Answered step by step

Verified Expert Solution

Question

1 Approved Answer

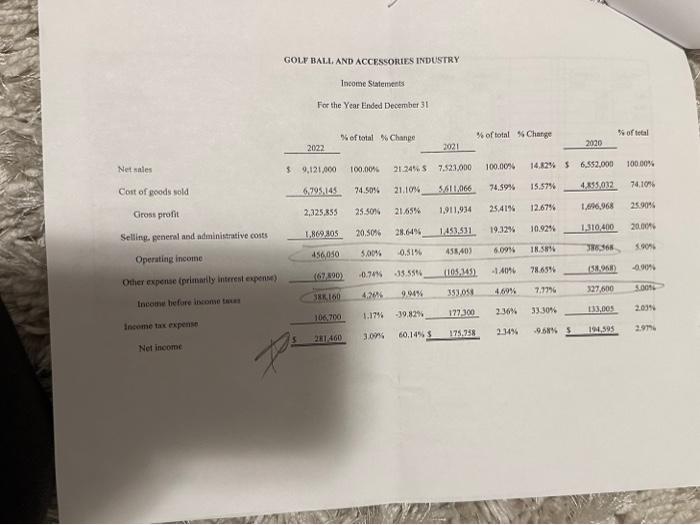

CASE STUDY ON RATIO ANALYSIS: B.C. COMPANY 30 The B.C. Company is a maker of golf balls and golf accessories. It is a closely held

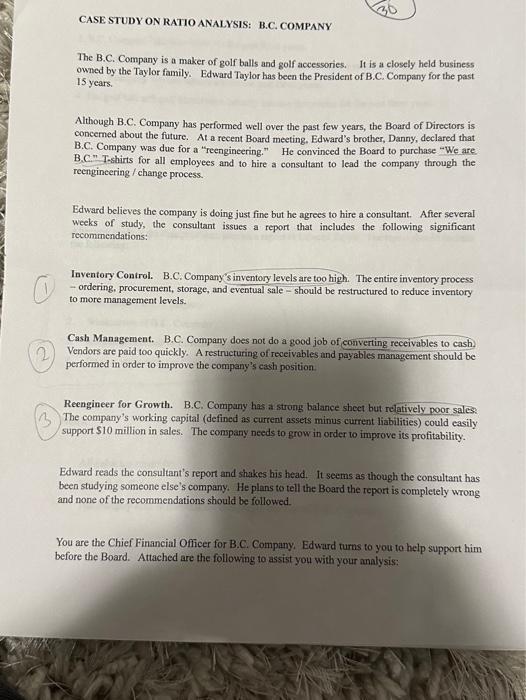

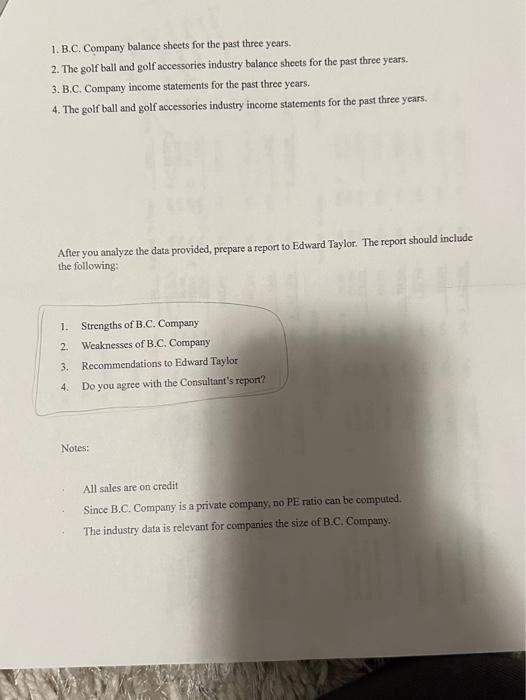

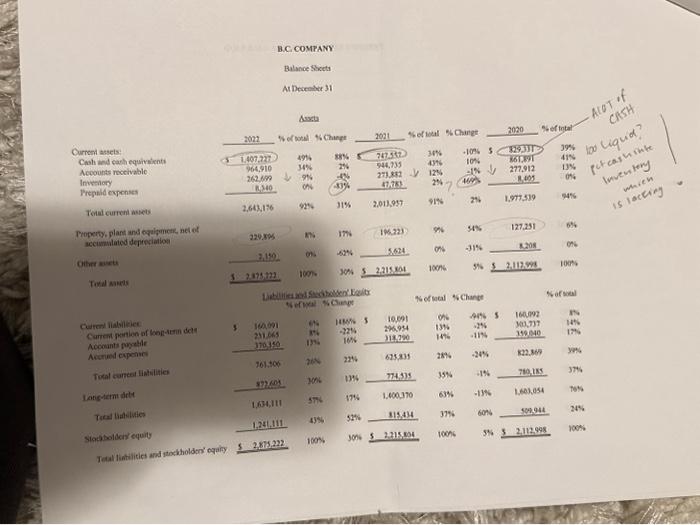

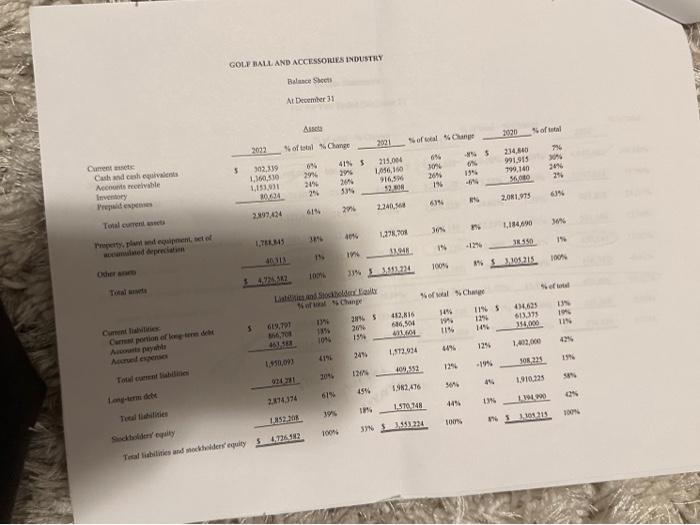

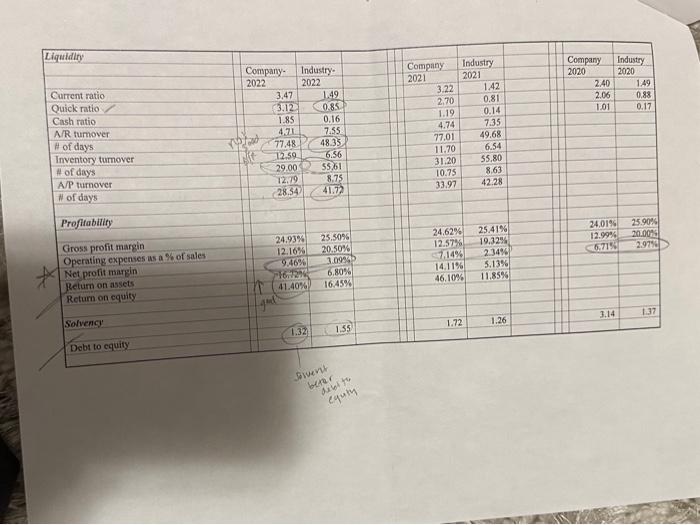

CASE STUDY ON RATIO ANALYSIS: B.C. COMPANY 30 The B.C. Company is a maker of golf balls and golf accessories. It is a closely held business owned by the Taylor family. Edward Taylor has been the President of B.C. Company for the past 15 years. Although B.C. Company has performed well over the past few years, the Board of Directors is concerned about the future. At a recent Board meeting, Edward's brother, Danny, declared that B.C. Company was due for a "reengineering." He convinced the Board to purchase We are B.C." T-shirts for all employees and to hire a consultant to lead the company through the reengineering / change process. Edward believes the company is doing just fine but he agrees to hire a consultant. After several weeks of study, the consultant issues a report that includes the following significant recommendations: Inventory Control. B.C. Company's inventory levels are too high. The entire inventory process - ordering, procurement, storage, and eventual sale should be restructured to reduce inventory to more management levels. Cash Management. B.C. Company does not do a good job of converting receivables to cash. Vendors are paid too quickly. A restructuring of receivables and payables management should be performed in order to improve the company's cash position. 3 Reengineer for Growth. B.C. Company has a strong balance sheet but relatively poor sales. The company's working capital (defined as current assets minus current liabilities) could easily support $10 million in sales. The company needs to grow in order to improve its profitability. Edward reads the consultant's report and shakes his head. It seems as though the consultant has been studying someone else's company. He plans to tell the Board the report is completely wrong and none of the recommendations should be followed. You are the Chief Financial Officer for B.C. Company. Edward turns to you to help support him before the Board. Attached are the following to assist you with your analysis:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started