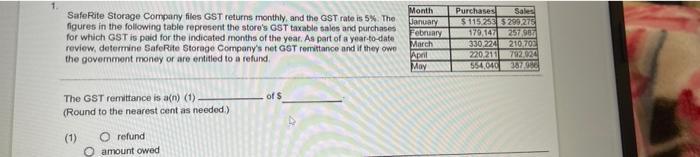

SafeRite Storage Company files GST returns monthly, and the GST rate is 5%. The figures in the following table represent the store's GST taxable

SafeRite Storage Company files GST returns monthly, and the GST rate is 5%. The figures in the following table represent the store's GST taxable sales and purchases for which GST is paid for the indicated months of the year. As part of a year-to-date review, determine SafeRite Storage Company's net GST remittance and if they owe the government money or are entitled to a refund. The GST remittance is a(n) (1). (Round to the nearest cent as needed.). (1) O refund amount owed of $ Month January February March April May Purchases Sales $115.253 $299,275 179,147 257,987 330,224 210,703 792,924 387,986 220,211 554,040

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Quie Total Purchase 115253 179147330224 220 211 1398875 5...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started