Answered step by step

Verified Expert Solution

Question

1 Approved Answer

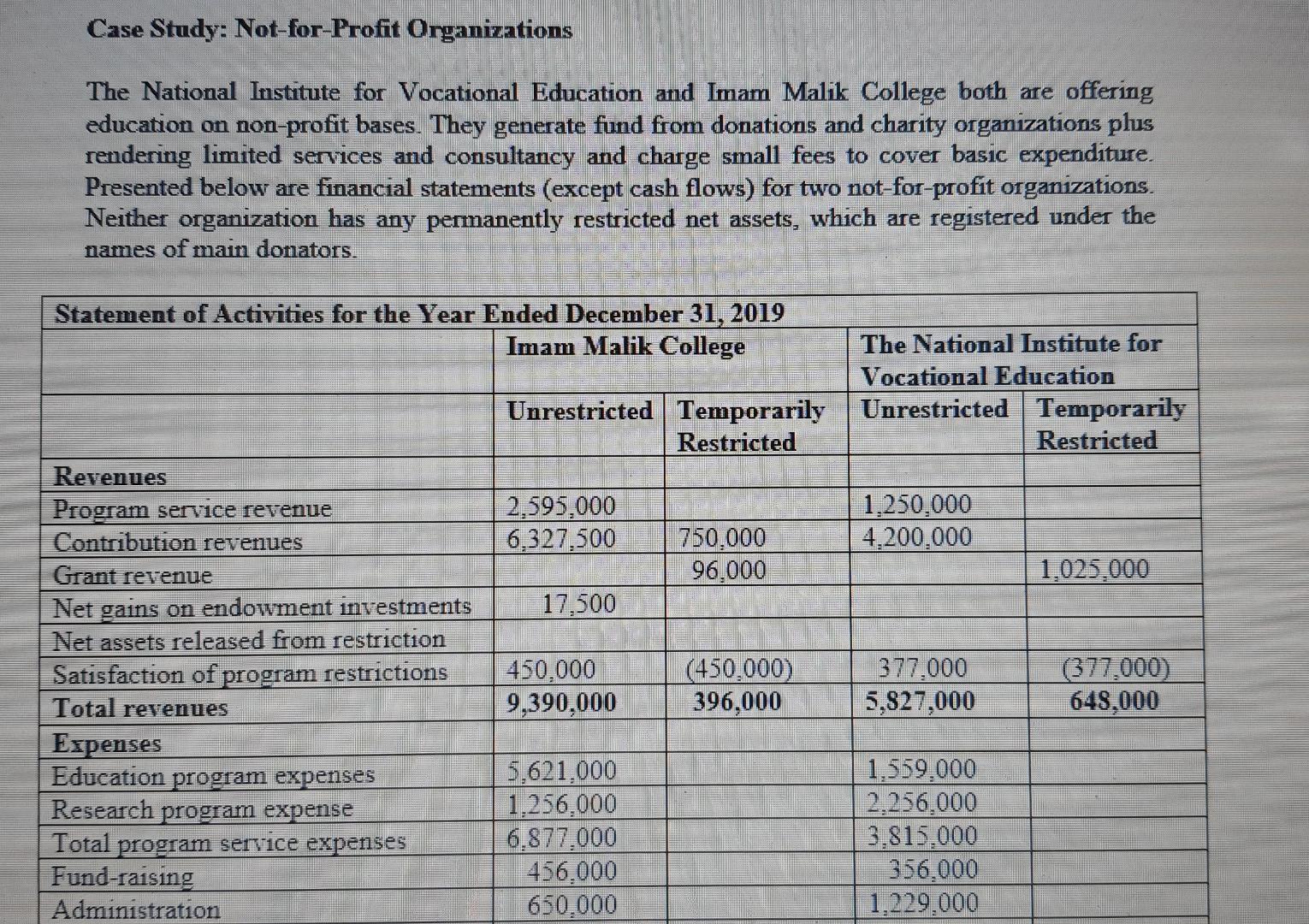

Case Study: Not-for-Profit Organizations The National Institute for Vocational Education and Imam Malik College both are offering education on non-profit bases. They generate fund from

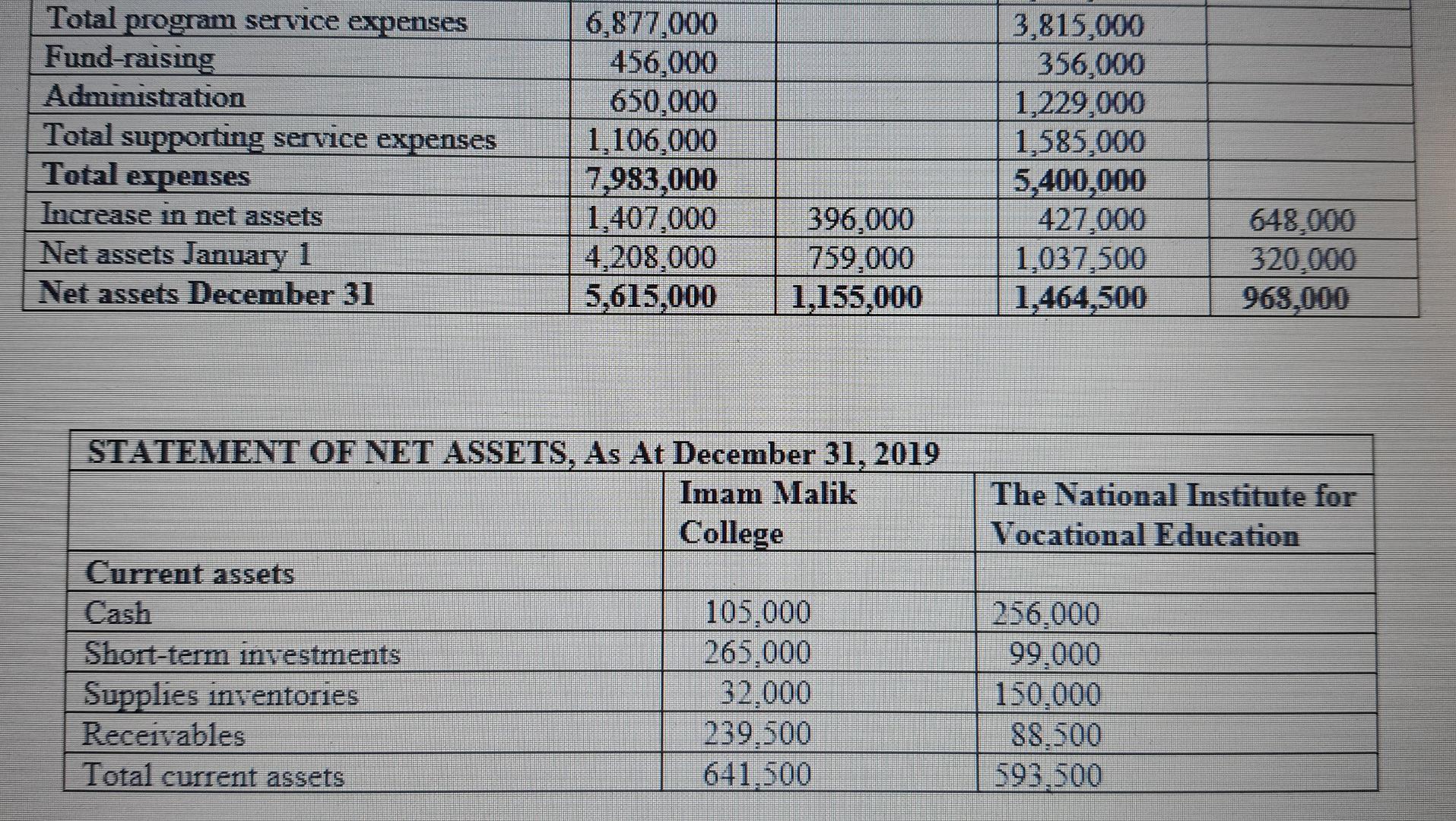

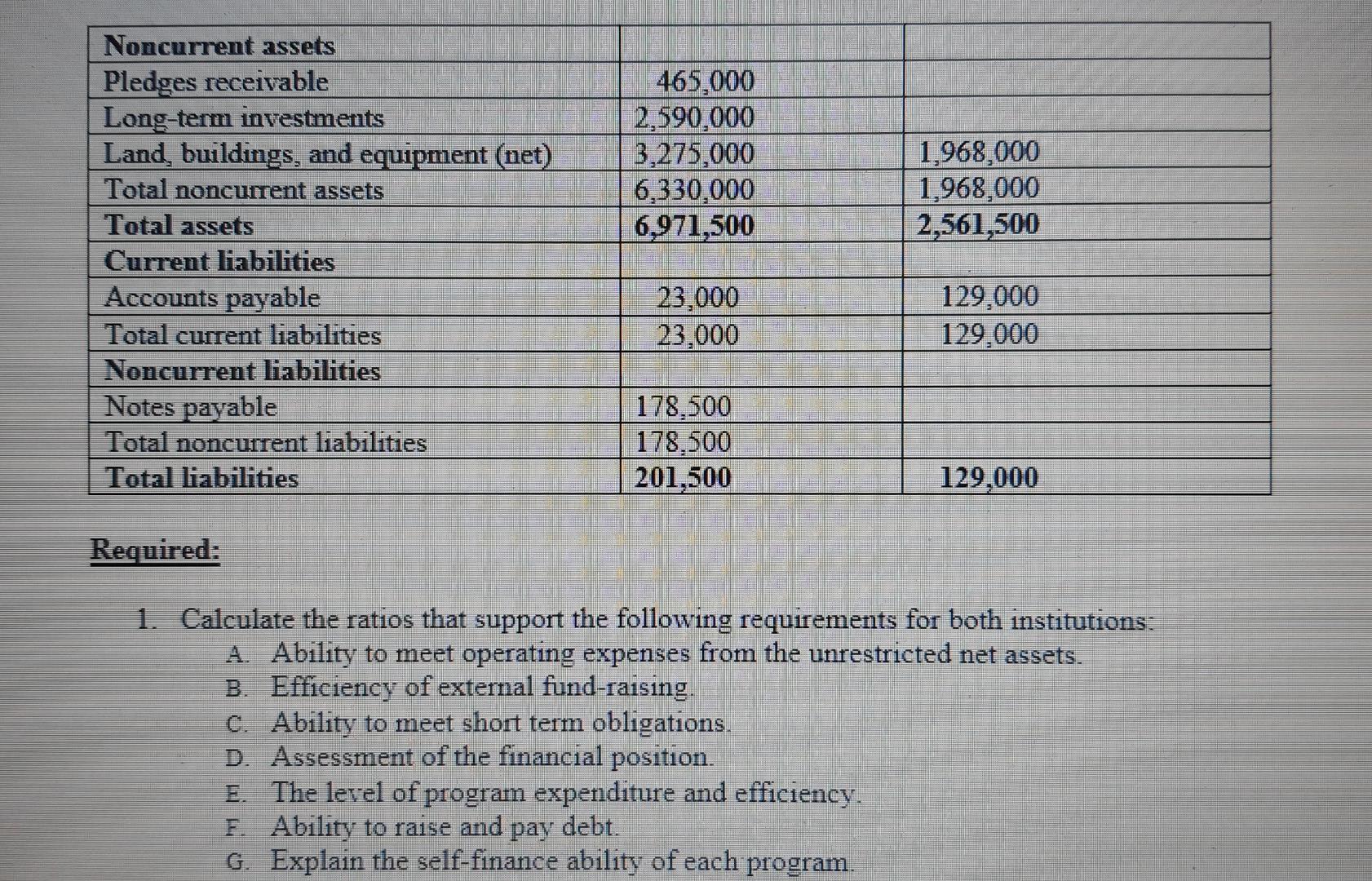

Case Study: Not-for-Profit Organizations The National Institute for Vocational Education and Imam Malik College both are offering education on non-profit bases. They generate fund from donations and charity organizations plus rendering limited services and consultancy and charge small fees to cover basic expenditure. Presented below are financial statements (except cash flows) for two not-for-profit organizations. Neither organization has any permanently restricted net assets, which are registered under the names of main donators. Statement of Activities for the Year Ended December 31, 2019 Imam Malik College The National Institute for Vocational Education Unrestricted Temporarily Restricted Unrestricted Temporarily Restricted 2,595,000 6,327,500 1.250.000 4.200.000 750,000 96,000 1,025.000 17,500 Revenues Program service revenue Contribution revenues Grant revenue Net gains on endowment investments Net assets released from restriction Satisfaction of program restrictions Total revenues Expenses Education program expenses Research program expense Total program service expenses Fund-raising Administration 450,000 9,390,000 (450.000) 396,000 377.000 5,827,000 (377,000) 648,000 5,621,000 1,256.000 6.877.000 456.000 650.000 1,559.000 2.256,000 3.815.000 356,000 1,229,000 Total program service expenses Fund-raising Administration Total supporting service expenses Total expenses Increase in net assets Net assets January 1 Net assets December 31 6,877.000 456,000 650.000 1.106.000 7.983.000 1.407.000 4,208,000 5,615,000 3,815,000 356,000 1,229,000 1,585,000 5,400,000 427,000 1,037,500 1,464,500 396,000 759,000 1,155,000 648,000 320,000 968,000 The National Institute for Vocational Education STATEMENT OF NET ASSETS, As At December 31, 2019 Imam Malik College Current assets Cash 105.000 Short-term investments 265.000 Supplies inventories 32.000 Receivables 239.500 Total current assets 641,500 256.000 99.000 150.000 88.500 593.500 465,000 2,590,000 3,275,000 6,330,000 6,971,500 1.968,000 1,968,000 2,561,500 Noncurrent assets Pledges receivable Long-term investments Land, buildings, and equipment (net) Total noncurrent assets Total assets Current liabilities Accounts payable Total current liabilities Noncurrent liabilities Notes payable Total noncurrent liabilities Total liabilities 23,000 23,000 129.000 129,000 178.500 178,500 201,500 129,000 Required: 1. Calculate the ratios that support the following requirements for both institutions: A. Ability to meet operating expenses from the unrestricted net assets. B. Efficiency of external fund-raising. C. Ability to meet short term obligations. D. Assessment of the financial position. E. The level of program expenditure and efficiency. F. Ability to raise and pay debt. G. Explain the self-finance ability of each program. Total liabilities 201,500 129,000 Required: I 1. Calculate the ratios that support the following requirements for both institutions: A Ability to meet operating expenses from the unrestricted net assets. B. Efficiency of external fund-raising. C. Ability to meet short term obligations. D. Assessment of the financial position E. The level of program expenditure and efficiency. F. Ability to raise and pay debt. . G. Explain the self-finance ability of each program 2. Based on answer of each requirement of 1 above, explain which of the two organizations has the stronger position and performance. Comment and advise the management based on calculated ratios and your own analysis. 3. If you have been selected to audit both institutions, which audit report and opinion you will submit for each institution. Justify your report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started