Answered step by step

Verified Expert Solution

Question

1 Approved Answer

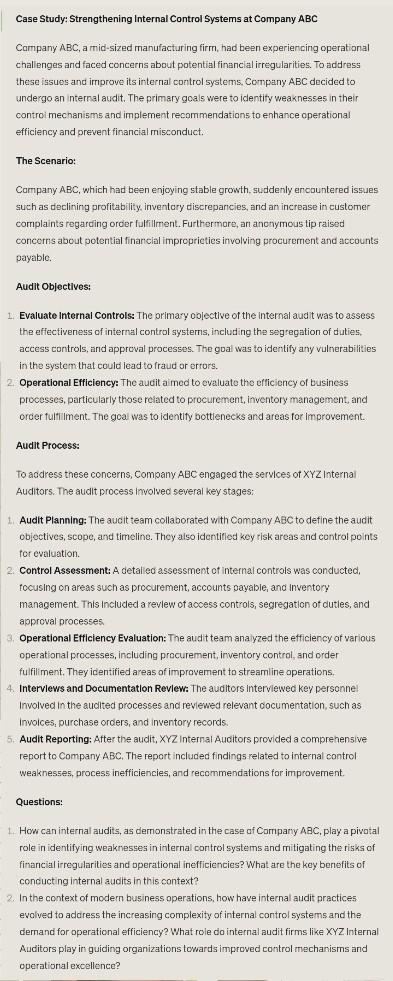

Case Study: Strengthening Internal Control Systems at Company ABC Campany ABC, a mid-sized manufacturing firm, had been experiencing operational challenges and faced concerns about potential

Case Study: Strengthening Internal Control Systems at Company ABC Campany ABC, a mid-sized manufacturing firm, had been experiencing operational challenges and faced concerns about potential financial irregularities. To address these issues and irmprove its internal control systems. Company ABC decided to undergo an internal audit. The primary goals were to identity weaknesses in their controi mechanisms and implement recommendations to enhance operational efficiency and prevent financial misconduct. The Scenario: Company ABC, which had been enjoying stable growth, suddenly encountered issues such as declining profitability. inventary discrepancies, and an increase in customer complaints regarding order fulfillment. Furthermore, an anonymous tip raised concoms about potential financial improprieties involving procurement and accounts payable. Audit Objectives: 1. Evaluate Internal Controls: The orimary oblectlve of the internal audit was to assess the effectiveness of internal control systerns, including the segregation of duties, access controls, arid appreval processes. The goal was to identify any vulnerabilities in the system that could lead to fraud or errors. 2. Operational Efficiency: The audit a med to evaluate the efficiency of business processes, particularly those related to procurement, inventory management, and order fultilment. The goal was to identify bottienecks and areas for improvement. Audit Process: To address these concerns, Company ABC engaged the services of XYZ Internal Auditors. The audit process involved several key stages: 1. Audit Planning: The aucit team collaborated with Company ABC to define the audit objectives, scope, and timeline. They also identifled key risk areas and eontrol points for evaluation. 2. Control Assessment: A detaled assessment of internal controls was conducted, focusing on areas such as procurement, accounts payable, and inventory management. This included a revlew of access controls, segregation of dutles, and approval processes. 3. Operational Efficiency Evaluation: The audit team ana yzed the efficiency of various operational processes, including procurement, inventory control, and order fulfiliment. They identified areas of improvement to streamline operations. 4. Intervlews and Documentation Revlew: The auditors Interviewed key personne! Involved in the audited processes and revlewed relevant cocumentation, such as involces, purchase orders, and inventory records. 5. Audit Reporting: After the audit, XYZ internal Auditors provided a comprehensive report to Company ABC. The report included findings related to internal control weaknesses, process inefficiencies, and recommendations for improvernent. Questions: 1. How can internal audits, as dernonstrated in the case of Company ABC, play a pivatal role in identifying weaknesses in internal cortrol systems and mitigating the risks of financial irregularities and operational inefficiencies? What are the key benefits of concucting internal audits in this context? 2. In the context of modern business operations, how have internal audit practices evolved to address the increasing complexity of internal control systems and the dernand for operational efficiency? What role do internal audit firms like XYZ Internal Auditors play in guiding organizations towards improved control mechanisms and operational excellence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started