Question

Case Study Startup Business Plan and Financing: Our mission is to replace chocolate in mass-market products by 2035. At this time, we will be a

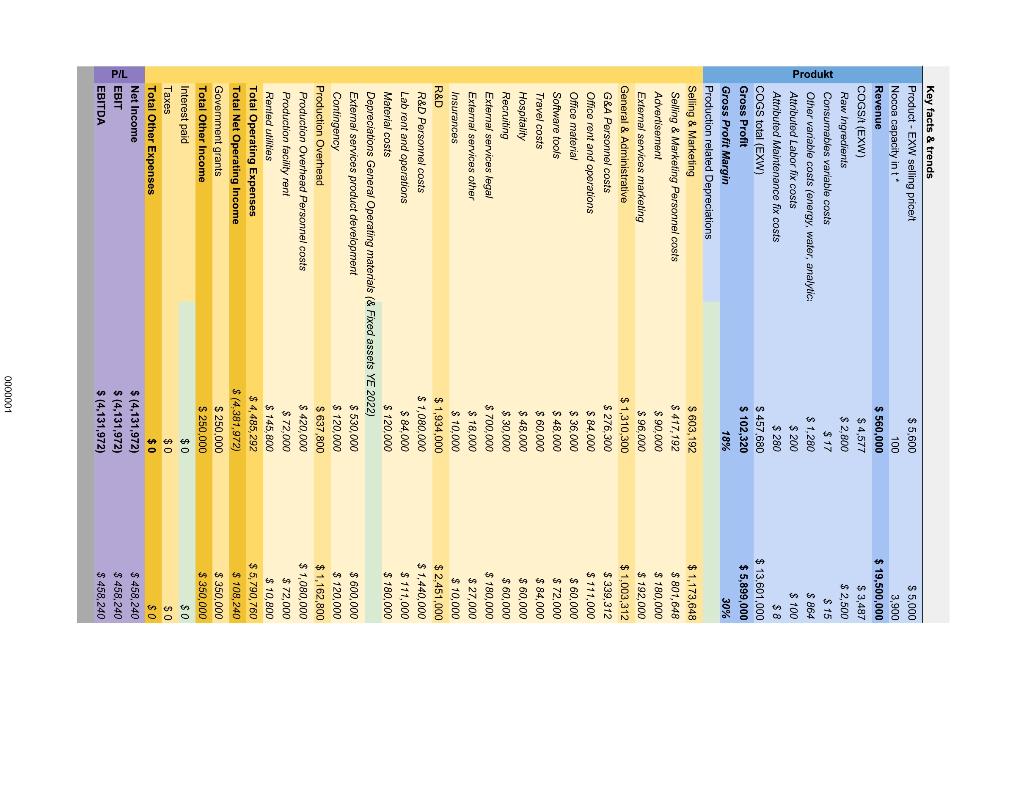

Case Study Startup Business Plan and Financing: Our mission is to replace chocolate in mass-market products by 2035. At this time, we will be a huge B2B company delivering chocolate to corporations such as Mondelez and Mars. In order to reach this goal, as a startup company we need financing from partners like venture capital funds or strategic investors. With a great idea, a great team, and a great business plan we will convince partners to support us financially on our mission. As a Finance Associate, imagine a situation where you support the founders and the CFO by finalizing the business plan and prepare for a next financing round. You have been provided with a draft business plan in Excel file (Recruiting Case Finance). The following topics have to be finalized for the business years 2023 and 2024. Profit and Loss Forecast Monthly depreciations on the basis of planned capex (see spreadsheet CapEx for P&L and Cash Flow). Monthly interest expenses based on your proposed financing structure. Operating Cash Flow Forecast Fill in the missing information based on the updated P/L Forecast. Financing Cash Flow Please propose a financing strategy for the years 2023 and 2024 assuming a mixture of equity capital and debt capital financing provided by venture capital funds. Please consider: Minimum liquidity at the end of every month of USD 1M. Interest for venture debt is 10% p.a., maximum maturity available is 4 years, maximum interest free period is 12 months. Debt capital will only be available to finance capex for building cost (200) & (300) based on invoices on hand, multiple drawdowns under a debt capital facility are feasible but minimum draw down amount is USD 0.3M. No dividend payments through 2023 and 2024. Balance Sheet Please set up key balance sheet KPIs as of month end. Development of Total Fixed Assets (net of depreciations). Development of Net Debt (assume zero debt at YE 2022). Total Balance Sheet Equity (assume Total Balance Sheet Equity of USD -3M at YE 2022).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started