Answered step by step

Verified Expert Solution

Question

1 Approved Answer

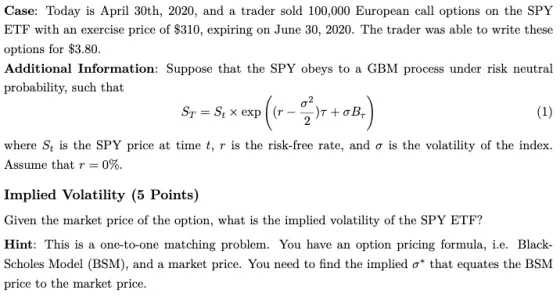

Case: Today is April 30th, 2020, and a trader sold 100,000 European call options on the SPY ETF with an exercise price of $310,

Case: Today is April 30th, 2020, and a trader sold 100,000 European call options on the SPY ETF with an exercise price of $310, expiring on June 30, 2020. The trader was able to write these options for $3.80. Additional Information: Suppose that the SPY obeys to a GBM process under risk neutral probability, such that ST = S x exp > ((r = 1/ ) T + OB) (1) where S, is the SPY price at time t, r is the risk-free rate, and is the volatility of the index. Assume that r = 0%. Implied Volatility (5 Points) Given the market price of the option, what is the implied volatility of the SPY ETF? Hint: This is a one-to-one matching problem. You have an option pricing formula, i.e. Black- Scholes Model (BSM), and a market price. You need to find the implied o that equates the BSM price to the market price.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To find the implied volatility of the SPY ETF we can use the BlackScholes option pricing formula f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started