Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study You are interested to acquire the following private equity firm. The private firm operates in Australia and its main business is in biotechnology.

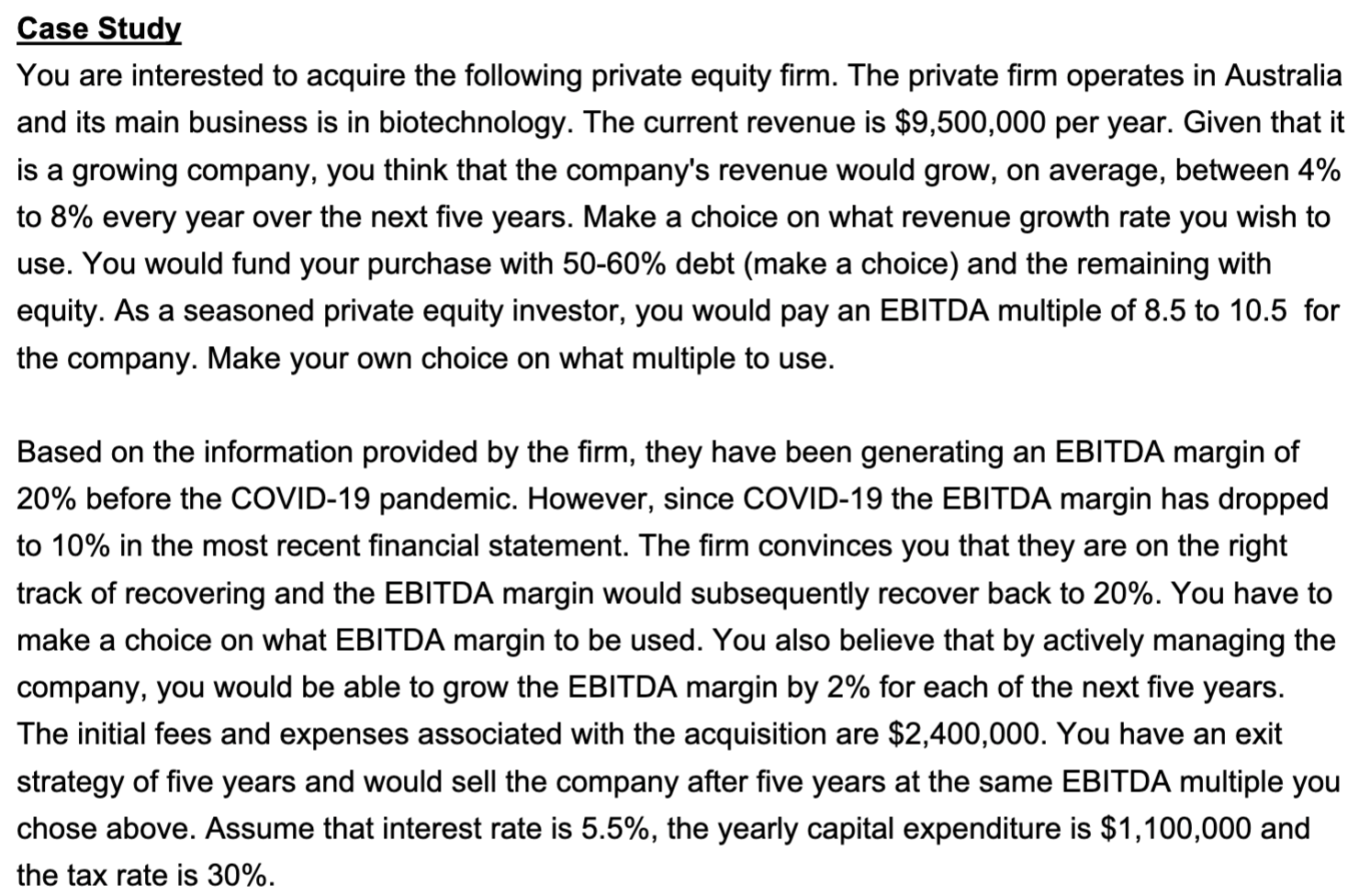

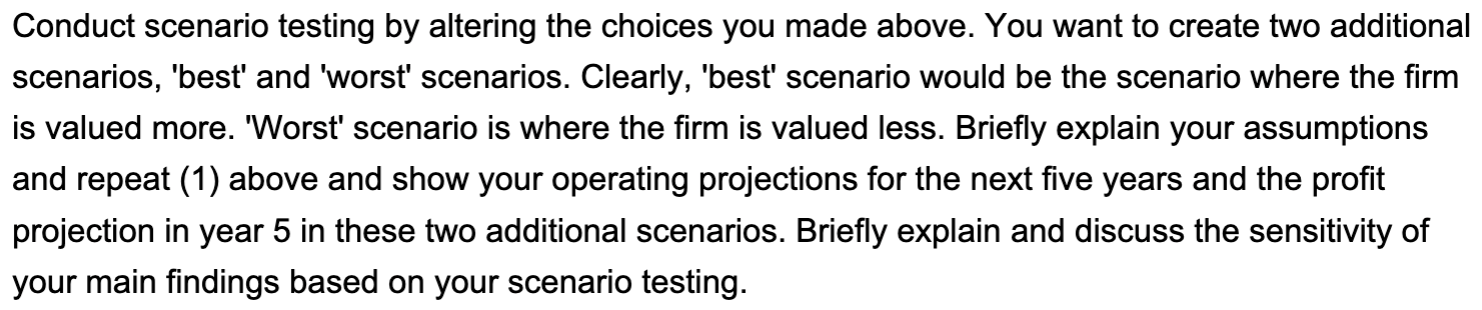

Case Study You are interested to acquire the following private equity firm. The private firm operates in Australia and its main business is in biotechnology. The current revenue is $9,500,000 per year. Given that it is a growing company, you think that the company's revenue would grow, on average, between 4% to 8% every year over the next five years. Make a choice on what revenue growth rate you wish to use. You would fund your purchase with 5060% debt (make a choice) and the remaining with equity. As a seasoned private equity investor, you would pay an EBITDA multiple of 8.5 to 10.5 for the company. Make your own choice on what multiple to use. Based on the information provided by the firm, they have been generating an EBITDA margin of 20% before the COVID-19 pandemic. However, since COVID-19 the EBITDA margin has dropped to 10% in the most recent financial statement. The firm convinces you that they are on the right track of recovering and the EBITDA margin would subsequently recover back to 20%. You have to make a choice on what EBITDA margin to be used. You also believe that by actively managing the company, you would be able to grow the EBITDA margin by 2% for each of the next five years. The initial fees and expenses associated with the acquisition are $2,400,000. You have an exit strategy of five years and would sell the company after five years at the same EBITDA multiple you chose above. Assume that interest rate is 5.5%, the yearly capital expenditure is $1,100,000 and the tax rate is 30%. Conduct scenario testing by altering the choices you made above. You want to create two additional scenarios, 'best' and 'worst' scenarios. Clearly, 'best' scenario would be the scenario where the firm is valued more. 'Worst' scenario is where the firm is valued less. Briefly explain your assumptions and repeat (1) above and show your operating projections for the next five years and the profit projection in year 5 in these two additional scenarios. Briefly explain and discuss the sensitivity of your main findings based on your scenario testing

Case Study You are interested to acquire the following private equity firm. The private firm operates in Australia and its main business is in biotechnology. The current revenue is $9,500,000 per year. Given that it is a growing company, you think that the company's revenue would grow, on average, between 4% to 8% every year over the next five years. Make a choice on what revenue growth rate you wish to use. You would fund your purchase with 5060% debt (make a choice) and the remaining with equity. As a seasoned private equity investor, you would pay an EBITDA multiple of 8.5 to 10.5 for the company. Make your own choice on what multiple to use. Based on the information provided by the firm, they have been generating an EBITDA margin of 20% before the COVID-19 pandemic. However, since COVID-19 the EBITDA margin has dropped to 10% in the most recent financial statement. The firm convinces you that they are on the right track of recovering and the EBITDA margin would subsequently recover back to 20%. You have to make a choice on what EBITDA margin to be used. You also believe that by actively managing the company, you would be able to grow the EBITDA margin by 2% for each of the next five years. The initial fees and expenses associated with the acquisition are $2,400,000. You have an exit strategy of five years and would sell the company after five years at the same EBITDA multiple you chose above. Assume that interest rate is 5.5%, the yearly capital expenditure is $1,100,000 and the tax rate is 30%. Conduct scenario testing by altering the choices you made above. You want to create two additional scenarios, 'best' and 'worst' scenarios. Clearly, 'best' scenario would be the scenario where the firm is valued more. 'Worst' scenario is where the firm is valued less. Briefly explain your assumptions and repeat (1) above and show your operating projections for the next five years and the profit projection in year 5 in these two additional scenarios. Briefly explain and discuss the sensitivity of your main findings based on your scenario testing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started