Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study Two: (10% of final grade ) Fiona and Dan have recently had their third child 1 month ago. They already have a 6

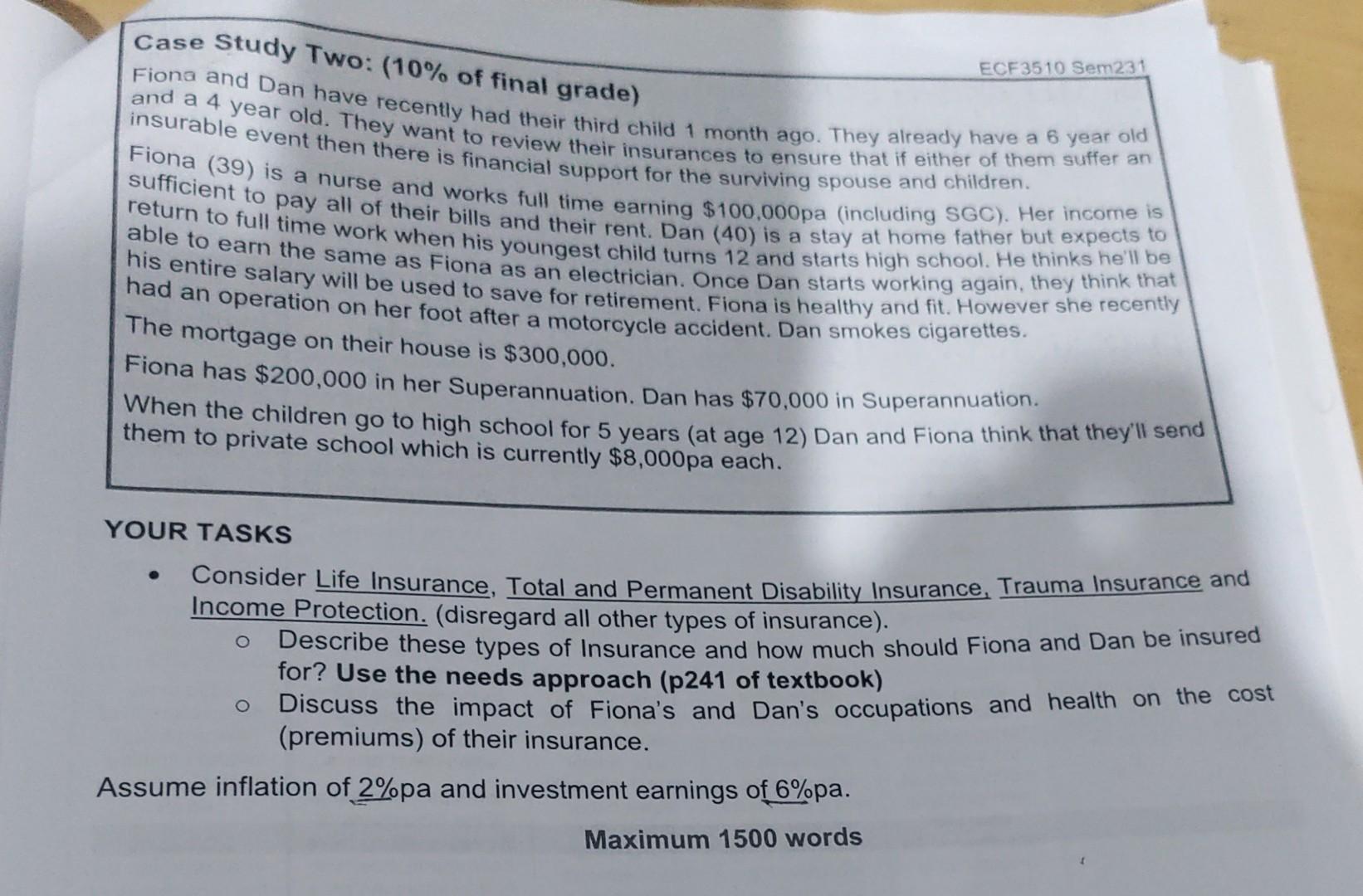

Case Study Two: (10% of final grade ) Fiona and Dan have recently had their third child 1 month ago. They already have a 6 year old insurable event then want to review their insurances to ensure that if either of them suffer an Fiona (39) is a nurse there is financial support for the surviving spouse and children. sufficient to pay all of and works full time earning $100,000 pa (including SGC). Her income is return to full time work when his youngest rent. Dan (40) is a stay at home father but expects to able to earn the same as Fiona as an electrician. Once Dan starts working again, they think that his entire salary will be used to save for retirement. Fiona is healthy and fit. However she recently had an operation on her foot after a motorcycle accident. Dan smokes cigarettes. The mortgage on their house is $300,000. Fiona has $200,000 in her Superannuation. Dan has $70,000 in Superannuation. When the children go to high school for 5 years (at age 12) Dan and Fiona think that they'll send them to private school which is currently $8,000 pa each. YOUR TASKS - Consider Life Insurance, Total and Permanent Disability Insurance, Trauma Insurance and Income Protection. (disregard all other types of insurance). - Describe these types of Insurance and how much should Fiona and Dan be insured for? Use the needs approach (p241 of textbook) - Discuss the impact of Fiona's and Dan's occupations and health on the cost (premiums) of their insurance. Assume inflation of 2% pa and investment earnings of 6% pa. Maximum 1500 words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started