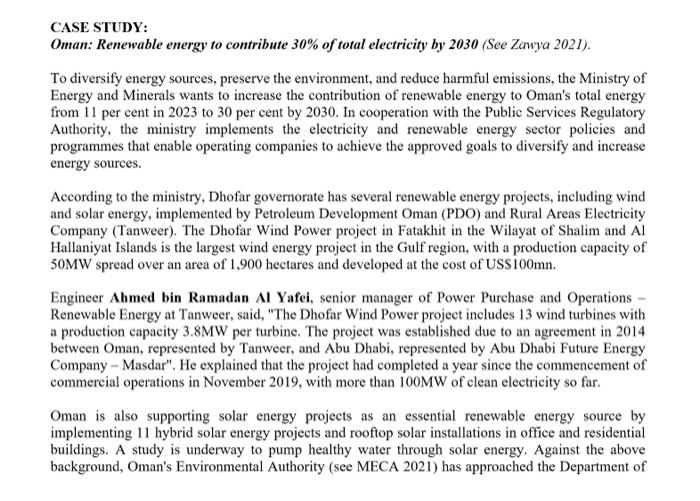

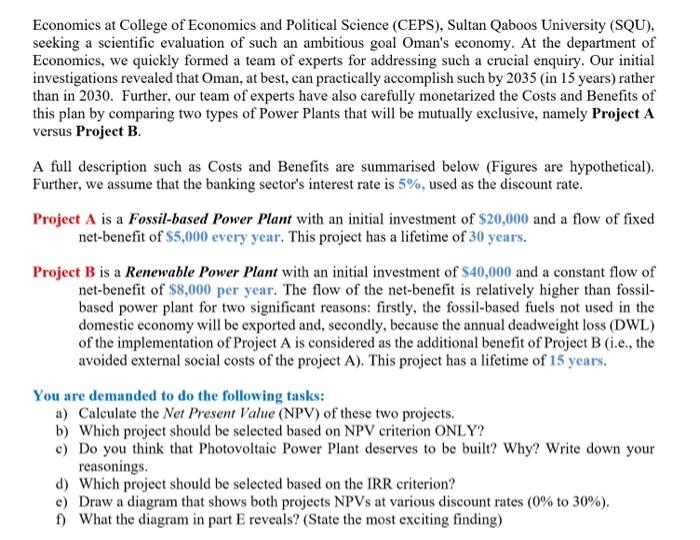

CASE STUDY: Oman: Renewable energy to contribute 30% of total electricity by 2030 (See Zawya 2021). To diversify energy sources, preserve the environment, and reduce harmful emissions, the Ministry of Energy and Minerals wants to increase the contribution of renewable energy to Oman's total energy from 11 per cent in 2023 to 30 per cent by 2030. In cooperation with the Public Services Regulatory Authority, the ministry implements the electricity and renewable energy sector policies and programmes that enable operating companies to achieve the approved goals to diversify and increase energy sources. According to the ministry, Dhofar governorate has several renewable energy projects, including wind and solar energy, implemented by Petroleum Development Oman (PDO) and Rural Areas Electricity Company (Tanweer). The Dhofar Wind Power project in Fatakhit in the Wilayat of Shalim and Al Hallaniyat Islands is the largest wind energy project in the Gulf region, with a production capacity of 50MW spread over an area of 1,900 hectares and developed at the cost of US$100mn. Engineer Ahmed bin Ramadan Al Yafei, senior manager of Power Purchase and Operations Renewable Energy at Tanweer, said, "The Dhofar Wind Power project includes 13 wind turbines with a production capacity 3.8MW per turbine. The project was established due to an agreement in 2014 between Oman, represented by Tanweer, and Abu Dhabi, represented by Abu Dhabi Future Energy Company - Masdar". He explained that the project had completed a year since the commencement of commercial operations in November 2019, with more than 100MW of clean electricity so far. Oman is also supporting solar energy projects as an essential renewable energy source by implementing 11 hybrid solar energy projects and rooftop solar installations in office and residential buildings. A study is underway to pump healthy water through solar energy. Against the above background, Oman's Environmental Authority (see MECA 2021) has approached the Department of Economics at College of Economics and Political Science (CEPS), Sultan Qaboos University (SQU), seeking a scientific evaluation of such an ambitious goal Oman's economy. At the department of Economics, we quickly formed a team of experts for addressing such a crucial enquiry. Our initial investigations revealed that Oman, at best, can practically accomplish such by 2035 (in 15 years) rather than in 2030. Further, our team of experts have also carefully monetarized the Costs and Benefits of this plan by comparing two types of Power Plants that will be mutually exclusive, namely Project A versus Project B. A full description such as Costs and Benefits are summarised below (Figures are hypothetical). Further, we assume that the banking sector's interest rate is 5%, used as the discount rate. Project A is a Fossil-based Power Plant with an initial investment of $20,000 and a flow of fixed net-benefit of $5,000 every year. This project has a lifetime of 30 years. Project B is a Renewable Power Plant with an initial investment of $40,000 and a constant flow of net-benefit of $8,000 per year. The flow of the net-benefit is relatively higher than fossil- based power plant for two significant reasons: firstly, the fossil-based fuels not used in the domestic economy will be exported and, secondly, because the annual deadweight loss (DWL) of the implementation of Project A is considered as the additional benefit of Project B (1.e., the avoided external social costs of the project A). This project has a lifetime of 15 years. You are demanded to do the following tasks: a) Calculate the Net Present Value (NPV) of these two projects. b) Which project should be selected based on NPV criterion ONLY? c) Do you think that Photovoltaic Power Plant deserves to be built? Why? Write down your reasonings. d) Which project should be selected based on the IRR criterion? e) Draw a diagram that shows both projects NPVs at various discount rates (0% to 30%). f) What the diagram in part E reveals? (State the most exciting finding)