Question

CASE STUDY ON MS. A Historically, over the years Singapore has drawn the attention of many businessmen and investors from overseas based on its tremendous

CASE STUDY ON MS. A Historically, over the years Singapore has drawn the attention of many businessmen and investors from overseas based on its tremendous and continuous growth and successes. Ms. A, who is one such foreign investor, came across various news reports since the beginning of the year that a large number of foreigners are already invested or are showing a keen interest in the Singapore real estate sector. As an ultra-high net worth individual (UHNWI) investor herself with at least an equivalent of SGD 500 million in net investable assets, Ms. A has now decided to allocate SGD 10 million in cash to invest in Singapore real estate but is clueless as to the wide range of choices available in the real estate sector and related investment opportunities here.

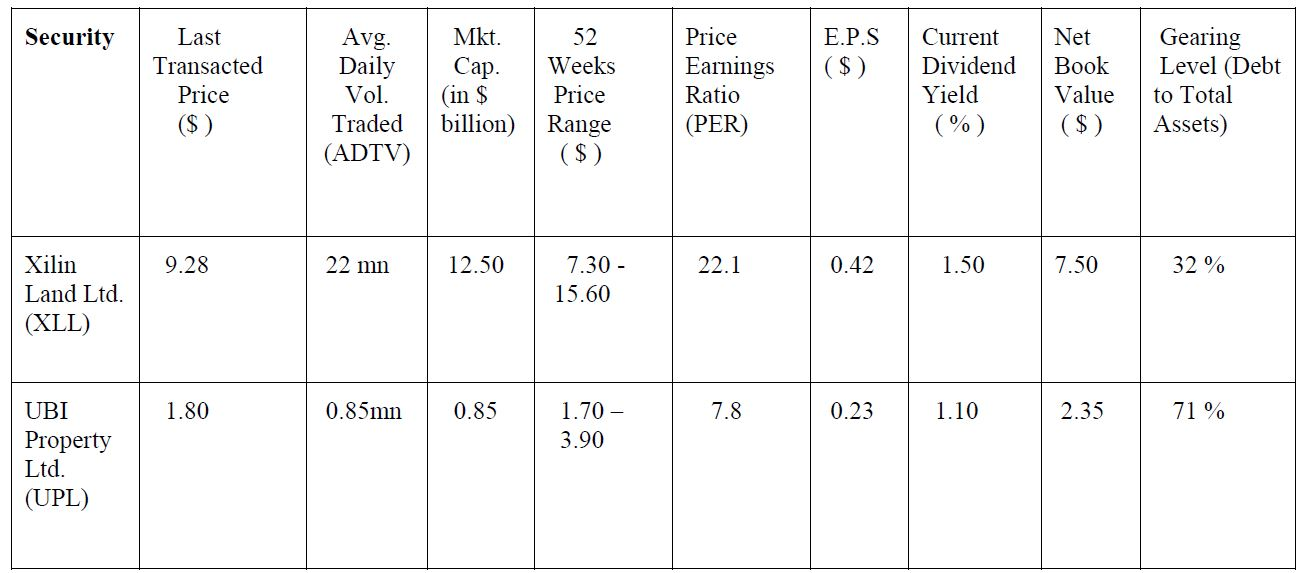

Discuss the merits and demerits of these investments, provide meaningful comparisons given their main business sector, market capitalisation, liquidity, earnings dividends and book values. Assess the implications and conclude which is a preferred investment option for Ms. A.

Security E.P.S ($) Last Transacted Price ($) Avg. Daily Vol. Traded (ADTV) Mkt. Cap. (in $ billion) 52 Weeks Price Range ($) Price Earnings Ratio (PER) Current Dividend Yield (%) Net Book Value ($) Gearing Level (Debt to Total Assets) 9.28 22 mn 12.50 22.1 0.42 1.50 7.50 32 % Xilin Land Ltd. (XLL) 7.30 - 15.60 1.80 0.85mn | 0.85 1.70 3.90 7.8 0.23 1.10 2.35 71% UBI Property Ltd. (UPL)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started