 0.2638 -0.2337 -0.1304

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To retrieve the riskfree rate of return we can use the annual interest rate of US treasuries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started