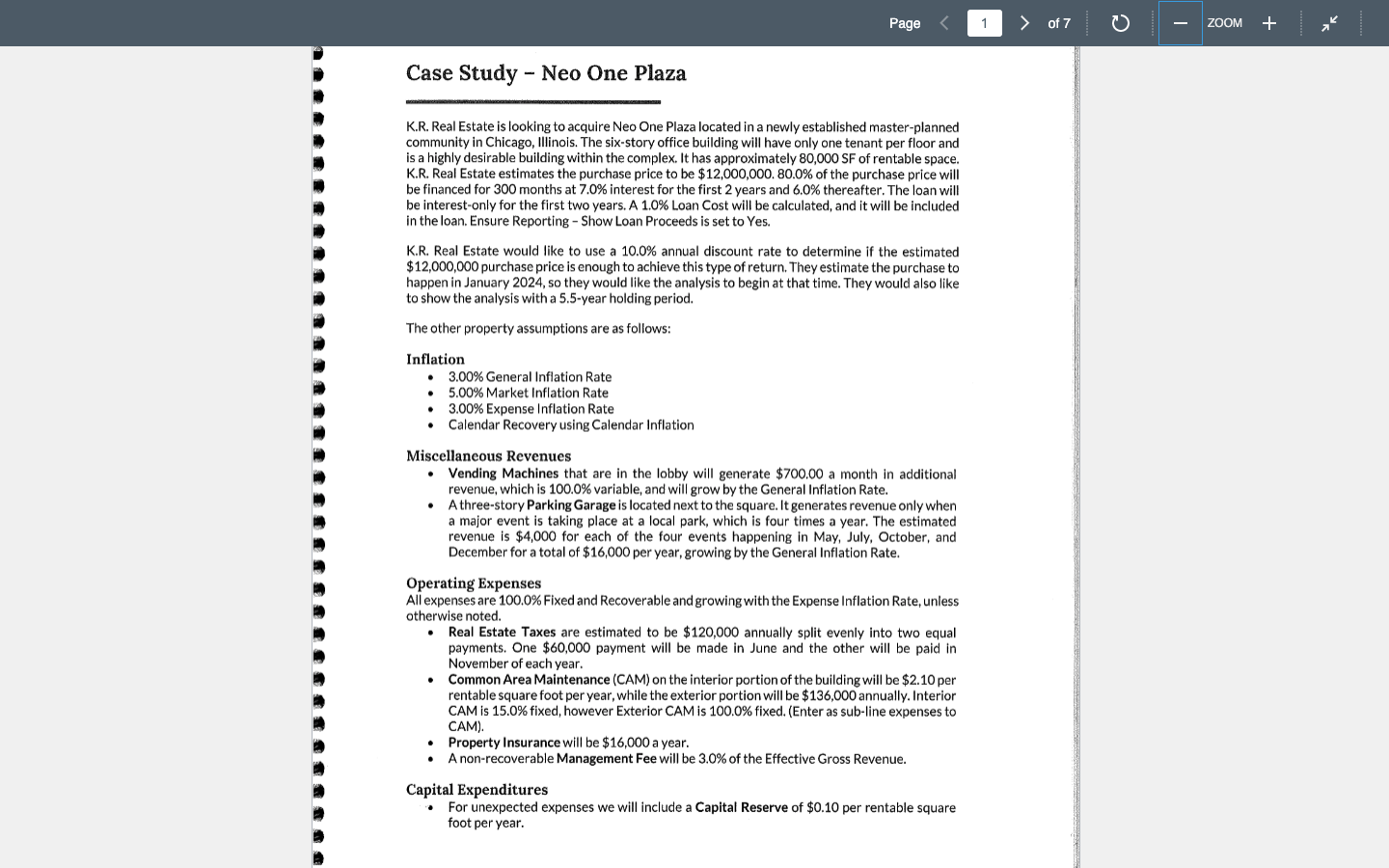

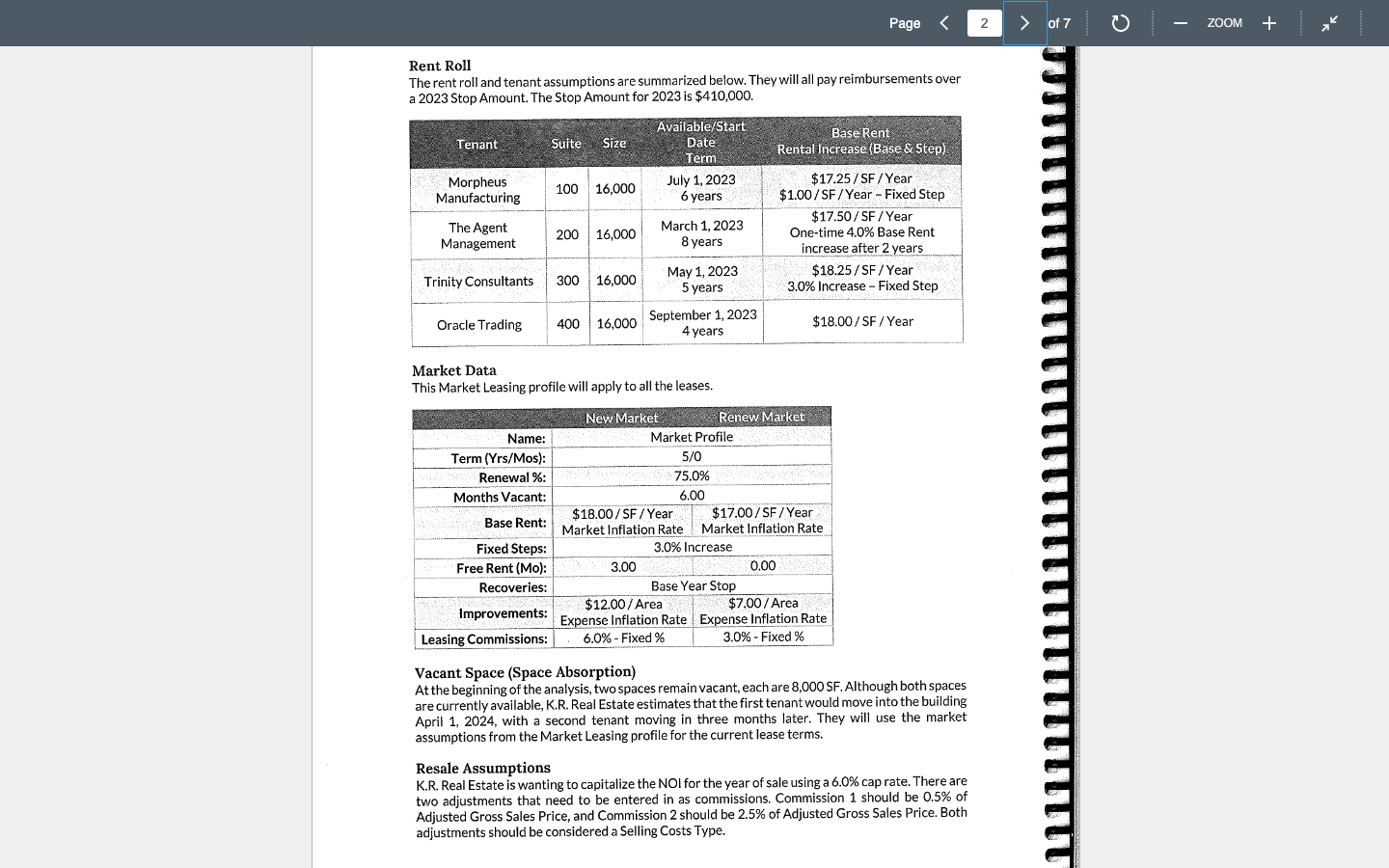

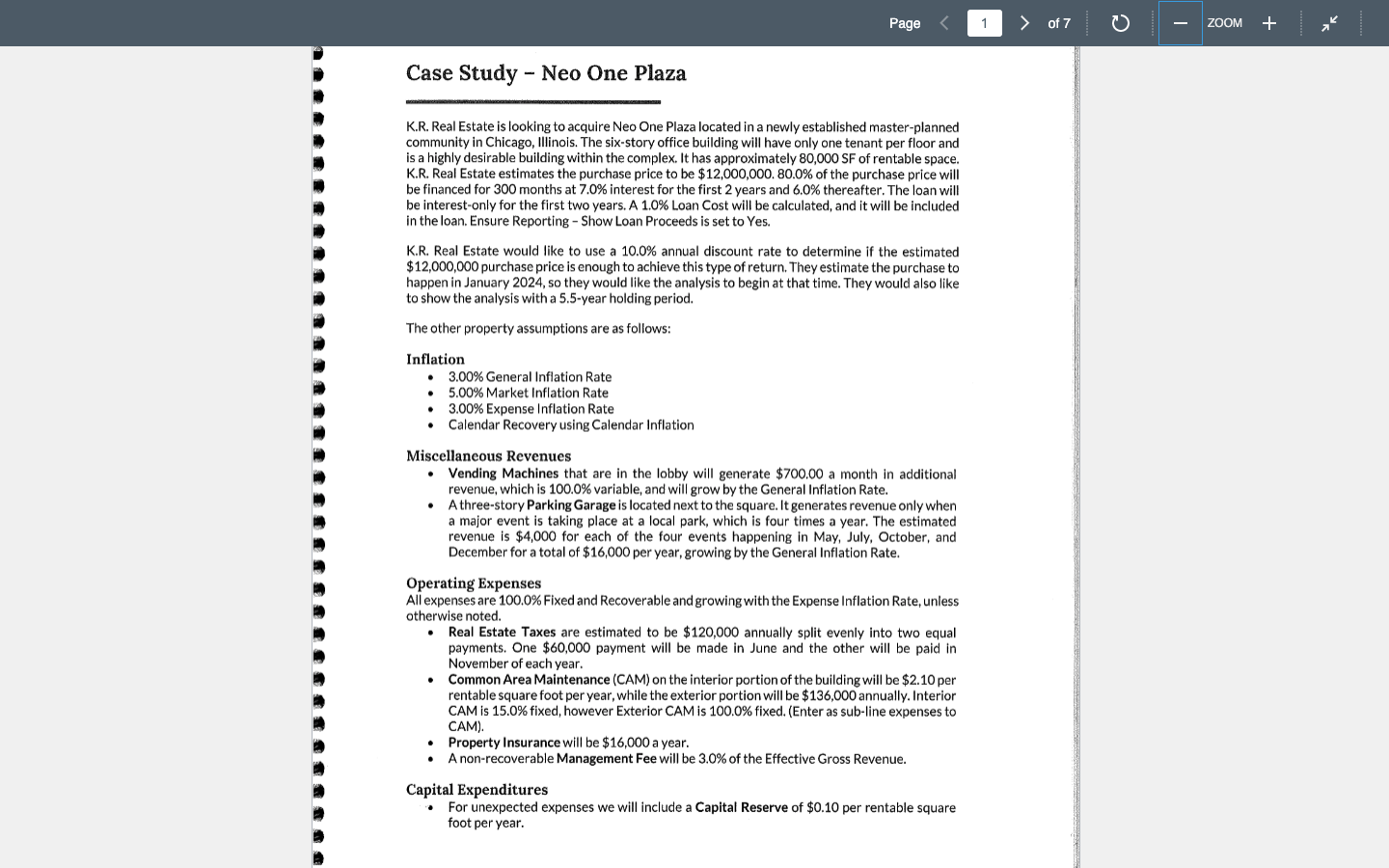

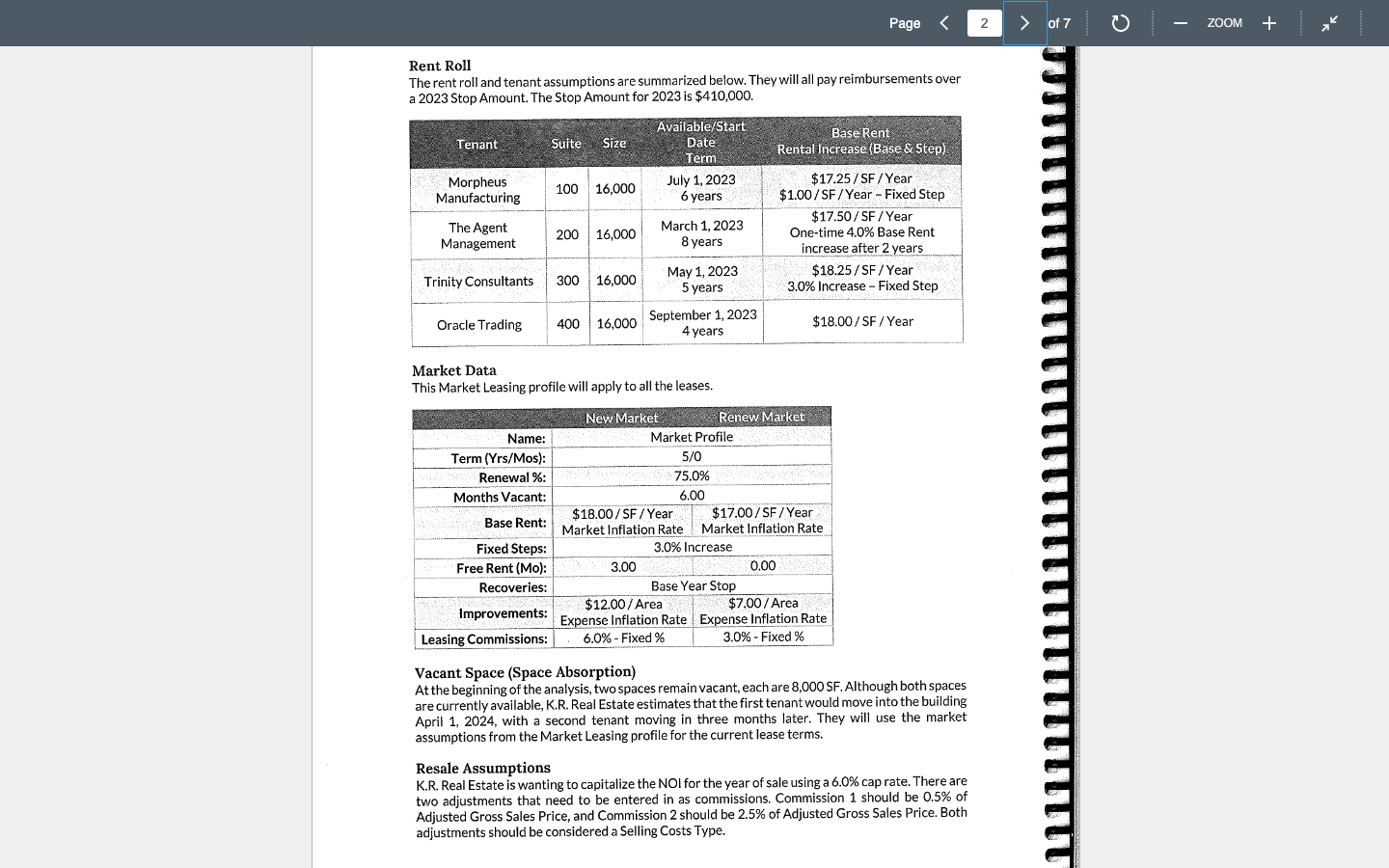

Case Study - Neo One Plaza K.R. Real Estate is looking to acquire Neo One Plaza located in a newly established master-planned community in Chicago, Illinois. The six-story office building will have only one tenant per floor and is a highly desirable building within the complex. It has approximately 80,000SF of rentable space. K.R. Real Estate estimates the purchase price to be $12,000,000.80.0% of the purchase price will be financed for 300 months at 7.0% interest for the first 2 years and 6.0% thereafter. The loan will be interest-only for the first two years. A 1.0% Loan Cost will be calculated, and it will be included in the loan. Ensure Reporting - Show Loan Proceeds is set to Yes. K.R. Real Estate would like to use a 10.0% annual discount rate to determine if the estimated $12,000,000 purchase price is enough to achieve this type of return. They estimate the purchase to happen in January 2024 , so they would like the analysis to begin at that time. They would also like to show the analysis with a 5.5-year holding period. The other property assumptions are as follows: Inflation - 3.00% General Inflation Rate - 5.00% Market Inflation Rate - 3.00% Expense Inflation Rate - Calendar Recovery using Calendar Inflation Miscellaneous Revenues - Vending Machines that are in the lobby will generate $700.00 a month in additional revenue, which is 100.0% variable, and will grow by the General Inflation Rate. - A three-story Parking Garage is located next to the square. It generates revenue only when a major event is taking place at a local park, which is four times a year. The estimated revenue is $4,000 for each of the four events happening in May, July, October, and December for a total of $16,000 per year, growing by the General Inflation Rate. Operating Expenses All expenses are 100.0\% Fixed and Recoverable and growing with the Expense Inflation Rate, unless otherwise noted. - Real Estate Taxes are estimated to be $120,000 annually split evenly into two equal payments. One $60,000 payment will be made in June and the other will be paid in November of each year. - Common Area Maintenance (CAM) on the interior portion of the building will be $2.10 per rentable square foot per year, while the exterior portion will be $136,000 annually. Interior CAM is 15.0% fixed, however Exterior CAM is 100.0% fixed. (Enter as sub-line expenses to CAM). - Property Insurance will be $16,000 a year. - A non-recoverable Management Fee will be 3.0% of the Effective Gross Revenue. Capital Expenditures - For unexpected expenses we will include a Capital Reserve of $0.10 per rentable square foot per year. Rent Roll The rent roll and tenant assumptions are summarized below. They will all pay reimbursements over a 2023 Stop Amount. The Stop Amount for 2023 is $410,000. Market Data This Market Leasing profile will apply to all the leases. Vacant Space (Space Absorption) At the beginning of the analysis, two spaces remain vacant, each are 8,000 SF. Although both spaces are currently available, K.R. Real Estate estimates that the first tenant would move into the building April 1, 2024, with a second tenant moving in three months later. They will use the market assumptions from the Market Leasing profile for the current lease terms. Resale Assumptions K.R. Real Estate is wanting to capitalize the NOI for the year of sale using a 6.0\% cap rate. There are two adjustments that need to be entered in as commissions. Commission 1 should be 0.5% of Adjusted Gross Sales Price, and Commission 2 should be 2.5\% of Adjusted Gross Sales Price. Both adjustments should be considered a Selling Costs Type. Case Study - Neo One Plaza K.R. Real Estate is looking to acquire Neo One Plaza located in a newly established master-planned community in Chicago, Illinois. The six-story office building will have only one tenant per floor and is a highly desirable building within the complex. It has approximately 80,000SF of rentable space. K.R. Real Estate estimates the purchase price to be $12,000,000.80.0% of the purchase price will be financed for 300 months at 7.0% interest for the first 2 years and 6.0% thereafter. The loan will be interest-only for the first two years. A 1.0% Loan Cost will be calculated, and it will be included in the loan. Ensure Reporting - Show Loan Proceeds is set to Yes. K.R. Real Estate would like to use a 10.0% annual discount rate to determine if the estimated $12,000,000 purchase price is enough to achieve this type of return. They estimate the purchase to happen in January 2024 , so they would like the analysis to begin at that time. They would also like to show the analysis with a 5.5-year holding period. The other property assumptions are as follows: Inflation - 3.00% General Inflation Rate - 5.00% Market Inflation Rate - 3.00% Expense Inflation Rate - Calendar Recovery using Calendar Inflation Miscellaneous Revenues - Vending Machines that are in the lobby will generate $700.00 a month in additional revenue, which is 100.0% variable, and will grow by the General Inflation Rate. - A three-story Parking Garage is located next to the square. It generates revenue only when a major event is taking place at a local park, which is four times a year. The estimated revenue is $4,000 for each of the four events happening in May, July, October, and December for a total of $16,000 per year, growing by the General Inflation Rate. Operating Expenses All expenses are 100.0\% Fixed and Recoverable and growing with the Expense Inflation Rate, unless otherwise noted. - Real Estate Taxes are estimated to be $120,000 annually split evenly into two equal payments. One $60,000 payment will be made in June and the other will be paid in November of each year. - Common Area Maintenance (CAM) on the interior portion of the building will be $2.10 per rentable square foot per year, while the exterior portion will be $136,000 annually. Interior CAM is 15.0% fixed, however Exterior CAM is 100.0% fixed. (Enter as sub-line expenses to CAM). - Property Insurance will be $16,000 a year. - A non-recoverable Management Fee will be 3.0% of the Effective Gross Revenue. Capital Expenditures - For unexpected expenses we will include a Capital Reserve of $0.10 per rentable square foot per year. Rent Roll The rent roll and tenant assumptions are summarized below. They will all pay reimbursements over a 2023 Stop Amount. The Stop Amount for 2023 is $410,000. Market Data This Market Leasing profile will apply to all the leases. Vacant Space (Space Absorption) At the beginning of the analysis, two spaces remain vacant, each are 8,000 SF. Although both spaces are currently available, K.R. Real Estate estimates that the first tenant would move into the building April 1, 2024, with a second tenant moving in three months later. They will use the market assumptions from the Market Leasing profile for the current lease terms. Resale Assumptions K.R. Real Estate is wanting to capitalize the NOI for the year of sale using a 6.0\% cap rate. There are two adjustments that need to be entered in as commissions. Commission 1 should be 0.5% of Adjusted Gross Sales Price, and Commission 2 should be 2.5\% of Adjusted Gross Sales Price. Both adjustments should be considered a Selling Costs Type