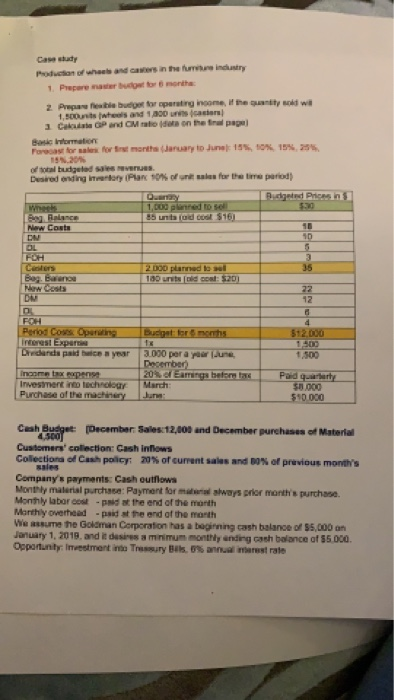

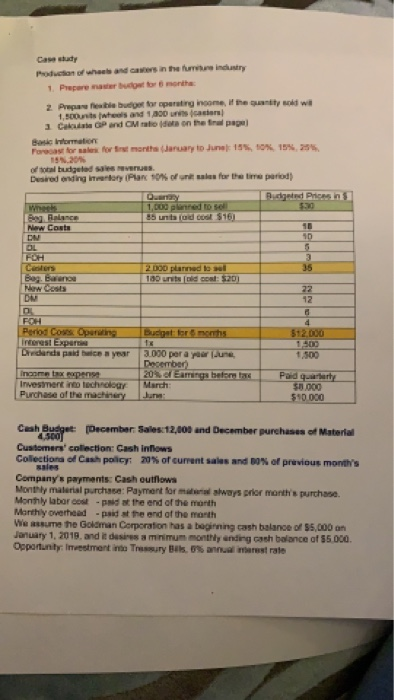

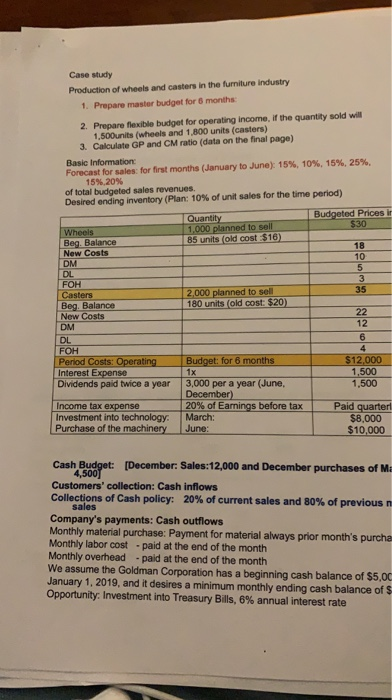

Case study Production of wheels and came in the industry 1. Prepare a budget for month 2 P e te budget for operating income, they wil 1,5unts who and 1.200 asta C P and Mall on the final papel Barman Forecast for sale for month January to June 15%, 10 15.25 SSN 207 of budgeted e nes Desiredonding inventory Plan 10% of f the time period R ated Prions in Wees Tg Race Now Costs Oy 1.000 puntos 85 unit ud od 5161 ANE 2 DOO planned to 100 units : $200 budget for months $12.000 Period CO During incoast Expert Didend paid he year Income tax pense Investimento lochnology Purchase of the machinery 3.000 per a prune December 20% of Engs before March Jane Paid q arty SN 000 $10.000 Cash Budget: December Sales: 12,000 and December purchases of Material 4500 Customers' collection: Cash inflows Collection of Cash policy 20% of current sales and bo's of previous month's Company's payments Cash outflows Monthly material purchase: Payment forma lways prior months purchase Monthly labor cost-paid at the end of the month Marthy overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,000 on Jormuary 1, 2019. and it dessa m mm morty ending cash balance of 35.000 Opportunity Investment in Treasury Bils. 0% rest rate Case study Production of wheels and came in the industry 1. Prepare a budget for month 2 P e te budget for operating income, they wil 1,5unts who and 1.200 asta C P and Mall on the final papel Barman Forecast for sale for month January to June 15%, 10 15.25 SSN 207 of budgeted e nes Desiredonding inventory Plan 10% of f the time period R ated Prions in Wees Tg Race Now Costs Oy 1.000 puntos 85 unit ud od 5161 ANE 2 DOO planned to 100 units : $200 budget for months $12.000 Period CO During incoast Expert Didend paid he year Income tax pense Investimento lochnology Purchase of the machinery 3.000 per a prune December 20% of Engs before March Jane Paid q arty SN 000 $10.000 Cash Budget: December Sales: 12,000 and December purchases of Material 4500 Customers' collection: Cash inflows Collection of Cash policy 20% of current sales and bo's of previous month's Company's payments Cash outflows Monthly material purchase: Payment forma lways prior months purchase Monthly labor cost-paid at the end of the month Marthy overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,000 on Jormuary 1, 2019. and it dessa m mm morty ending cash balance of 35.000 Opportunity Investment in Treasury Bils. 0% rest rate Case study Production of wheels and casters in the furniture Industry 1. Prepare master budget for 6 months 2. Prepare flexible budget for operating income, if the quantity sold will 1.500 units (wheels and 1,800 units (casters) 3. Calculate GP and CM ratio (data on the final page) Basic Information Forecast for sales: for first months (January to June): 15%, 10%, 15%, 25%. 15% 20% of total budgeted sales revenues. Desired ending inventory (Plan: 10% of unit sales for the time period) Budgeted Prices in $30 Wheels Beg. Balance New Costs Quantity 1.000 planned to sell 85 units (old cost $16) DM 2.000 planned to sell 180 units (old cost: $20) FOH Casters Beg. Balance New Costs DM DL FOH Perod Costs: Operating Interest Expense Dividends paid twice a year 12 6 Budget for 6 months 1x $12.000 1.500 1,500 Income tax expense Investment into technology: Purchase of the machinery 3,000 per a year (June, December) 20% of Earnings before tax March: June: Paid quarter $8.000 $10,000 Cash Budget: [December: Sales:12,000 and December purchases of Me Customers' collection: Cash inflows Collections of Cash policy: 20% of current sales and 80% of previous sales Company's payments: Cash outflows Monthly material purchase: Payment for material always prior month's purcha Monthly labor cost - paid at the end of the month Monthly overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,00 January 1, 2019, and it desires a minimum monthly ending cash balance of $ Opportunity: Investment into Treasury Bills, 6% annual interest rate Case study Production of wheels and came in the industry 1. Prepare a budget for month 2 P e te budget for operating income, they wil 1,5unts who and 1.200 asta C P and Mall on the final papel Barman Forecast for sale for month January to June 15%, 10 15.25 SSN 207 of budgeted e nes Desiredonding inventory Plan 10% of f the time period R ated Prions in Wees Tg Race Now Costs Oy 1.000 puntos 85 unit ud od 5161 ANE 2 DOO planned to 100 units : $200 budget for months $12.000 Period CO During incoast Expert Didend paid he year Income tax pense Investimento lochnology Purchase of the machinery 3.000 per a prune December 20% of Engs before March Jane Paid q arty SN 000 $10.000 Cash Budget: December Sales: 12,000 and December purchases of Material 4500 Customers' collection: Cash inflows Collection of Cash policy 20% of current sales and bo's of previous month's Company's payments Cash outflows Monthly material purchase: Payment forma lways prior months purchase Monthly labor cost-paid at the end of the month Marthy overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,000 on Jormuary 1, 2019. and it dessa m mm morty ending cash balance of 35.000 Opportunity Investment in Treasury Bils. 0% rest rate Case study Production of wheels and came in the industry 1. Prepare a budget for month 2 P e te budget for operating income, they wil 1,5unts who and 1.200 asta C P and Mall on the final papel Barman Forecast for sale for month January to June 15%, 10 15.25 SSN 207 of budgeted e nes Desiredonding inventory Plan 10% of f the time period R ated Prions in Wees Tg Race Now Costs Oy 1.000 puntos 85 unit ud od 5161 ANE 2 DOO planned to 100 units : $200 budget for months $12.000 Period CO During incoast Expert Didend paid he year Income tax pense Investimento lochnology Purchase of the machinery 3.000 per a prune December 20% of Engs before March Jane Paid q arty SN 000 $10.000 Cash Budget: December Sales: 12,000 and December purchases of Material 4500 Customers' collection: Cash inflows Collection of Cash policy 20% of current sales and bo's of previous month's Company's payments Cash outflows Monthly material purchase: Payment forma lways prior months purchase Monthly labor cost-paid at the end of the month Marthy overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,000 on Jormuary 1, 2019. and it dessa m mm morty ending cash balance of 35.000 Opportunity Investment in Treasury Bils. 0% rest rate Case study Production of wheels and casters in the furniture Industry 1. Prepare master budget for 6 months 2. Prepare flexible budget for operating income, if the quantity sold will 1.500 units (wheels and 1,800 units (casters) 3. Calculate GP and CM ratio (data on the final page) Basic Information Forecast for sales: for first months (January to June): 15%, 10%, 15%, 25%. 15% 20% of total budgeted sales revenues. Desired ending inventory (Plan: 10% of unit sales for the time period) Budgeted Prices in $30 Wheels Beg. Balance New Costs Quantity 1.000 planned to sell 85 units (old cost $16) DM 2.000 planned to sell 180 units (old cost: $20) FOH Casters Beg. Balance New Costs DM DL FOH Perod Costs: Operating Interest Expense Dividends paid twice a year 12 6 Budget for 6 months 1x $12.000 1.500 1,500 Income tax expense Investment into technology: Purchase of the machinery 3,000 per a year (June, December) 20% of Earnings before tax March: June: Paid quarter $8.000 $10,000 Cash Budget: [December: Sales:12,000 and December purchases of Me Customers' collection: Cash inflows Collections of Cash policy: 20% of current sales and 80% of previous sales Company's payments: Cash outflows Monthly material purchase: Payment for material always prior month's purcha Monthly labor cost - paid at the end of the month Monthly overhead -paid at the end of the month We assume the Goldman Corporation has a beginning cash balance of $5,00 January 1, 2019, and it desires a minimum monthly ending cash balance of $ Opportunity: Investment into Treasury Bills, 6% annual interest rate