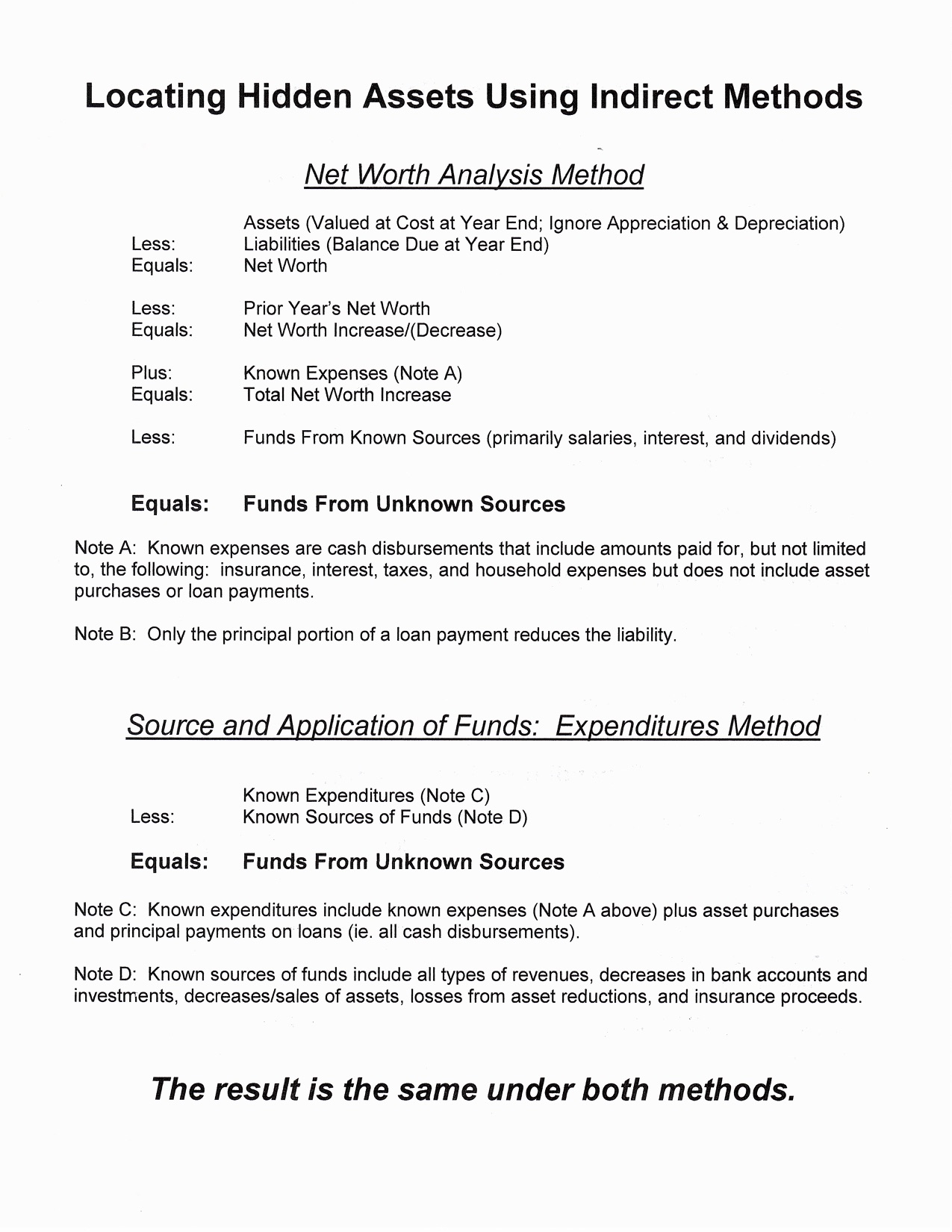

Case Study using net worth analysis method and source of application of funds- expenditures method

Case Study: R. H. and June Dobbins It is believed that R. H. and June Dobbins did not start out to commit fraud. The couple was always thought of as very honest people. They built their careers around the fact that they were responsible, dependable, and credible individuals. The Dobbins quickly found themselves in a situation where the line between what was right and wrong became very fuzzy. Unfortunately, a tragic event, followed by a probing lawsuit, caused the couple to react defensively when faced with losing their property, lifestyles and possibly their careers. R. H. started a successful management consulting company after working for 10 years as a management consultant with his mentor Philip Bluestein. June was a computer specialist and consultant for a large accounting firm for 12 years. She joined him in the business two years later. R. H. and June were married after they both graduated from a prestigious eastern university 18 years ago. They both completed graduate schools in the top 10 percent of their class and received MBA's. Their marriage was as successful as their business. R. H. and June were equal partners in their consulting firm. R. H. and June were widely respected and their clients were quite happy with the services they received. Several of their clients were fortune 500 companies. Besides June and R. H., the rm employed three other employees: one clerical, a professional who mainly conducted research, and an accountant. The Dobbins lived in Southern California where they owned a home. In addition they had a ranch where they raised quarter horses. Their lifestyle included luxury cars, jewelry, furs, eating in ne restaurants, and shopping in the nest stores, and most years, semi-annual vacations: skiing in February at Lake Tahoe and beach combing in Hawaii during the early fall. Weekends, almost without exception, were spent on the ranch. The Dobbins had three children. In the summer of 2014 their lives took a turn for the worse. June was coming back from the ranch when she was involved in a serious car accident for which she was at fault. June was injured, however her injuries were not serious when compared to Diana Brucknell's, the driver of the other vehicle, who went into a coma and eventually died. The Bruckneil estate led a wrongful death suit and a trial ensued. In January, 2016, the jury returned a verdict against the Dobbins for $5 million. In February, the Dobbins filed for Chapter 7 bankruptcy. Representatives of the Bruckneil estate maintained that the Dobbins had led for bankruptcy because they did not want to pay the judgment. The Brucknell's estate claimed that the Dobbins possessed ample assets to partially cover the claim, and the judgment was the only major debt faced by the couple. The Dobbins stated that they had always lived beyond their means and their business had suffered greatly from the accident and subsequent lawsuit. Many of their customers terminated their services because they believed that the Dobbins would not be able to appropriately complete their engagements. In fact, they stated that since they both were involved in the lawsuit, Locating Hidden Assets Using Indirect Methods Less: Equals: Less: Equals: Plus: Equals: Less; Equals: Net Worth Analysis Method Assets (Valued at Cost at Year End; Ignore Appreciation & Depreciation) Liabilities (Balance Due at Year End) Net Worth Prior Year's Net Worth Net Worth Increaset(Decrease) Known Expenses (Note A) Total Net Worth Increase Funds From Known Sources (primarily salaries, interest, and dividends) Funds From Unknown Sources Note A: Known expenses are cash disbursements that include amounts paid for, but not limited to, the following: insurance, interest, taxes, and household expenses but does not include asset purchases or loan payments. Note B: Only the principal portion of a loan payment reduces the liability. Source and Application of Funds: Expenditures Method Less: Equals: Known Expenditures (Note C) Known Sources of Funds (Note D) Funds From Unknown Sources Note C: Known expenditures include known expenses (Note A above) plus asset purchases and principal payments on loans (ie. all cash disbursements). Note I): Known sources of funds include all types of revenues, decreases in bank accounts and investments, decreasestsales of assets, losses from asset reductions, and insurance proceeds. The result is the same under both methods