Question

Case Study: The Rise of Netflix (and the Fall of Blockbuster) When Netflix launched in 1997, Blockbuster was the undisputed champion of the video rental

Case Study: The Rise of Netflix (and the Fall of Blockbuster)

When Netflix launched in 1997, Blockbuster was the undisputed champion of the

video rental industry.

Between 1985 and 1992, the brick-and-mortar rental chain grew from its first

location (in Dallas, Texas) to more than 2,800 locations around the world.

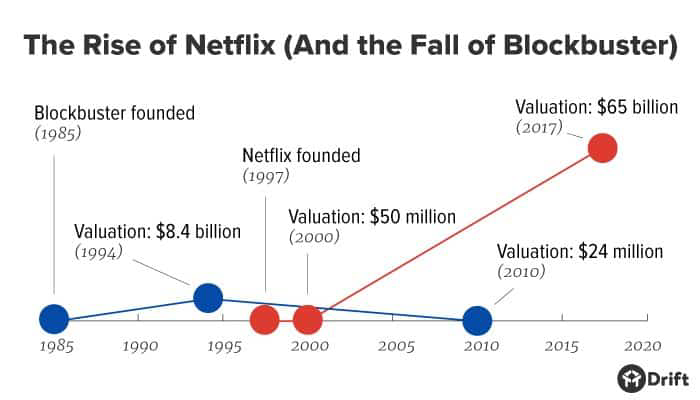

Two years later, Viacom paid $8.4 billion to acquire Blockbuster.

So by the time Netflix showed up on the scene with its video rental-by-mail service,

it appeared to be a classic case of David vs. Goliath.

In fact, in the year 2000 perhaps realizing that itd be easier to fight alongside

Blockbuster than against them Netflix co-founder and CEO Reed Hastings

approached Blockbusters then CEO, John Antioco, with a merger proposal:

Hastings wanted $50 million for Netflix. And as part of the deal, the Netflix

team would run Blockbusters online brand.

Of course, that deal never materialized.

At the time, Antioco considered Netflix to be small potatoes, and would come to

realize only too late that having an online platform would be the way of the future.

In 2004, Blockbuster did launch a Netflix-like online DVD rental platform, and even

abandoned their unpopular (but lucrative) late fees for overdue rentals.

By 2006, subscribers for Blockbusters online services had grown to more than 2

million. (Meanwhile, in that same year, the number of Netflix subscribers reached

6.3 million.)

The Rise of Netflix

(and the Fall of Blockbuster)

BUSD 2013 Change Management Types of Organizational Change

Business Administration Page 2 of 2 NorQuest College

Then in 2007, Antioco left Blockbuster, late fees were reinstated, and Blockbusters

online efforts were put on the back burner.

The companys fate was sealed.

Flash forward to 2010, and Blockbuster was filing for bankruptcy, having incurred

more than $1 billion in losses on the year.

Their valuation at the time?

$24 million.

For comparison, today, Netflix is valued at around 65 billion a 1,300x increase

from their valuation back in 2000.

Case Study: The Rise of Netflix (and the Fall of Blockbuster)

Refer to Table 1.2 on the back page of this document to guide your discussion.

Tuning

What tuning changes could Blockbuster have made? Consider that this type of organizational change is anticipatory and incremental/continuous.

Adapting

What adapting change could Blockbuster have made? Consider that this type of organizational change is reactive with incremental/continuous measures.

Redirecting or Reorienting

What redirecting or reorienting changes could Blockbuster have made? Consider that this type of organizational change is anticipatory with discontinuous/radical measures.

Overhauling or Re-creating

What type of overhauling or re-creating change could Blockbuster have made? Consider that this type of organizational change is reactive with discontinuous/radical measures.

Which type of organizational change should Blockbuster have ultimately implemented to prevent its failure? Why?

Table 1.2 Types of Organizational Change

| Incremental/Continuous | Discontinuous/Radical | |

| Anticipatory | Tuning Incremental change made in anticipation of future events Need is for internal alignment Focuses on individual components or subsystems Middle-management role Implementation is the major task For example, a quality improvement initiative from an employee improvement committee | Redirecting or Reorienting Strategic proactive changes based on predicted major changes in the environment Need is for positioning the whole organization to a new reality Focuses on all organizational components Senior management creates sense of urgency and motivates the change For example, a major change in product or service offering in response to opportunities identified |

| Reactive | Adapting Incremental changes made in response to environmental changes Need is for internal alignment Focuses on individual components or subsystems Middle-management role Implementation is the major task For example, modest changes to customer services in response to customer complaints | Overhauling or Re-creating Response to a significant performance crisis Need to reevaluate the whole organization, including its core values Focuses on all organizational components to achieve rapid, system-wide change Senior management creates vision and motivates optimism For example, a major realignment of strategy, involving plant closures and changes to product and service offerings, to stem financial losses an return the firm to profitability |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started