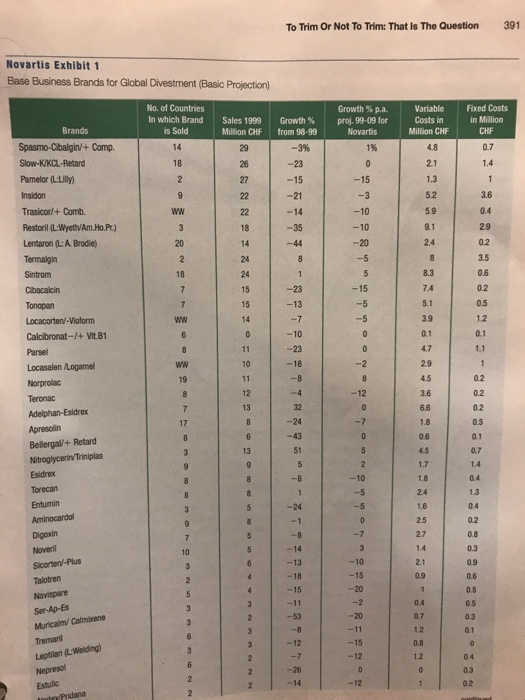

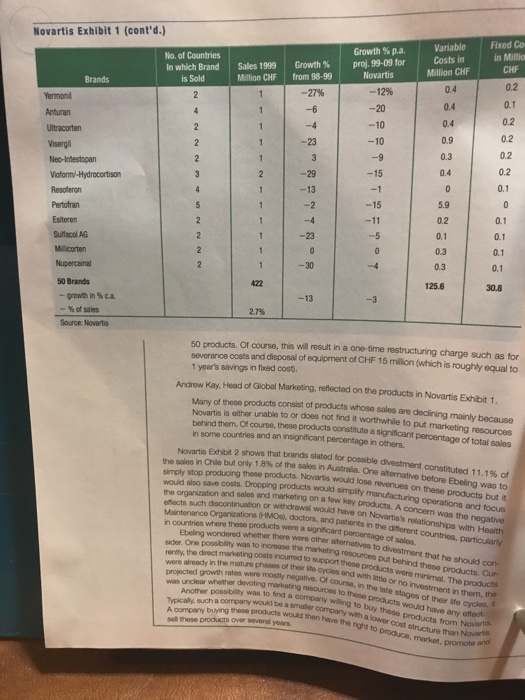

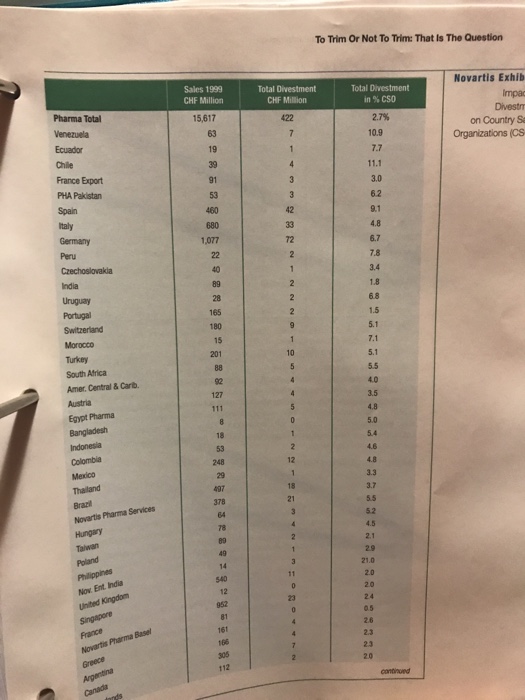

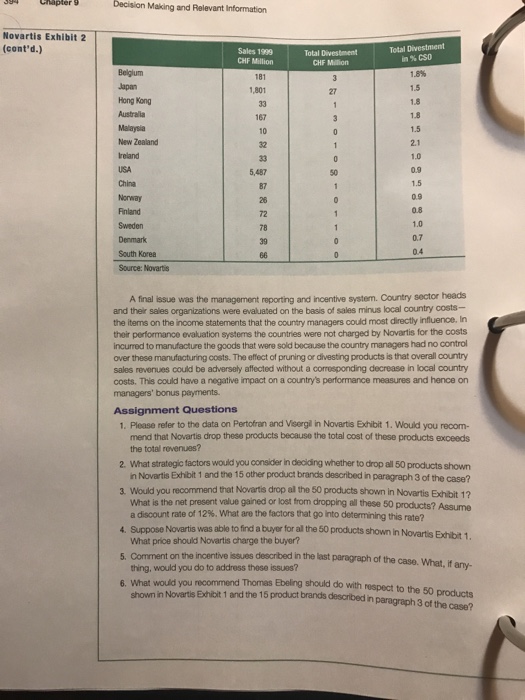

Case To Trim Or Not To Trim: That Is The Question The issue had come up again and again in various management meetings and company semi nars. Novartis had too many products and needed to reduce the product proliferation that had occurred. Thomas Ebeling, Chief Operating fficer, Novartis Pharmaceuticals, wondered what he should do. The merger of Ciba-Geigy and Sandoz to form Novartis on December 20, 1996 had resulted in a significant increase in the pharmaceutical product portfolio of Novartis's Pharma Sector Combining the pharmaceutical product lines of Ciba-Geigy and Sandoz had given Novartis a leadership position in several therapeutic areas, including immunology and inflammatory dis- eases, as well as strong positions in central nervous system disorders, cardiovascular diseases, oncology, dermatology, and asthma. Novartis now had approximately 250 product brands (such as Sandimmun, Voltaren, Lamisil, and Foradilj. The sales volumes of each of the different brands, however, were very different. In 1999, the top 20 brands accounted for 79% of pharmaceutial revenues while the remaining brands yielded 21% of revenues. Novartis Exhibit 1 presents sales, anticipated sales growth rates, cost and other data for the 50 smallest global base business brands that account for CHF 422 million in sales (or approximately 2.7% of pharmaceutical product sales) in 1998. In addtion to the base business brands listed in Novartis Exhibit 1, 15 other product brands contributed an additional CHF 2.4 million in revenues. Although these products generated very small revenues, they satisfied some important medical needs. For example, Visken had sales of CHF 114,000 in South Africa but it was unique among betablockers regarding the effect on serotonin 1a receptors for the onset of antidepressant action. Novartis Exhibit 1 subdivides costs into variable costs and fixed costs. A variable cost changes in total in proportion to changes in the related level of total activity or volume. An example of a variable cost is direct materiais used to make the product. If sales are small, variable costs are smal. As sales increase, variable costs increase proportionately as well. A fixed cost remains unchanged in total for a given time period despite wide changes in the related level of total activity or volume. Examples of fixed costs are costs of operating the plant and costs of drug regulatory affairs to maintain registration of products. In the long run, however foxed costs can sometimes be adjusted to match the levels needed to support future activity levels or production volumes. Commenting on the fxed costs reported in Novartis Exhibit 1, Andre Khairallah, Head of Controling, commented: Dropping a few products out of the 50 products shown in Appendix 1 will not in savings in fixed costs even in the long run. We already have idle plants so dropping a few of these products will only result in even If we drop all 50 products, some of the fixed costs in technical scheduling, drug registration, warehousing and inventory management, and distri will be saved. If we dropped all 50 products, we can reduce the used to support these products, something we cannot do if we products. estimate that we can save 50% of the total bed costs if two or three result capacity in our more idle capacity products, we cannf we dropped al operations drop only two or three Source: Fleprinted by permission of Harvard Business School Copyright 02000 by the President and Fellows Harvard Business School case 9-100-105 The case was prepared by Srkant Datar as the basis for class d eflective or inefoctive handing of an administrative of Harvard College the basis for class discussion rather than to Case To Trim Or Not To Trim: That Is The Question The issue had come up again and again in various management meetings and company semi nars. Novartis had too many products and needed to reduce the product proliferation that had occurred. Thomas Ebeling, Chief Operating fficer, Novartis Pharmaceuticals, wondered what he should do. The merger of Ciba-Geigy and Sandoz to form Novartis on December 20, 1996 had resulted in a significant increase in the pharmaceutical product portfolio of Novartis's Pharma Sector Combining the pharmaceutical product lines of Ciba-Geigy and Sandoz had given Novartis a leadership position in several therapeutic areas, including immunology and inflammatory dis- eases, as well as strong positions in central nervous system disorders, cardiovascular diseases, oncology, dermatology, and asthma. Novartis now had approximately 250 product brands (such as Sandimmun, Voltaren, Lamisil, and Foradilj. The sales volumes of each of the different brands, however, were very different. In 1999, the top 20 brands accounted for 79% of pharmaceutial revenues while the remaining brands yielded 21% of revenues. Novartis Exhibit 1 presents sales, anticipated sales growth rates, cost and other data for the 50 smallest global base business brands that account for CHF 422 million in sales (or approximately 2.7% of pharmaceutical product sales) in 1998. In addtion to the base business brands listed in Novartis Exhibit 1, 15 other product brands contributed an additional CHF 2.4 million in revenues. Although these products generated very small revenues, they satisfied some important medical needs. For example, Visken had sales of CHF 114,000 in South Africa but it was unique among betablockers regarding the effect on serotonin 1a receptors for the onset of antidepressant action. Novartis Exhibit 1 subdivides costs into variable costs and fixed costs. A variable cost changes in total in proportion to changes in the related level of total activity or volume. An example of a variable cost is direct materiais used to make the product. If sales are small, variable costs are smal. As sales increase, variable costs increase proportionately as well. A fixed cost remains unchanged in total for a given time period despite wide changes in the related level of total activity or volume. Examples of fixed costs are costs of operating the plant and costs of drug regulatory affairs to maintain registration of products. In the long run, however foxed costs can sometimes be adjusted to match the levels needed to support future activity levels or production volumes. Commenting on the fxed costs reported in Novartis Exhibit 1, Andre Khairallah, Head of Controling, commented: Dropping a few products out of the 50 products shown in Appendix 1 will not in savings in fixed costs even in the long run. We already have idle plants so dropping a few of these products will only result in even If we drop all 50 products, some of the fixed costs in technical scheduling, drug registration, warehousing and inventory management, and distri will be saved. If we dropped all 50 products, we can reduce the used to support these products, something we cannot do if we products. estimate that we can save 50% of the total bed costs if two or three result capacity in our more idle capacity products, we cannf we dropped al operations drop only two or three Source: Fleprinted by permission of Harvard Business School Copyright 02000 by the President and Fellows Harvard Business School case 9-100-105 The case was prepared by Srkant Datar as the basis for class d eflective or inefoctive handing of an administrative of Harvard College the basis for class discussion rather than to