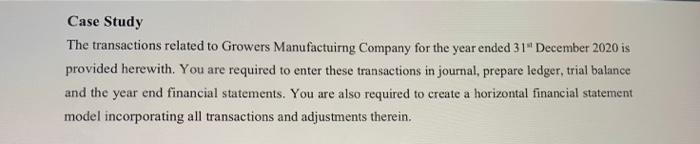

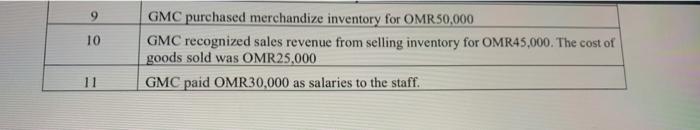

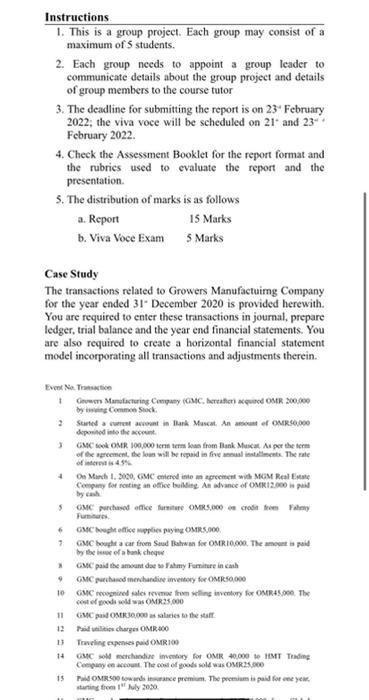

Case Study The transactions related to Growers Manufactuirng Company for the year ended 31 December 2020 is provided herewith. You are required to enter these transactions in journal, prepare ledger, trial balance and the year end financial statements. You are also required to create a horizontal financial statement model incorporating all transactions and adjustments therein. 9 10 GMC purchased merchandize inventory for OMR50,000 GMC recognized sales revenue from selling inventory for OMR45,000. The cost of goods sold was OMR25,000 GMC paid OMR30,000 as salaries to the staff. 11 12 13 14 Paid utilities charges OMR400 Traveling expenses paid OMR 100 GMC sold merchandize inventory for OMR 40,000 to HMT Trading Company on account. The cost of goods sold was OMR25,000 Paid OMR500 towards insurance premium. The premium is paid for one year, starting from 1ST July 2020. GMC purchased merchandize inventory worth OMR40,000 from Global Traders, on account. The credit terms were 2/10 n/30 15 16 Instructions 1. This is a group project. Each group may consist of a maximum of 5 students. 2. Each group needs to appoint a group leader to communicate details about the group project and details of group members to the course tutor 3. The deadline for submitting the report is on 23 February 2022, the viva voce will be scheduled on 21 and 23 February 2022 4. Check the Assessment Booklet for the report format and the rubrics used to evaluate the report and the presentation 5. The distribution of marks is as follows a. Report 15 Marks b. Viva Voce Exam 5 Marks Case Study The transactions related to Growers Manufactuimg Company for the year ended 31. December 2020 is provided herewith. You are required to enter these transactions in journal, prepare ledger, trial balance and the year end financial statements. You are also required to create a horizontal financial statement model incorporating all transactions and adjustments therein. Event Net 1 Gown Manufacturing Company (GMC beration equired OMR 200.000 by using Commen Stock 2 Suede contin Bank Muscat. An of OMR50,000 deposited into the scout ) GMC OMR 100,000 ie term from Bank Muscat. As per the term of the greement, the loans will be repaid in fe installment Theate 4 On March 10, GMC entered into apreement with MCM Real Estate Company for resting an office building. An advance of OMR 2.000 bych 5 GMC purchased office furniture OMR5,000 credit from Filmy Purmures 6 GMC helice pe paying OMR5,000 7 GMC bought a car from Sad Balafo OMRIO.00. The most is paid by the of a bank chew GMC paid the amount doe de hoy Furniture in cash GMC pred mechandise investy for OMR50,000 10 GMC recopied des revenue from willing inventory for OMR45.000. The corte de las OMR25,000 11 GMC OMR0.000 se to the staff Paid charges OMR 200 13 Traveling expenses OMR100 14 GMC merchandietary for OMR 40,000 MT Trading Company account. The cost of goods sold was OMR 25.00 15 POMS www premium. The premium is paid for you starting free "July 2030 = 5 GMC purchased office furniture OMR5.000 on credit from Fahmy Furnitures 6 GMC bought office supplies paying OMR5,000 7 GMC bought a car from Saud Balwan for OMR10,000. The amount is paid by the issue of a bank cheque 8 GMC paid the amount due to Fahmy Furniture in cash 9 GMC purchased merchandise inventory for OMR50,000 10 GMC recognized sales revenue from selling inventory for OMR 45,000. The cost of goods sold was OMR25,000 11 GMC paid OMR30,000 as salaries to the staff 12 Paid utilities charges OMR 400 Traveling expenses paid OMR100 14 GMC sold merchandize inventory for OMR 40,000 to HMT Trading Company on account. The cost of goods sold was OMR 25,000 15 Paid OMR500 towards insurance premium. The premium is paid for one year, starting from 1 July 2020 16 GMC purchased merchandize inventory worth OMR40,000 from Global Traders, on account. The credit terms were 2/10/30 17 GMC returned some of the inventory purchased in Event 16. The list price of returned merchandise was OMR 1,000 18 GMC paid the amount due to Global Trades within the discount period. 19 Office upplies purchased on account OMR2,000 20 Bought computers for office OMR1,500 21 Interest on loan paid OMR 750 22 GMC paid OMR 50.000 to purchase land for a place to locate the future business 23 Dividend paid OMR10,000 24 Received amount due from HMT Trading Company, Adjustments 1. Salary paid only for 10 months. 2. A physical examination of supplies revealed that supplies worth OMR2,000 are currently available for future use. 3. Insurance premium is paid from "July 2020 4. Interest due on loan OMR4,500 5. The advance rent is paid for one year starting from 1" March, 2020