Question

Case Study PFI 3381 Case Study Goals: Students will have the opportunity integrate what they have learned in the course to evaluate a portfolio and

Case Study PFI 3381 Case Study Goals: Students will have the opportunity integrate what they have learned in the course to evaluate a portfolio and give recommendations.Important Submission Instructions:Please save your casestudy in the following format: lastname_firstname_casestudy.docxUse the supplement titled: Documents for the Case Study as you work through this case.Please do not include the instructions or the charts and graphs in your submission. Please only include your own writing, citations, and a screenshot as instructed in section I.Please use multiple sources throughout your case study and citeany source you use!Please be concise but thorough in your responses to each question. There is no required word count or required number of pages. Having said that, if you complete this assignment with less than 1 page or more than 3 pages it begs the question of a lack of thoroughness (less than 1 page) or lack of conciseness (more than 3 pages). Pay attention to the rubric as you complete this assignment.Please submit a professional looking project, something you would turn into a boss or prospective employer.Remember that I will be running all case studies through plagiarism detection software afteryou submit them through Blackboard.Case Study Introduction: Your dear friend, Elsa, is a registered dietician and works for UnitedHealth. She has been with the company for 5 years and loves working for the company. When she first started working for UnitedHealth, sheenrolled in the 401(k) at the company. Shenow contributes 10% of hergross annually salary, and the company matches50% of contributionsup to 6%. Overthe past5years of contributions and growth the value of her401(k) has grown toalmost $90,000. Elsa knows that you have taken the investment course fromthe Personal Financeprogram at Texas Techand she has some questions for you! She has asked for your analysis ofhercurrent portfolio.Please seethe document titled:Documents for the Case Study for information on Elsasdesired asset allocation based on herlevel of risk tolerance.

Section I: The Analysis

1.We can start analyzingthe Overall Allocation of the 401(k) planby using the X-RayOverview section ofMorningstar(located in the supplemental document titled: Documents for the Case Study)to answer the following questions:a.Doesthe current allocation ofyour friends401(k) plan satisfythedesired overall allocation?Please explain your answerb.If it doesnot, what are the changes that should be made regarding the bond/stock allocation? In otherwords, is sellingmore bonds to buy more stock or the other way aroundthe way to go?Note:Foreign Stocks are counted as Equity, and Cash can be counted toward Bond allocationc.Do you recommend eliminating any of the funds in the portfolio? Why or why not? Note:You will need to do some basic research on each of these fund companies. Remember to cite your sources.

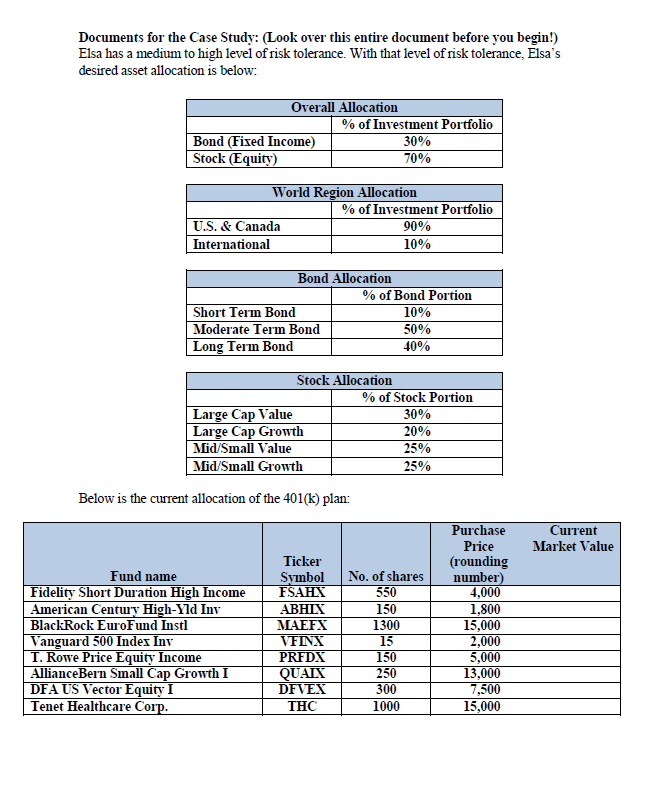

Documents for the Case Study: (Look over this entire document before you begin!) Elsa has a medium to high level of risk tolerance. With that level of risk tolerance. Elsa's desired asset allocation is below: Overall Allocation % of Investment Portfolio Bond (Fixed Income) 30% Stock (Equity) 70% World Region Allocation % of Investment Portfolio U.S. & Canada 90% International 10% Bond Allocation % of Bond Portion Short Term Bond 10% Moderate Term Bond 50% Long Term Bond 40% Stock Allocation % of Stock Portion Large Cap Value 30% Large Cap Growth 20% Mid/Small Value 25% Mid/Small Growth 25% Below is the current allocation of the 401(k) plan: Current Market Value Fund name Fidelity Short Duration High Income American Century High-Yld Inv BlackRock EuroFund Insti Vanguard 500 Index Inv T. Rowe Price Equity Income Alliance Bern Small Cap Growth I DFA US Vector Equity I Tenet Healthcare Corp. Ticker Symbol FSAHX MAEFX VFINX PREDX QUAIX DFVEX THC No. of shares 550 150 1300 15 150 250 300 1000 Purchase Price (rounding number) 4,000 1,800 15,000 2,000 5,000 13,000 7,500 15,000 Documents for the Case Study: (Look over this entire document before you begin!) Elsa has a medium to high level of risk tolerance. With that level of risk tolerance. Elsa's desired asset allocation is below: Overall Allocation % of Investment Portfolio Bond (Fixed Income) 30% Stock (Equity) 70% World Region Allocation % of Investment Portfolio U.S. & Canada 90% International 10% Bond Allocation % of Bond Portion Short Term Bond 10% Moderate Term Bond 50% Long Term Bond 40% Stock Allocation % of Stock Portion Large Cap Value 30% Large Cap Growth 20% Mid/Small Value 25% Mid/Small Growth 25% Below is the current allocation of the 401(k) plan: Current Market Value Fund name Fidelity Short Duration High Income American Century High-Yld Inv BlackRock EuroFund Insti Vanguard 500 Index Inv T. Rowe Price Equity Income Alliance Bern Small Cap Growth I DFA US Vector Equity I Tenet Healthcare Corp. Ticker Symbol FSAHX MAEFX VFINX PREDX QUAIX DFVEX THC No. of shares 550 150 1300 15 150 250 300 1000 Purchase Price (rounding number) 4,000 1,800 15,000 2,000 5,000 13,000 7,500 15,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started